Let’s face it, pet insurance terminology can be pretty tricky. Find yourself curious and you might just end up searching through hundreds of policy pages, only to find your answer buried beneath insurance jargon engineered for you not to understand.

At that rate, it’s almost easier to just sit back and pay your insurance bill, no questions asked. After all, they’re the experts, and what you don’t know won’t hurt you….right?

Wrong. Your pet insurance premium isn’t just another bill you pay every month. We’re talking about coverage for your old pal here—your best buddy, your baby.

That’s why knowing what goes into your policy is so crucial to selecting the best coverage for your fur family’s needs. A Lemonade pet health insurance policy starts at $10/month, but it’s not one-size-fits-all. A policy for a 7-year-old Beagle in Brooklyn will probably cost more than one for a two-year-old Poodle in Potomac. That’s because the breed, age of your pet, and the cost of veterinary care where you live can all impact your monthly premium.

(Check out our ultimate guide to how pet insurance works to see how Lemonade Pet could work for your pet.)

Want to add on more coverage for preventative care to help prevent your pet from developing an illness? That’ll increase your premium, too.

When you’re building a long-term plan to protect your dog or cat, you’ll want to make sure you’ve got the right coverage to give them the best life possible. Specifically, adjusting your co-insurance, annual deductible, and annual limits allows you to customize coverage to give your pet the care they need, and is a great way to adjust how much you’re paying for the policy each month.

Did we lose you with some of that jargon? Don’t worry, we’re here to explain everything you need to know in plain English.

How do claims payments work for pet health insurance?

Wondering if you’re covered or not? Insurance only works if you already have it before you need to file a claim. So as long as you’ve got a Lemonade pet insurance policy before your dog Buster steps on a piece of glass and needs an emergency procedure, we’ve got you covered.

In most states, you have 180 days to file a claim on the Lemonade website or app, and we’ll reimburse you for whatever costs are eligible. How much you and your insurance company actually end up paying depends on the amount you select for your co-insurance, annual deductible, and annual limit when you sign up for your Lemonade pet health insurance policy.

Simply put, you’ll contribute your portion of the co-insurance payment for every claim. An 80% co-insurance policy means you pay 20% of the cost, in addition to your annual deductible until it’s exhausted for the year.

