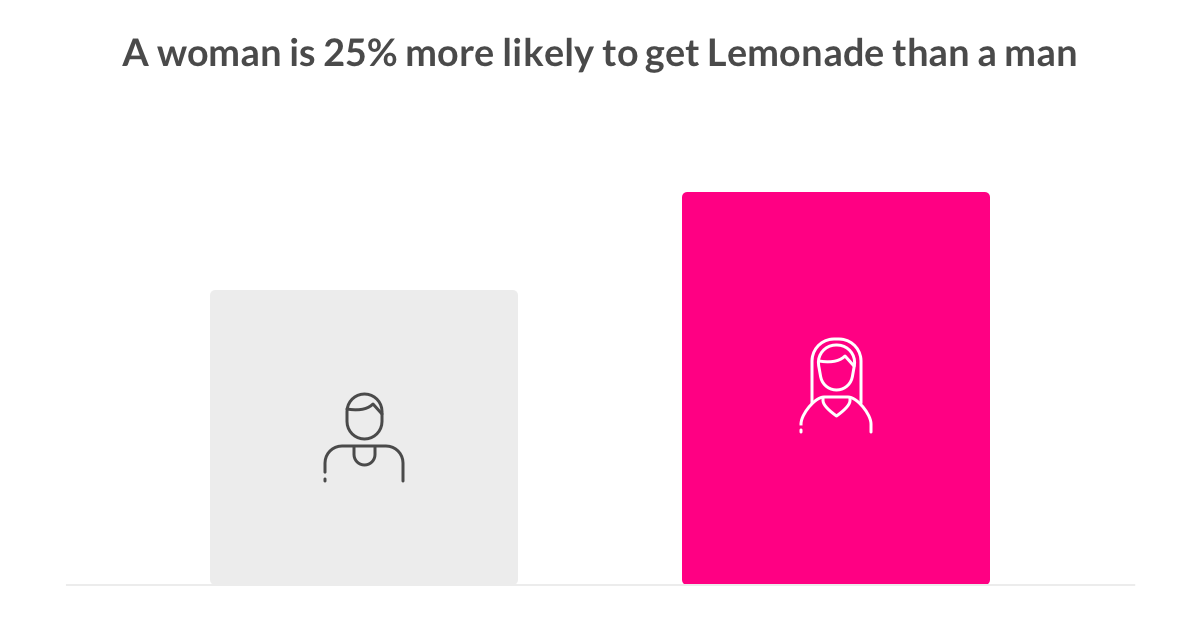

Two years ago, we discovered that women love Lemonade more than men. And in 2019, they still do.

More than half of our Lemonade community is female, but while that’s not a huge shocker, we were surprised to see women ‘convert’ better – while more men visit lemonade.com, more women buy policies.

Aka, women are more likely to get Lemonade.

So, who are these women? Ranging from 18 to 99 years old, they’re a diverse group living across the US. But as Lemonade grows older (we’ll mark 3 years in market in September!), a new generation has joined our community: Generation Z.

They’re younger (<24 years old), more likely to buy a policy on their phone, and (so far!) make fewer claims. They were also kids during the 2008 financial crisis, grew up in a post-Lean In world, and started #adulting as #MeToo unfolded into a movement.

Sound familiar? While you may think Gen Zers are just an extreme version of their millennial elders, you’d be wrong.

They’re the ‘anti-millennial.’

Generation Z: Growing up in a new world

Born after 1996, Gen Z is “on track to become the most educated, and racially and ethnically diverse yet,” according to a recent Pew Research Center survey.

They also grew up in a different historical contexts than millennials: They were babies when mobile technology emerged (‘what’s a floppy disk?’); in school when a black President and openly gay public figures were the norm; and teens during the 2008 financial crisis, when frugal spending was the name of the game.

This sets Gen Z women apart from their older female counterparts, and with the right resources, allows them to try and level their playing field.

Gen Z: Talking about inequality like never before

Gen Z women enter adulthood in a world where women are the sole breadwinners in their household more often than ever before.

Women are breaking the professional glass ceilings, getting married later, and staying alive longer. And discourse around transparency, financial freedom, gender inequality, and other topics that were once taboo have become PC.

But while we’re talking about inequality like never before, inequality is, well, very much alive.

