Bicycle Insurance, Explained

Good news: Bike insurance is much less complicated than you’d expect! Bad news: Bike theft is super common.

Good news: Bike insurance is much less complicated than you’d expect! Bad news: Bike theft is super common.

No matter how old you are, getting a new bike makes you feel like a child discovering independence for the first time. Speeding down the street feels like flying, and a shiny new bike is better than just about anything.

Insuring your bike can give you that same magical feeling. Okay, maybe not the day you get your policy… but if you file a claim for your favorite pair of wheels, insurance can get you back in the bike lane in no time. And it turns out bike theft is really, really common. (On that note, here’s a handy guide to preventing bike theft in the first place.)

If you’re wondering why you need insurance for your bike in the first place, just ask Levi, a Claims Experience Advocate at Lemonade. Levi estimates he handles 15 bike-related claims each month:

“Bikes are stolen all the time because they’re usually left alone outside, and they make their own getaway vehicle. Even expensive locks are being defeated, so bike insurance is your last line of defence.”

According to the Crime Survey for England and Wales (TCSEW) there were 232,000 bicycle thefts in 2021. Considering how likely you are to have your bike stolen at some point, insuring it seems like an obvious and practical move.

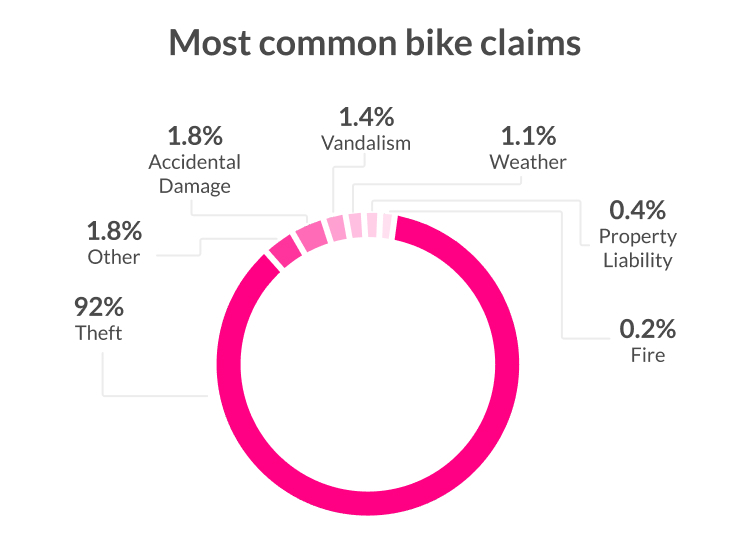

Last year, more than 3,400 bikes were added to Lemonade policies, and 1,300 bike-related claims were filed (92% of these were theft). We also collected your most burning questions about bicycle insurance cover—and we’ve got answers.

We crunched the data, and found that you’re at the highest risk for bike theft in the summer.

Insuring your bike is important—and it has never been easier.

Insuring a bike is easier than you’d expect, and there are several options to make sure you’re getting the right bike cover.

One quick note for e-bike riders before we start. Your policy won’t cover damage to motorised vehicles with compulsory insurance requirements, or a maximum speed above 15mph (e.g. cars, mopeds, high speed e-bikes, e-scooters).

We can cover damage you cause with your bicycle or electric bike though.

Here are three quick ways to insure your bike:

For starters, your bike is fully insured with a standard contents insurance policy. Your policy includes your personal property, aka contents insurance, which protects your stuff, including your bike. This cover could help recover the cost of your stolen or damaged stuff for a bunch of different scenarios. More specifically, it’s covered for the 16 named perils that can happen to you, listed in your policy, like vandalism, fire, burglary. and more.

A basic policy starts at £10,000 (up to £100,000) of contents cover, which you can tailor to fit your needs. Your bike alone is probably worth way less than that minimum threshold, but remember that your personal property also includes other high ticket items, like your phone, laptop, jewellery, and Xbox. Calculate how much your stuff is worth to make sure you have the right amount of cover.

With Lemonade, your bike is covered at home, and everywhere else as long as you’ve purchased the Theft and Loss add-on. So, if someone steals your bike while it’s locked outside of Nando’s, you’re covered. On the other hand, if it wasn’t locked, that’d be considered negligence, and your insurer might not cover you. If you want to cover your bike for accidents, include some Accidental Damage cover when you sign up for your contents cover.

