July 1, 2015, was our first day as Lemonade employees, and the start of an incredible journey for Shai, myself and our founding team. Five years later, on July 2, 2020, Lemonade IPO’d and LMND was born. Today’s double anniversary 🥂 feels like the perfect moment to ask: Has our strategy delivered the edge we believed it would? And can it keep delivering wins in the decade ahead?

Looking Back

The present has a funny way of coloring the past, rendering memories a little unreliable. Fortunately, we’re not at the mercy of memories, as I’ve dug up a couple of time capsules from the early days. One is the original deck we presented to the nascent team and board of directors, where the opening bullet was ‘Technology, not Bureaucracy: Insurance powered by artificial intelligence, not artificial delays.’

I loved rediscovering this deck, since aside from cosmetic issues (colors, fonts, the moniker ‘peer-to-peer’) it’s pretty much the same slides I’ve delivered at every investor meeting and team meeting since!

The second capsule I unearthed is an interview I did in 2016 about the broader societal implications of AI, and rewatching it left me both heartened and unsettled by how little I’ve updated my AI worldview since!

The point is that while today the letters ‘AI’ adorn every investor deck and earnings call, for us this isn’t some newfangled acronym, or the latest technology fad. It’s been the centralmost plank in our strategy and thinking from our very inception.

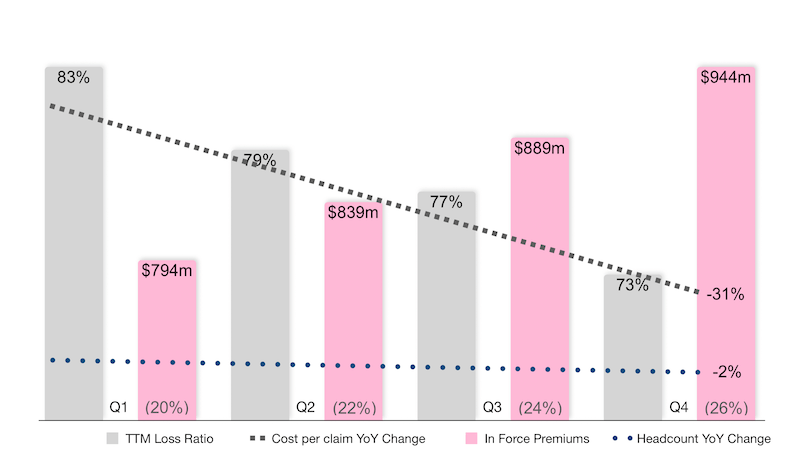

After a decade without pivots or restarts, I think the dividends of staying the course and compounding our investments in our AI-first strategy are clear: We went from standstill to over $1B in premiums in 10 years (Allstate–which grew faster than any other incumbent in their first decade–was about 90% smaller, even after adjusting for inflation, on their 10th birthday). We’re generating cash, accelerating growth, and scaling with ever greater efficiency.

In the world of insurance, dominated by truisms like ‘if it grows like a weed–it is!’ and ‘shrinking to excellence,’ seeing 10x growth coincide with rapidly improving economics is evidence of how fundamentally different Lemonade’s AI-first approach is. That’s our strategy at work, now evident in every line of our P&L.

Looking Forward

It’s neat that we committed to AI ahead of the crowd, but now everyone is awake to the power of AI, and as the adage goes, ‘past performance is no guarantee of future results.’ So it’s fair to ask whether our AI-first strategy will be more potent or less potent in the coming 5–10 years than it was in the past 5–10?

I’ve thought about this a fair bit, and my considered answer is a resounding ‘more…much more!’ Let’s consider why by evaluating two supposed threat vectors: incumbents catching up, and upstarts leapfrogging us.

Catching up!

It’s true, of course, that ‘nearly every insurance company uses AI now,’ but to paraphrase George Orwell, ‘The term AI now has no meaning except insofar as it signifies something desirable.’

The claim that companies like Berkshire Hathaway ‘use AI’ was both confirmed and eviscerated by Ajit Jain, Berkshire’s Vice Chairman overseeing all of their insurance operations (including GEICO), at their Annual General Meeting less than two months ago:

“People end up spending an enormous amount of money trying to chase the next new, fashionable thing…Our approach is more to wait and see…So right now, the individual insurance operations do dabble in AI…but we have not yet made a conscious big-time effort.”

To which Warren Buffett added:

“I wouldn’t trade everything that’s developed in AI in the next 10 years for Ajit—and I’m not kidding about that.”

