It was 5 years ago today that we sold the first Lemonade policy, and 5 years is the federal statute of limitations, so… I figure now might be a good time to spill the beans, settle scores, and fess up with impunity!

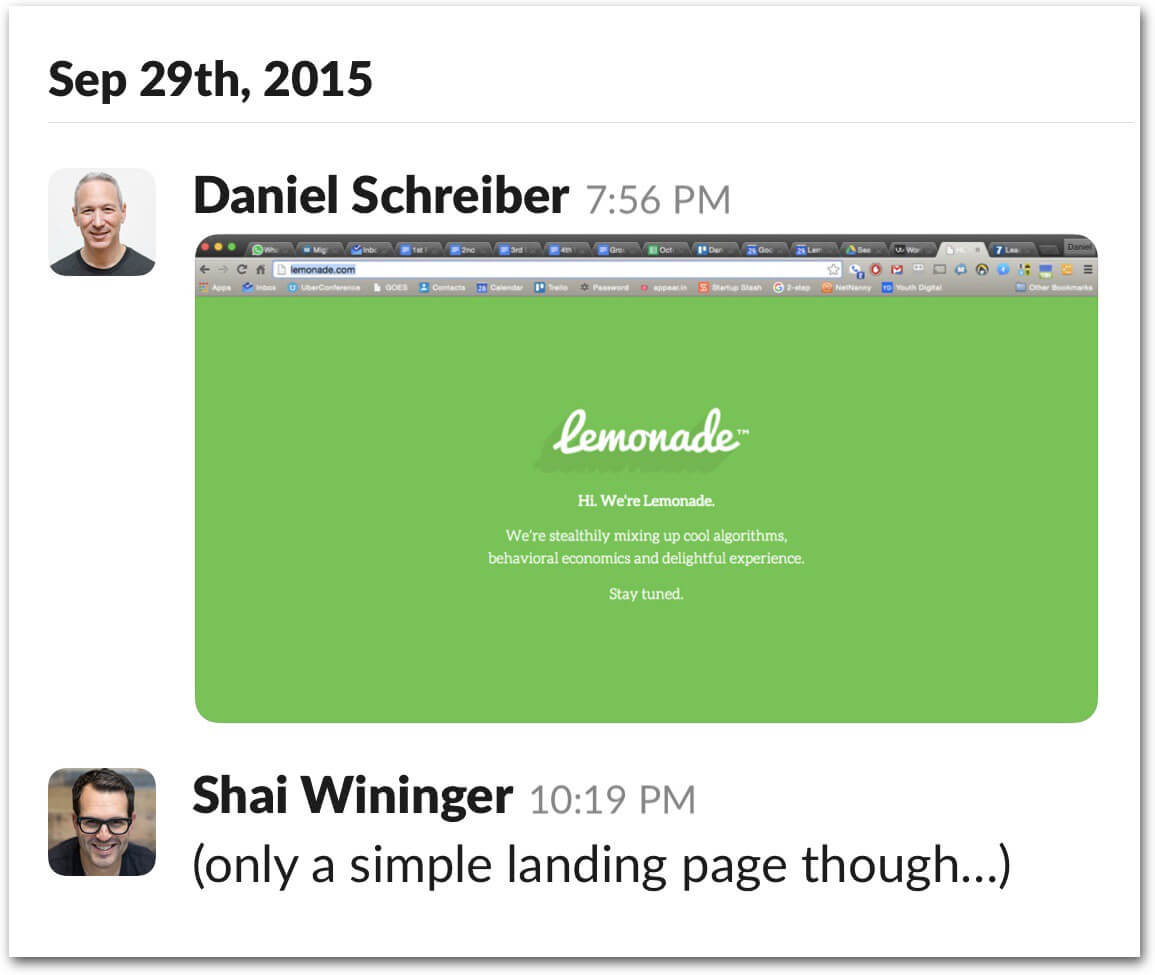

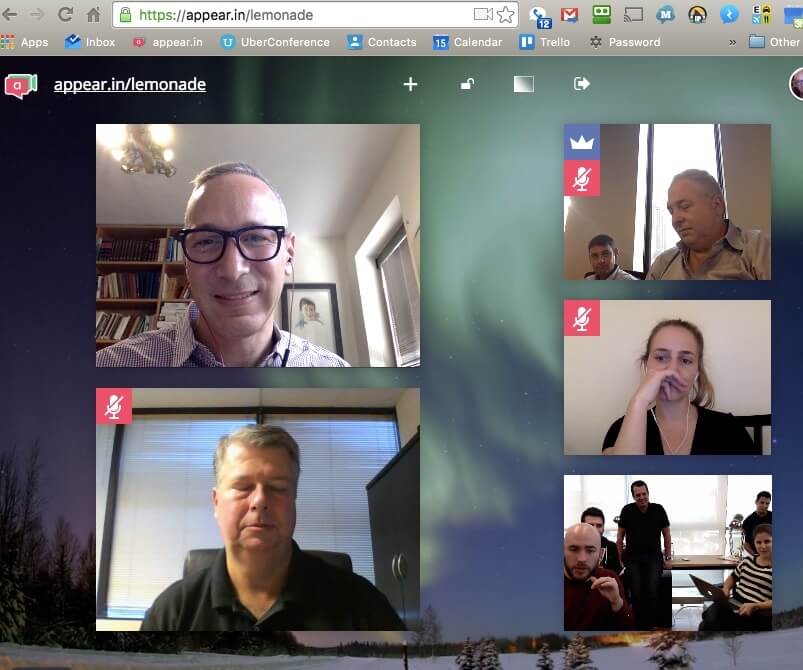

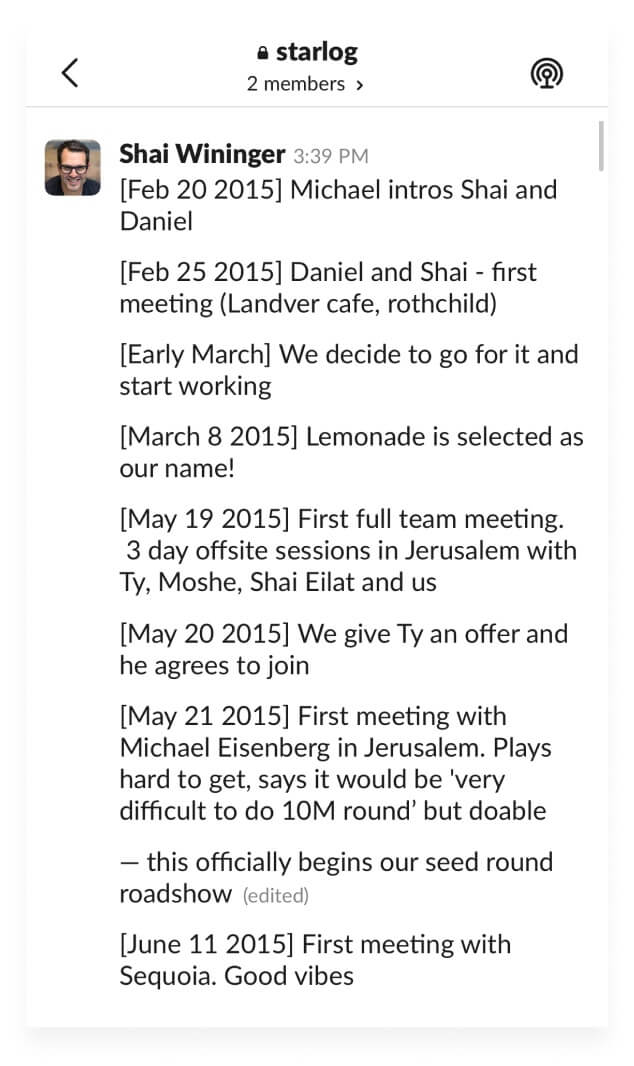

To wit, in a worldwide exclusive, I’m sharing excerpts from ‘Starlog,’ a private repository Shai and I created when we started Lemonade.

Ever since that fateful day, we have treated Starlog as our personal diary, where we record significant milestones, photos and commentary for our eyes only. Today I’m opening that archive and sharing undoctored screen shots. Some entries will forever remain entombed — mainly to protect the innocent — but many accompany this post untouched. No one on our team has ever seen Starlog, and our board doesn’t know it exists.

I guess they do now.

5 Stars

Let’s start with the obvious: our first 5 years exceeded our wildest fantasies. Two (admittedly cherry-picked) stats show why:

- We hit one million paying customers faster than Netflix, Spotify, or Amazon did, and 5–10 times faster than the most formidable insurers in the U.S. (Allstate, GEICO, State Farm, USAA).

- At a 150% compound annual growth rate, our top line accelerated faster in our first 5 years than did Facebook’s, Amazon’s, or Apple’s.

