Uninsured and underinsured motorist coverage can help pay for damages caused by a driver who doesn’t have car insurance, or a driver who doesn’t have enough coverage to pay the car accident’s full expenses.

What is uninsured and underinsured motorist coverage?

Unfortunately, sometimes drivers get behind the wheel even if they do not have car insurance (uninsured driver), or do not have enough car insurance (underinsured driver). And sometimes, those drivers cause accidents.

If an uninsured or underinsured driver is at-fault for a car accident that injures you, or damages your property—like your car, or your fence—uninsured and underinsured motorist coverage can pay for medical costs and repair from the crash.

How does uninsured and underinsured motorist coverage work?

When you are in an accident that is another driver’s fault, you can usually file a claim with the at-fault driver’s insurance company, and they will help pay for the damages caused. But that’s not the case if an uninsured or underinsured driver causes the accident.

You may be stuck paying out-of-pocket for auto repairs or medical expenses that were caused by someone else. That’s where uninsured and underinsured motorist coverage comes in.

There are two main kinds of uninsured and underinsured motorist coverage: bodily injury coverage and property damage coverage.

- Uninsured motorist bodily injury coverage (UMBI). This coverage can pay for medical bills and lost wages related to injuries caused by an uninsured driver.

- Uninsured motorist property damage coverage (UMPD). If you get into a car accident with an uninsured driver, this coverage can pay for the costs of repairing your car.

- Underinsured motorist injury coverage (UIMBI). This coverage can pay for remaining medical bills and lost wages related to injuries caused by an underinsured driver up to your UIMBI policy limits.

- Underinsured motorist property damage coverage (UIMPD). If you get into a car accident with an underinsured driver, this coverage can pay for the remaining costs of repairing your car up to your UIMPD policy limits.

Let’s say a driver who only carries $10,000 in property damage liability coverage sideswipes your car while making an illegal U-turn, and the cost of repairs comes out to $20,000? In that case, your underinsured motorist coverage would kick in and help cover the remaining $10,000.

Likewise, if a completely uninsured driver sideswiped your car, your uninsured motorist coverage would cover the damage to your vehicle. This could also apply if you need to file an insurance claim after you’re the victim of a hit-and-run accident.

Do I really need uninsured and underinsured motorist coverage?

Depends on where you live. Not all states require uninsured/underinsured motorist bodily injury coverage or underinsured/underinsured motorist property damage coverage, but at least half of the 50 US states require at least one.

These are the states that require uninsured and underinsured motorist bodily injury coverage:

- Connecticut

- Illinois

- Kansas

- Maine

- Maryland

- Minnesota

- Nebraska

- New Jersey

- New Hampshire

- New York

- North Carolina

- North Dakota

- Oregon

- Rhode Island

- South Dakota

- Vermont

- Virginia

The states that require uninsured and underinsured property damage coverage are:

- Maryland

- New Hampshire

- New Jersey

- North Carolina

- Rhode Island

- South Carolina

- Vermont

- Virginia

- West Virginia

- Washington D.C.

And just a quick FYI: These lists can change as state regulations do

Regardless of what state you live in, it is arguably still a good idea to include uninsured and underinsured motorist coverage in your car insurance policy. According to a 2025 survey by the Insurance Research Council, about one in seven drivers were uninsured.

How much uninsured and underinsured motorist coverage do I need?

Just a refresher: A “limit” in regard to your car insurance policy refers to the maximum amount your insurer would pay out on a certain type of claim.

The amount of uninsured and underinsured motorist coverage you need often depends on the state you live in. In some states you are required to match your uninsured motorist insurance limit to the limit on your liability coverage. So for instance, if your bodily injury liability coverage limit is $30,000/$60,000 (per person/total per accident), you will likely need to choose the same limit for your uninsured and underinsured motorist bodily injury coverage limit.

Even if your state does not require matching limits, it is a good idea to carry similar amounts of liability coverage and uninsured and underinsured motorist coverage, in addition to some extra coverages. It’s important to have enough insurance in the case of a crash.

This includes things like collision coverage and comprehensive coverage, and medical payments coverage or personal injury protection. You can find out more about the various types of required and optional car insurance coverages here.

Can I change my coverages and limits?

Yes. When you drive with the Lemonade app—and enable location services and permissions—you have the power to update your coverages and coverage limits at any time.

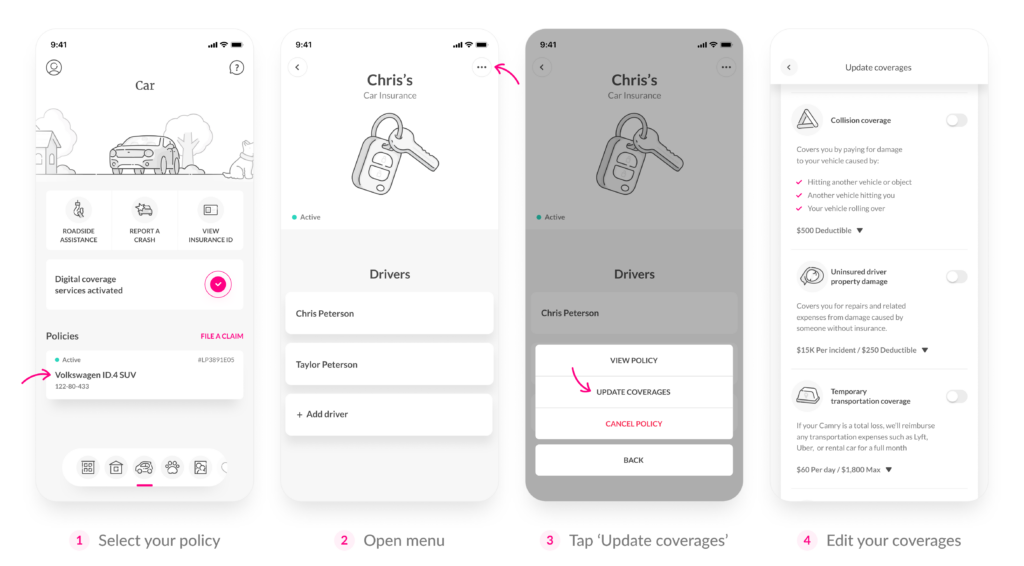

First, enter your policy from the Car tab on the app. Select the icon that has three dots in the top right-hand corner, then choose the ‘Update Coverages’ option.

From there, you can add and remove coverages, and increase and decrease your coverage limits, as effortlessly as when you signed up for your policy. Keep in mind: You won’t be able to remove coverages that are required in your state.

Updating coverage mid-term will likely impact your policy price, but you’ll see an estimated price change as you make changes in the Lemonade app. It’s up to you to decide what’s within your budget, and what level of protection you want—which is why Lemonade Car is great for anyone who really wants to customize a policy to their own needs.

A few quick words, because we <3 our lawyers: This post is general in nature, and any statement in it doesn’t alter the terms, conditions, exclusions, or limitations of policies issued by Lemonade, which differ according to your state of residence. You’re encouraged to discuss your specific circumstances with your own professional advisors. The purpose of this post is merely to provide you with info and insights you can use to make such discussions more productive! Naturally, all comments by, or references to, third parties represent their own views, and Lemonade assumes no responsibility for them. Coverage may not be available in all states.