Here’s one thing we can all agree on: paying off student loans kinda sucks. After finishing up what many call ‘the best four years of our lives,’ we’re excited to move to a new city, rent a fresh place, and land our first jobs. One of the last things we want to worry about is paying off debt.

If you’re paying off your student loans, you’re not alone.

In fact, the average 2016 grad has over $37,000 in debt (including those who graduated debt-free). (Forbes)

Paying off thousands of dollars is no easy task, but with the help of behavioral economics, you can majorly boost your strategy. Here are 5 science-backed tips to help you say goodbye to student debt and hello to financial freedom.

1. Automatically pay every month

Picture this: You come home from a busy day at work and remember a silver lining – you got your paycheck today! You open it blissfully, and begin to imagine exciting, new ways to spend your money this month. But then you remember you have to use a huge chunk of that change to pay off your student loans… womp womp.

You begin to think about how much to set aside when a tempting thought creeps in: ‘I’ll just pay the smallest amount I can, so I can purchase those awesome new Adidas sneaks I’ve been eyeing.’

This is called hyperbolic discounting, in behavioral economics speak. We tend to choose smaller rewards now over bigger ones later. That’s because it’s easy for us to understand how a current reward would look and feel, whereas later rewards seem fuzzy and abstract.

It’s very difficult for our brains to think about our future selves. In fact, your brain shows the same neurological activity when you think about your future self as when you think about a complete stranger. (Hershfield, Hal & Wimmer, G Elliott & Knutson, Brian. 2008 – via ResearchGate) So when you’re given the choice between new sneakers for yourself, or financial freedom for a stranger, you’ll probably go with the shoes.

That means putting aside money for our student loans is cognitively hard. How can we make it more effortless?

Trick your brain by saving automatically

“The lesson of behavioral economics is that people only save if it’s automatic. If people just put away what’s left at the end of the month, that’s a recipe for failure,” explains behavioral economist Richard Thaler. (WSJ)

Several studies have shown the power of automatic saving. According to a Harvard Business School study, employees drastically increase their long-term savings when they’re automatically enrolled in a retirement plans. The study found that when automatic enrollment didn’t exist, employees rarely had a savings plan. When it did, the number of employees who participated in the savings plan jumped to a whopping 95%, just because it was automatic.

So the trick here is to automate your student loans payments. How? You can either withhold your paycheck through automatic payroll deductions, or set up automatic withdrawals from your bank account. That way, the decision will be made for you.

Bonus: All government and some private lenders charge a slightly lower interest rate if you make your monthly payments this way. Score!

2. Pay more than you have to

But how much cash should you set aside, you ask?

Let’s review how student loans work. Each month, you get a statement that tells you the minimum payment you have to make. Real talk: Your lender only wants you to pay the minimum amount, and nothing more. That’s because the longer it takes to pay off your loans, the more interest builds up, and the more money your lender makes in the long run – which is great for them, but not so great for you.

To spend less overall, pay student loans quickly

So you should pay your student loans as quickly as you can. What’s the best way to do that? We got to the bottom of this by sitting down with our Chief Behavioral Officer Dan Ariely. His advice?

“Increase your overall payment – let’s say you owe $500, make it $550. And on top of that, from time to time, when you have extra money, put it towards student loans. This will shrink the amount you pay, and help you feel like you’re making progress.”

Set payment above the minimum amount

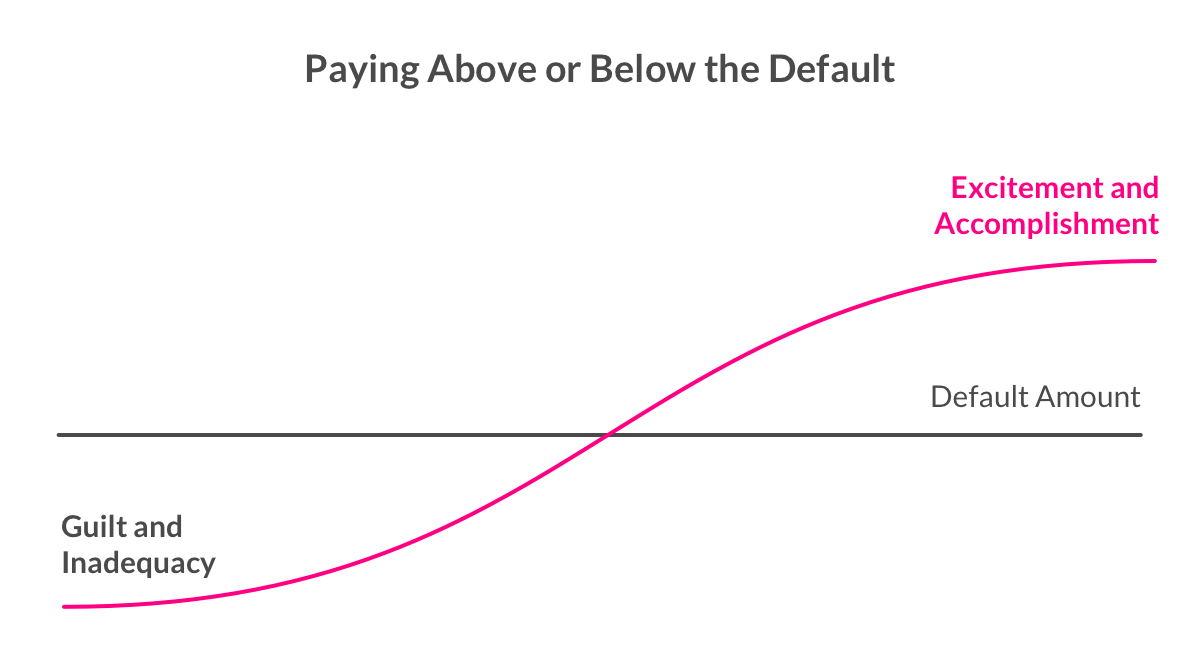

Let’s break that down. First off, when you set up your automatic payment, set it above the minimum amount. Creating this default will do more than just remove the cognitive effort of deciding how much to pay each month – it will also reframe your monthly payments.

