Here’s What You Need to Know About Your Excess

Exploring how insurance excess works for your contents insurance policy.

Exploring how insurance excess works for your contents insurance policy.

You probably haven’t spent too much time thinking about your insurance excess. And, to be fair, it’s not the most stirring topic imaginable. But it’s important to have a handle on how your excess works within the context of your contents insurance policy.

Here’s the TL;DR if you’re short on time:

An insurance excess is the amount of money you choose when purchasing a policy that will be subtracted from any future claims payouts.

Let’s say your £750 watch was stolen and your excess was £250. If your claim is approved, your insurance company would pay you £500 when you get reimbursed.

Think of an excess as your participation in the damage or loss. You’re saying, “I commit £X to any approved claim for future losses or damages, and my insurance company will cover the rest.”

It probably all sounds a little confusing, but don’t worry, it’ll all make sense, we promise!

When signing up for a contents insurance policy, you’ll be asked to choose an excess. At Lemonade, this ranges from £100 to £500 (£100, £150, £250, £400, £500). The excess is how much money would be deducted on every covered claim.

What you’re actually choosing is your amount of financial participation (the amount subtracted from a claim) in the event that something happens to your stuff.

Here are a few examples:

Scenario A

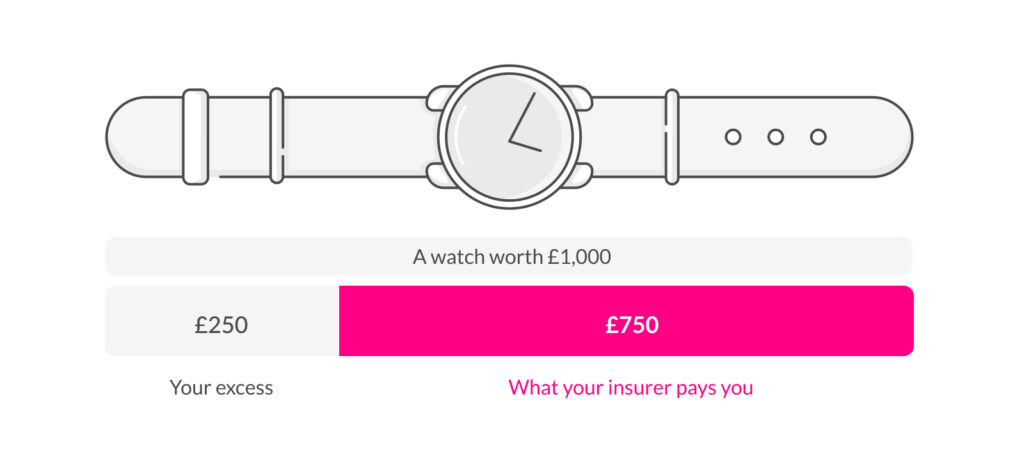

1. You have contents insurance, and chose an excess of £250 when you bought your policy

2. A few months later, you file a claim for a stolen watch valued at £1,000

3. If the claim is approved, your insurer will pay you £750 (£1,000 minus your £250 excess)

Scenario B

1. You chose an excess of £250 when you bought your policy

2. Your £200 Bose headphones get stolen

3. Since the replacement cost of the headphones is less than your excess, you won’t get anything from your insurer on this one.

Note: If the total loss is less than the excess, there’s no point in making a claim since you won’t be eligible to receive any money back.

So, now you’re probably wondering: Why doesn’t everyone just choose a low excess to make sure that if anything goes missing, it’ll be covered in full?

In general, the lower an excess you pick, the higher your monthly insurance rate will be. Conversely, if you choose a high excess, your insurance rate will be lower.

First off, there’s no such thing as the “right” amount. Different people have different preferences.

First, ask yourself a few questions, such as:

If you answered ‘yes’ to most of these questions, you’ll probably want to choose a higher excess. If you answered ‘no,’ you’ll want to stick with something on the lower end of the spectrum.

Another helpful strategy is to think about something of value in your flat or home. What would you be able to comfortably pay today if you had to replace it?

Some of you are probably saying, “All this excess stuff is really confusing. Wouldn’t it be easier if insurance companies just dropped the idea completely?”

There are two main reasons excesses exist in an insurance policies:

1. To mitigate the behavioural risks associated with moral hazard

Basically, if you’re responsible for participating in some part of a future claim, you’ll probably be more careful when it comes to your things.

2. To solve the classic “tragedy of the commons” problem

Yet another mouthful. Consider this: How many claims would insurers have to handle if they responded to every single claim, no matter how small? As small as £50—as small as £5! Think scratched sunglasses, lost scarves, dented laptops, and so on. That would be a lot of claims to manage.

The costs associated with these types of claims are enormous. Insurers would invest the same amount of time on a £5 claim as they would on a £5,000 claim.

So, if insurers took on every £5 claim that came their way, they’d be stretched too thin. Sometimes, the money it costs to deal with the claim is worth more than the claim itself.

Insurance companies would have to hire more people or invest in more technology to handle the workload. This investment would have to be financed somehow, most likely at the expense of your insurance premiums.

TL;DR; Insurance companies use an excess to reduce loss exposure and to help keep premium costs at a minimum for all policyholders.

If you have a policy with Lemonade, you can simply open the app and pull up your excess.

What if you want to change your excess at any point? Just open your app, scroll down to the excess section, and go for it. You’ll receive confirmation of your updated policy via email, right away.

Please note: Lemonade articles and other editorial content are meant for educational purposes only, and should not be relied upon instead of professional legal, insurance or financial advice. The content of these educational articles does not alter the terms, conditions, exclusions, or limitations of policies issued by Lemonade, which differ according to your state of residence. While we regularly review previously published content to ensure it is accurate and up-to-date, there may be instances in which legal conditions or policy details have changed since publication. Any hypothetical examples used in Lemonade editorial content are purely expositional. Hypothetical examples do not alter or bind Lemonade to any application of your insurance policy to the particular facts and circumstances of any actual claim.