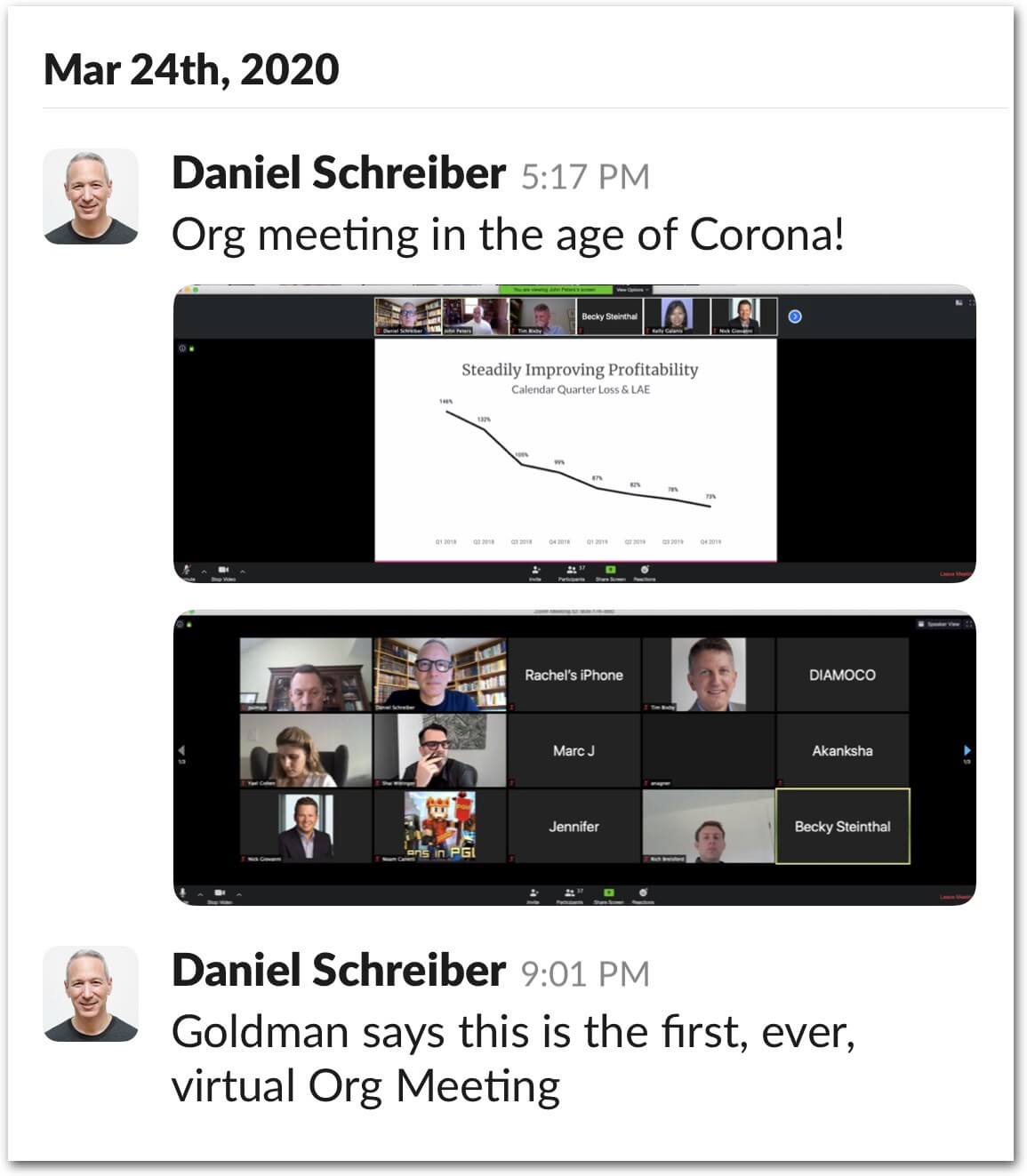

Along the way, Lemonade listed on the New York Stock Exchange, securing a multi-billion-dollar valuation and a 100X return for those who invested with us in the early days.

That last point is perhaps the most rewarding — and I don’t mean in the dollars-and-cents sense. As founders, there is nothing quite so gratifying as seeing those who threw their lot in with us — investors and teammates alike — requited. Committing capital and careers to Lemonade at such an early stage was a deeply personal bet, and we held our breath until it paid out. More than anything else, our IPO allowed us to exhale.

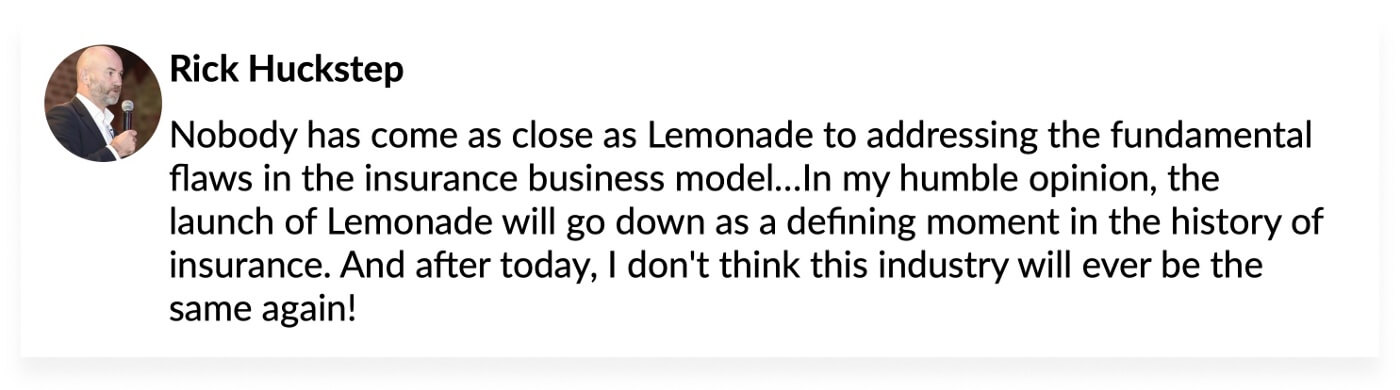

After all, in the early days, it was a rare breed of industry-commentator who was willing to publicly declare their faith in what we were setting out to do.

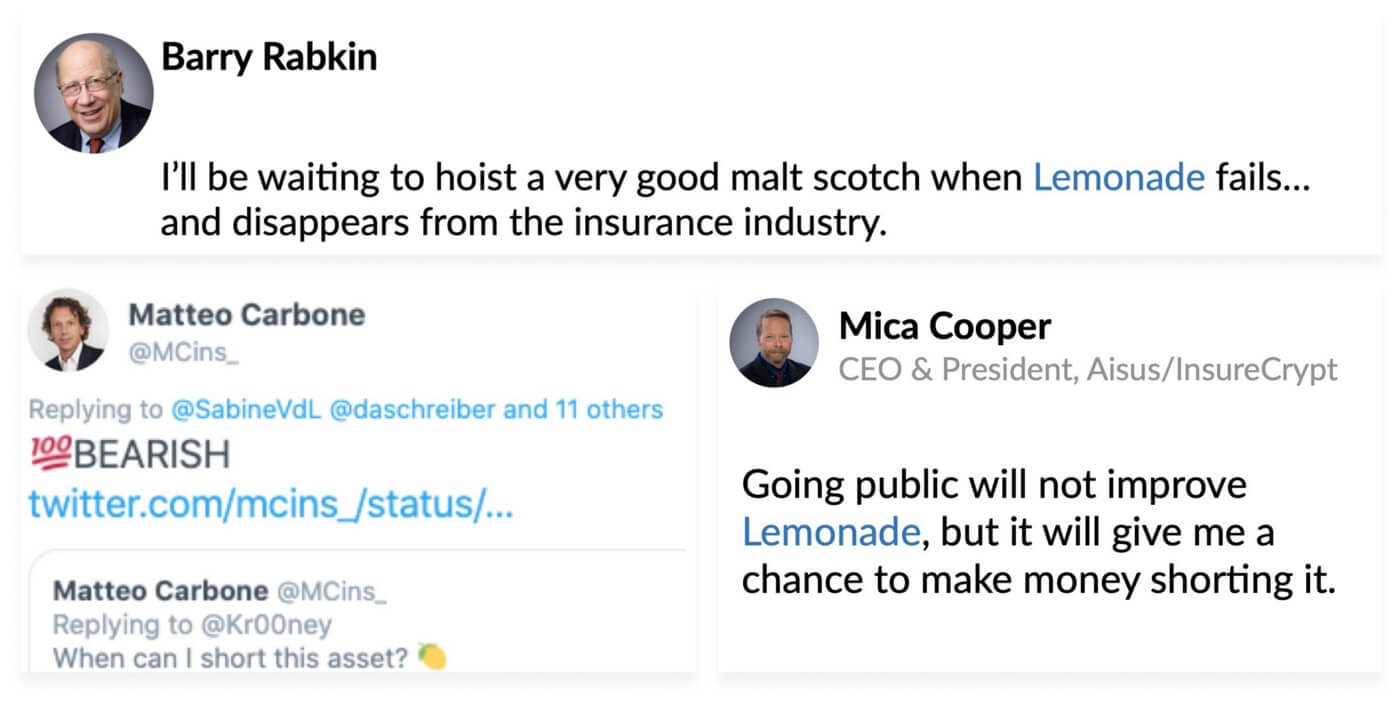

Far more prevalent were those offering prophecies of doom.

While it’s tempting (and fair game, I think) to take cheap shots at the talking heads who sought to toast and profit from our demise, I do understand their skepticism, and — in my more generous moments — am grateful that their soundtrack accompanies our journey.

For one: Lemonade was a high stakes proposition for a bunch of reasons (and for a bunch of years), and things could absolutely have turned out differently, vindicating their nastygrams. There, but for the grace of God, and all that.

For another: The race is not yet run, and things still could turn out differently. Yes, Lemonade has cleared early hurdles and racked up important wins, but as measured against our aspirations, it’s way way too early to take a victory lap.

If, as I hope we will in the coming years, we grow 100X from where we are today — State Farm would still tower over us. We’re less than 1% of the way to being 50% of their size!

