Think of actual cash value as the eBay price of used items. It’s how much an item would go for today (same make and model), minus depreciation.

What’s actual cash value?

Actual cash value, or ACV, is a way in which some insurers price out most personal property claims to renters. Meaning, if your bike is stolen, most insurers will calculate the bike’s actual cash value when determining how much they’ll pay you for it

Insurers calculate ACV by:

- Figuring how much it would cost to replace your stolen or damaged property with a similar item today (aka the replacement cost)

- Subtracting the loss in value over time due to age, wear, and tear (depreciation)

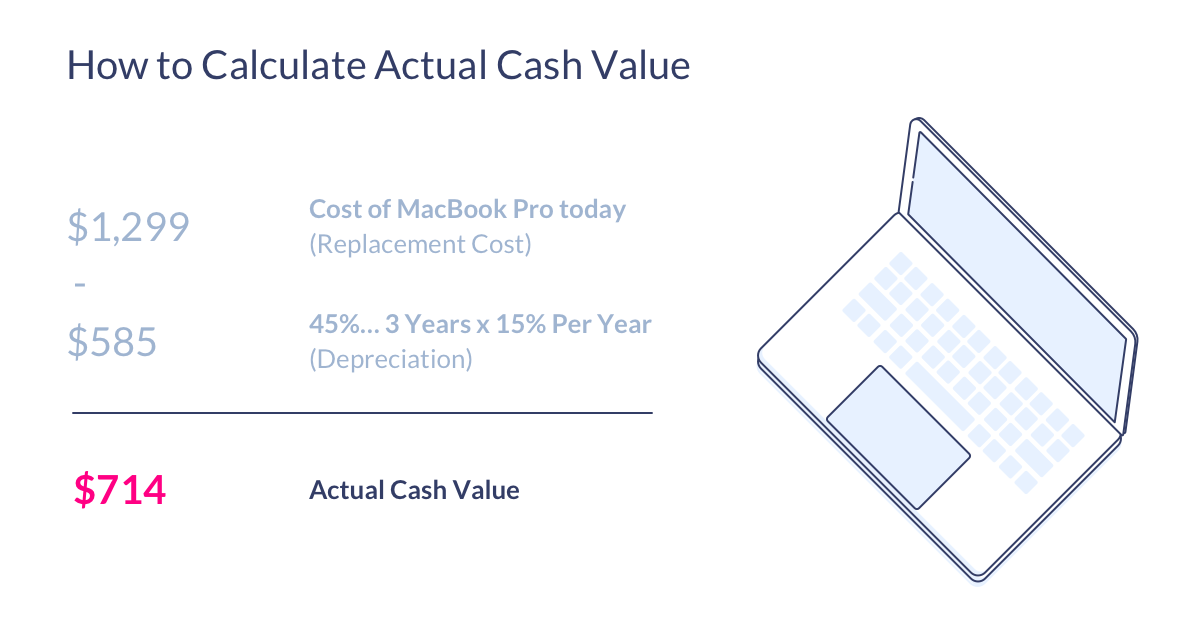

The equation for ACV looks like this:

Replacement Cost – Depreciation = Actual Cash Value

So, say someone stole a computer you originally bought for $2,000, and it was 2 years into an 8 year life span (25% depreciation means $500). If that same computer is going for $1,500 today (the replacement cost), the actual cash value of your computer would be $1,000.

Wait, what’s replacement cost?

Replacement cost is relatively simple: think of it as the “Amazon price” of how much your item (same make and model) would sell for today, if it were new.

That means, if you originally bought headphones for $300 and the current retail price for the same make and model is $250, that’d be your replacement cost.

How depreciation is determined

Depreciation is a bit trickier, because even if you’ve kept something in mint condition, it’s still aged. Unlike wine that gets better over time, most items that are covered under a homeowners or renters insurance policy go down in value over time.

Why’s that?

Think about buying a new car – the minute you drive off the lot, it has lost value.

This may go without saying, but stuff that’s damaged has also depreciated in value. Say you bought a new laptop and dropped it on the way home from the store. If you try to sell it online that day, it won’t be worth the same amount you purchased it for, even if it’s functioning properly.

While both of the above examples highlight depreciation, keep in mind that without photographic proof of the condition your item was in, insurers will usually determine depreciation as a factor of ‘lifespan,’ which is essentially how long something tends to last before it stops working or breaks.

Moral of the story? When you buy something, it gets old, and loses its value. That’s depreciation.

Here’s the equation for depreciation:

Replacement Cost x Percentage Lifespan Used = Depreciation

How is actual cash value determined by insurance companies?

Say you bought a TV 3 years ago for $2,500, and a burst pipe in your place damaged it beyond repair. You have renters insurance (yay!) and submit a claim to your insurer.

How will your insurer calculate the ACV of your TV?

Let’s use what we learned above:

- Say that same TV, or a similar model (if it’s been discontinued), costs $2,000 today. That’s your replacement cost.

- If it was damaged three years into its 12-year lifespan, that means it depreciated by $500 (25% of $2,000).

- Last up, the calculation: $2,000 (replacement cost) – $500 (depreciation) = $1,500 (actual cash value)

Pro tip: Make sure to always save your receipts and regularly take photos of your stuff. It’ll make a huge difference if anything bad happens and you have to make a claim.

Claims and actual cash value

So, the actual cash value is how much you’ll receive from your insurer when a claim is approved, right? Well, not really.

There’s one more thing to take into account: your claims payout is actual cash value minus your deductible.

Say what?

As a refresher, a deductible is an amount of money you commit upfront that’ll go towards any future claims payments.

Going back to the example in the previous section, if you chose a deductible of $250, at the end of the day you’ll receive $1,250 for your damaged TV ($1,500 ACV minus the $250 deductible).

A few quick words, because we <3 our lawyers: This post is general in nature, and any statement in it doesn’t alter the terms, conditions, exclusions, or limitations of policies issued by Lemonade, which differ according to your state of residence. You’re encouraged to discuss your specific circumstances with your own professional advisors. The purpose of this post is merely to provide you with info and insights you can use to make such discussions more productive! Naturally, all comments by, or references to, third parties represent their own views, and Lemonade assumes no responsibility for them. Coverage and discounts may not be available in all states.