Building an insurance company means dealing with volumes of laws and regulations, nuanced requirements by state, different customer needs, capital, you get it… probably explains the lack of new insurance carriers popping up, and why the average age of leading companies is 104. That’s old.

At Lemonade, we shield the customer from all of this, and created the simplest, easiest, and clearest way to get protected. Maybe we’ve been too successful on that front, implied that everything is seamless and perfect, and changing a centuries-old industry is a piece of cake.

If we implied that, I am sorry – it is not, and we never thought it would be.

We knew it would be an uphill battle, and that it would probably be easier to go along other “insurance-y” routes, like create an agency or a comparison platform. But to truly revolutionize a centuries-old industry, we needed to start from scratch. That’s why we assembled a team of knowledgeable insurance leaders to complement our outstanding technology squad.

As one should in this industry, I take the long view.

We are building a company that is here to stay, and just as in my previous insurance underwriting report last year, I wanted to share how we’re doing.

The underwriting stats (almost) a year in

As any lifer will tell you, growing in insurance is easy, and as you know, we’ve been growing fast. It’s growing intelligently that is hard.

Before I go on, one caveat. The first thing I wrote back in January was “100 days of data isn’t that meaningful in insurance.” Well, the same largely holds true for 300 days of data. But with that grain of salt, here is where we are.

From an underwriting perspective, things are proceeding as expected. We have a grand total of $433,000 in earned premium in the first half of 2017. We are selective about our underwriting – purposefully so. Renters are generally pretty straightforward, so most become Lemonade members instantly. Homeowners are a little more complex, and we need to be more careful in setting prices and determining what properties we can take on.

To give you a sense, we decided to not quote nearly half of homeowners customers in the first nine months. Yes, that would have been $10 million in premium, and we would have felt great – until the insurance claims started arriving.

Our underwriting team makes sure homes are in good shape, our portfolio is balanced, and our customers are thoughtful, reliable, and aligned with the Lemonade movement. If you were one of those declined a quote, we apologize. That does not mean, of course, that you are a bad person. All it means is that we can’t provide the right product at the right price to everyone – yet :).

The customers that are joining largely still fit the same profile we outlined in our very first 48 hours – younger, educated, tech-savvy, above-average earners, passionate about giving back – and as we recently posted, women. We love our customers, think they fit well with Lemonade’s values and mission, and are thrilled each time another member joins the Lemonade community.

Claims, as expected

Claims have been as expected. We’ll settle in at around a 3% claims frequency. That is slightly higher than the industry norm, but we love that our customers actually USE insurance for what it was meant to be, and don’t see it as a necessary evil, a black hole they pour money into. Good news from an insurance perspective is that severity, or the cost of a typical claim, is lower than average for us – and that’s encouraging.

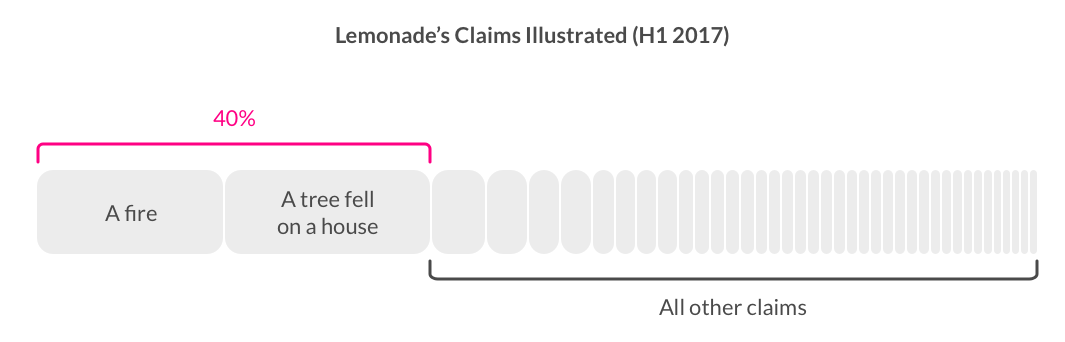

Since our launch, we have handled two large claims. One customer had a tree land on their house; another had a fire. We were there for them in their time of need, and we feel good about that. Those two claims account for almost 40% of our claims dollars.

That is the business of insurance. If they had not happened, our results would look much better. So we can’t get too excited with great results or too disappointed with worse results when we are so young. As many industry experts point out, long term results are what matter.