Gulp.

So while we’re drawn to the stats and comps that frame our first 5 years in the best possible light, we also pay heed to our critics’ mantra: ‘the glass is half empty.’ It’s humbling, it focuses us on the work ahead, and it helps us build a better, more grounded, and more valuable enterprise. After all, we all know what cometh after pride.

The Prequel

But I’m getting ahead of myself. A lot happened before we could even launch Lemonade, let alone hope to confound its critics.

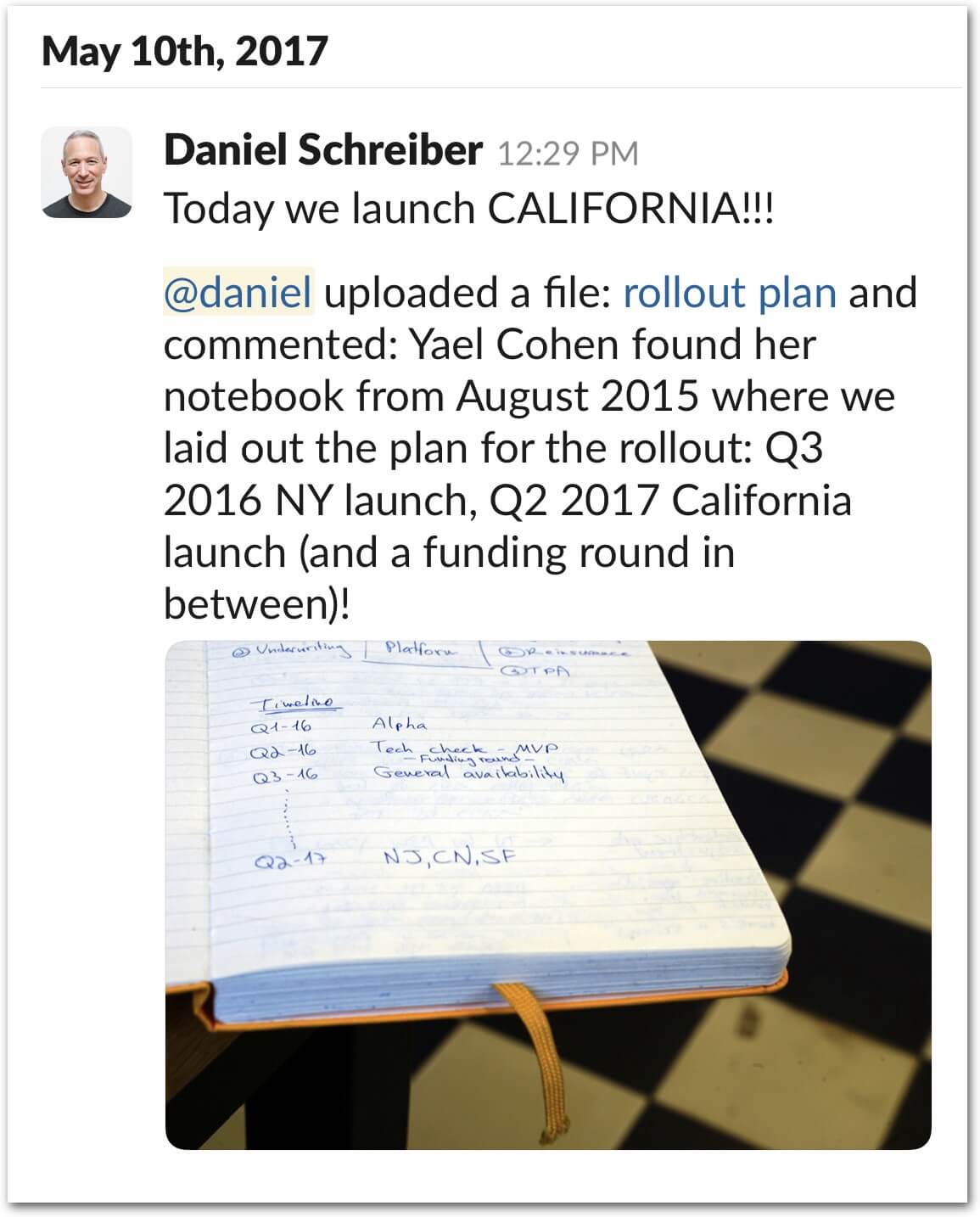

While we sold our first policy 5 years ago today, coding Lemonade kicked off exactly 365 days earlier — a coincidence I discovered when combing through Starlog.

