- What is 'Extra Coverage,' exactly?

- When would Extra Coverage for musical instruments kick in?

- Other crummy scenarios in which musical instrument insurance would come in handy...

- Do you only cover 'traditional' instruments?

- What about speakers, cables, and other gear?

- If I make money using my musical instruments, am I eligible?

- Will you cover literally any instrument?

- What if the value of my instrument increases over time?

- What's the deal with instrument appraisals?

- Are my instruments only protected if I'm at home?

- FAQs

Picture this: You’re the late, great Kurt Cobain, and a certain band by the name of Nirvana is playing at the Reading Festival. After a particularly raw and angry rendition of “In Bloom,” you raise your 1969 Fender Mustang guitar high over your head, and smash it into splinters. The crowd goes wild! Punk lives!

Afterward, you file a renters insurance claim and are swiftly paid back for the full value of your destroyed guitar. Score!

Hold on one sec—this isn’t exactly how insurance works, and your renters policy won’t actually have you covered if you intentionally destroy your instrument (no matter how cool it may look).

But renters insurance will have your valuables protected against a great number of threats, from theft to vandalism. And at Lemonade, you can also add what we call Extra Coverage for your most important things. That’s a nicer name for what the insurance biz calls “scheduled personal property coverage.”

What is ‘Extra Coverage,’ exactly?

Extra Coverage is an add-on to your base renters or homeowners policy that’s meant to provide additional insurance perks for things like cameras, jewelry, bicycles, artwork, and musical instruments.

There are various perks to Extra Coverage: you won’t pay any deductible on your claims; you could be covered for higher dollar amounts; and you’ll also be set for things your base policy doesn’t cover, like accidental damage or loss. You can learn more than you’d ever want to know about the ins and outs of Extra Coverage by reading our guide here.

But hey, you’re here to talk about musical instrument insurance, so let’s riff on some possible scenarios you might face IRL…

When would Extra Coverage for musical instruments kick in?

Unlike your base policy on its own, Extra Coverage adds protections against accidental damage or mysterious loss. What does that mean, in practice?

Well, imagine you’re mastering the bass line to Queen’s “Under Pressure” and the instrument’s strap breaks, sending your cherry-red Gibson crashing to the concrete floor. The bass’s neck snaps and its pick-ups are toast. But good news: Extra Coverage would kick in!

Ditto if you were traveling via subway to play a free, outdoor, socially distanced gig in the East Village. Maybe you’re distracted, wondering if the very concept of the mosh pit will be a casualty of the pandemic. With your head in the clouds, you wander onto the F train and leave your expensive Roland synthesizer on the platform, never to be seen again.

No worries—even though this is an absent-minded mistake that is kinda, well, your fault…Extra Coverage would cover the loss.

Other crummy scenarios in which musical instrument insurance would come in handy…

- You’re moving your home studio to a new apartment. While loading your tenor saxophone and drum kit into a rented UHaul, you accidentally drop the whole lot on the sidewalk. Covered? Yes, sir.

- You’re driving your car to a friend’s house for an impromptu jam session when you get rear-ended. The smash-up totally wrecks the timpani and theremin in your trunk. Good news: You’ve got Extra Coverage, and you’re covered.

- It looks like a beautiful day, and your band is scheduled to play a free charity concert in the park. Midway through your set—right between your Joy Division/James Brown mash-up—the skies erupt with rain, and your electric piano gets fried. Thankfully, you’ve got Extra Coverage.

Do you only cover ‘traditional’ instruments?

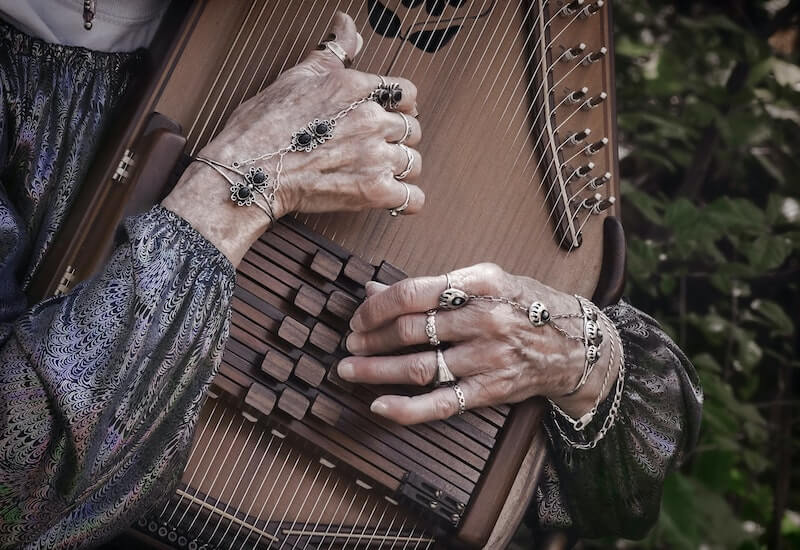

Nope! We understand that the modern definition of ‘an instrument’ is pretty broad. If you’re a DJ, you can get Extra Coverage for things like turntables, samplers, MIDI keyboards, and the like. (That said, each item submitted for Extra Coverage is reviewed independently, so certain pieces of equipment might not be eligible.)

