Hey everyone. It’s been almost a month since my last update where we exposed the metrics from Lemonade’s first 48 hours. Today, I want to let you in on some of the secret stuff that drives our unique claims experience.

I couldn’t have asked for a better setting for writing this post – here in this gorgeous countryside village, on the outskirts of Lisbon, where once a year, a bunch of techies get together for a few days of talk about Artificial Intelligence, Virtual Reality, Healthcare, and autonomous everything.

Big things are coming, and I’m super excited to see Lemonade a part of it.

Enjoying mixed reality with Robert Scoble and Paddy Cosgrave

Alright, I could go on about this forever, but we have things to discuss.

A well-hidden secret

When we started mapping everything that we thought was broken in the old insurance world, one thing kept coming up: just how poor the claims experience was. People told us they sometimes had to wait months before having their claims paid, not to mention the hassle and paperwork involved.

There are many reasons why insurance companies find it difficult to provide a good claims service. First, insurance companies are run by people, tens of thousands of them, doing manual labor, filling out forms, faxing stuff, and calling phones. These operations take time. Just think about those claims piling up on someone’s desk…

But there’s another, less obvious reason. One that insurance companies feel bad admitting even exists.

You see, that guy who’s responsible for your claim could be an honest fella. I bet he is. But it doesn’t matter because the system he works for is designed to maximize profits, so he and his coworkers are under constant pressure to cut costs and meet their targets.

But in the claims world, cutting costs often means paying you less, or not at all.

This was our Aha! moment. If we could figure out how to take away the underlying incentives that drive insurance companies to behave the way they do, we’d have a shot at profoundly changing how insurance works.

We realized that to build a system that is clean from bureaucracy, manual processes, and distrust, we would have to remove the temptation of maximizing profits by never keeping unclaimed premiums to ourselves.

Instead of feeding from premium leftovers, we take a flat fee off the top. The rest goes to stuff like reinsurance, surplus, taxes, claims, and our famous Giveback.

This way, regardless of the amount we pay out in claims, we end up with the same bottom line.

This changes everything.

Now, there’s no more pressure to hold back on payments, and no incentives that work against our customers. Check out what Jim, who leads claims at Lemonade, wrote about how we’re revolutionizing the way claims are handled.

Btw, if you’re asking yourself – what happens when money runs out, it’s the same as in any other insurance company. We’re reinsured by the biggest names in the industry, including Lloyd’s.

This is something (the real) Jim wrote on our office window, to remind himself of our unconventional values

So we no longer treat our users’ leftover premium money as our potential revenue because we give it back anyway. And because it’s not ours and we’re giving it back — we can delight our customers by doing everything painfully simple and super fast.

We designed Lemonade to be instant. Buying a policy, filing a claim, or switching from a previous insurer shouldn’t take more than seconds.

Self-Served Claims

The part of our product that got the most attention was the claims system. After looking at commercial insurance software it was clear that we needed something completely different.

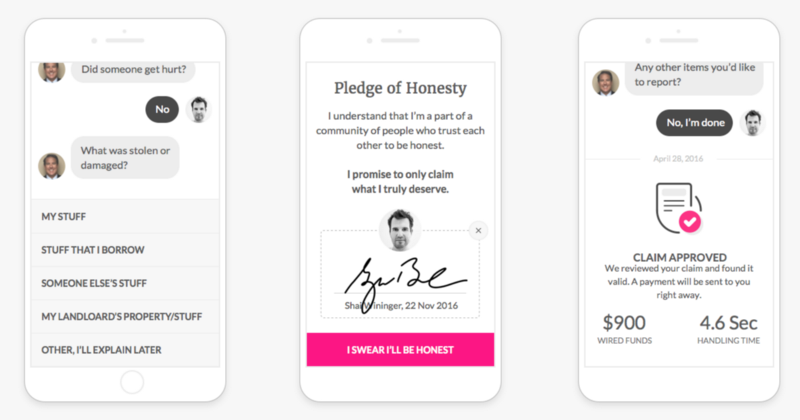

Put simple, we needed a bot version of Jim, so our customers could enjoy his charming personality and kickass claims handling, 24/7 365.

Chatting with AI Jim while filing a claim in the Lemonade app

Our team spent months learning how claims are handled by humans in old insurance companies. We then used this knowledge to craft an instant claims experience for our claims bot – AI Jim. The algorithms powering AI Jim ‘understand’ the nature of claims, their severity, and whether the user is in a state of emergency. AI Jim also tries to assess the likelihood of a claim being fraudulent and even nudges people to be more honest by incorporating years of behavioral economics research into every little detail in the conversation and the UI.

Jim’s AI tracks loads of user-generated data-points to help us identify suspicious activity and predict what our customers need before they even know it. In the first month or so, our system tracked 3.7 million signals.

But as we often experience from the likes of Siri, as smart as algorithms may be, they aren’t always perfect. This is why we only use our claim algorithms to help us reach one single decision: should a claim be handled automatically or not.

AI Jim will either pay claims instantly or call in the human Jim to take charge.

Setting expectations

Having AI and a good infrastructure doesn’t mean that we’ll blindly and automatically pay every claim we get. Insurance is a regulated business, and even if we wanted to, paying every claim will put us and our reinsurers out of business quickly.

So, setting expectations is very important, and is something we’ll be working on improving constantly. Our policy forms are still based on the regulatory approved format, and they’re lame, we know 😉

Here’s an example of a claim we will not cover: Our policy clearly states that there are certain breeds that won’t be covered if they attack someone and that someone gets injured. If a person ignores this and his Pitbull Terrier (one of the non-covered vicious dogs) bites Newman the Mailman, we will not be able to help.

It’s still too early to share stats about our claims activity (there isn’t much to share), but I promise to do so as we continue to gather interesting insight about damages, claims and everything that’s in between.

In the meantime, stay safe and check out lemonade.com.