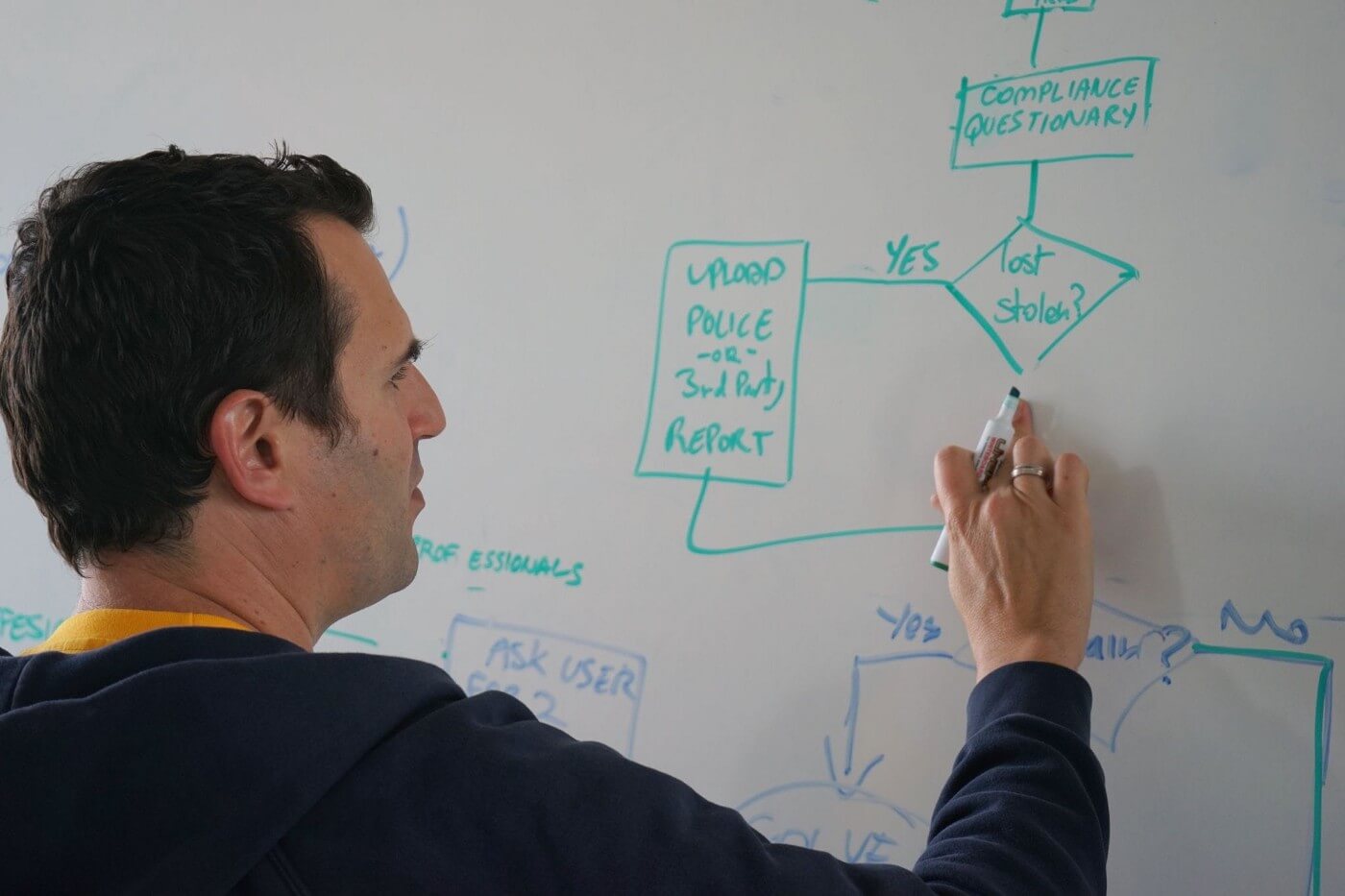

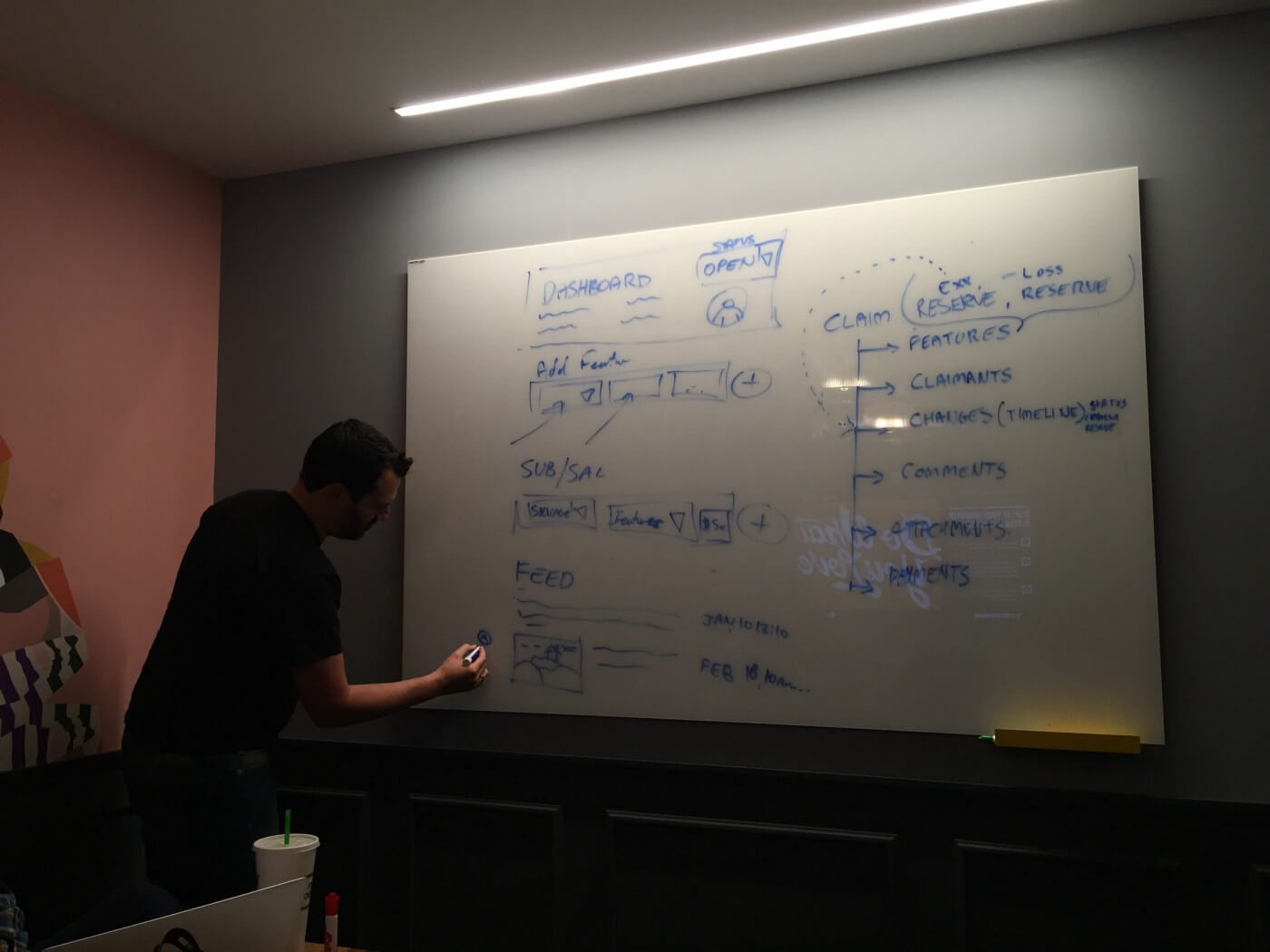

Before we decided to code the entire stack — start to finish — from scratch, we evaluated all the existing software vendors and solutions that insurance companies use. Shai sat through about 10 lengthy pitches, with each vendor explaining why their all-encompassing tech — that would set us back more than a million dollars and 12–18 months — was the way to go.

Shai is deep and thorough, and I well remember how frustrated he was by these meetings. At some point he turned to me and said: “Daniel, either I’m missing something really big, or I could code what they just showed us on my Apple Watch while driving home.”

And that’s kinda what we did.

A mere three months later, on January 5, 2016, v1 of Lemonade was ready to launch. It wasn’t coded on an Apple Watch while driving home, but six extraordinary engineers (Eyal, Liron, Mark, Moshe, Shai E, and Yuval) and 100 packed days was enough to create a proto version of the Lemonade experience.

V1 was imperfect and incomplete. We prioritized the customer-facing ‘AI Maya’ chat, and knew we’d have to do a lot of manual work behind the scenes (we had no claims flow yet, for example), but we had native apps for Android and iOS, as well as a snazzy website — and they could all sell homeowners and renters insurance delightfully. The tech was good enough to launch!

But we didn’t launch.

The long pole in the tent was never going to be the software — over which we had some mastery — but the regulators, over which we had none.

Getting to ‘Yes’

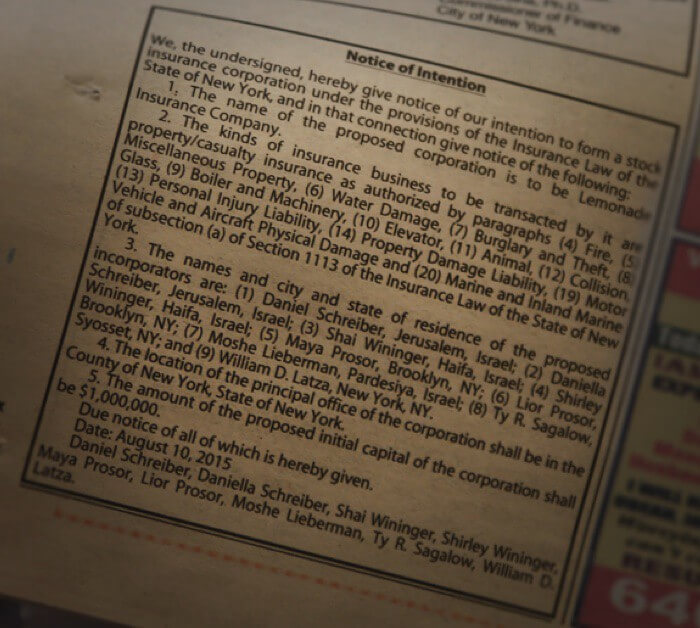

The first step in standing up an insurance carrier is for 9 ‘incorporators’ to publish a ‘Notice of Intention’ in the newspaper. Since Team Lemonade had only 5 people back then, our spouses joined as incorporators, and the notice was duly published on August 10, 2015, followed by the formal application.

And then: crickets.

Applying for a license to establish a new insurance company in New York is a rare thing. It was years since anyone had done it, and no one had ever done it in a t-shirt and jeans, so it was hard to know what to expect. But we expected something.

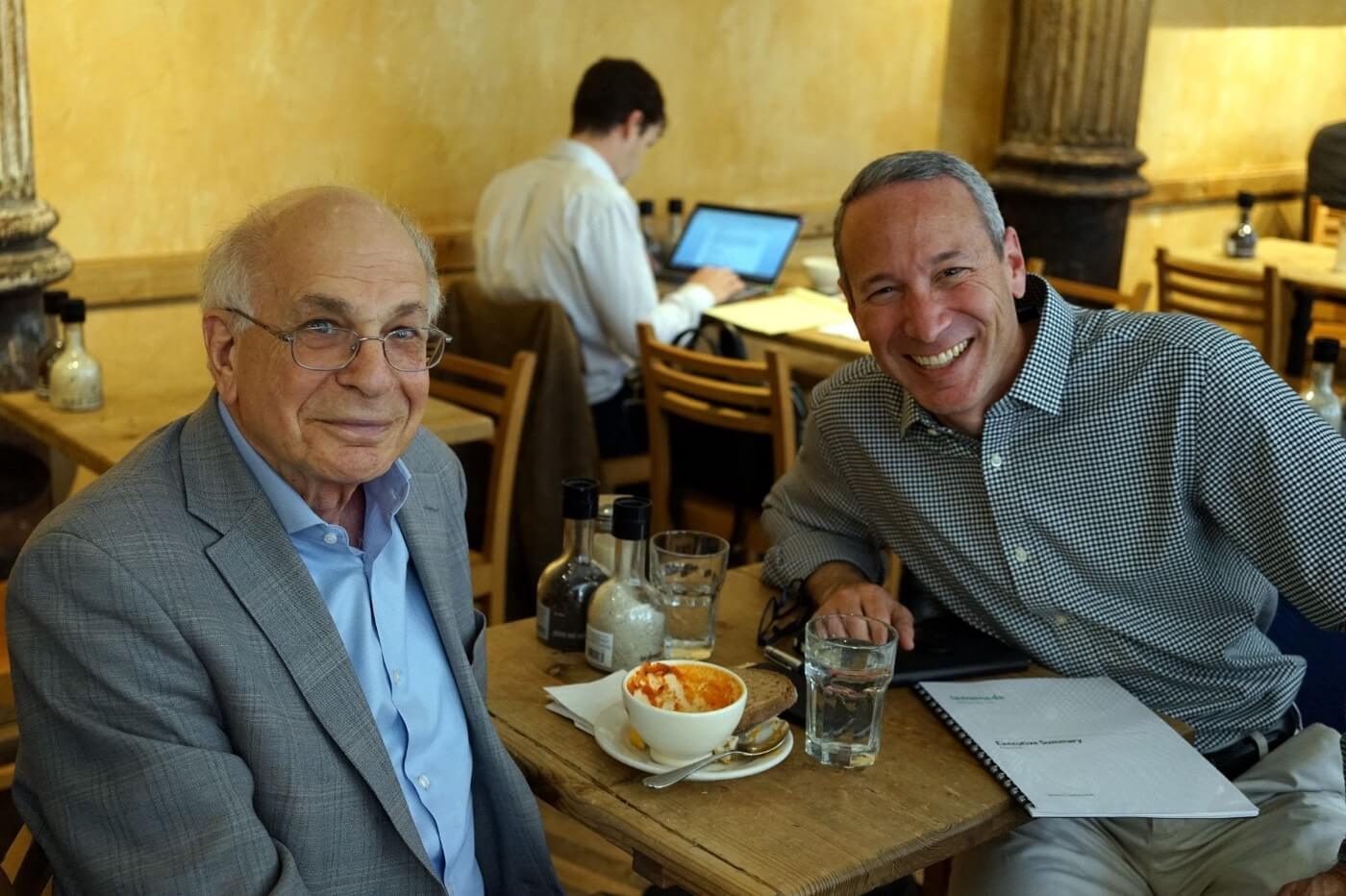

We figured it was time to bring on board some folks who knew insurance, and who were known to the regulators — yet somehow they also had to be right for Lemonade. That felt like a contradiction in terms. As I wrote back then, we were “looking for insurance insiders who were simultaneously outsiders, able to question and challenge the foundations on which they built their career.” In other words, I explained, we wanted “an oxymoron. A paradox. A unicorn.”

