Ever wondered about the true value of your favorite jewelry pieces? Whether it’s a sparkling diamond ring or a beloved heirloom necklace, understanding their worth can be essential.

This is where a jewelry appraisal comes in handy. They offer clarity, revealing not just the market value, but are also pretty important when it comes to properly insuring your jewelry. Let’s dive into all things jewelry appraisals.

- A jewelry appraisal is a document from an expert, called an “appraiser”, that provides an estimated value of a piece of jewelry.

- Jewelry appraisals are often used for insurance purposes, but can also come in handy if you’re selling your jewelry, or estate planning.

- Factors like the gemstones and metals used, the condition, and current market demand can all impact the value of your jewelry.

- A base plan at Lemonade can cover $1,500 worth of jewelry against theft, but you can also protect your higher ticket items up to their full value with Extra Coverage, which requires a jewelry appraisal.

What is a jewelry appraisal?

A Jewelry appraisal is an official document that states how much your jewelry is worth.

To get an appraisal, you’ll need to find an experienced and qualified jewelry appraiser to perform an in-person inspection of your jewelry.

After the appraisal, you’ll receive a certificate with a brief description of the item and its appraised value. The appraisal will also list out the owner’s name, address, and contact info, as well as the date of the appraisal. This will serve as legal proof that you own your jewelry.

Types of jewelry appraisals

When it comes to the value of your precious jewelry, getting an appraisal isn’t just useful for insurance purposes. There are several reasons why you might consider getting an appraisal to estimate the value of your jewelry.

Let’s explore the different types of jewelry appraisals and how they can come in handy for a few different situations:

Insurance appraisal

An insurance appraisal tells your insurance company how much your jewelry is worth. By sharing the estimated value of your jewelry with your insurance company, it will help with:

- Protecting your jewelry from loss or damage

- Estimating the replacement cost of your valuables

- Determining you have adequate coverage in the event that your jewelry is lost or damaged due to a covered peril under your policy

But you might be asking—why would I need an appraisal to get my jewelry properly covered under my policy?

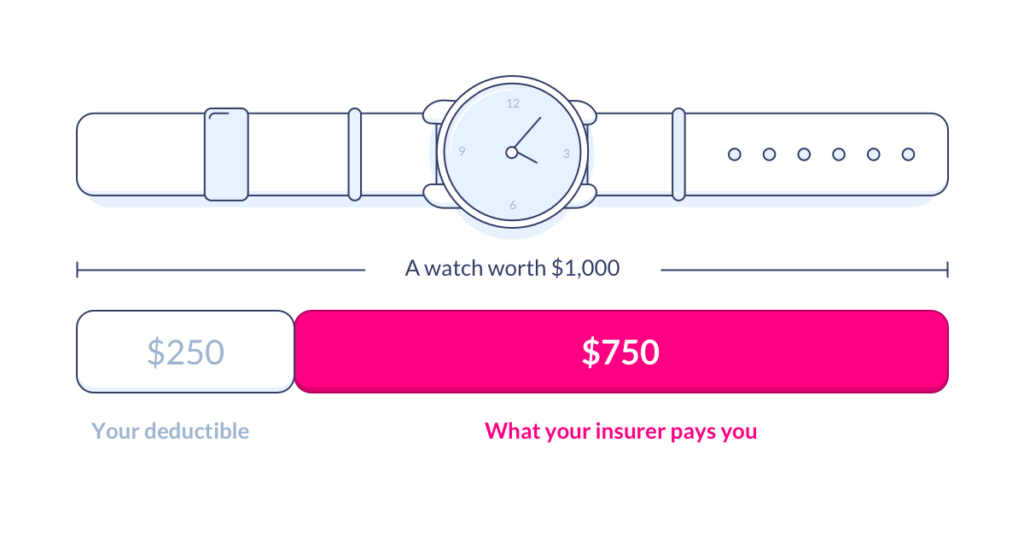

If your jewelry is stolen or damaged, your insurance company can pay you the current value to repair or replace your valuables, minus your deductible, of course. It’s easy to say the jewelry you get online is priceless. That’s why insurance companies require third-party certification to verify it’s worth as much as you say it is.

