I joined Lemonade right at its launch, when I traded in my corner office for a desk at the Lemonade shared working space in lower Manhattan. Some called me outright crazy.

I had decades of experience in traditional insurance, working at the biggest and best companies in the US and around the world. But I had also fallen into a rhythm, one that was distancing me from the transformational change insurance was undergoing.

When I joined Lemonade, it was because I believed we were on the cusp of an insurance revolution, and I wanted to be part of the change our industry needed and customers deserved.

This was, in many ways, a leap of faith, or a belief that starting from scratch would enable something dramatically better.

Fast forward two and a half years: I’m a stronger believer than ever before.

Loss Ratio 101

Insurance companies need to be around for the long haul. You pay them premium in advance to fulfill the promise of being there in the future when you need them. Sounds simple, but it is not.

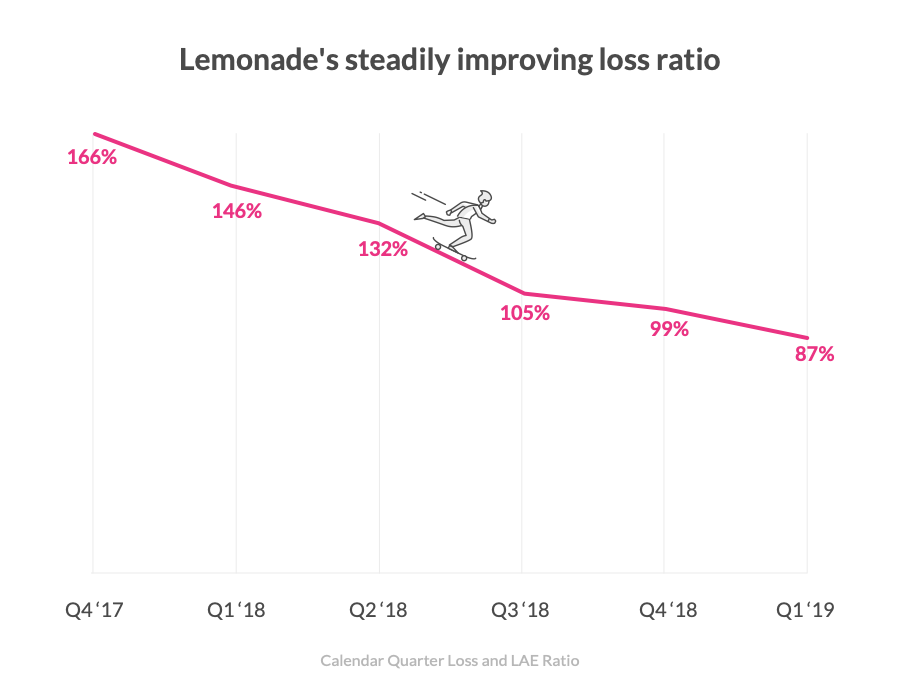

The fundamental measure of whether a company is running well is its loss ratio. In simple terms, it’s the claims you pay divided by the premium you earn.

(In precise terms, everything I refer to here is calendar quarter estimated gross ultimate loss and loss adjustment expense divided by gross earned premium – as reported in our statutory financial statements – no funny numbers. Just good old school insurance stats.)

If your loss ratio is too high, you are not charging customers for the risk they represent – and that makes it hard to be around for the long term. Charge too much, and the insurance company is making lots of money, but not providing a particularly compelling product to its customers.

Ask any of our incumbent competitors: managing this in a stable, predictable environment is challenging enough. And managing it while growing rapidly is anything but easy.

So what’s the big deal?

To understand the loss ratio, here’s a quick recap of the business model: Lemonade takes a flat fee, and the rest of the money is used to pay claims or donated to the charities customers choose. We can do this because we have great reinsurance companies that take a share in the risk.

In the medium term, customers are well protected and Lemonade has a fixed ‘net loss ratio’ after reinsurance. In the long term, and since this needs to work for our reinsurance partners as well, we need to ensure we select the right customers and charge them the right amount.