In the job description we literally wrote ‘midlife crisis’ as a requirement!

We found them. People like Ron Topping (CFO of Lemonade Insurance Company) and Jim Hageman (our Chief Claims Officer, and the embodiment of AI Jim), joined us, and we suddenly had real insurance muscles.

TechCrunch breathlessly reported that “Those names may not mean much in the tech community, but these guys are like the Satya Nadellas or Eric Schmidts of the insurance industry.” High praise indeed. But the next day, when I read TechCrunch’s superlatives to the insurance team they looked at me blankly. “Who is Satya Nadella?” they asked, “Who is Eric Schmidt?” 🤦🏻♂️

Yet the regulatory silence persisted. We were sitting in our WeWork office on Broad Street, a stone’s throw from the New York regulators, but couldn’t secure a meeting and couldn’t get any indication as to what was happening with our application. Our paperwork (it was all paper work) was sitting in some pile somewhere, months were ticking by, and in the meantime we were burning cash.

So we started working on Plan B. I got invited to 10 Downing Street — very exciting for a Brit like me — and the UK made a compelling case for why London, rather than NY, should be Lemonade’s headquarters.

They explained that the UK is a sizable market, and the City a global hub for insurance. Furthermore, they boasted, England enabled easy access to the US, while being an integral part of the EU. It was pretty compelling.

That meeting was on June 15, 2016 — eight days before the Brexit referendum. “We just need to get over next week’s vote,” they assured me at Downing Street, “and then we can move ahead with getting you a pan-European license.”

In the words of the Yiddish proverb — and the lyrics of Public Enemy — man plans, God laughs!

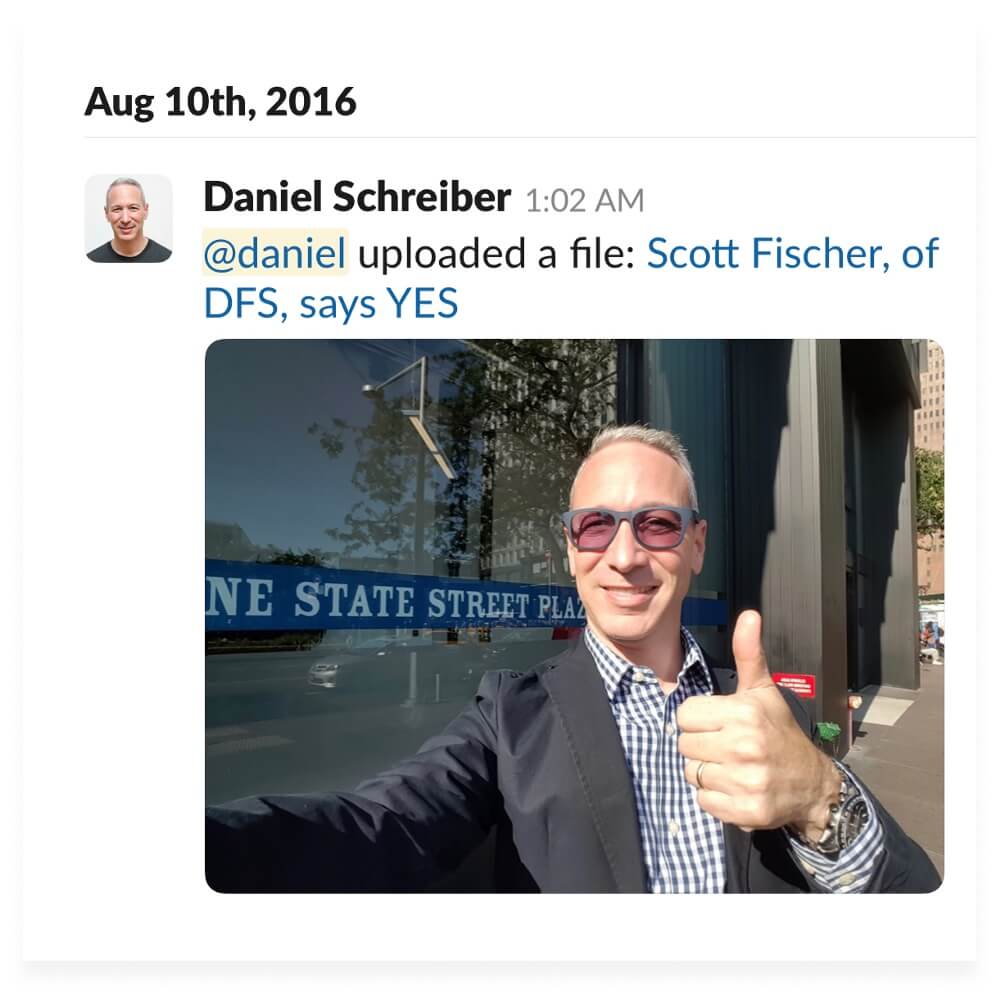

Luckily we were still working on Plan A — getting licensed in New York — and joined forces with Bradley Tusk, who helped us launch a political campaign in parallel with the stalled legal process. Bradley has dedicated a chapter in his book (The Fixer) to our exploits, but the upshot was my being summoned to the head insurance regulator at New York’s DFS (Department of Financial Services) to tell me we would be getting our license after all. The date was August 10, 2016, a year to the day after we first publicly posted our intention to form a New York insurer. It felt like an eternity.

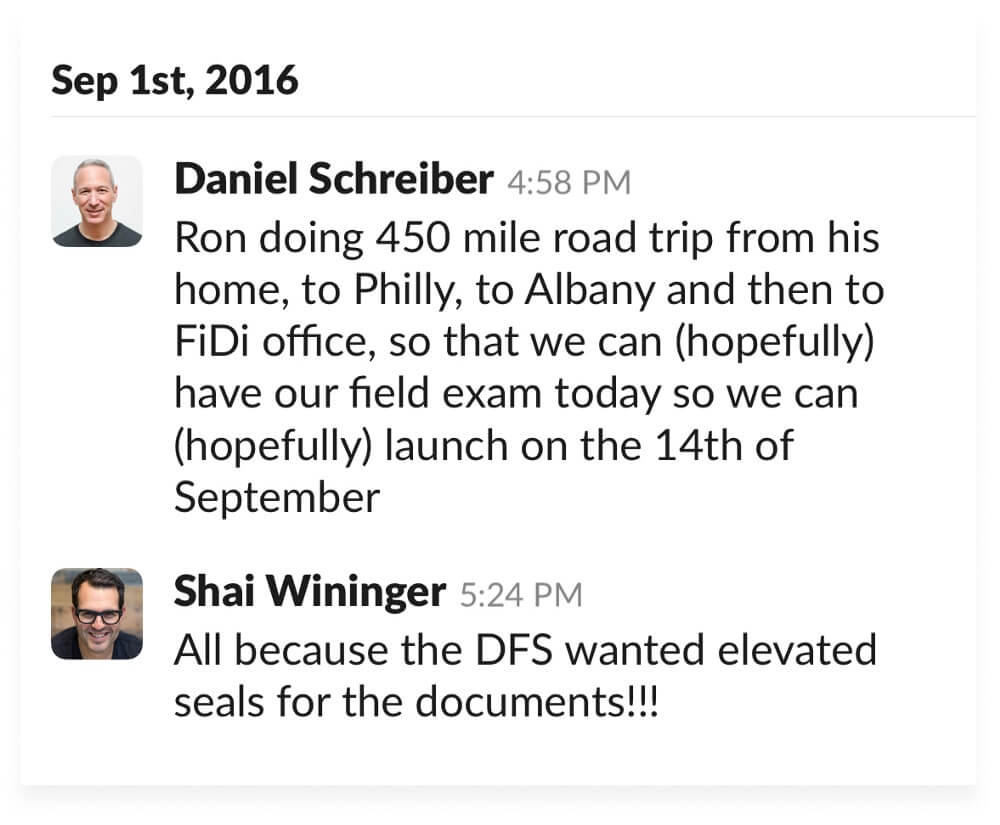

Getting from a notional ‘yes’ to an actual license required some steps that reminded us just how old-school insurance is. Turns out an insurance company needs to have a locked filing cabinet (even if everything is stored in the cloud), and a ‘field exam’ to inspect it — so we bought a cabinet and stuck it in our WeWork cubical. Turns out some papers need to be stamped with an ‘elevated seal,’ requiring extended road trips to courier a piece of paper around the country. Insurance regulations, it’s fair to say, were not drafted with Lemonade in mind!

