You might be wondering how much life insurance costs, and if it’s really worth it. As of 2024 the average cost of a life insurance policy is $26 a month, according to NerdWallet. This figure is based on data provided by Quotacy for a 40-year-old buying a 20-year, $500,000 term life policy.

But life insurance rates depend on a lot of factors—including the type of policy, amount of coverage, and term length you choose—in addition to other things like your age and health status.

Lemonade offers term life insurance rates starting as little as $8 a month with coverage amount options from $100,000 up to an unlimited maximum benefit.

Let’s break down what goes into calculating the price of piece of mind.

What factors impact the cost of life insurance?

When determining your policy price, life insurance providers consider lots of factors that not only give them an idea of how long you might live but also consider your lifestyle, financial habits, and the specifics of the policy you choose, ensuring the cost reflects both the risks and the coverage you’re getting.

These factors include both elements within and outside of your control.

Factors within your control

- Smoking status: Non-smokers typically have significantly lower your premiums

- Lifestyle choices: Safer hobbies and maintaining a safe driving record can reduce costs, while avid sky divers might have higher premiums

- Health and fitness: Improving your health through diet and exercise can lead to lower premiums

- The life insurance company you choose

- Policy type: There are several types of life insurance, each with their own pricing differences

- Policy term length: You’d likely pay less for a 20-year term life insurance policy than for a 40-year term life policy

- Amount of coverage: You’ll probably see higher rates for $5 million in coverage than for $100,000

- Policy riders: Deciding on which additional benefits to include or exclude can affect the price

Factors beyond your control

- Your age when you buy the life insurance policy

- Statistically based gender differences in life expectancy

- A history of hereditary conditions in your family

- Your pre-existing health conditions and past medical issues

- Broader economic conditions—like inflation

Keep in mind: These are just a few of the many factors that might go into your life insurance pricing.

How much life insurance do I need?

When we talk about how much coverage you’d want with a life insurance policy, what we’re really talking about is the amount of the so-called death benefit that would be provided to your beneficiaries if you were to pass.

So if someone is describing a 10-year term life insurance policy with coverage of $1 million, that means that if the policyholder dies within that 10 year span, their loved ones would receive a tax-free payment of $1 million.

The amount of coverage that’s best for you really depends on how much you want to have available to help ensure that your loved ones have financial protection if you weren’t around to provide for them any longer.

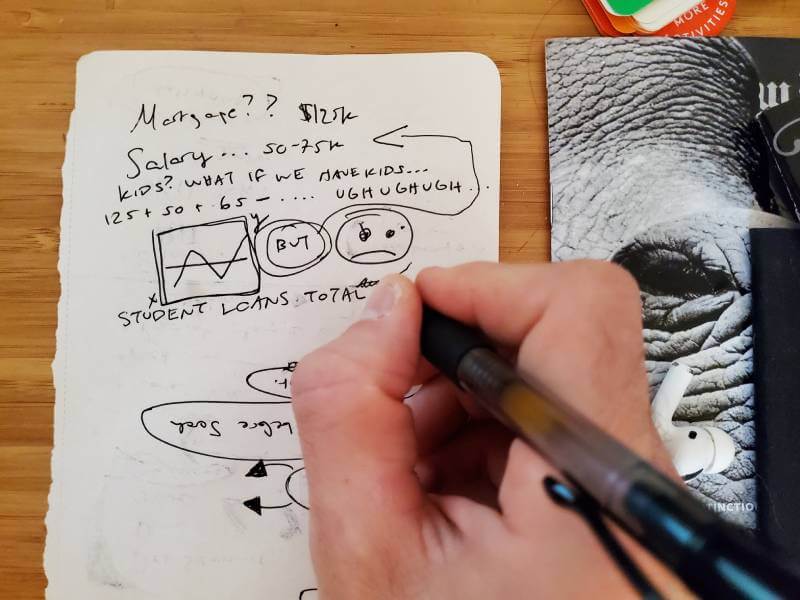

Here are some questions to keep in mind to get a sense of the financial obligations you have now, and what they might look like for your loved ones down the road:

- What are my family’s expenses for an average year?

- What do I pay in rent, or toward a mortgage?

- Are there any childcare expenses?

- Do I still have student loan debt?

- What’s my current annual income, and what would my loved ones need to offset this if Iwere no longer around to contribute financially?

Then think of your available resources and assets, which could balance out some of those costs. That includes any savings you currently have in the bank, as well as the value of things you might own outright (like your home, if you’re lucky).

Based on those personal calculations, you’ll want to make sure that your term life plan’s payout (death benefit) is sufficient for your loved ones’ financial needs.

This will be different for everyone. If you’re a 31-year old mom buying a 10-year term life policy, you’re basically posing a hypothetical question to yourself: “If I were to pass away at the age of 40, what amount of money would safely cover my family from that point into the future?”

Is term life insurance cheaper than whole life insurance?

Yes, term life insurance tends to cost much less than whole life insurance.

For example, on average a 30-year old woman who selects $1 million in coverage might expect to pay $280 a year for a 20-year term life policy compared to $7,953 annually for a whole life policy, according to NerdWallet.

Term life provides coverage for a specific period of time and pays out only if the insured person dies during that term, without any savings or cash value component. In contrast, whole life insurance covers the insured for their entire life and includes a cash value component, which accumulates over time, making it more expensive due to the added investment feature and lifelong coverage.

For both policy types, premiums typically stay the same during the length of the policy.

If you’re interested, check out the differences between term life and whole life insurance.

How can I lower the cost of my life insurance premium?

Like we mentioned above, there are several factors within your control that could help reduce how much you pay for life insurance—like your policy details and lifestyle choices. Here are additional strategies that could potentially lower your life insurance costs even further:

- Buy early: The younger you are when you get life insurance, the lower your premiums will likely be

- Improve your credit score: This can sometimes lead to lower premiums

- Consider a joint policy, if relevant: For couples, a joint policy might be more cost-effective than two separate policies. But it’s important to understand how these policies pay out.

- Shop around: Compare quotes from multiple providers to find the best rates for the coverage terms you want

Don’t forget: While saving on premiums is important, ensure the policy adequately meets your needs and provides sufficient coverage for your beneficiaries. It’s best to consult a financial advisor or insurance broker that can help you navigate the complexities of life insurance and find the best rates for your unique circumstances.

So, what’s the best life insurance company?

We might be a bit biased, but term life insurance policies offered by Lemonade could give you and your loved ones peace of mind with awesome coverage and competitive prices. Did you know that Lemonade term life insurance pricing is among the top 3 in the US?

Lemonade term life insurance premiums start at as little as $8 a month, with policies starting from $100,000 of coverage and you can select coverage as high as you choose: $500,000, $1,000,000, $5,000,000, or more! Plus, you have the option to choose from a 10- to a 40-year term, in five year increments.

Keep in mind: Medical exams might be required as part of your application, which can impact your policy price.

Click below to start your free quote.

A few quick words, because we <3 our lawyers: This post is general in nature, and any statement in it doesn’t alter the terms, conditions, exclusions, or limitations of policies issued by Lemonade, which differ according to your state of residence. You’re encouraged to discuss your specific circumstances with your own professional advisors. The purpose of this post is merely to provide you with info and insights you can use to make such discussions more productive! Naturally, all comments by, or references to, third parties represent their own views, and Lemonade assumes no responsibility for them. Coverage and discounts may not be available in all states.