Annual Percentage Rate

An annual percentage rate, aka APR, is the yearly interest rate and extra costs you pay on a loan.

An annual percentage rate, aka APR, is the yearly interest rate and extra costs you pay on a loan.

An annual percentage rate, aka APR, is the yearly interest rate and extra costs you pay on a loan. To put it simply, it’s the price you pay to borrow money from your lender. Knowing a loan’s APR percentage helps you understand every penny you need to pay back at the end of the term of the loan.

An annual percentage rate is used to show the interest rate and other costs you should expect to pay on a home loan or mortgage.

When checking the details of a home loan, you’re presented with multiple rates. Your interest rate is not the same as your APR. An interest rate is the percentage of the loan that a lender charges you to borrow the money. An APR, however, includes the fees you pay to take out the loan. So an APR gives you a better idea of the total cost of the loan. It’s also a great way to compare mortgage quotes.

In addition to your interest rate, you also need to pay:

FYI – these fees are unique to a home loan or mortgage, rather than an auto loan or student loan. Other types of loan APRs will include fees that have to do with processing or managing the loan.

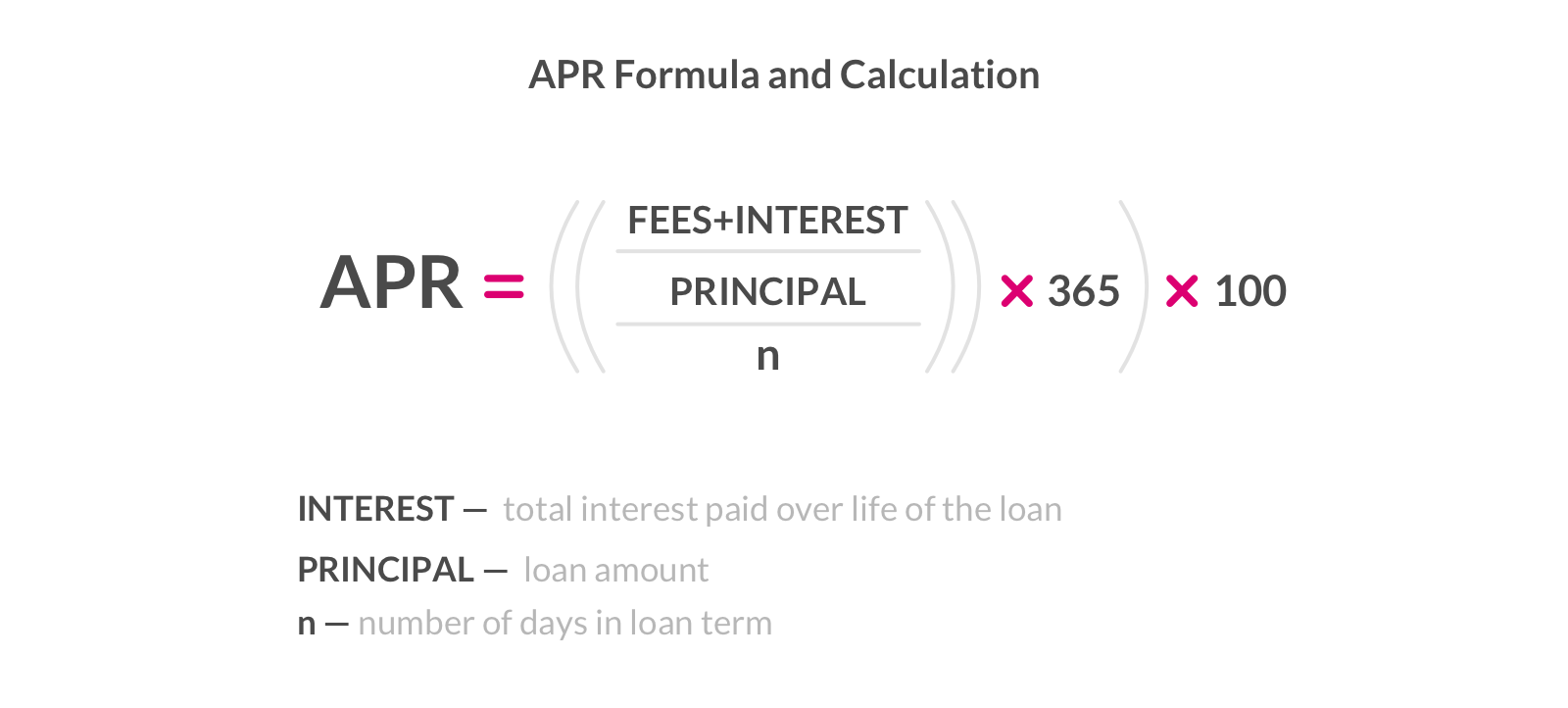

The APR is calculated using a simple formula.

Take your loan’s interest rate and add the fees. Then divide it by the actual loan amount. Divide that number by the number of days in your loan term. Multiply that by 365, and again by 100. Confusing? Take a look at the formula below:

For example, let’s say you take out a $1,000 loan, over a 180-day loan term, and have to pay $75 in interest, plus a $25 origination fee to take out the loan.

1. Add fees and the interest ($25 + $75 = $100)

2. Divide it by the principal aka, the loan ($1000), $100 divided by $1000 = 0.1.

3. Divide it by the number of days in the loan term: 0.1 divided by 180 = 0.00055556

4. Multiply by 365: 0.00055556 x 365 = 0.20277778

5. Multiply by 100 to get the APR: 0.20277778 x 100 = 20.28%

So what’s really the point of this formula? Knowing a loan’s APR percentage helps you understand every penny you need to pay back at the end of the term of the loan. It can be tempting to just look at the interest rate but APR is a better gauge for comparison of other mortgage quotes. Generally, the lower the APR, the better the terms of the loan.

You’ll want to know what sort of APR you’re talking about when presented with a mortgage quote. A fixed APR means the APR doesn’t change during the lifetime of the loan. A variable APR however, can fluctuate since they’re tied to the market interest rate. So if the market rate increases, so would a variable APR. A fixed APR is far more predictable when budgeting for your loan.

A few quick words, because we <3 our lawyers: This post is general in nature, and any statement in it doesn’t alter the terms, conditions, exclusions, or limitations of policies issued by Lemonade, which differ according to your state of residence. You’re encouraged to discuss your specific circumstances with your own professional advisors. The purpose of this post is merely to provide you with info and insights you can use to make such discussions more productive! Naturally, all comments by, or references to, third parties represent their own views, and Lemonade assumes no responsibility for them. Coverage and discounts may not be available in all states.

Please note: Lemonade articles and other editorial content are meant for educational purposes only, and should not be relied upon instead of professional legal, insurance or financial advice. The content of these educational articles does not alter the terms, conditions, exclusions, or limitations of policies issued by Lemonade, which differ according to your state of residence. While we regularly review previously published content to ensure it is accurate and up-to-date, there may be instances in which legal conditions or policy details have changed since publication. Any hypothetical examples used in Lemonade editorial content are purely expositional. Hypothetical examples do not alter or bind Lemonade to any application of your insurance policy to the particular facts and circumstances of any actual claim.