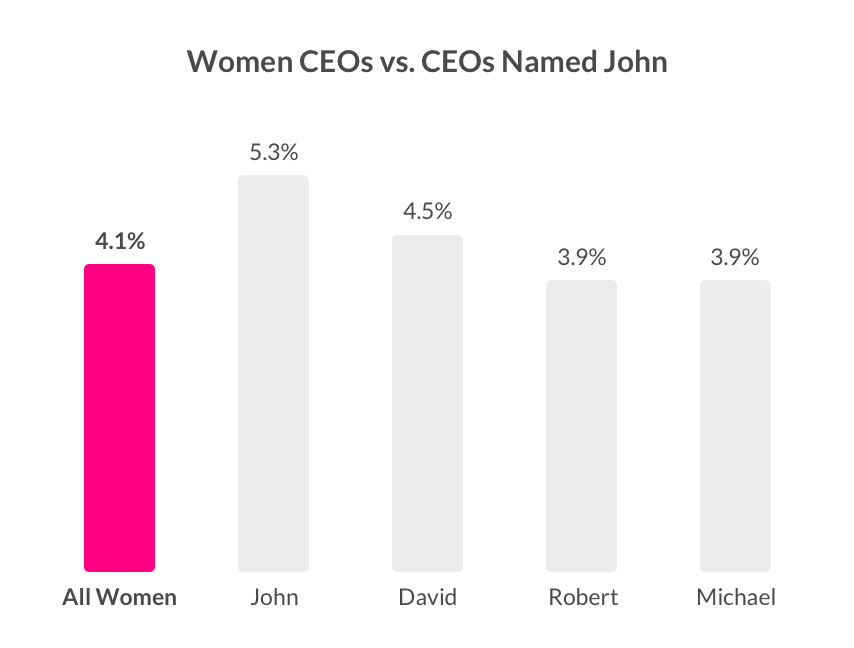

On average, American women earn less than their male peers, with highly educated women faring worst of all (WSJ). And the latest update from The New York Times’ Glass Ceiling Index still reports that “fewer women run big companies than men named John.”

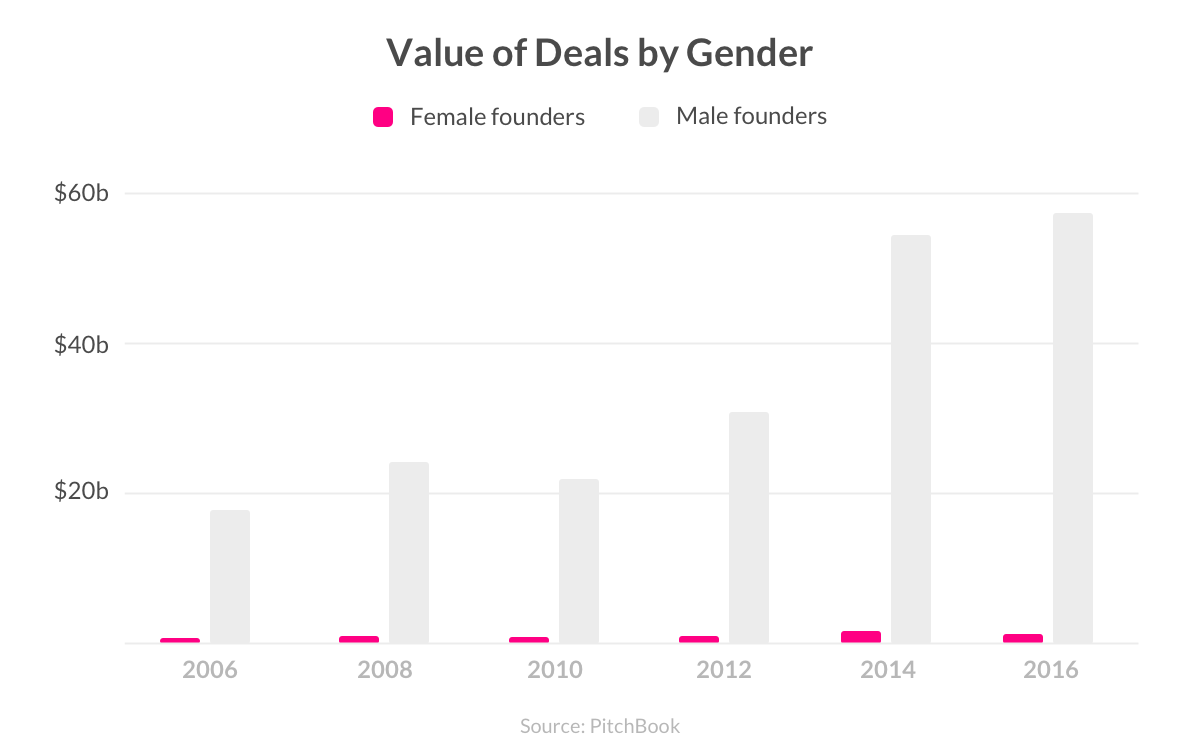

In the venture funding world, the gap is even bleaker, with startups run by women receiving a measly 5% of all venture funding:

As Sallie Krawcheck (ex head of Merrill Lynch and current Ellevest founder) puts it,

“The investing industry has been, frankly, ‘by men, for men’ — and has historically kept women from achieving their financial goals.”