BTW, all contents insurance policies come with some personal liability cover. If you’re an avid cyclist, or triathlon enthusiast, you‘ll want to increase your cover to be properly protected. Lemonade also offers a Legal Protection add-on which can pay for legal expenses for disputes related to personal injury that you suffer.

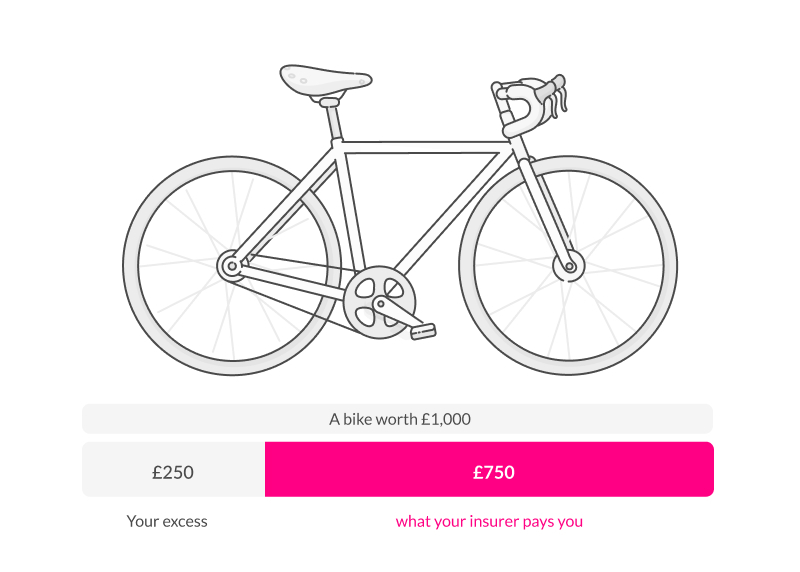

Keep in mind that if you need to file a claim on an item, and it’s approved, your insurance company will pay the value of that item, minus your excess.

Now, what’s an excess?

An excess is the amount subtracted from your claim in the event that something happens to your stuff. Basically, it’s your contribution to claims that you file. When signing up for a contents Insurance policy, you’ll be asked to choose an excess amount. They tend to range from £100 to £500 on basic contents insurance policies.

TL;DR, High-value item cover is basically like an extra policy taken out on big-ticket items, like a fancy bike. This cover would have your back if your bike was stolen, damaged, lost, or destroyed by any of the “perils” for a loss above £2K up to the bike’s value.

Different companies might use different language to describe exactly what they cover on High-Value Items, so make sure to read through your policy language.

If you’ve added your bike as a high-value item, you’re covered for everything listed on your base policy. But remember, if you want to be covered for theft outside your home, you’ll have to include Theft & Loss cover, and if you want to be covered for any accidents that might happen, include Accidental Damage cover.

If a bike is a part of your everyday routine, knowing it’s covered for pretty much everything will provide some serious peace of mind, but if you also use it professionally, ike as a pro mountain bike racer, you might need something beyond high-value Items cover.

That’s because only your personal items can be covered by ‘High-Value Items’. While you can’t schedule personal property cover for things that you use for your business, your base policy can cover items you use for your work up to a certain amount, for ‘named perils.’ So, if you’re a professional bike rider, a one-person-delivery-service, or one of the kids from Stranger Things, your policy can’t help you here.

If this is the case, go ahead and look into getting specialty bicycle insurance.

A helicopter airlift will (hopefully) never be necessary for your morning commute, but if you have an accident while riding to work, your contents insurance won’t be able to help. That’s where specialty bicycle insurance would come in.

A bicycle insurance policy will cover you for theft, damage, and more, but they’ll also cover the cost of emergency situations on bike courses, as well as medical expenses with personal accident cover.

Since it’s such a specialised option, it’s certainly not for every biker—and full disclosure, we don’t offer bicycle insurance at Lemonade, but it is an option if you’re a more serious cyclist who needs next level protection.

A standard contents policy with a couple of add-ons is probably all you need to safely insure your bike.

