You see something you like, and just can’t keep your eyes off it. Your common sense is out the window. You begin to sweat. All you can think is how badly you want it. Right. Now.

You’re Black Friday shopping, and find these deals completely irresistible.

It’s not your fault. As humans, our brains are programmed to light up when we see the words ‘exclusive,’ ‘limited time’, or ‘special offer.’ Suddenly, we go from ‘just looking’ to ‘just charge it to my card.’

So it’s no surprise that Americans buy into the madness of Black Friday each year. Retailers know that all too well – they do anything to convince us to swipe our cards and leave rationality behind.

Their weapon of choice? Behavioral economics.

This isn’t to trash Black Friday – because who doesn’t love a good sale? – but to call attention to just how easy it is to irrationally overspend. We all want to come home with killer savings, but not ‘killer’ items we realistically don’t need.

Here are 6 science-backed tips to help you outsmart your irrational self — and retailers — on Black Friday.

1. Splurge on a big-ticket item, but don’t grab anything else on your way to checkout

Picture this: You see an amazing discount for sneakers, and decide to get a pair — yours are really dirty anyway. As you head towards the cash register, you spontaneously pick up socks, a small gym bag, and a headband, because they’re all on sale.

That pair of sneakers is called the “doorbuster” - behavioral economics speak for something priced low in order to get you through the door. Its sole purpose (no pun intended) is to set you up to buy more stuff while you’re there.

These “doorbusters” tend to work because retailers design their stores to nudge you to spend more time there, even after you found what you needed.

For example, they often play slow tempo music so you’ll slow down on your way to the register, according to consumer psychologist Lisa Nemeth Cavanagh.

They also tend to place high-margin items at eye-level, and lead consumers on a counterclockwise journey through the store until they reach the cash register. (The Atlantic) This compels them to wander throughout the store while looking at tempting items.

So how do you deal? According to Lemonade’s Chief Behavioral Officer Dan Ariely, being aware of our irrationalities is the first step to stopping them. So when you’re shopping, keep these biases in mind. Grab the discounted sneakers, stay strong, and make it to checkout without adding anything else to your cart.

2. Stay energized to avoid “decision fatigue”

When you shop till you drop, your willpower drops, too.

It usually goes like this: You begin your shopping trip fully energized. At first, you contemplate how much each items costs, how much you’ll use it, and whether it fits in with your spending goals. You’ll think to yourself:

“This top is 50% off, but it’s still expensive, and I don’t think I’ll get that much use out of it. And wait, I think i saw a cheaper version at that other department store. I’ll pass”

But after many decisions, your thought processes will probably sound more like, “It’s 50%… it’s a good deal… I should get it.”

Sound familiar?

It’s not just you. Making multiple decisions, one after another, is mentally draining. As time goes on, it becomes much more difficult for humans to make rational decisions, according to science.

This is called ‘decision fatigue.’ Consider this: According to a study, shoppers who made more purchasing decisions throughout the day gave up the quickest when asked to solve simple arithmetic problems, social psychologist Roy Baumeister found. (The New York Times Magazine) Meaning, the more decisions we make, the more worn out our brains become.

Funny enough , Baumeister’s team suggested a refreshing glass of lemonade to get you back to your energized self so you can keep saving money. Electrolytes and glucose actually increase willpower.

Yes, science is telling you to eat sugar when you’re Black Friday shopping. Score.

3. Don’t fall for “FREE!”

Let’s be real: We love “FREE!”. But we don’t love when retailers use ‘FREE!’ to get us to buy something we don’t need.

Something strange happens in our brains when we see the word ‘free.’ We stop thinking clearly and go out of our way to get it.

Have you ever added a random pair of socks to your cart just to get free shipping? Or bought a sub-par bottle of wine just to get the second one free?

There’s a scientific explanation for this type of consumer behavior, and retailers take full advantage of it on Black Friday.

Prof. Dan Ariely explains in his book Predictably Irrational:

“A few years ago, Amazon.com started offering free shipping of orders over a certain amount. Someone who purchased a single book for $16.95 might pay an additional $3.95 for shipping, for instance. But if the customer bought another book, for a total of $31.90, they would get their shipping FREE! Some of the purchasers probably didn’t want the second book (and I am talking here from personal experience) but the FREE! shipping was so tempting that to get it, they were willing to pay the cost of the extra book.”

Moral of the story? Don’t make extra purchase to satisfy your need for ‘free.’ It’s irrational, and that purchase will probably end up being something you don’t need and never use.

