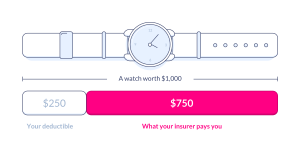

Deductible

A deductible is the amount you cover out of pocket for losses or damages before your insurance company kicks in with coverage.

How does an insurance deductible work?

Think of an insurance deductible as your participation in a damage or loss. You’re saying, “I commit to paying X dollars for any future claim, and my insurance company will cover the rest.”

How deductibles are structured

The typical homeowners insurance deductible is between $250 and $5,000, while renters insurance deductibles range from $250 – $2,500. They’re usually structured in increments ($500, $1,000, $1,500, etc.), meaning you cannot choose a deductible of $738 for example.

That said, it’s up to you to choose your deductible when buying a policy. In general, the higher the deductible you pick, the lower your monthly premium will be, and vice versa.

While your deductible will most likely come in the form of a fixed dollar amount, some companies also offer deductibles as a percentage of an insured value.

Note: Deductibles may vary based on where you live, as insurance regulations differ from state to state.

How do deductibles work?

A deductible is the amount you choose when buying your policy that gets subtracted from any covered claim, whether it’s for renters, homeowners, pet, or car insurance.

Here’s how it works in practice:

Say you have $2,000 in covered damages and a $500 deductible. Your insurance company would cover $1,500 ($2,000 – $500 = $1,500).

But if you only have $300 in damages with that same $500 deductible? There’s no point filing a claim since you wouldn’t get anything back ($300 – $500 = $0).

The key thing to remember: you handle costs up to your deductible amount, then insurance kicks in for the rest of any covered loss above that threshold.

How does a renters insurance deductible work?

Your renters insurance deductible applies to personal property claims like theft, fire damage, or water damage to your belongings. At Lemonade, you meet your deductible for each separate claim you file.

Here’s how it works: Say your laptop gets stolen and replacing it costs $800. If you have a $250 deductible, your insurer would cover the remaining $550 ($800 – $250 = $550).

Important note: Your deductible applies per claim, not per year. If you file three separate claims in one year, you’ll meet your deductible three times. However, liability coverage (if someone gets hurt in your apartment) and additional living expenses typically don’t require meeting a deductible.

How does a homeowners insurance deductible work?

Your homeowners deductible applies to covered property damage claims and you meet it per claim, not per year. At Lemonade, each coverage type (dwelling, other structures, personal property) has its own deductible that needs to be met before we can pay claims.

Here’s how it works: A kitchen fire causes $5,000 in damage to your home and belongings, and you have a $1,000 deductible. If your claim gets approved, your insurer pays you $4,000 ($5,000 – $1,000 = $4,000).

Important note: You pay your deductible per separate incident. So if you have a break-in in spring and storm damage in fall, you’d meet your deductible for each claim separately.

How does a car insurance deductible work?

Car insurance has separate deductibles for different types of coverage. At Lemonade, you choose deductibles for collision, comprehensive, and uninsured motorist property damage when you set up your policy.

For collision coverage (when your car hits another vehicle or object): Say you slide into a tree during an ice storm causing $3,000 in damage. With a $500 collision deductible, you’d pay $500 upfront and Lemonade covers the remaining $2,500.

For comprehensive coverage (theft, vandalism, weather, or animal strikes): If a hailstorm causes $1,800 in damage and you have a $250 comprehensive deductible, you’d pay $250 and insurance covers the remaining $1,550.

For uninsured motorist property damage: If an uninsured driver rear-ends you causing $2,200 in damage and you have a $500 UMPD deductible, you’d pay $500 and insurance covers $1,700.

Note: You pay your deductible per claim, not per year. So if you file three separate claims, you’d pay your deductible three times.

How does a pet insurance deductible work?

Pet insurance deductibles work on an annual basis at Lemonade, resetting each policy year. You choose from $100, $250, $500, or $750 deductible options.

Here’s how it works: Say your cat needs a $600 emergency surgery and you have a $250 annual deductible with 80% reimbursement. First, we apply your reimbursement rate to the total bill ($600 × 80% = $480), then subtract your deductible ($480 – $250 = $230). So Lemonade would reimburse you $230, and your total out-of-pocket cost would be $370.

Once you’ve met your annual deductible, you only pay your co-insurance percentage (20% in this example) for the rest of the policy year. So if your cat needs another $400 treatment later that year, you’d only pay $80 (20% of $400) and get reimbursed $320.

Note: Each pet has their own separate annual deductible, so if you have multiple pets, you’ll need to meet the deductible for each one individually.

How is a deductible determined?

Your insurance deductible is determined by the amount you choose when purchasing your policy. Insurance companies offer set deductible options rather than letting you pick any random amount.

Some factors that may influence your available options include your state’s regulations, your insurance company’s policies, and occasionally your coverage limits or property value. But ultimately, you’re in control. You pick the deductible amount that fits your budget and comfort level.

How does deductible affect your insurance cost?

Your deductible choice directly impacts your monthly premium in a predictable way: higher deductibles mean lower premiums, and lower deductibles mean higher premiums.

Here’s why this trade-off exists: When you choose a higher deductible, you’re taking on more financial responsibility if something happens. In exchange, your insurance company reduces your monthly cost since they’re covering less of the potential loss.

The exact savings depend on your specific situation, location, coverage amounts, and insurance company. But the relationship is consistent across all insurance types: you’re essentially choosing between paying more each month or paying more when you actually need to use your insurance.

How to choose the right deductible

A helpful way to pick your deductible is to think about your financial comfort zone.

Ask yourself: What amount could you comfortably cover out of pocket today if you had to?

Say something worth $1,200 gets damaged or stolen. Could you handle covering $250 of that replacement cost? $500? $1,000? The full amount?

The less you can comfortably cover upfront, the lower your deductible should be. Just remember that lower deductibles mean higher monthly premiums.

Bottom line: Choose a deductible that matches what you can realistically handle without financial stress. If unexpected expenses would strain your budget, go lower. If you’ve got solid emergency savings, you can go higher and save on your monthly premium.

Where to find and how to change your deductible

If you happen to forget what deductible you chose, you can always check out the declarations page on your insurance policy.

If you have Lemonade, you can simply open your app and check. Additionally (for Lemonaders), if you’d like to change your deductible at any point, click “Edit Coverage” on the home screen of the app, scroll down to the deductible section, and change away! It’ll only take a few seconds, and you’ll get confirmation of your updated policy via email right away.