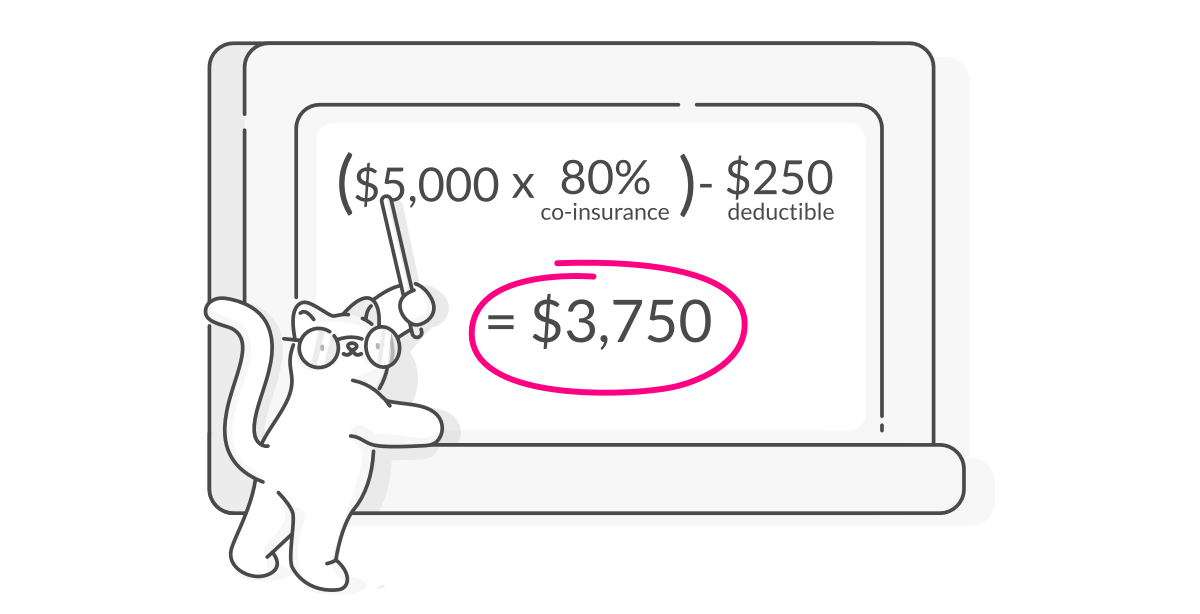

We’ll pay the rest. Think of the calculation for a claim payment from Lemonade as looking like this:

This is how you and your insurance company would split the cost of claims for the rest of the year until you reach your annual limit, or until you exhaust your annual deductible.

Now we’re going to dive a bit deeper into how it all works.

What’s co-insurance?

When you purchase a Lemonade pet insurance policy you select a percentage of co-insurance. This is the part of your veterinary bill that we pay on eligible claims. The remainder is what you’ll contribute.

Seems simple enough, right? But co-insurance shouldn’t be confused with the similar insurance term co-pay. Rather than representing a fixed percentage of liability like co-insurance, a co-pay is a fixed, out-of-pocket fee that splits costs between insurance providers and their policyholders for needs like doctor’s appointments and prescriptions.

At Lemonade, we offer co-insurance values of 70%, 80%, and 90%. (Which means you’re deciding if you want to pay 30%, 20%, or 10% of the costs on eligible claims.)

Here’s an example. Say your tabby cat Blossom accidentally eats a poisonous plant in your backyard (oh no!). She needs to be hospitalized, with the final bill running to $2,000.

Six months ago, you selected an 80% co-insurance plan when you purchased your pet insurance policy. Now let’s say Blossom had previously had an expensive ear infection that exhausted your annual deductible on tests and meds two months ago.

Because your annual deductible is already paid in full, we’ll cover 80% coverage for Blossom’s hospitalization. This means we pay $1,600 ($2,000 x 80% = $1,600), so you only owe the remaining 20%, which is $400 ($2,000 – $1,600 = $400).

What’s an annual deductible?

The deductible on your pet health insurance policy is an annual deductible, which means it isn’t something you’ll have to pay for every claim. It’s a flat fee you select when signing up for your pet policy that spans the entire year, and you can raise your deductible at any time during the policy period through the Lemonade app.

Just a heads up, any coverage changes are subject to approval from our Underwriting team and could be impacted by claims you’ve filed.

Because this part of your payment participation is not claim-specific, it can be exhausted in just one single claim or spread out between multiple claims made within the same year.

How, exactly? Let’s say you chose a $250 annual deductible with a co-insurance of 80%. You take your cat to the vet and the bill is $100. Out of this total, $40 are for the standard vet visit fees, which you’ll pay out-of-pocket since those aren’t covered by your pet insurance (unless you add-on the Extended Accident & Illness package!). Note that in either case those eligible vet visit fees will be applied toward your plan’s deductible, though.

Now that leaves you and your cat with a remaining $60 fee for eligible services. Your deductible isn’t met yet, so you’ll be responsible for paying this full $60. But how much will it take off your deductible? It’s not a full $60. We’d calculate $60 x your co-insurance of 80%, which comes to $48—that’s how much your deductible will be lowered.

Next time you and your cat go to the vet, your remaining deductible will be $202. This process would repeat until you’ve met your full deductible. After that, Lemonade would reimburse you for 80% of all eligible services, and you’d pay the remaining 20%, until you hit your plan’s annual limit.

Let’s take a closer look at how this would all work if you have a really big-ticket claim. We’ll use the example of the tabby cat Blossom we talked about earlier.

When signing up for Lemonade Pet insurance, you selected an annual deductible value of $250, with 80% co-insurance. Blossom’s hospital stay is expensive—$2,000 in eligible services—and you haven’t paid out any part of your annual deductible yet. How does this impact your claim payout?