Framing AI as a “fashionable thing” that some parts of the organization “dabble in”, but around which there is no “conscious big-time effort” – kinda says it all. And Buffett adding, with a straight face, that the financial impact of a single executive eclipses all the “AI that’s developed in the next 10 years”, is a startling insight into the value attached to AI in the next decade by the nation’s No. 2 insurance company.

Nor are Berkshire and GEICO outliers. Erie Indemnity’s CEO told investors they’re ‘taking a measured approach’ to AI, and a MunichRe survey of global P&C chiefs found that most CEOs are holding back investment in AI ‘until the ROI is clearer.’

In fairness, it’s not like most incumbents have the option of becoming AI-first. Legacy systems devour 70% of their IT spend, and only 4% of millennials will contemplate a career at their companies, so the AI-talent pipeline is dry. Meanwhile 97% of claims data is unstructured, trapped in PDFs and idiosyncratic adjuster notes—useless for large-scale model training. And going fully digital risks alienating their independent agents, who still place 62% of all US P&C premiums.

And it’s not just that “using” or “dabbling in” AI is not the same as being AI-first or AI-native, it’s that the differences are set to grow. Here’s how I think about it.

When you’re walking down those endless airport corridors, you can take the moving walkway, or the adjacent standard path. Which you choose doesn’t matter all that much, because the walkways move at a leisurely 1.4 mph, and are only about 100 meters long.

But imagine they were 100 miles long, and that their pace–while moderate at first–was constantly accelerating. Now whether you are on or off the walkway makes a huge and growing difference. Before too long, those on the walkway will be moving not 50% faster, but 10x faster, and then 100x faster than those who chose to stay on terra firma.

That’s how I think of being ‘AI-native’: to me it means that your company moves at the pace of AI. Not because you are exerting yourself more, but because the ground beneath you is moving at an accelerating pace.

Here’s a simple litmus test: On April 16 OpenAI dropped their new reasoning model, o3. On April 17, did your company move faster as a result? Did your automation rate jump? Did productivity increase? How about when Gemini 2.5 dropped? Claude 4.0? OpenAI’s new voice model? If not, you’re not on the moving walkway–you’re dabbling and dawdling.

In its celebrated forecast ‘AI 2027,’ the nonprofit AI Futures Project projected that the AI acceleration in software development will mean that in 2-3 years’ time, a ‘year passes every week.’ Sam Altman wrote similarly of being able to do ‘a decade’s worth’ of progress ‘in a year, or a month.’ That’s the acceleration I’m talking about.

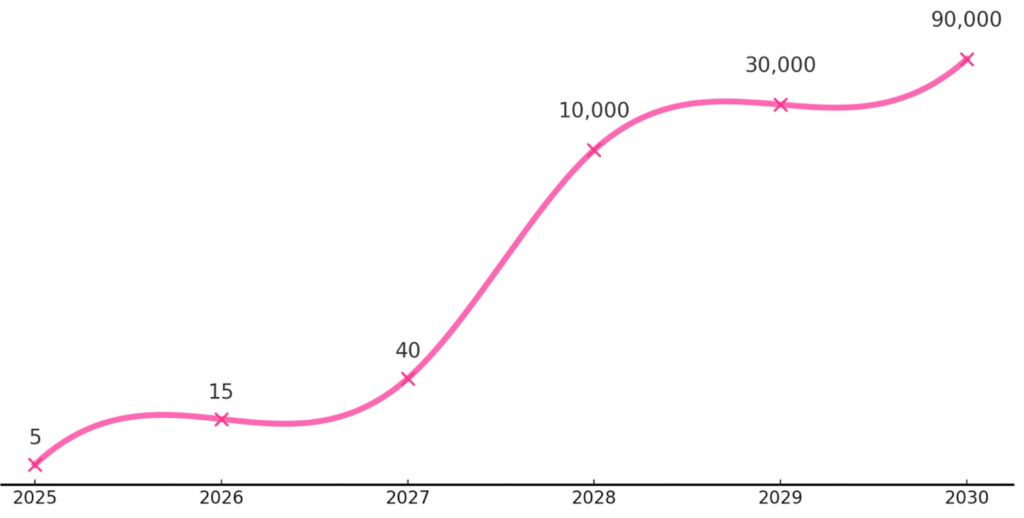

I ran some numbers using the best forecasters’ estimates of the rate of AI progress in coding, and reformulated these in terms of how many ‘engineering-years’ we can get for one million dollars – a number that hovers at around 5 today.

I concluded that it is entirely possible that before the decade is out, those that are moving at the pace of AI will find that the same $1m that buys one squad’s worth of engineering firepower in 2025, will deliver the equivalent of 90,000 engineers in 2030, firepower available only to technological superpowers like Google today, at the cost of tens of billions of dollars.

