You’re all dressed up. You showered, did your hair, and spritzed some perfume or cologne. You went out to that swanky new restaurant in town. You got a good seat by the window and you’re ready for a romantic evening.

The date is going great, until… the waiter asks about wine. Before you can jump in, your partner orders the first option they see, which happens to be a $40 bottle of Pinot Grigio. Your stomach twists in a knot. This happens every time we go out. Should I bring it up? How are we gonna split this bill? I don’t want this to lead to a fight…

Sound familiar? Even in the healthiest relationships, financial disagreements can be a major thorn. And when left unaddressed for long enough, they can become a death toll.

Most social scientists agree that financial disagreements can cause stress and dissatisfaction in relationships. In fact, a study at Kansas State University found that when new couples argue frequently about money, they’re around 2.5 times more likely to be less satisfied later in their marriage.

Of course, financial stress isn’t something you and your partner can fix overnight. But while the cause of financial stress might not go away, you still have the power to change how you communicate about that stress.

So we’ve come up with a three-round positive discussion, backed by social science, that’ll help you see eye-to-eye with your partner when it comes to financial choices.

Ding, ding! Gloves up; fighters to their corners. Ready for a fair fight? Let the match begin!

Round One: Decisions, decisions

First, we get into the nitty-gritty: Figuring out how each of your personality traits impact your spending decisions. Because what are finances, really, besides an ongoing series of personal decisions? Sure, you might have some of your monthly bills on autopay, but you’re faced with decisions about how to budget every day.

Why start here? Each of your decision-making styles can help explain the differences between your spending habits, and ultimately increase the empathy you have for one another when it comes to these hard discussions.

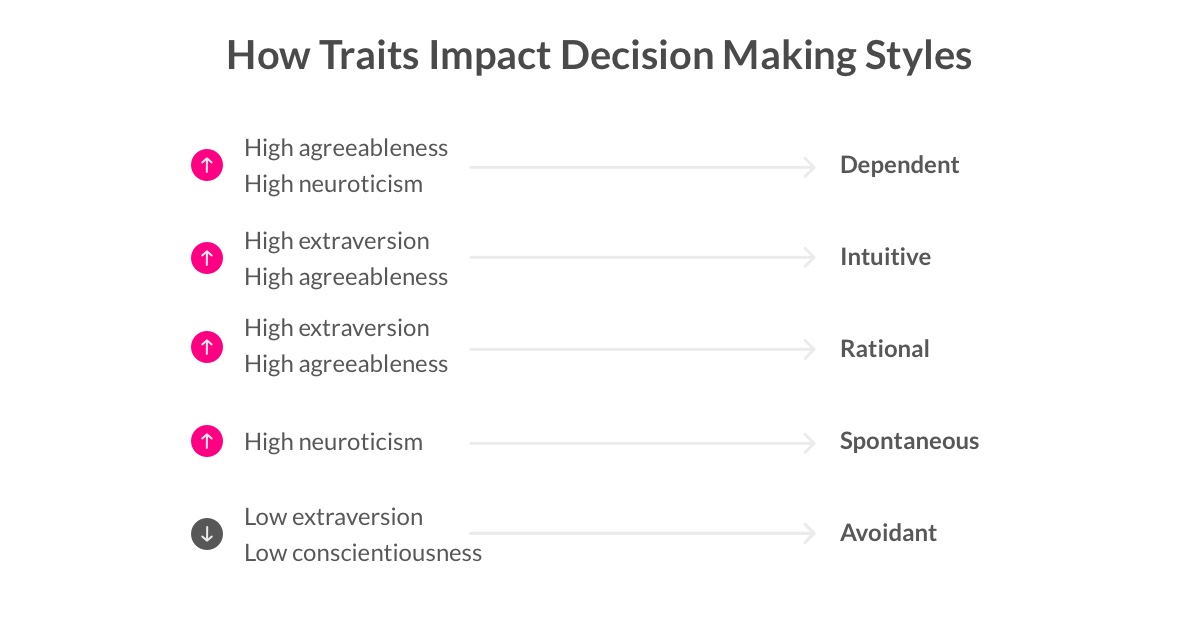

According to social scientists, there are 5 distinct styles of decision making:

As you probably guessed, your signature style can impact your decisions! Let’s say you’re ordering at a restaurant – If you’re rational, you’ll probably check out all the menu options, consider the prices, weigh your options etc. If you’re an avoidant decider, you’ll likely wait until the waiter comes to your table, and then scramble to figure out what you want (and may be swayed when the waiter recommends the most expensive dish on the menu).