But here’s the thing: Most insurance companies cover jewelry up to a certain amount. For example, Lemonade’s base plan covers $1,500 worth of jewelry for theft.

If you have any big-ticket items or items with strong sentimental value, consider adding Extra Coverage to your insurance policy.

Extra Coverage (sometimes called scheduled personal property) is insurance-speak for adding a valuable item to your insurance policy. Here’s how it works: Yyou need to get an appraisal to verify the cost of your jewelry, and then tell your insurance company you’re willing to pay for more insurance each month as an extra layer of protection.

If something happens to your valuables, your insurance company will pay you back the value of your jewelry, which is where your jewelry appraisal comes back in. Btw, Extra Coverage covers accidental damage and mysterious disappearance, deductible free!

Fair market value appraisal

Thinking about selling your jewelry? An appraisal can be your trusted partner in this process. This appraisal reflects what your piece could sell for in a fair market, considering current trends and demand. While the selling price might not match the appraisal exactly, it gives you a solid starting point, so you can feel confident that you’re in the right price range during negotiations.

Estate appraisal

Jewelry appraisals play an important role in estate planning. This appraisal helps determine the valuation of pieces that are part of an estate, to provide an equitable distribution among heirs. Appraisals can also assist in calculating estate taxes or preparing for the sale of estate items. With a clear understanding of each item’s worth, you can make informed decisions that respect both financial considerations and sentimental value.

Immediate liquidation value appraisal

Used for quick sales, this appraisal estimates what you might receive in a forced sale. It typically yields a lower value due to urgency, often seen in auctions, business closures, or divorce settlements.

How does jewelry appraisal work

Let’s break down the steps your appraiser will take when valuing your piece:

1. Initial assessment

A certified appraiser starts by assessing the general condition of your jewelry item. This initial review is essential for identifying unique features and any potential damages, and preparing for a detailed evaluation of pieces like engagement rings or antique jewelry.

2. Examination of materials

The jeweler or gemologist meticulously examines the components of your jewelry such as precious metals and gemstones, assessing their quality. Using tools like a grading report, they verify attributes such as carat weight and gemological characteristics.

3. Market research

To establish a fair market value or insurance replacement, the appraiser investigates current trends and sales data. This involves analyzing the resale potential of fine jewelry, reflecting demand in key markets like NYC or through auction houses.

4. Documentation and final valuation

Finally, the appraiser compiles detailed descriptions and photographs into an appraisal report, vital for insurance purposes and providing a complete profile for your insurance company. This documentation supports the final valuation, where the appraiser calculates the appraised value, considering both intrinsic qualities and market influences.

What happens if I don’t get a jewelry appraisal?

If you don’t want Extra Coverage to insure your jewelry, you’re only covered for the max amount covered by your base insurance policy (minus your deductible). This means you can still make a claim for anything that costs more than your deductible, but you’ll still need to show proof of the purchase, like a receipt or bank statement, and you might not get the full value of your jewelry’s worth in the case of a claim.

For example, without Extra Coverage?

- If your earrings cost $200 and your deductible is $250: insurance will not pay you on items below the value of the deductible

- If your watch cost $500 and your deductible is $250: insurance will pay up to $250

- If your fav necklace cost $1,000 and your deductible is $250: insurance will pay up to $750

- If this entire jewelry collection totaling $1,700 was stolen: insurance will only pay $1,500

Basically, Extra Coverage is a way to pay more now, in order to get its appraised value later in case something happens.

When do I need to get an appraisal?

Usually, if you bought the piece of jewelry within the last five years, you can show your insurance company the receipt. Sometimes, that’s better than an appraisal, since it’s the most current value.