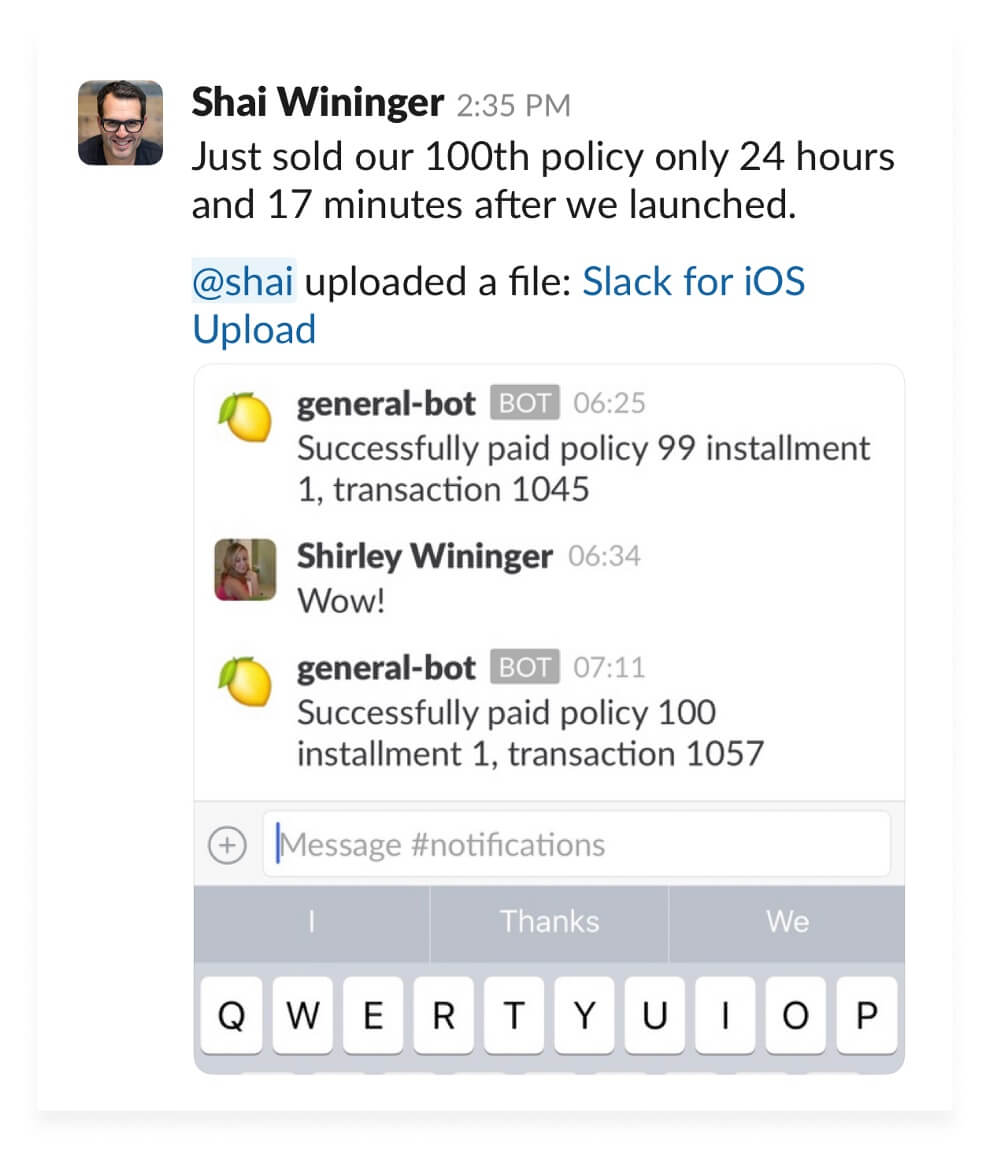

When September 21st came around — our launch day — Lemonade was composed of 23 people. None of us knew what to expect. How many people, after all, would trust a newborn insurer with an irreverent name, and a team that could comfortably fit into a single WeWork conference room?

97, as it turns out. That’s how many people bought a policy on our inaugural day. Many were tire kickers (competitors, reporters, tech or insurance buffs), but 5 years later about half of our day-1 customers are still with us!

On that first day, hundreds of people (222 to be precise) inundated us with questions of all sorts. Our Customer Experience team — comprised of Pete and Jelani — was quickly overwhelmed, and so everyone joined them in a ‘war room’ to deal with the deluge. Shai, who is the guardian of the brand’s tone, quickly (and nicely) banished me from the room. Apparently my style is too stilted, formal, and altogether too 1980s for the Lemonade brand 🤷🏻♂️.

The Empire Strikes Back

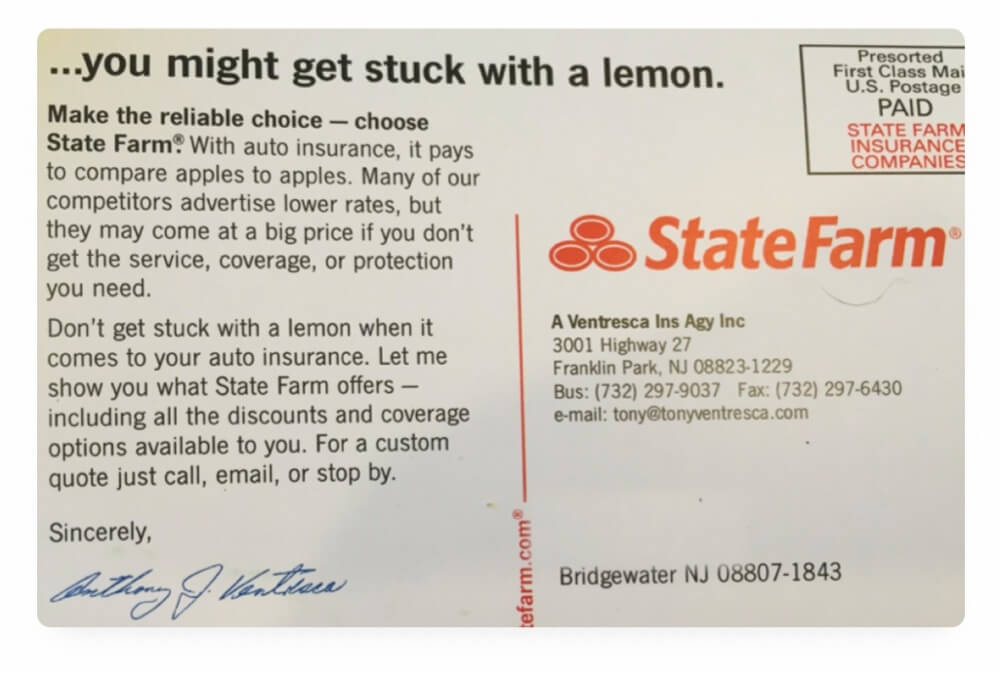

As though timed for our launch, State Farm, the largest insurer in the nation, sent out postcards urging people to choose State Farm so as not to “get stuck with a lemon.” But things really got allcaps with State Farm a couple of years later when they ran a star-studded national TV ad attacking our bots.

Christmas had come early! It was such a great ad, placing State Farm proudly in the Luddite camp, and making the battle lines between old and new as stark as ever.

We loved what their ad said so much that we did something that’s never been done before: We paid to amplify our competitor’s ad on YouTube — until State Farm’s lawyers stepped in to stop the party.

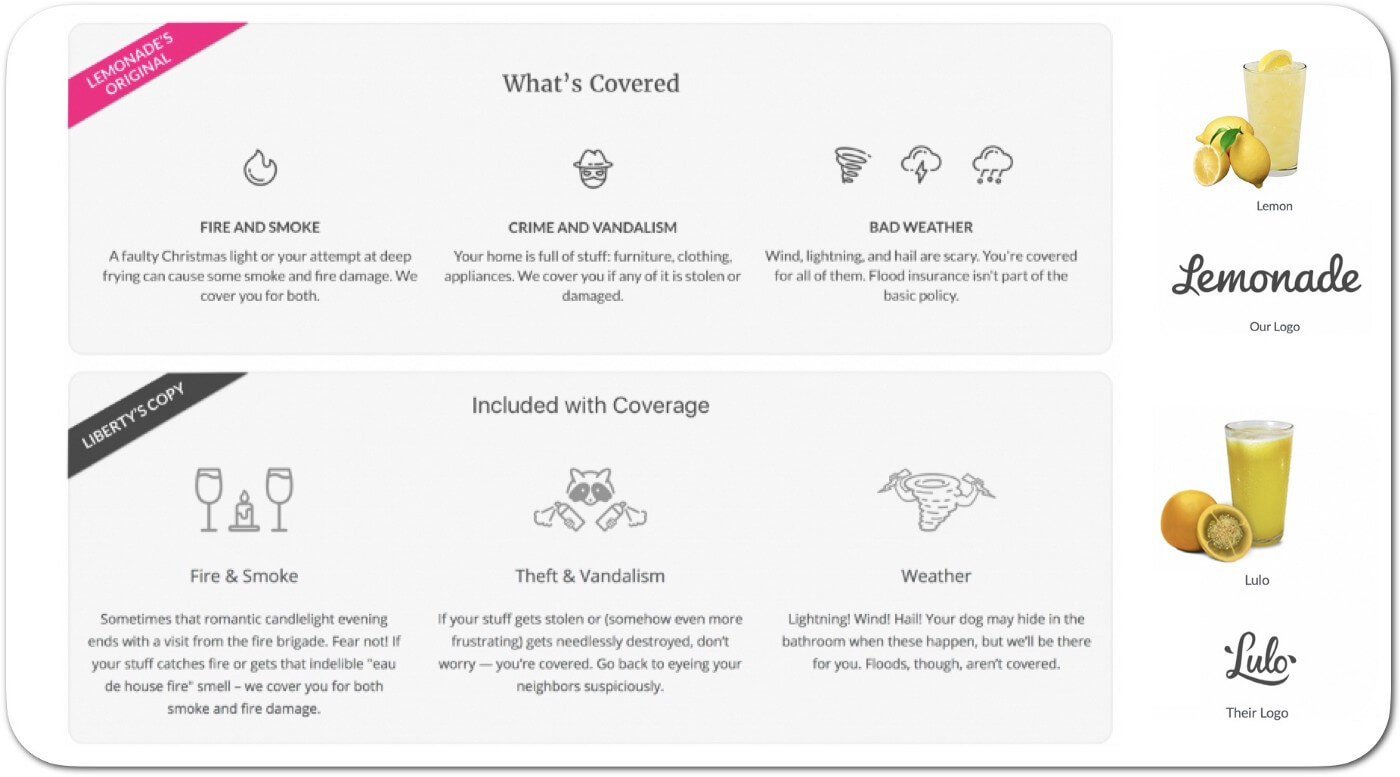

Not to be outdone, Liberty Mutual also took a run at us. Rather than attacking Lemonade, though, they decided to clone us.