Yes, it will. The price of insurance can vary significantly, depending on your home’s location and the amount of cover you choose–so adding a bike to your policy as a high-value item will increase your monthly payments as will it with every add-on you choose.

Want to go behind-the-scenes on the cost of contents insurance? Check out our guide to contents insurance prices.

As long as you’ve purchased your Theft and Loss add-on, your bike is covered wherever it is. But if you want to share your bike with your significant other, you’ve got options too.

Once you’re married, you and your spouse are considered related, so you’re both automatically covered under your contents policy. Same with family members you live with.

Adding your spouse to your plan is easy, and it won’t cost you a penny! They’ll be considered a “Named Insured,” who is someone implicitly included in the policyholder’s plan.

If you’re living with a significant other who you share your bike with (things are getting serious!), add them to your insurance policy as an ‘additional insured’ to include them in your cover. That way, if something happens while they’re using your bike, you’ll be covered.

If you’re just insuring your bike with a base contents policy, you don’t need any documents to get covered, but you will need to provide them if you end up filing a claim.

So, in case bad luck strikes, we recommend keeping a digital copy of receipts for your bike in your inbox or in the digital storage of your choice. Don’t forget to include your bike accessories, too. You probably have a basket, phone holder, bell, and if you haven’t invested in a good lock yet, now’s the time!

If your bike goes missing, you’ll end up claiming more than just the bike itself. If you’ve added your bike as a high-value item, this should include the cost of any accessories that are permanently affixed to your bike. Don’t worry, items like your helmet or lock are still covered under your base policy.

Here’s how to include your bike as high-value item to your policy.

Adding your bike as a high-value item (HVI) to your Lemonade policy is simple. First, make sure you download the Lemonade app. It’ll take you a minute, so just follow these steps:

1. When you’re getting your Lemonade policy, answer yes when Maya asks if you have any items worth more than £2K. Then, while customising your quote, select which items you’d like to insure under HVI’s in the Lemonade app. Maya will then send you an email.

2. Open up the email you’ll get from Maya, our friendly bot, and click ‘Add High-Value items’.

3. Go through the flow, and send over:

– A picture of your bike taken that day

– The receipt

– A picture of your bike with the receipt

If you don’t have a receipt, we can also accept a screenshot and link to a retailer selling the same item, along with your bike’s serial number and model number.

4. Our Underwriting team will get back to you and let you know the status of your request via email. Don’t worry about forgetting anything, you can always add on more items later.

A couple of notes on cover here:

Here’s a guide to everything you need to know about high-value item cover.

Have more questions about high-value item cover?

Open up your Lemonade app, and ask AI Maya, or shoot an email over to [email protected], and our customer experience team will get back to you as soon as possible.

Now that we’ve covered how you can get reimbursed for a stolen bike, what about reuniting with a stolen bike in the first place? If your bike gets stolen will you ever see it again?

If you register your bike with the Bike Register there’s a chance it could be recovered.

It’s easy to register your bike for free at the Bike Register. Add your bike details to the National Police-approved database for free. Mark and protect your bike with security marking kits. Apply warning label and reduce your risk of theft by warning thieves that you use Bike Register.

That way, if your bike does get stolen, your registration helps police get in touch with you if they find your ride.

A good bike lock can only get you so far when it comes to preventing bike theft. The reality is, bikes get stolen… a lot. The good news? Proper cover can make that terrible day a whole lot better.

Insuring your bicycle is more important, easier, and more affordable than ever! Using AI and machine learning, Lemonade’s Contents insurance quotes and policies are much lower than the industry average. See for yourself!

Please note: Lemonade articles and other editorial content are meant for educational purposes only, and should not be relied upon instead of professional legal, insurance or financial advice. The content of these educational articles does not alter the terms, conditions, exclusions, or limitations of policies issued by Lemonade, which differ according to your state of residence. While we regularly review previously published content to ensure it is accurate and up-to-date, there may be instances in which legal conditions or policy details have changed since publication. Any hypothetical examples used in Lemonade editorial content are purely expositional. Hypothetical examples do not alter or bind Lemonade to any application of your insurance policy to the particular facts and circumstances of any actual claim.