Defaults change the way we interpret our options, according to research in behavioral economics. (National Academy of Sciences) If your default is to pay the minimum amount on your student loans, paying more than that will seem like an exciting (and rare) accomplishment. But if your default is to pay above the minimum amount, paying any less will probably create feelings of guilt and inadequacy. You’ll be much less tempted to pay only the minimum amount if doing so makes you feel guilty.

Now that we’ve got that settled, let’s figure out how much more you should pay each month. First, decide on your goal. How fast would you like to pay off your student loans? How much are you looking to save? Then, use this handy calculator by Student Loan Hero to determine how much you’ll need to save each month in order to reach your goals, so you can create a plan that works for you.

For example, if you have $37,000 in debt (the national average), increasing your payment 10% will save you nearly $1,000 in interest, and will allow you to finish paying your student loans 1 year and 2 months earlier. Boom.

3. Set aside unexpected gains

Let’s move on to Dan Ariely’s second tip – put some extra money towards student loans from time to time. But how can you do that without affecting your day-to-day? After all, you probably have tons of other bills to pay, and want to go out to dinner, a movie, or a concert once in a while.

A good strategy here is to put aside money that you got unexpectedly, called ‘cash windfalls.’ These include tax refunds, a surprise check from your grandma, returned cash from a deposit, or a settlement from a lawsuit or insurance claim.

Why cash windfalls?

According to a study called The Psychology of Windfall Gains, we tend to spend this type of money much more irresponsibly than other gains. This has to do with ‘mental accounting,’ which is our tendency to separate money into different mental categories, and spend it differently depending on the category. We tend to place cash windfalls in a ‘fun money’ account, rather than an ‘income’ account, so we’re much more likely to spend it in unreasonable ways.

For example, let’s say your grandmother gives you a surprise check of $100 (a cash windfall). You’re more likely to spend this money freely, maybe on a new pair of headphones or a fancy meal out, without thinking much about the opportunity cost. But once you’re left with the cash from your own wallet, you’ll probably get back to your usual spending habits. Since you have different accounts for the different sources of money, you’ll approach your spending differently.

So here’s the trick: instead of spending this unexpected cash on stuff you won’t even remember, try putting it towards your student loans.

We promise.

4. Trim your budget the smart way

Looking to put even more cash aside for your student loans? Try cutting back on spending, but do so with your own biases in mind. Think about how many times you’ve told yourself you’re going spend less this month without following through. If you’re like most people, it’s probably more than once.

“If you need to cut back on your lifestyle, we find that in general it’s easier for people to just cut things off as a category,” advises Professor Ariely. (Slate) So rather than reducing the amount you spend on grocery shopping, Lyft rides, and nights out, pick one group of unnecessary expenses and eliminate it altogether.

Decide where to stop spending

Where’s the best area to cut off? “The idea of ‘the best’ is an activity we can give up without sacrificing too much on our happiness,” according to Dan Ariely. It’s different for every person. To figure yours out, look at your most recent credit card statement, and mark the purchases you regretted the most. Determine which category a majority of these fall under, and eliminate that domain.

Once you’ve decided, whenever you don’t spend money on that thing, event, activity, or subscription, put that cash in an envelope or record the amount on your phone. Chances are, you’ll have a pretty nice chunk of change at the end of the month to put towards your student loans.

5. Enjoy your strategy

If you don’t enjoy putting money towards your student loans, you may not continue doing it. Science has repeatedly shown that the more we enjoy something, the more motivated we become to keep going. This has to do with dopamine, which is the neurotransmitter your brain releases when you experience pleasure. When dopamine spikes, you become motivated because you anticipate something important is going to happen.

We can use the science of dopamine to trick our brains into wanting to put more money towards student loans. But how?

Do something you love

One trick is to take something you’re passionate about and turn it into a side gig. You could start a blog, create a tutoring business, sell your creations on Etsy, freelance on Fiverr, or start a baking business – take your pick. Put your earnings straight towards paying off your loans. This will not only help you pay off your student loans faster, but will also allow you to pursue your passion in the process. Win win.

Another approach is to declutter your life. For many of us, the stuff we own has ‘mental weight’ – it takes up space in our home, and requires tons of TLC. Getting rid of your unwanted stuff will not only free up space – both physically and psychologically – but it will also give you an opportunity to make some extra cash. List all the stuff you don’t use on Craigslist, eBay, or a buy/sell Facebook group, and put all of your profits towards paying off your student debt.

One final hack is to turn your student loan payments into a game. You can do this two ways. The first is to compete against yourself – create personal targets, track them, and make it your goal to beat them. Another way is gamification. Givling is a nice example. It’s a trivia game that awards daily prizes by crowdfunding the payoff of student loans. By playing the game, you can accumulate up to $50,000 to fund your student loans. Yeah, you read right.

Moral of the story

Paying off student loans may seem intimidating, but it can be a whole lot easier if you apply the lessons of behavioral economics. If you pay off your student loans automatically, strategically, and thoughtfully, you’ll make a dent in your debt in no time. Sooner than you think, you’ll have the financial freedom to do more of what you want to do, worry (and debt) free.