While I expect AI to accelerate coding faster than other professions, I fully expect legal, underwriting, finance, marketing, actuarial and the rest of our functions to follow on a similar trajectory – if on a somewhat elongated timeline.

Leapfrog

Ok, you say, so incumbents are encumbered, and the gap between Lemonade and the establishment is set to expand, not contract. Cool. But what about the AI-native startups of the future? If AI will write code for a fraction of the cost it took Lemonade to code its systems, what’s to stop an entrepreneur in a few years’ time–unencumbered by 100 years of legacy–from instructing an AI to ‘vibe-code a complete knockoff of the Lemonade system’?

Nothing. But it will take a lot more than knocking off our software to replicate Lemonade.

Think about it: cloned software won’t get our imaginary entrepreneur licensed in demanding jurisdictions like the EU, NY and CA, nor reinsured by the most trusted names in the industry. They cannot vibe their way to the capital required to stand up an insurance company, nor to a brand consumers know and trust with their most treasured assets. Without licenses, backers, capital, and trust, software is useless.

And then there’s data. Just as Waze gets better the more traffic patterns it ingests and the more route permutations it trials, so Lemonade’s software grew big and strong on a diet of user traffic and field tests. In the past decade we’ve conducted thousands of product A/B tests, each on about thirty thousand customers; we tested some fifty thousand variations of ads and creative on about one hundred million people; and we tracked over ten million customer journeys alongside tens of millions of customer inquiries. All told, we’ve painstakingly amassed over ten billion data points with which to feed our models. Our decade of proprietary, fine-grained data is embedded into how we’ve configured every button, ad, screen, and pathway in our system–but is beyond the reach of a vibe-coded doppelganger. There’s simply no shortcut to that level of performance.

And user experience and funnel optimization are the easy part; when you turn to pricing and underwriting, it gets far worse (or much better!). Only about 6% of Home and Car customers file a claim in a given year, while fewer than 2% of Renters’ do. That means it takes millions of policies to gather enough exposure features—and years of claims history—before a machine-learning model can reliably detect and weight the predictors. We’ve harvested over a trillion exposure data points and processed millions of claims, and it is their multivariate interactions that form the very core of our system’s intelligence. Without ten years at the school of hard knocks, Lemonade couldn’t do what it does today.

That was precisely the logic behind our purchase of Metromile three years ago. In my blog post announcing the transaction I wrote that “The most vulnerable time in the life of an insurance product is during its early years, before data accumulate”, and that it was Metromile’s “decade-long head start, in combination with the Lemonade tech stack, that holds the promise of boosting Lemonade Car to the vanguard of car insurance.” A great tech stack without great data, is as useful as a car without an engine.

10 Years In, 10 Years Out

I say all of this with conviction, but also with an awareness of just how unpredictable things are going to get. We are headed towards a future where intelligence is ostensibly free and infinite, and the blast from that intelligence explosion will upend everything we think we know about education, taxation, labor, meaning, abundance, inequality, and just about everything else.

We have reason to believe we understand the coming wave better than most of our industry, and are best placed to ride it, but we are also determined to remain open-minded, curious, agile and humble.

Here’s how we think about it: While it’s fairly straightforward to pocket a billiard ball by striking the white ball at it, it’s harder to create a chain reaction (white➜blue➜red➜pocket), and the difficulty compounds. I’ve heard it said that a chain of 8 balls leaves so little margin for error that you’d have to take into account the gravitational pull of bystanders in the room, while a 13 ball chain requires accounting for every atom in the universe.

This urban legend makes concrete the difficulty of planning too many steps ahead, when there’s uncertainty around each step and errors compound. In our Founders’ Letter, published as part of our IPO 5 years ago, we explained our approach to pioneering under conditions of uncertainty:

“We are committed to planning, but not to plans. Uncharted territory is just that: we have state-of-the-art kit, an intrepid team and an ambitious destination, but no map. So we explore, probe, and course correct. We think strategically, but are opportunistically opportunistic.”

So we’ll stay Bayesian—rolling each fresh claim, click, and customer conversation into our priors, recalibrating the odds before we line up the next shot. This isn’t just corporate philosophy; it’s our competitive advantage. While incumbents ‘dabble’ in AI with committee-driven caution, we update our models in real-time. While they wait for ‘clearer ROI,’ we compound our advantage with every interaction.

Ten years in, that habit has transformed hunches and hypotheses into battle-tested capabilities. Ten years out, we expect it will propel us faster still, enabling us to 10x our business while barely growing our expense base. That’s our strategy, that’s our edge–and that’s exactly how we plan to win.