Here’s where things get interesting: Last year, two social scientists published research indicating that the way we make decisions is correlated to some of our static personality traits:

Everyone possesses these traits at various degrees, and each trait operates independently. To know where you (and your partner) fall, go ahead and take the Big 5 personality quiz.

Back to your decision-making style. Turns out, if you’re high or low in one of these traits (ex. you’re very extroverted or not at all neurotic), there’s a good chance you have a specific decision-making style.

If you’re highly extraverted and agreeable, but not particularly neurotic, there’s a good chance you make your decisions either rationally or intuitively.

With this, you and your partner can determine how your personality traits impact your spending styles. So when your partner makes a spending decision you don’t agree with, you might be able to attribute that choice to a part of their personality.

Now, look back at one of the latest financial fights you had with your partner. Who was making the decision, and how were they making it? How were your personality traits at play?

As you duke this out with your partner, you might see certain patterns emerging. Maybe you’re a rational decider, but your partner is spontaneous, which is why you get ticked off when your partner buys things impulsively.

Round Two: Find common ground, and talk big picture

Now that you’ve learned a bit about yourself and your partner, you can begin folding the dynamics of your decisions into the larger-scale goals and values you share.

First, name your top three priorities when it comes to spending, and have your partner do the same. Are you concerned with the ecological impact of your purchases? Does quality matter, or do you tend to go for the cheaper option?

![]()

These should be concrete, tangible answers. Your priorities may be convenience, quality, and ecological impact, while your partner’s may be cost, quality, and necessity.

Next, think of your top 5 long-term financial goals. If there’s just one money-related accomplishment you’d like to make by the time you retire, what would it be?

You both might want want your children to graduate from college with minimal debt, but only your partner may want to donate at least 3% of your joint income to charity.

Hone in on the goals and values you share. How can you work as a team to achieve those goals? And most importantly: who should be making which decisions?

Say you’re a rational decider, and your partner is spontaneous. In that case, maybe you should be the one to make household purchases. Meanwhile, your partner should take the reins when it comes to having fun, and be the ‘tie-breaker’ when you’re stuck between two options for your night out.

The crucial thing here is creating a game plan to achieve your goals and live by your values, where each person is equally needed and equally in control.

As you talk with your partner, listen with the intent to understand. There are no wrong answers here, only your own perspectives. Prepare to be sensitive if your partner feels distressed over student loan debt or their parents’ insufficient retirement account.

In fact, Lemonade’s Chief Behavioral Officer Dan Ariely stresses that “when you fight, it’s best not to argue about facts. Instead, fight about emotions. Describe your emotions as a result of your partner’s actions. Like, ‘I felt this way when you did this.’ This can be a good conversation, or a difficult one.”

Carve out some time to have the conversation, rather than bringing it up spontaneously. If you try to force this conversation with your partner while they’re busy, it’ll only heighten the tension.

Final Round: Dig for roots

At this point, you’re either feeling relieved to see all the similarities between you and your partner, or overwhelmed by the differences. Both are normal!

Your partnership didn’t come from nowhere. You have shared roots, values, and interests that define your relationship. Your personality also didn’t come from nowhere; it came from your parents, cultural upbringing, memories, and deepest fears.

Now that everything’s on the table, talk to your partner about those things.

Say you’ve agreed that your partner is a spontaneous decider who doesn’t think much about price. This makes you anxious, because you’re avoidant and value saving money because it makes you feel safe.

Why is that? Take the time to introspect, and ask your partner questions to probe for that deeper meaning. How old were you when you first purchased something on your own? What was the context of that purchase? Did you get an allowance from your parents? What means did your parents use to teach you about money, and why?

While this might sound like a counterintuitive way to end a conversation about finance, it’ll help you and your partner see that your arguments have never really been about money. Money, after all, is merely a way to assign importance to material things, experiences, and values. There are many more meaningful forces that bind you two together.

Talking about money is hard, and bringing up financial disagreements with your partner is even harder. But by understanding that this fight is really about understanding yourself and your partner better, you can set your fears aside, and have a healthy fight!

And while you’re here, check out our science-backed advice on maximizing gift-giving and having deep conversations with your partner.