This, together with the gender salary gap, longer life span, and the fact that women are more likely to halt their careers when having children put them at a huge disadvantage when it comes to reaching financial goals.

Yet our #MeToo and #TimesUp era places the element of inequality front and center – and these social movements are in part about money, says Krawcheck:

“It’s about equality. And money is equality in a capitalist society. For us [women] to break through, we need to have as much money as the guys do. One of the underlying things about all this is we’ve got to get women more money.” (Inc.)

Compared with a man who doesn’t interrupt his career, the average woman cumulatively earns $1.06 million less by the time she hits retirement age (Merrill Lynch & Age Wave).

In fact, according to a recent SoFi study, men contribute 32% more to their investment accounts than women do, which means women are missing out on the opportunity to grow their wealth on a much larger scale. And as Ashley Feinstein Gerstley of The Fiscal Femme notes,

“A lot of the [financial] information available is dense and boring, and resources were mostly by and catered to older, white men.”

Gen Z: Financial feminists

Introducing ‘financial feminism,’ a term meant to empower young women and inject the understanding that money is power. Financial feminism recognizes women already have tremendous power and the means to increasingly use that power.

It’s no coincidence that this term rose to popularity as Gen Zers become responsible for their own finances. Studies show Gen Z is more frugal with their spending, since they learned from the mistakes of FOMO-spending millennials and Gen Xers who struggled to find jobs after the recession.

An overwhelming 89% of Gen Zers say planning for their financial future makes them feel empowered, and most of them start planning at age 13. (Visual Capitalist)

And it shows. Take the real estate marketplace Zillow, which found that Gen Z women are already reaching financial equality, citing data showing women and men are purchasing homes at a similar rate and at similar prices, in comparison to single men and women who are older.

Gen Z: Leveling the playing field through tech

This inequality has found a voice in tech – with a growing number of apps and platforms dedicated specifically to women. From Ellevest to The Fiscal Femme and The Budgetnista, these platforms are tailored to ‘female-focused financials.’

Beyond the plethora of female-focused fintech, young women can also do so using the countless gender-neutral apps as well (Lemonade, Mint, Stash Wealth, and Robinhood, etc).

As Gen Z women have the opportunity (and necessity) to become more economically independent and financially literate, technology will continue to meet their need and provide them with tailored tools to grab their financial planning by the horns, no parents or partner needed.