They launched Lulo, a shameless doppelgänger of Lemonade, copying our pricing, wording, font, iconography, name, look, feel, and messaging:

Liberty Mutual is an incredible company and it was a little awkward seeing them stoop to selling a Lemonade-facsimile. As you might expect, these efforts produced a lemon, and Liberty quietly deep-sixed Lulo a short while later.

And then there was T-Mobile’s parent, Deutsche Telekom. These silly billies took us to court for using… the color pink!

As Shai said at the time, “monopolizing all the pink in the world sounds like something a cartoon villain would do in a Disney epic…it’s the move of a big corporation that has run out of good ideas.” So we called bullshit.

We filed counter lawsuits, and in a ruling issued on December 15, 2020, French authorities found that “there is no evidence of genuine use of this mark for the contested services” by Deutsche Telekom, confirming that “the owner of the contested mark should therefore be deprived of his rights.” Our pan-European attack on their trademark still awaits its day in court — but we plan to continue to work to #FreeThePink and have fun along the way.

The moral of these stories is that incumbents struggle with the asymmetry inherent in their battle with startups. When the largest insurer in the nation attacks a company one-thousandth its size, it boosts us and belittles itself. When Deutsche Telekom gets injunctions against our using a color, they tarnish the very brand they seek to protect. When Liberty Mutual knocks off Lemonade, it shifts the battleground to our turf…all but guaranteeing an embarrassing rout. As I tell the team, if you want to beat Kasparov, challenge him to any game other than chess!

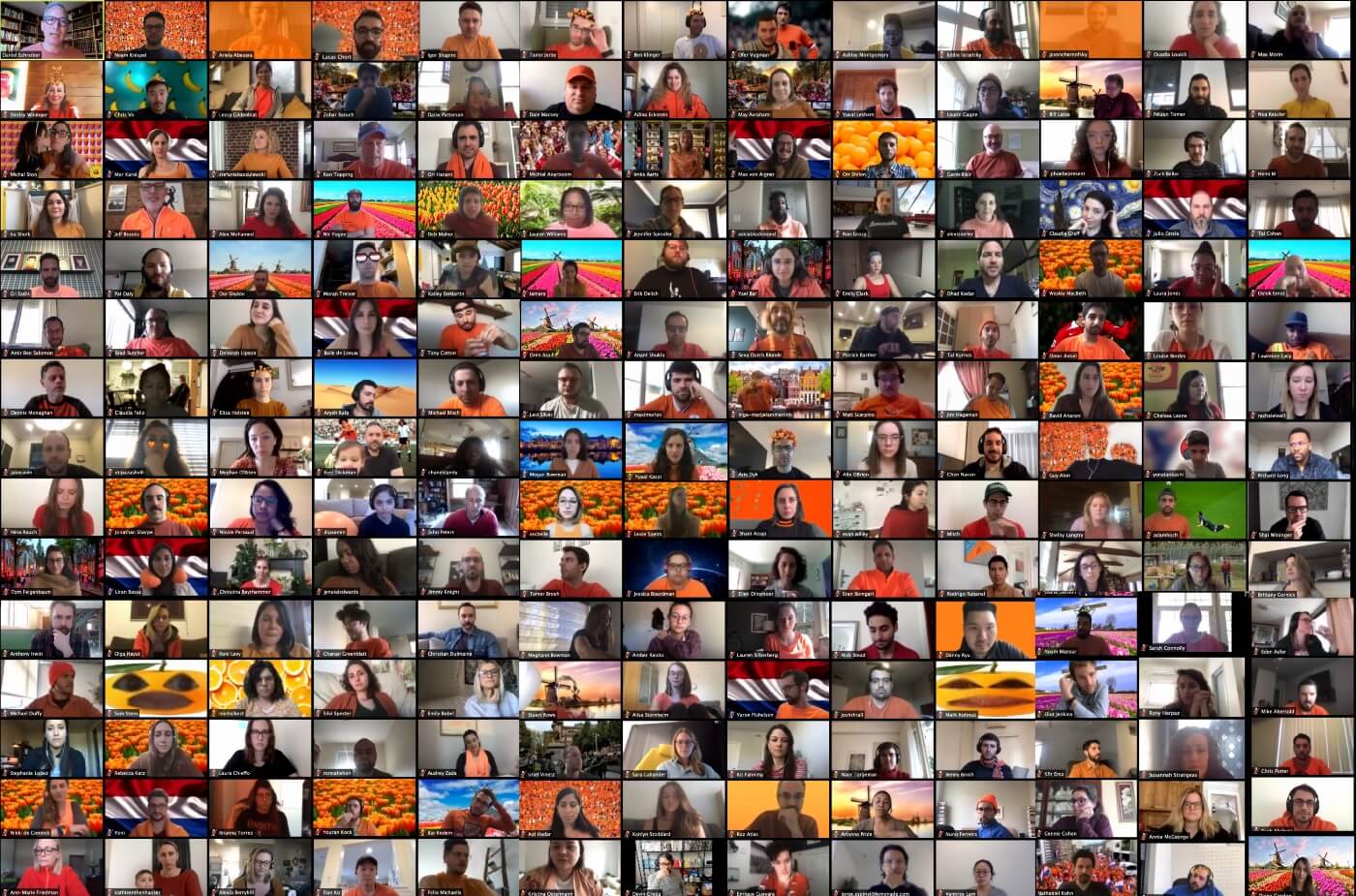

Growing a team 50X in 5 years

We were 23 people at launch — we’re adding more than ten times that in this quarter alone. In fact, every year since launch we’ve onboarded more newcomers to Lemonade than there were old-timers to welcome them.

Growing a team 50x changes more than its size — it changes its nature. To manage such a growth spurt without serious injury requires constantly evolving new organs, developing new muscles, and extending our technological exoskeleton. Achieving that is dependent on intrepid, ambitious, and open-hearted people, who infuse Lemonade with a culture that welcomes change and welcomes newcomers.

We are incredibly blessed to have such a team, and on our 5th anniversary I want to say this to them:

To those who’ve been with us for a while, know that working with you continues to be the thrill of a lifetime. Never have I been at a place with such density of talent, or such a warm, bighearted, and motivated crew.

To those who’ve joined lately, forget what you heard — you are one of Lemonade’s earliest employees. Honestly, you’ll see. You only missed the first five minutes, and now that you’re here, we’re gonna get this party started!

5 Years, 5 Numbers

And so, despite (to spite?) skeptics, cynics and competitors — and with due reverence for the trials and tribulations that lie ahead — we’re incredibly grateful for what team Lemonade has accomplished in these 5 years.

5 stats capture what a difference 5 years can make.

- Growing with our Customers:

- 50% of the customers who bought Lemonade in our first 30 days are still our customers 5 years later, and…

- They spend more than 2X on Lemonade now, than they did then.

2. Time is Relative:

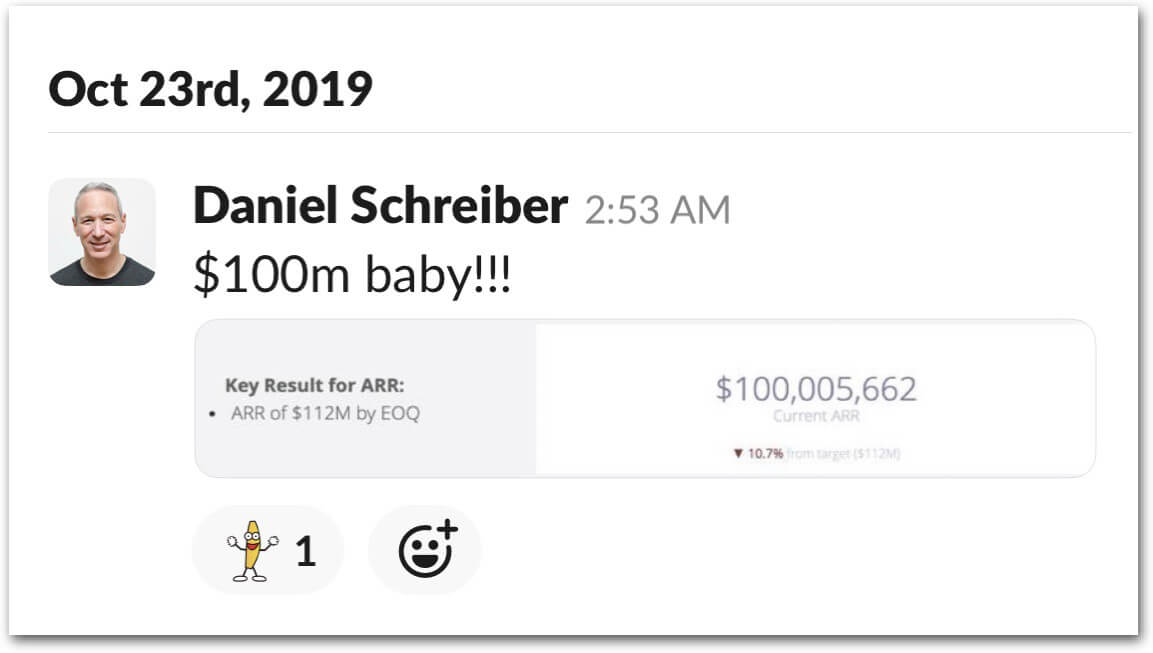

- 3 years to go from zero to $100m of in-force premium.