Well, with your 80% co-insurance, you’re responsible for 20% of that hospital bill, which comes to $400. But you haven’t yet met any of your plan’s deductible yet, so we’d have to add on $250 to that $400, arriving at a total of $650. Lemonade would reimburse you for the remainder: $2,000 – $650, so that’s $1,350.

The good news is that your annual deductible is now exhausted, so any future claims made within the remaining year of your policy will be paid out to the full co-insurance value by Lemonade. (That is until you hit your annual limit.)

BTW, not to confuse you, but if you also have a renter insurance or homeowners insurance policy with Lemonade, that deductible is a bit different… it isn’t annual, so it applies to every claim.

What’s an annual limit?

Don’t worry, the annual limit on your pet health insurance policy is the easiest of these terms to understand… it’s just the maximum value Lemonade will pay out each year for all your claims combined. You’re the one who picks what that limit is!

When you purchase your pet health insurance policy you’ll be able to select an annual limit between $5,000 and $100,000, so you can make sure you’re picking the best pet insurance plan for both your budget and your pet’s needs.

It’s pretty simple. Pick a plan with an annual limit of $20,000 and we’ll pay every claim covered by your policy, until Lemonade’s payout for the year reaches $20,000.

Once this limit is reached, any further veterinary costs during the year are left for you to cover out of your own pocket. That’s why it’s crucial for you to weigh all policy options and select the plan that doesn’t burden you the most in the long run.

How do these coverages affect my monthly payments?

Now that you have a better idea of what goes into each individual claim payment, let’s take another look at your premium. How do all of these coverages impact what you pay each month?

It’s important to remember that the more coverage you receive from your insurance, the more you end up paying.

Looking at co-insurance, a higher percentage means Lemonade pays out a larger portion of your veterinary costs. Similarly, when you pick a bigger annual limit, we have your back for even more expenses. This means that larger co-insurance and annual limits equal more coverage on our part—and a higher premium from you.

Now, what about annual deductibles? A lower deductible means you pay less money before our payments kick in. So lower annual deductibles lead to more coverage on our part, which equals a higher premium from you.

When picking the best plan for your furry friend, it’s important to ask yourself both what your pet may need and what you’re ready to pay.

Don’t want to pay as much for your pet insurance? Adjust your coverages and get a lower premium. But keep in mind that, while this might save you cash in the short term, it could cause you grief in the long run. With less coverage, one accident or illness can leave you to face a difficult, painful financial decision.

Picking your policy is all about balance.

So, to recap all of that…

- A monthly pet insurance premium varies by policy. The cost of pet insurance is determined by many factors, including the co-insurance, annual deductible, and annual limit on your plan.

- Co-insurance options at Lemonade are 70%, 80%, and 90%. This is the percentage of your veterinary expense your insurer pays on each claim.

- The annual deductible is a flat fee paid by you, the policyholder, over one or multiple claims throughout the year, until the deductible has been met.

- We’ll continue to pay out your claims until your pet’s medical bills exceed the annual limit you chose when you signed up.

- Weigh all these options when picking your cat insurance or dog insurance in order to select the price and plan best suited for your needs.

At the end of the day, we want our pets to experience the top-notch care they deserve—without breaking the bank. Find yourself picking the wrong plan and you may just end up biting off more than you can chew. But weigh your options carefully and you’ll have coverage that keeps your fur fam secure.

A few quick words, because we <3 our lawyers: This post is general in nature, and any statement in it doesn’t alter the terms, conditions, exclusions, or limitations of policies issued by Lemonade, which differ according to your state of residence. You’re encouraged to discuss your specific circumstances with your own professional advisors. The purpose of this post is merely to provide you with info and insights you can use to make such discussions more productive! Naturally, all comments by, or references to, third parties represent their own views, and Lemonade assumes no responsibility for them. Coverage and discounts may not be available in all states.