One big caveat: If you’re a DJ who’s making $5,000 a night playing a residency in Las Vegas, your instruments aren’t eligible, since they’re being used professionally…more on that later.

And let’s say you’re a DJ or experimental sound artist who primarily uses a program like Serato on your MacBook… even though your computer is your instrument in this case, you can’t add Extra Coverage to it.

What about speakers, cables, and other gear?

You won’t be eligible to apply Extra Coverage for most of the gear that surrounds your instruments. That means stuff like microphones, speakers, headphones, monitors, instrument cases… you get the idea. And if you’re a singer or rapper, and your own voice is your ‘instrument’…well, we can’t cover you there.

That said, you can apply Extra Coverage to things that would be considered necessary for playing your instrument—like an amp for an electric guitar, or your violin’s bow.(However, in order to add Extra Coverage for something like a guitar amp, you’d also need to have Extra Coverage for the guitar it accompanies!

If I make money using my musical instruments, am I eligible?

The short answer: No.

This is an important one. You can only apply Extra Coverage to your musical instruments if they’re for non-professional use. That’s why in some of the examples above we kept stressing that the hypothetical gigs and concerts were ‘free’ shows.

Now, you might not think of yourself as a professional musician. You don’t make your entire living recording or playing gigs, and you consider it more of a fun hobby that earns a few bucks on the side. But if you make any income from your music, that would technically classify the use of your instruments as being for business, and therefore not eligible for Extra Coverage.

Will you cover literally any instrument?

Each item that you apply for Extra Coverage on will be evaluated individually, so we can’t guarantee that your instrument will be accepted, even if it seems to fit the main criteria we’ve already discussed.

We’ve insured a wide range of instruments, from accordions to harps and ‘singing bowls.’ But each instrument is reviewed individually, so we can’t promise that your beloved, super delicate, circa-1812 thumb piano will be eligible.

What if the value of my instrument increases over time?

Let’s say you purchase a vintage guitar or violin and add Extra Coverage to the instrument. Four years later, you suspect that the instrument’s value may have gone up significantly for some reason. In this instance, it’d make sense to get a new appraisal and contact our Customer Experience (CX) team to see if the value of your item should be adjusted.

What’s the deal with instrument appraisals?

Your local music shop should be able to offer an accurate appraisal of your instrument. Here’s an in-depth guide to what that appraisal should include, as well as other info on Extra Coverage documentation.

Are my instruments only protected if I’m at home?

Nope. Extra Coverage will cover your instruments no matter where you are in the world: at a practice space, on a trip, or while you’re serenading strangers with Leonard Cohen and Ella Fitzgerald covers in the park.

So go out and rock out knowing that your policy will have your back even when you’re on the road. To very liberally paraphrase the mid-20th-century songwriter Harlan Howard: “All you need to write a song is three chords, the truth…and insurance with Extra Coverage.”

FAQs

Can I insure multiple instruments under a single policy?

Many insurance providers offer the option to insure multiple musical instruments under a single renters or homeowners insurance policy, which can be more convenient and cost-effective than insuring each instrument separately. Keep in mind: There may be limits on the total value of instruments covered under a single policy.

How much does it cost to insure a musical instrument?

The cost to insure your musical instrument can vary depending on the instrument’s value, the coverage limits you select, and even your location. In general, the premium to insure your instrument will be a percentage of the instrument’s value.

Is musical instrument insurance worth it?

If you have high-end or vintage instruments, insurance can provide invaluable peace of mind and financial protection. For inexpensive instruments, the cost of insurance might not be justified. Ultimately, consider the value and importance of your instruments when deciding on coverage.

What documentation is required to insure my musical instruments?

When you sign up for a Lemonade policy and want to protect your musical instruments Extra Coverage, you’ll need to provide some documentation, including:

- Proof of Possession to show that you currently have the instrument. Acceptable documents include recent photos of the instrument or a receipt from a recent appraisal.

- Proof of Ownership, which confirms that you are the owner of the instrument. You can provide a purchase receipt, a bill of sale, or a notarized document stating ownership.

- Proof of Value to verify how much your instrument is worth. You can use an appraisal document, a purchase receipt that lists the value, or an insurance valuation report.

Are there any exclusions or limitations with instrument insurance policies?

Yes, instrument insurance usually doesn’t cover normal wear and tear, damage from improper maintenance, or loss due to negligence. Make sure to review your policy details carefully to understand what’s included and excluded.

A few quick words, because we <3 our lawyers: This post is general in nature, and any statement in it doesn’t alter the terms, conditions, exclusions, or limitations of policies issued by Lemonade, which differ according to your state of residence. You’re encouraged to discuss your specific circumstances with your own professional advisors. The purpose of this post is merely to provide you with info and insights you can use to make such discussions more productive! Naturally, all comments by, or references to, third parties represent their own views, and Lemonade assumes no responsibility for them. Coverage and discounts may not be available in all states.