Extra Coverage Documentation Made Simple

Scheduled property coverage (or Extra Coverage, as we call it at Lemonade) requires some simple documentation. We break it down for you here.

Scheduled property coverage (or Extra Coverage, as we call it at Lemonade) requires some simple documentation. We break it down for you here.

So you’ve gotten a renters or homeowners insurance policy, or are planning to soon—congratulations! You’re one step closer to having all your valuable stuff protected. But the most valuable of your valuables might benefit from what Lemonade calls Extra Coverage…

What’s so extra about it? Well, your standard base policy does cover your personal belongings against unfortunate stuff like vandalism, theft, fire, and other named perils, both when you’re at home and on-the-go.

But adding Extra Coverage means we’ve got your back in other instances—like accidental damage or mysterious loss (that’s a dramatic way of saying you misplaced property and have no clue where it is). Another perk: $0 deductibles for any claims related to your belongings that have Extra Coverage applied.

Now, you can’t get this add-on for every object you hold dear. But it does apply to jewelry as well as valuables like bikes, cameras, fine art, and musical instruments.

Here’s a guide that breaks down most of the basics—but in this article, we’re mainly going to focus on the documentation you’ll need to have on hand.

Ah, documentation! It’s everyone’s favorite thing. But seriously: Providing the right paperwork helps us help you, and ensures that your expensive Bianchi bike or high-tech Canon camera is covered against crashes, drops, and those “oops I think I left it in the taxi” moments.

Let’s dive into the details. By the time we’re done, you’ll be able to submit Extra Coverage documentation in your sleep.

When you first sign up for your Lemonade policy, you’ll be given the option to secure 14 days of temporary blanket Extra Coverage for items in the categories we mentioned earlier. But to make sure that this extended protection carries on beyond those two weeks, you’ll need to submit the proper documentation.

This is an important point. If you’re getting Extra Coverage for an engagement ring, a painting, and a violin—that’s going to mean three separate submissions of documentation. You’ll upload all of this via the Lemonade app or our website.

Extra Coverage is not a compulsory part of your base insurance policy, and so the decision of whether to accept a certain item for this coverage is up to our underwriting team. That said, having clear, correct documentation to submit can only help your chances of getting your Extra Coverage items approved!

We only approve Extra Coverage for items whose value is at least $350. If your valuable item is worth $350 or less, it’s most likely already covered under your base policy!

There are three main things we look for when considering Extra Coverage for a valuable item like a diamond bracelet or a vintage Stratocaster guitar. They are Proof of Possession, Proof of Ownership, and Proof of Value (or PoPPoOPoV, as real insurance insiders like to say**).

Okay, so what the hell does that all mean? Is Proof of Possession a sequel to The Exorcist? Is Proof of Value the new Liam Neeson thriller set on Wall Street?

Sadly, the reality is a bit more mundane…but still important! Here goes:

When submitting your documentation via the app or website, our A.I. bot Maya will typically request current photos of your items to ensure that they’re currently in your possession and in good condition. This prevents anyone from trying to insure a valuable item that they used to own, but have actually since lost or sold.

Sometimes a digital photo carries metadata that allows our system to confirm the date an image was taken. But this isn’t always the case. If we need to confirm the date further, we’ll be sure to let you know.

Your Lemonade policy only covers you, your family, and any secondary insureds currently living at the address listed on your policy. The documentation we ask for will help us confirm that you’re the legal owner of the item.

If your Extra Coverage item gets lost, stolen, or damaged, we’ll need to know what it’s actually worth.

All documentation is not created equal. The right combination of paperwork will make our underwriters smile in delight—and who doesn’t love making an underwriter smile?

