Extended glass coverage refers to an add-on to your Lemonade car insurance policy that can help cover the costs to repair or replace your car’s glass—like a windshield, or a sunroof—if it’s damaged in a covered incident. There’s little or no deductible for these claims, depending on your state.

How can I cover my car’s glass, in general?

Comprehensive car insurance—among other things—can help cover the cost of repairing or replacing various types of auto glass if it’s damaged in a covered incident that isn’t related to a collision.

Picture this: You’re cruising to the local farmers market, singing along to your favorite tunes when out nowhere—WHAM! A rogue pebble is kicked up by the tire of a passing truck, leaving you with a cracked windshield that’s beyond repair.

When you signed up for a Lemonade Car policy, you added comprehensive coverage with a $250 deductible. The price tag to replace your windshield comes out to $400. In this hypothetical scenario, Lemonade approves your claim, so you’ll just need to pay your $250 deductible for the windshield glass replacement, and we’ll cover the difference.

Your comprehensive coverage would also include glass damage caused by:

- Vandalism

- Fallen tree branches

- Hail

- Hitting a deer, or another animal

Keep in mind: If you only carry the barebones liability insurance (that’s required by state law in nearly every state), you won’t be able to make an insurance claim for glass damage on your vehicle, no matter the cause.

What is extended glass coverage?

When you drive with Lemonade Car and include comprehensive coverage on your policy, you may have the option to add extended glass coverage, depending on where you live.

With this extra insurance coverage you’re eligible to replace several types of glass (and plastic parts) with little to no deductible, depending on the state you live in, including:

- Windshield

- Backglass

- Windows

- Sunroof

- Moonroof

For example, Tennessee drivers who add comprehensive coverage to their Lemonade Car policy are eligible for extended glass coverage with a $50 deductible. That’s not a bad deal, considering that windshield replacements range from $100 to $400, or as much as $1,500 for certain vehicles.

How does extended glass coverage work?

When you spot an issue with your car’s glass—like windshield damage—file a glass claim right away.

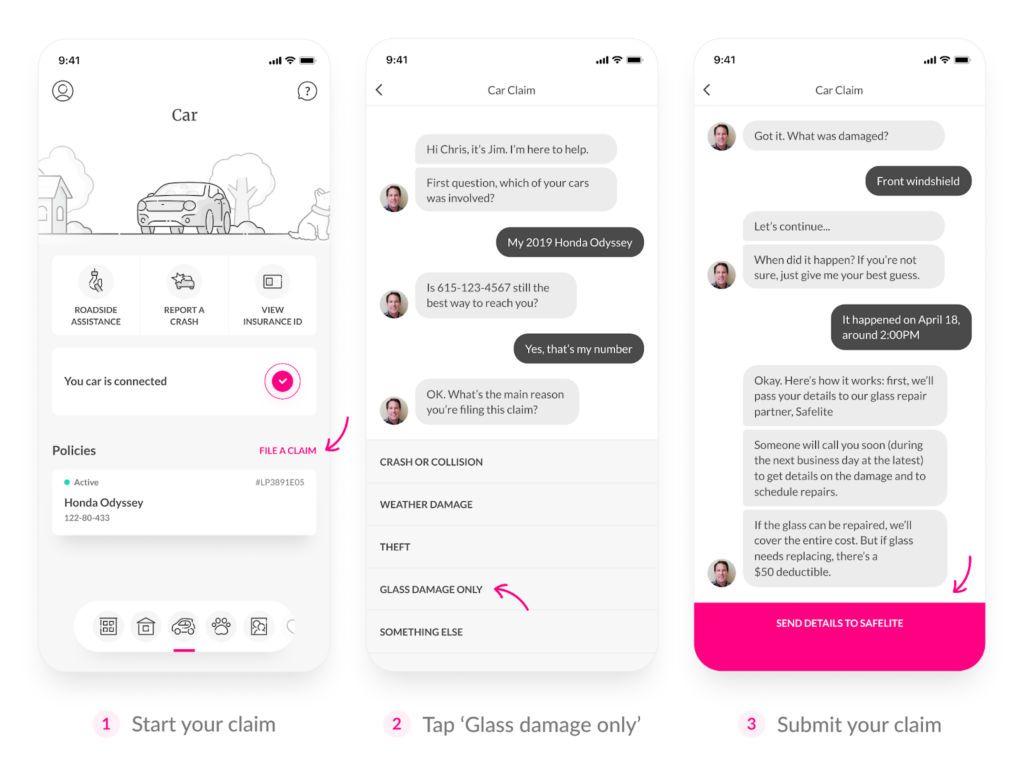

Follow these quick steps to file your auto glass claim:

- Head to the Lemonade app

- Scroll down to the ‘Policies’ section from the Car tab on the app

- Select the pink ‘File A Claim’ option on the right-hand side (our friendly chatbot, AI Jim, will be there to help you navigate the rest of the process)

- When AI Jim asks you to choose the main reason for filing the insurance claim, make sure to select “Glass damage only”.

Once you answer a few more questions and tap the ‘Send details to Safelite’ button at the bottom of the screen, we’ll pass your details to our trusty auto-glass repair partner, Safelite.

From there, Safelite will coordinate with you directly to assess your car’s damage and arrange repairs.

What’s the difference between comprehensive coverage and extended glass coverage?

Comprehensive coverage and extended glass coverage both cover auto glass damage, but there are some distinctions to keep in mind. The key difference is the deductible—the amount you’ll need to pay to repair or replace your car’s glass if it’s damaged in a covered incident.

Comprehensive coverage

Can help pay to repair or replace your car if it’s damaged by a covered incident that isn’t a collision—including theft, vandalism, natural disasters, fire, and, importantly, glass damage.

Comprehensive insurance typically covers the costs of repairing or replacing damaged auto glass, but it usually involves an insurance deductible—which is the amount you still need to pay out-of-pocket when your insurance kicks in. Comprehensive deductibles typically range from $250 to $2,500.

Extended glass coverage

Designed specifically to provide protection for auto glass damage unrelated to a collision—for things like a full windshield replacement, or repairing a sunroof with a minor chip—often with little or zero deductible.

That means you won’t wind up having to pay out-of-pocket expenses—or only need to pay a minimal amount—if the glass is damaged in a covered incident.

Extended glass coverage is sometimes referred to by insurance companies as ‘full glass coverage’, if the coverage offers a $0 deductible for any glass damage.

I already have comprehensive coverage to protect my car’s glass, why would I want extended glass coverage too?

Let’s say you included comprehensive coverage on your Lemonade Car policy with a $1,000 deductible, and you have a claim-free record. Overnight a hailstorm strikes and your sunroof gets pelted. What the hail!?

The price tag for the new sunroof comes out to $700. Even though the hail damage is considered a covered incident, the replacement cost for the sunroof is less than your comprehensive deductible, so you’d need to pay for the full replacement cost without reimbursement.

But if you also included extended glass coverage on your policy—which in this hypothetical case has a $50 deductible—Lemonade pays $650 ($700 minus your $50 deductible).

How much does it cost to fix a broken windshield?

Several factors can impact the price to repair or replace a damaged windshield—including the make and model of your car, the level of damage, and where you live.

Windshield repairs can range from roughly $50 to $150, with minor chips and cracks on the lower end and more extensive damage being a little pricier.

Windshield replacement costs can range from around $100 to $400 for more standard vehicles, but can go up to $1,500 or more.

So how the heck do you know if your cracked windshield just needs some repairs, or a full-blown replacement? Consult a professional auto glass technician at a repair shop for a definitive evaluation. They’ll consider factors like the size, location, type, and depth of the damage, as well as any potential safety concerns, to make an informed recommendation. Trusting a professional’s advice will help ensure the safety and structural integrity of your windshield and vehicle.

If your windshield has a crack or dent in the driver’s line of sight, for example, some states will require windshield replacement.

A few quick words, because we <3 our lawyers: This post is general in nature, and any statement in it doesn’t alter the terms, conditions, exclusions, or limitations of policies issued by Lemonade, which differ according to your state of residence. You’re encouraged to discuss your specific circumstances with your own professional advisors. The purpose of this post is merely to provide you with info and insights you can use to make such discussions more productive! Naturally, all comments by, or references to, third parties represent their own views, and Lemonade assumes no responsibility for them. Coverage may not be available in all states.