Insurance is based on the law of large numbers – lots of people contribute money, and it goes to a small number that have claims. As we’ve declared from day one, our results were lumpy, and in total, too high. But as Shai announced at the end of 2018, we’ve been steadily improving, and I’m happy to report we’re closing in on where we need to be to make everything work.

So what’s the big deal?

Start-up companies just don’t do that – especially while growing 500%. We’ve seen the eighth consecutive quarter of loss ratio improvement, and with increasing volume, the numbers are more and more stable, and reliable.

An 87% loss ratio is still not good enough – but it’s not only about the number, it’s the trend. We improved 12 points in the last quarter alone, and averaged 15 points quarter-over-quarter improvement in the past year. In that context, 87% is not that daunting.

There are a lot of nuances under a headline number, so for the really interested, let’s unpack this a little, with the top 6 hidden themes that explain our numbers.

Explaining our numbers

1. We’re getting smarter. Lemonade started at a data disadvantage, building up a data set from scratch and collecting information at every customer interaction. We knew it was only a matter of time before we were at a data advantage. If we’re not there yet, we sure are close. Interacting with our customers directly and digitally means we know them really well, even if we’ve never met them face-to-face. That knowledge is translated to a ‘risk score’ that accurately predicts future loss ratios, and can be used across the organization, from marketing to acquisition to policy management and claims. It has not yet impacted our pricing sophistication, but that day will come – just like credit history did and auto telematics may soon.

2. We are better at spotting fraud with each passing day. We love 99% of our customers, but we have the 1% too. I can’t share much about how our fraud algorithms have evolved, but we’ve mapped the behaviors of fraudsters.

When we find fraud, we report it to the police for prosecution. Insurance fraud is a crime, you know.

3. Our tailwinds are growing every day, and increasingly winning. For example, the longer we have a customer, the better they are, which is the flip side of the classic ‘new business penalty.’ When you start, 100% of your customers are new. Two years in, just as you’d expect, our renewals are performing better and growing as a share of the portfolio.

You can see the same things in results by state. More mature states are performing better than the ones we just launched. The good news is our share of ‘mature’ states grows every day too.

4. Reserving is critical, and we’re getting it right. Every quarter, insurance companies must set aside money to pay for old claims. Well-run companies set aside enough money; ones without a firm grip on economics or that are trying to meet quarterly targets, may not.

For four quarters in a row, Lemonade’s reserves have proven conservative, meaning we exercise financial discipline and have a good handle on results. If the trend continues, even today’s results could look better in the rearview mirror.

5. We’re getting faster. To be fair, we were always fast – the advantages of being completely digital. Algorithms are coded, tested, and rolled out in days. To put this into better perspective, traditional carriers often push out monthly production releases. While we thought 3 per day was impressive when we launched, we now average 8 releases per day. Adjustments to coverage, customer service, claims, language – you name it – all help us deliver world-class customer service while ensuring a sustainable loss ratio.

6. Driven by social good. Here’s my favorite differentiator from the incumbents. Typically, when insurance companies see a bad loss ratio, they increase prices. They’re focused on their bottom line. At Lemonade we very deliberately did not raise prices – instead we worked smarter. We’ll adjust prices on a few customer segments this year when required, but since we’re committed to a double bottom line (we give underwriting profits to non-profits), we only want to make adjustments so everyone pays their fair share, and there is a little left over for causes we care about.

Nearly there

Where are results headed? All I can say is we feel like we’ve barely scratched the surface. We have hundreds of ideas for analyses we can do, insights we can find, and actions we can take to ensure customers pay the right amount and no more; to continue to attract the right type of customer, and pursue social impact.

The smarter we get, the more everyone benefits – especially our customers and the charities the Lemonade community supports.

Starting a successful company is hard – attracting talent, confirming product-market fit, demonstrating you can grow, and as one investor phrased it – ‘doing a million of something.’

In insurance, you do it under the spotlight of quarterly filings and financial disclosures – and for good reason. Customers and regulators need to have confidence you’ll be around for the long term. That includes proving you can succeed on traditional insurance metrics and on tech company metrics.

Still a skeptic? I can say with confidence – with a view from the inside and with the benefit of decades in this industry – that the leap is far smaller than ever… and maybe just a short hop.

John is Lemonade’s Chief Underwriting Officer