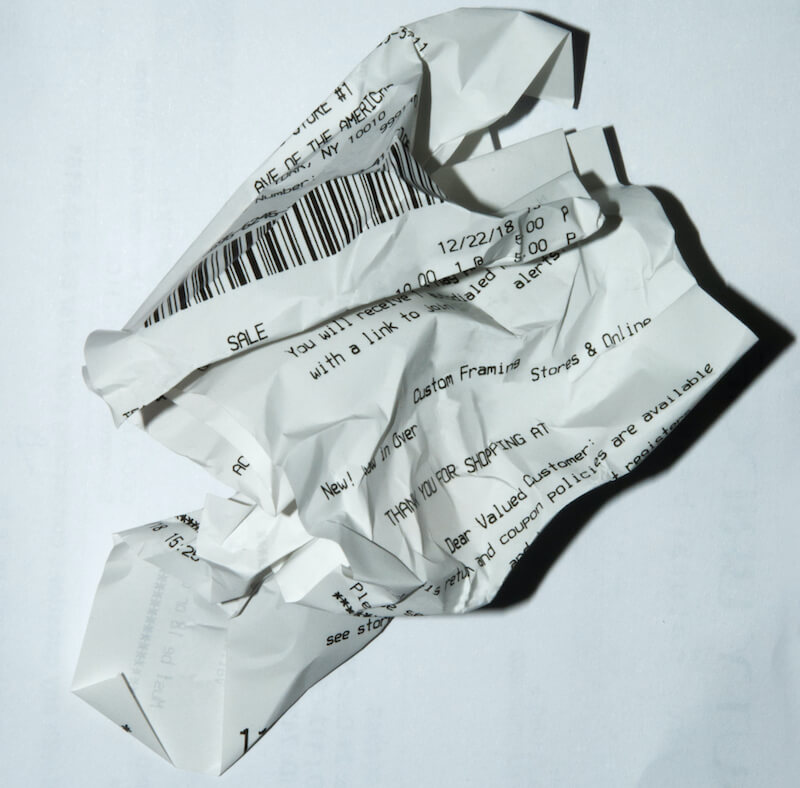

First, there are receipts. That’s simple enough, eh? But a few caveats:

And then there are appraisals, an alternate way to confirm an item’s value. This is especially useful in the case of belongings that wouldn’t have a store receipt—like that engagement ring that you inherited from your great grandmother.

One important note: We don’t accept online appraisals, as we need the retailer to be able to inspect your belongings in person to calculate the most accurate value.

Your appraisal should ideally include all of the following:

That really depends on what kind of item we’re talking about. For instance, you’d likely have a store receipt for bicycles, camera equipment, or jewelry you purchased recently. But if that jewelry is a well-worn family heirloom, then you’d want to obtain and submit an appraisal (even if you were able to find the original paperwork, we wouldn’t be able to accept a receipt from 1902).

What about artwork? Either a receipt or an appraisal might make sense, depending on the circumstances. We’re happy to answer specific questions and work through what documentation we need for your individual case.

That said, there are a few things to keep in mind for specific Extra Coverage categories.

Jewelry: We don’t accept “summation of appraisal” reports or Statements of Value (SOV). For any jewelry setting that contains diamonds or other stones, the receipt or appraisal must indicate the total price of the entire jewelry piece itself, not just the stones.

Bicycles and camera equipment: You probably have a receipt for these items. But if not, we can also accept a screenshot and website link to a retailer who is currently selling the same item. (Make sure that the retail link you give us pertains to an item that is of the same make, model, and year.) You’ll also have to include that item’s serial and model numbers.

Musical instruments: If you don’t have a store receipt for that trumpet or bass, we can also accept a signed appraisal from your local music shop.

Here are some general guidelines to keep in mind:

**okay, we admit it, referring to Proof of Possession, Ownership, and Value as “PoPPoOPoV” is not a “thing” that “real insurance insiders” do. But hey, thanks for reading all the way to the very end!

A few quick words, because we <3 our lawyers: This post is general in nature, and any statement in it doesn’t alter the terms, conditions, exclusions, or limitations of policies issued by Lemonade, which differ according to your state of residence. You’re encouraged to discuss your specific circumstances with your own professional advisors. The purpose of this post is merely to provide you with info and insights you can use to make such discussions more productive! Naturally, all comments by, or references to, third parties represent their own views, and Lemonade assumes no responsibility for them. Coverage and discounts may not be available in all states.

Please note: Lemonade articles and other editorial content are meant for educational purposes only, and should not be relied upon instead of professional legal, insurance or financial advice. The content of these educational articles does not alter the terms, conditions, exclusions, or limitations of policies issued by Lemonade, which differ according to your state of residence. While we regularly review previously published content to ensure it is accurate and up-to-date, there may be instances in which legal conditions or policy details have changed since publication. Any hypothetical examples used in Lemonade editorial content are purely expositional. Hypothetical examples do not alter or bind Lemonade to any application of your insurance policy to the particular facts and circumstances of any actual claim.