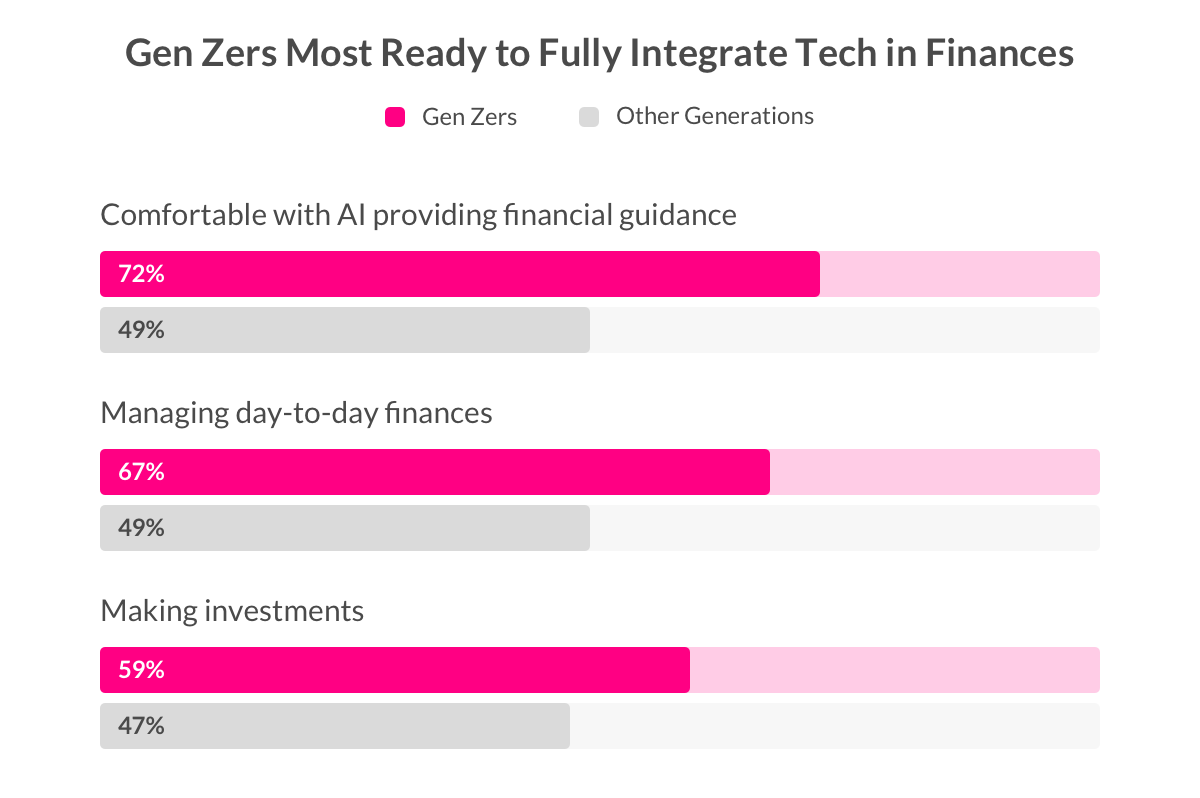

It’s no surprise then that these financial solutions are tech-based, according to a 2018 Merrill Lynch report:

A generation that knows only mobile tech expects to handle their finances on their phone, fast, and simple.

Gen Z: “The Kids Have Come To Save Us”

Beyond tech and financial feminism, recent societal advances have shaped reality for Gen Z, from legalizing gay marriage to adopting environmentally-friendly legislation. What were milestones for millennials are the norm for Gen Zers.

This has created a generation for whom a certain standard of social circumstances is expected.

Older generations have taken note of these socially-driven Gen Zers: A few days before last year’s March For Our Lives, which was organized by the Parkland high schoolers after their friends were gunned down in school, The Washington Post ran Dana Milbank’s op-ed titled “The Kids Have Come To Save Us.”

Milibank notes that we’re on the “cusp of change of a magnitude not seen since the 1960s,” citing social issues such as guns, immigration, race, and more, as Gen Z will repudiate the status quo.

Parkland survivor and Gen Z woman Emma Gonzalez told The New Yorker that activism comes naturally for her generation because “we know how to keep people’s attention on us because we’re teenagers, and we have the phones.”

In a survey conducted by UN Foundation organization Girl Up, 65% of Gen Z female respondents said they expect brands to take a stand on social issues, and 72% think it’s imperative to purchase products that are environmentally friendly.

The Gen Z Women Lemonaders

So, what does this all have to do with an insurance company?

Built completely on a digital substrate, Lemonade equalizes the insurance playing field and makes it accessible for anyone with a phone to financially protect their most valuable assets.

For Gen Zers, who walk around with computers in their pockets, getting a policy and updating coverage is as easy as ordering a Lyft, and it empowers both young women and men to take control of their financial selves.

Julia, a 23-year-old Gen Z policyholder, told us that Lemonade

“is not like some big scary company. It’s friendly and accessible, and even the language used is relatable.”

Gen Z Lemonader Alice told us that “Gen Z women are currently moving into their first apartments and starting to take on more responsibility. Since they do not have a prior home insurance go-to company/plan, they are looking for something techy and quick. Lemonade is the perfect option.”

It may not seem obvious at first glance, but beyond the value Lemonade provides with its instant technology, we’re really into the values part, too.

“Gen Z women probably value Lemonade more because it’s a user-friendly app that values their customers and charitable causes. I myself chose the charity Evolve Creative Alliance for my Lemonade Giveback, because it aims to support education in low-income areas. Having gone to a magnet public school in Philadelphia, I was exposed to a lot of socioeconomic and racial diversity which was incredibly valuable to me.”- Liz, 23, Lemonade policyholder

As a company built on transparency and trust, we’ll always aim to take stands on things that matter. As Emma Gonzales and her peers have illustrated, doing something is better than doing nothing. So from committing not to invest in coal, or taking a stance on guns, or simply distributing hacks to reduce our everyday plastic use, we’ll try to always do the right thing.

That’s something we hope everyone, men and women alike, Gen Z to Boomers, can all stand for.