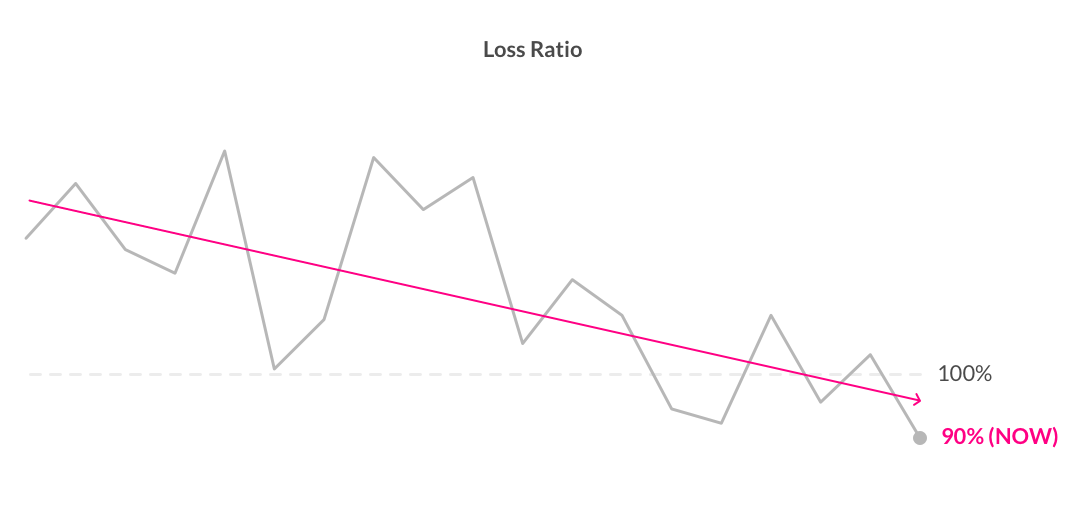

So you don’t need to dig into our financial statements, here are the highlights. Our gross loss ratio in 2017 is 140%. That is high, but reread the paragraph above. In fact, it’s been on the decline – currently at 90%, and dropping.

Fortunately, we have great reinsurance partners who reimbursed us for many of those claims, so our net loss ratio, as of June 30, is 76%.

A big deal: Our reinsurance partners believe in Lemonade

You may ask – will these partners always be around to support us? The good news is they take the really long-term perspective, and we are developing exactly as expected. I’m happy to report that we signed a new reinsurance contract a month ago, and many of the leading insurance and reinsurance companies from across the globe joined in. This includes two of the top three global reinsurers; expert specialists that reinsure and even write homeowners themselves. From New York, Bermuda, and London, these partners are in the hubs of insurance knowledge and capital.

More importantly, they signed on for multiple years and gave us the flexibility to learn, grow, and develop.

They did so with the full knowledge of every single underwriting and claims metric, and full access to every person on the team. We were over-subscribed, and could not accommodate all of the demand. As a veteran of the traditional insurance industry, I really respect these underwriters and companies, and if that is not a vote of confidence from experienced insurance leaders, I don’t know what is.

Reassuringly similar, but powered by technology

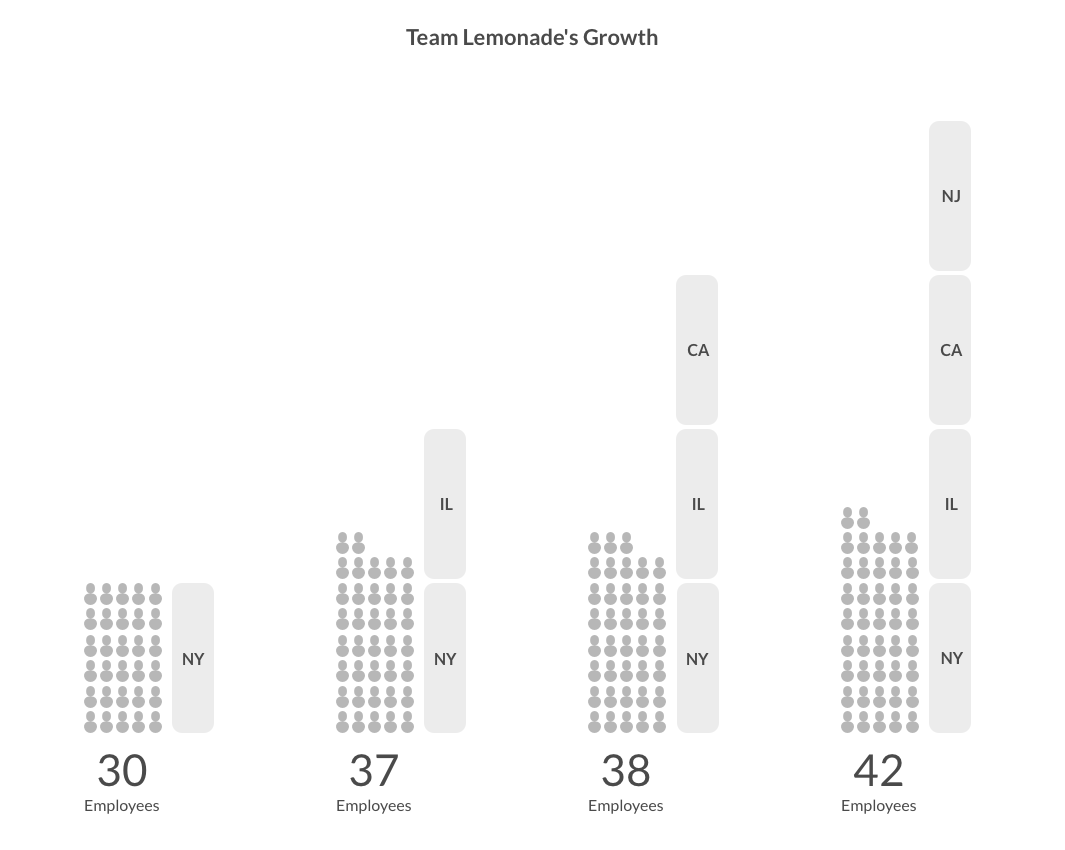

Looking at our expense ratio from a traditional perspective won’t make much sense. If you’ve ever tried to start and grow a business from scratch, this should be beyond obvious. Just do the simple math – 48 employees and $2 million in revenue – and the answer is clear.

The best news? We had 30 employees when we were in 1 state, 37 in 2 states, 38 in 3 states, and 42 in 4 states.

Oh, the places you can go and the stuff you can do when you’re powered by tech. Even if this is an early indication, it’s a trend I’m willing to sign up for.

As our volume grows, our results will get more and more stable and meaningful. As always, we will be transparent and explain things in plain english. And while it is not easy, we are on our way to (positively) change this great, centuries-old industry we love.