- What is flood insurance?

- Why damages and loss from flooding generally aren't covered? (and what you can do about it)

- Do I need flood insurance?

- Is all flood insurance through FEMA?

- What does flood insurance cover?

- What isn't covered by flood insurance?

- When should I buy flood insurance?

- How much does flood insurance cost?

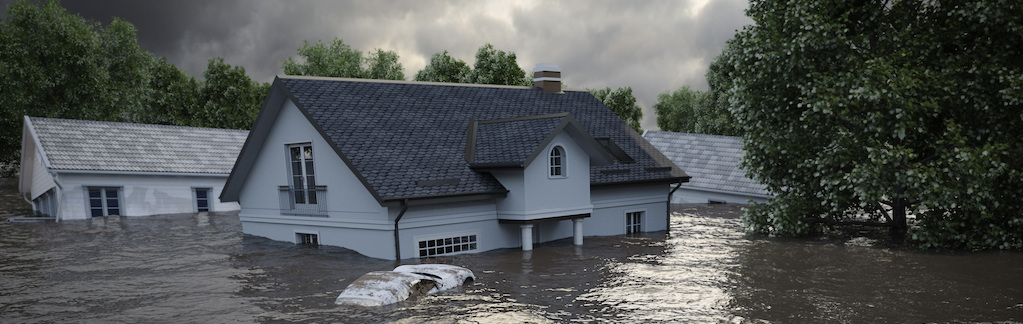

Flood insurance provides you with coverage when your stuff and/or property is ruined as a result of… you guessed it, flooding.

What is flood insurance?

Flooding is one of the most common natural disasters in the U.S.

Whether you live in the Northeast and face the dreaded thawing of winter or in the Deep South under the threat of hurricane season, you know how important it is to make sure you’re properly covered.

That said, flooding (by mother nature) isn’t covered by your typical renters or homeowners insurance policy.

In fact, any water damage from the outside-in isn’t covered on standard homeowners or renters policies. Some states, such as New York, even have a special exclusion for direct or indirect loss resulting in flooding.

Why damages and loss from flooding generally aren’t covered? (and what you can do about it)

So, what gives? Why aren’t you covered for flooding if it fits the parameters of sudden and unexpected, two of the main tenants of events your insurer will cover?

Well, insurance is supposed to provide you with a safety net for sudden, accidental, and abnormal cases in which your stuff is ruined.

Flooding, though, is so common and apt to cause serious damage that most home insurers can’t provide coverage for it. It’s a risk they can’t take. But you can avoid this risk (and sometimes have to) by purchasing a separate flood insurance policy.

Do I need flood insurance?

If you live in an area prone to flooding and need to take out a mortgage on your house, your bank might make you get a policy – it’ll protect your investment and their stake in your home. Even if you don’t think you need flood insurance, it’s a good idea to get it, especially considering the damages this natural occurrence can cause.

It’s relatively easy to buy flood insurance– you can do it through your insurance agent or directly through your insurer if they participate in the National Flood Insurance Program (NFIP).

The NFIP is a program Congress created in 1968 as part of the Federal Emergency Management Agency (FEMA). It’s designed to help renters and homeowners protect themselves against damage caused by floods with federal flood insurance, since a typical policy won’t include it.

Is all flood insurance through FEMA?

Since FEMA’s NFIP coverage maxes out at less than the cost of many homes, several people opt to purchase flood insurance through a private carrier. These policies are still backed by FEMA and the NFIP, but they’ll allow you to adjust your coverage to cover more expensive property.

Keep in mind that these prices are not regulated, so you’ll want to shop around to make sure you’re getting a fair price from a company that will be able to pay out claims in the event of a major flood.

What does flood insurance cover?

Flood insurance covers two main things: your stuff and your place.

By stuff we mean your personal property – we’re talking all your clothes, electronics, curtains, carpets, and other valuables up to $100,000.

By place, we mean things like flooring, carpets, built-in appliances, walls, ceilings, and more. Think of it this way: if you were to tip your house upside-down, whatever wouldn’t fall out goes under this category, and is covered up to $250,000.

In general, flood insurance is a bit finicky. So, like all insurance policies, make sure you read everything and you understand what you’re buying!

What isn’t covered by flood insurance?

Two common flooding scenarios that wouldn’t be covered by insurance include sewage backup and flooding from rain.

- If sewage backup is the thing that caused the “flooding,” you’d only be covered if you purchased an endorsement (extra coverage) for that on your home policy

- When your basement fills up with water from heavy rain, you won’t be covered since flood policies generally only cover damage for parts of your home above the ground

Take note: In addition to the above, things that resulted from flooding and could have been prevented with proper cleanup and/or attention (like mold, mildew, moisture, etc.) won’t be covered.

In terms of property, if you’re a homeowner, the following aren’t covered by flood insurance:

- Anything that isn’t attached to your house (i.e. fences, dog houses, sheds)

- Stuff that may have floated away

- Anything that wasn’t enclosed within a structure on your property during the flood

When should I buy flood insurance?

Flood insurance has a waiting period before it’s active. It takes 30 days for it to kick in, so don’t wait for the weather report to be your reminder that you want some insurance.

Residents who lived in a place for 7 years only had flood insurance for 2-4 years on average, according to a study by the National Flood Insurance Program.

Why? They probably only got flood insurance when facing a loss, or didn’t feel the need to renew when they no longer perceived a risk! So if an unexpected flood happened when they weren’t insured, they’d have to cover the cost of the damage with their own wallet.

Moral of the story? Don’t wait for an “oh $%#&” moment to act. Because at the end of the day, you can’t know when bad things could happen.

How much does flood insurance cost?

In general, the cost of insurance policies depends on several factors, like the location and condition of your building. The cost of flood insurance is also determined by your home’s elevation, since it has a major impact on how likely it is to be flooded.

According to FEMA, flood insurance costs an average of $700 per year, but a higher deductible is one of many variables that can have a huge impact on how much you’re paying. Flood insurance for renters, for example, costs way less since it doesn’t need to cover any structures.

A few quick words, because we <3 our lawyers: This post is general in nature, and any statement in it doesn’t alter the terms, conditions, exclusions, or limitations of policies issued by Lemonade, which differ according to your state of residence. You’re encouraged to discuss your specific circumstances with your own professional advisors. The purpose of this post is merely to provide you with info and insights you can use to make such discussions more productive! Naturally, all comments by, or references to, third parties represent their own views, and Lemonade assumes no responsibility for them. Coverage and discounts may not be available in all states.