Here’s a good rule of thumb: If you would’ve paid the same amount whether or not ‘free’ was offered, great. But skip it if A) the offer requires you to spend more than you planned or B) the deal is part of a ‘buy two get one free,’ ‘three for the price of one,’ etc. type of offer.

4. Tune out your inner FOMO

“Limited time offer”

“Only 5 items left”

“Valid until the 31st”

“Pre-order only”

“Maximum 1 per customer”

Any of these sound familiar? They’re some of the top tactics retailers use to create that love-to-hate feeling of FOMO.

Retailers often create the illusion of ‘scarcity’ when it comes to their items, because it creates a feeling of psychological arousal. If we see something’s scarce, we feel a slight high, and we want it. It’s the oldest trick in the book.

James Mourey, author of Urge, backs that up. He says presenting an item as scarce, or a deal as limited, gets shoppers thinking irrationally, even if they know they could get that same item at a better price elsewhere .

This is especially applicable to holidays characterized by mega discounts such as Black Friday . Through scarcity, retailers will make you think what you’re getting is worth more than what’s on the price tag.

How to combat this? It all goes back to Prof Ariely’s advice about awareness – if you walk into Black Friday with this bias in mind, you’ll be much less likely to fall for these tricks.

5. Don’t stop feelin’ the pain

You stroll into Anthropologie, but you’re just there to browse because you’re trying to maintain your budget. But then you see a pillow on sale that would go perfectly with your room, so you swipe your card. Then you buy $15 shampoo at CVS and $100 headphones at Brookstone— but now, you don’t feel too bad about it. So you keep shopping.

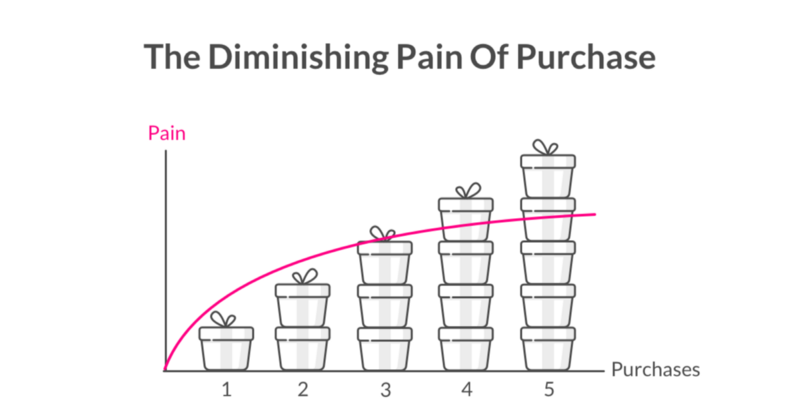

What gives? Research shows that while people are initially loss averse — aka, they don’t like losing money — once they start losing money, this aversion fades, according to Nobel Prize Laureates Daniel Kahneman and Amos Tversky explain. Why? The amount of pain we experience lessens with every additional dollar after our first purchase. (HuffPost)

So on Black Friday, after that ‘doorbuster’ we discussed above, the $15 shampoo and $100 headphones won’t lead to the “pain of paying” that usually keeps us from buying every darn thing in the store the other 364 days of the year.

That’s why retailers pull out every trick in the book on Black Friday: instant rebates, one-time sign-up discounts, credit cards, and more.

One way to combat this is to shop with cash, rather than a credit card. Research shows that paying with cash increases the pain of paying, because it makes the loss feel more concrete. So to prevent overspending, head over to your ATM a few days before Thanksgiving, and leave your card at home on Black Friday.

6. Recognize that it’s actually okay to splurge and embrace your inner spender (but just for a day)

A couple has a tradition of going to a cheap restaurant every Tuesday. However, one Tuesday they decide to splurge. They go to an expensive restaurant, and order expensive food and wine. Can you guess what they did the following Tuesday? Spoiler: They went back to that cheap restaurant.

Why? Turns out, if people increase their spending on a “special day,” they’ll usually go back to their normal routine. But those who spend more on on a random day are more likely to increase their spending in the future, according to Prof. Dan Ariely.

“If you do something in your natural habitat, it becomes part of your repertoire…if you do it separately, then it’s not me, it’s just Black Friday.” — Dan Ariely

What does this mean for our inner spender?

If you have the urge to splurge, make sure you tell yourself that it’s a special day, so afterwards you can return to your good ‘ole thrifty self.

Happy shopping!

Pro tip: It wouldn’t hurt to keep this guide handy on Cyber Monday 🙂