If you don’t have the receipt or it’s been more than five years since you bought it, you’ll need to get an appraisal to confirm its value. So if you submit your grandmother’s diamond engagement ring for Extra Coverage in June of 2022 but you only have a diamond appraisal from 2015, you’ll need to get an updated one.

How much does a jewelry appraisal cost?

The cost of an appraisal depends on the jewelry appraiser, so be sure to ask for the price upfront. You’ll either pay a fixed price per item, or an hourly rate between $50 and $150.

What factors influence jewelry value?

Understanding what influences the value of jewelry can help you appreciate and manage your pieces better. Here are some key factors that determine your piece’s worth:

- Gemstones: The carat, cut, clarity, and color of gemstones like diamonds and rubies are vital, and often evaluated by GIA standards.

- Precious metals: Metals such as gold and platinum add significant intrinsic value to fine jewelry.

- Market trends: Current demand and trends, especially in dynamic areas like NYC or LA, can affect valuation.

- Cultural or historical significance: Pieces with unique histories or cultural importance, such as pieces from an important era like the Victorian Era, can command higher values.

- Condition of the piece: Any damages or wear can decrease the appraised value, making the condition of your jewelry a critical factor in determining its worth.

How do I find a jewelry appraiser near me?

For a legitimate appraisal, the jewelry should be inspected and verified in-person, so it’s easiest to find an appraiser nearby. When searching for a reliable jewelry appraiser, consider these steps to ensure you choose a qualified professional:

- Word of mouth: Start by asking friends, family, or local jewelers for recommendations. Personal referrals can point you to appraisers who have already established trust in the community.

- Credentials: Look for appraisers with certifications from recognized institutions like the Gemological Institute of America (GIA) or the National Association of Jewelry Appraisers (NAJA). Such credentials indicate that the appraiser has the expertise needed for accurate jewelry appraisal.

- Continuing Education: By verifying that the appraiser you choose is committed to ongoing education you can be confident that they are updated on industry standards and practices, which is vital for providing precise appraised values.

- Experience: Experienced gemologists are more likely to provide a thorough and reliable assessment of your pieces, which is why choosing an appraiser with a solid track record in valuating fine jewelry can provide you with confidence that you are in the right hands.

- Ethical and legal standards: An appraiser is tasked with handling your most valuable possessions, so making sure that they adhere to the highest level of ethics and professionalism is a must.

If you decide to search for a jewelry appraiser online, make sure the appraiser has relevant training and experience. Organizations that offer formal training include:

- International Society of Appraisers

- American Society of Appraisers

- National Association of Jewelry Appraisers

Following these steps, you can feel confident that you’ll find the right appraiser for your needs. Now that you know what to look for, it’s also beneficial to be aware of some potential red flags when finding your appraiser, including if the appraiser:

- Doesn’t have credentials

- Doesn’t require a physical inspection

- Pressures you to sell your jewelry

- Charges large upfront fees. Typical fees range from roughly $50 to $150 per hour but can vary depending on several factors

All of the above points can be a sign that you may be getting scammed. Keep these red flags in mind when you’re selecting the right appraiser for your needs.

Before we go…

Just like anything precious, your valuable jewelry deserves protection. Let’s face it, it would really stink if you lost your sparkling new engagement ring, or your Grandma’s diamond tennis bracelet.

While adding Extra Coverage to a Lemonade renters policy won’t be able to replace the sentiment behind your pieces, it can make sure that you’re paid for what your jewelry is worth, offering some peace of mind in the event that the worst happens. Ready to get started?

A few quick words, because we <3 our lawyers: This post is general in nature, and any statement in it doesn’t alter the terms, conditions, exclusions, or limitations of policies issued by Lemonade, which differ according to your state of residence. You’re encouraged to discuss your specific circumstances with your own professional advisors. The purpose of this post is merely to provide you with info and insights you can use to make such discussions more productive! Naturally, all comments by, or references to, third parties represent their own views, and Lemonade assumes no responsibility for them. Coverage and discounts may not be available in all states.