- 14 months to get from $100m to $200m.

- 8 months to go from $200m to $300m!

3. Maya is Getting the Hang of Things:

Maya Generated over 8 million insurance quotes in 5 years:

- 2 years to generate the first million.

- 2 months to generate the most recent million.

4. Expanding Family:

- 1 line of insurance for our first four years (homeowners).

- 4 lines this year (homeowners, pet health, term life — and we’re on the cusp of launching Lemonade Car!).

5. Giveback Grows 40X:

- $4,278,340 donated to 154 nonprofits by the Lemonade community.

- 4,232% growth between our first and our fifth Giveback.

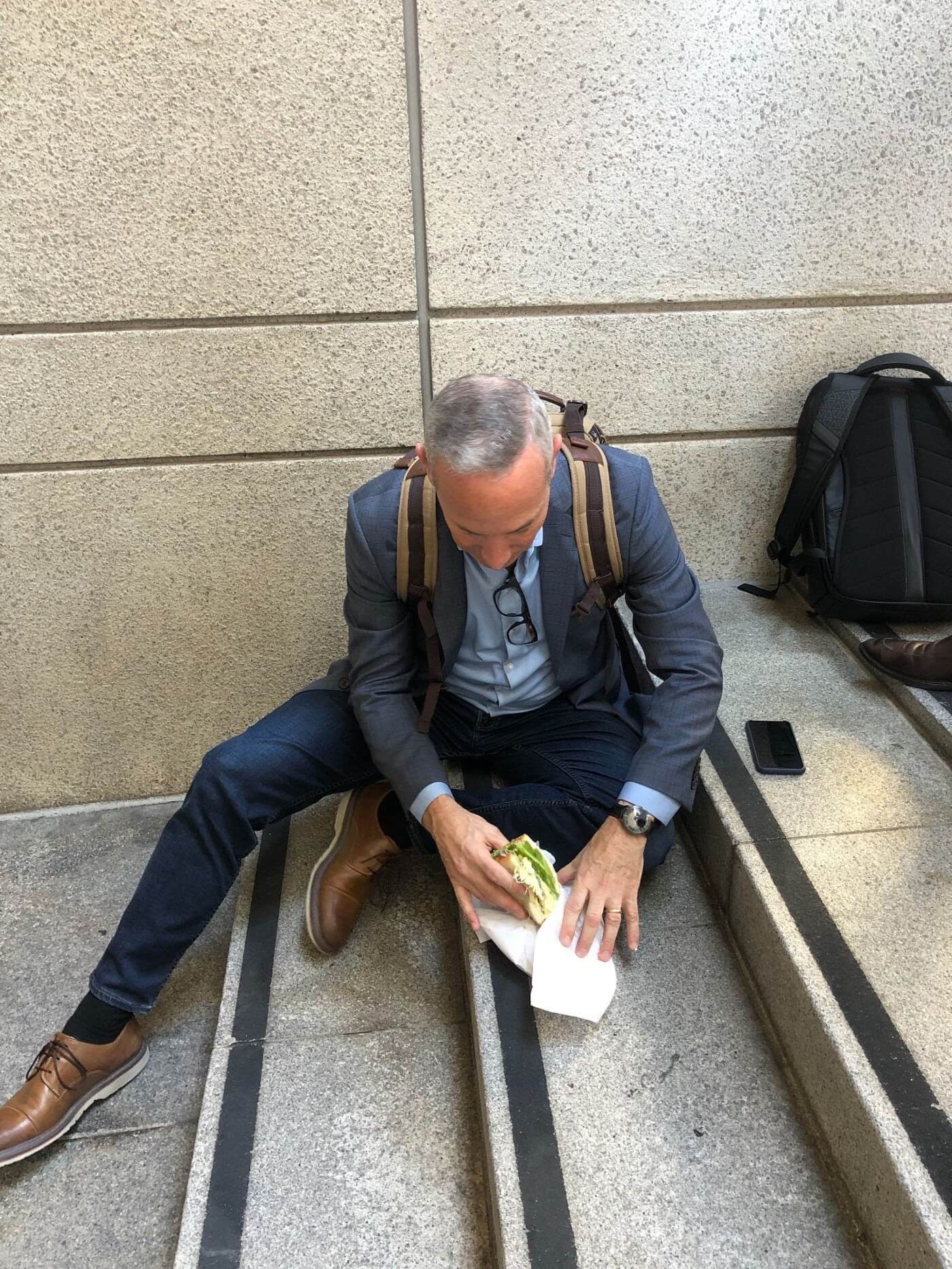

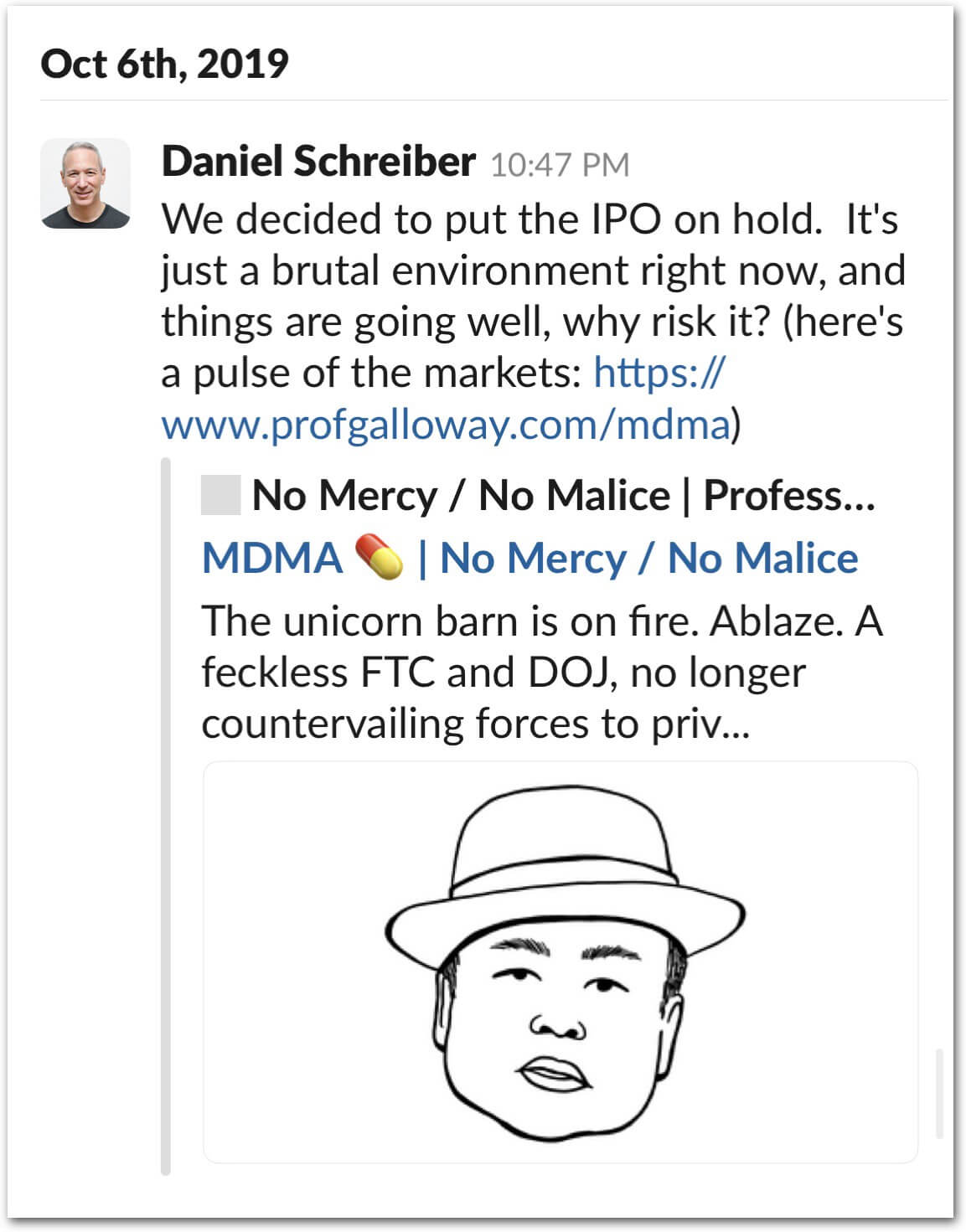

5 Years in Photos