Real Talk About Taking the Next Step in the Relationship

A deep dive into relationships and living with your partner.

A deep dive into relationships and living with your partner.

This February, we skipped the Valentine’s cards, and instead dug into the real moments and conversations that couples are—and aren’t—having after the chocolate hangover.

Modern love isn’t just the fancy dinner you had to book two months in advance, or posting the sparkly jewelry you got all over socials. It’s navigating the jungles of IKEA without breaking up, dropping a truth bomb about your finances a year into your relationship, or adopting a pet together and deciding who gets custody of Mr. Whiskers if things go south.

A recent Lemonade-commissioned survey, performed in collaboration with market research firm OnePoll, asked 2,000 Americans who live with their partner what it means to live in harmony (here’s more on the methodology).

Let’s take a look at what’s happening behind closed doors in relationships today.

According to the research, couples dated eighteen months on average before taking the big step, while more than a quarter (26%) of couples moved in after less than six months of dating. 21% of baby boomer survey respondents reported moving in with their current partner after less than six months of dating, compared to 32% of Gen Zers.

Nearly a third of couples (31%) say they moved in together gradually and without an official conversation, and nearly a fifth (19%) say they wished they had discussed both day-to-day and long-term finances together before shacking up.

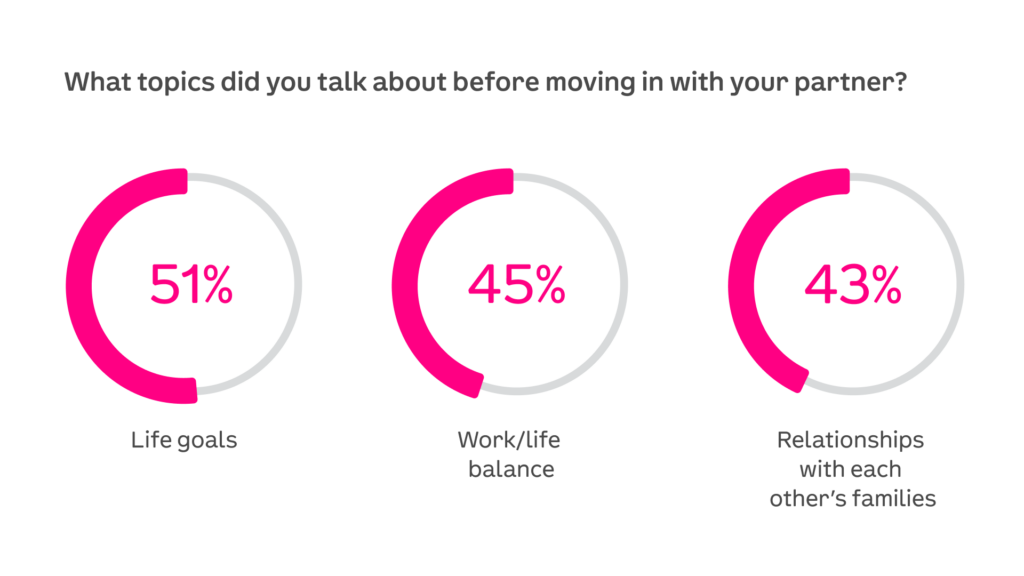

For couples who did have a move-in conversation, the most common topics discussed during “the talk” included:

Out of every generation, before moving in together, Gen Z respondents were most likely to discuss life goals with their partners (55%, compared to Gen X’s 52%, millennials’ 48%, and baby boomers’ 44%) and work/life balance (51%, compared to 44% among Gen Xs and baby boomers and 40% among millennials).

Of those who did discuss money, which generation are the best financial planners? Both Gen Z (42%) and baby boomers (54%) talked more about day-to-day finances compared to millennials (30%), while Gen Z respondents discussed their long-term finances the most (44%).

Important conversations continue once a couple decides to move in together. 40% of total respondents said they need to spend more time planning and discussing pragmatic matters—like insurance and budgets—with their live-in partner.

More than half (56%) of those surveyed say they don’t have a contingency plan about how to handle realities like splitting up joint memberships and moving out if they break up.

Whatever conversations you have or haven’t had up until now, it’s imperative that you and your partner are on the same page when it comes to everyday responsibilities. Financial planning and being open about personal finances can be a sensitive topic, but it can make any potential issues down the road much easier to manage if you’re aligned at the start.

Sean Burgess, Chief Claims Officer at Lemonade

While the vast majority (86%) of respondents feel that their partner knows them extremely or very well, this doesn’t mean that their relationship is picture perfect.

The majority of couples experienced unexpected disagreements and different expectations after they moved in together. 25% of surveyed respondents had different expectations about spending quality time together, and 24% had disagreements about how to manage budgets and finances together.

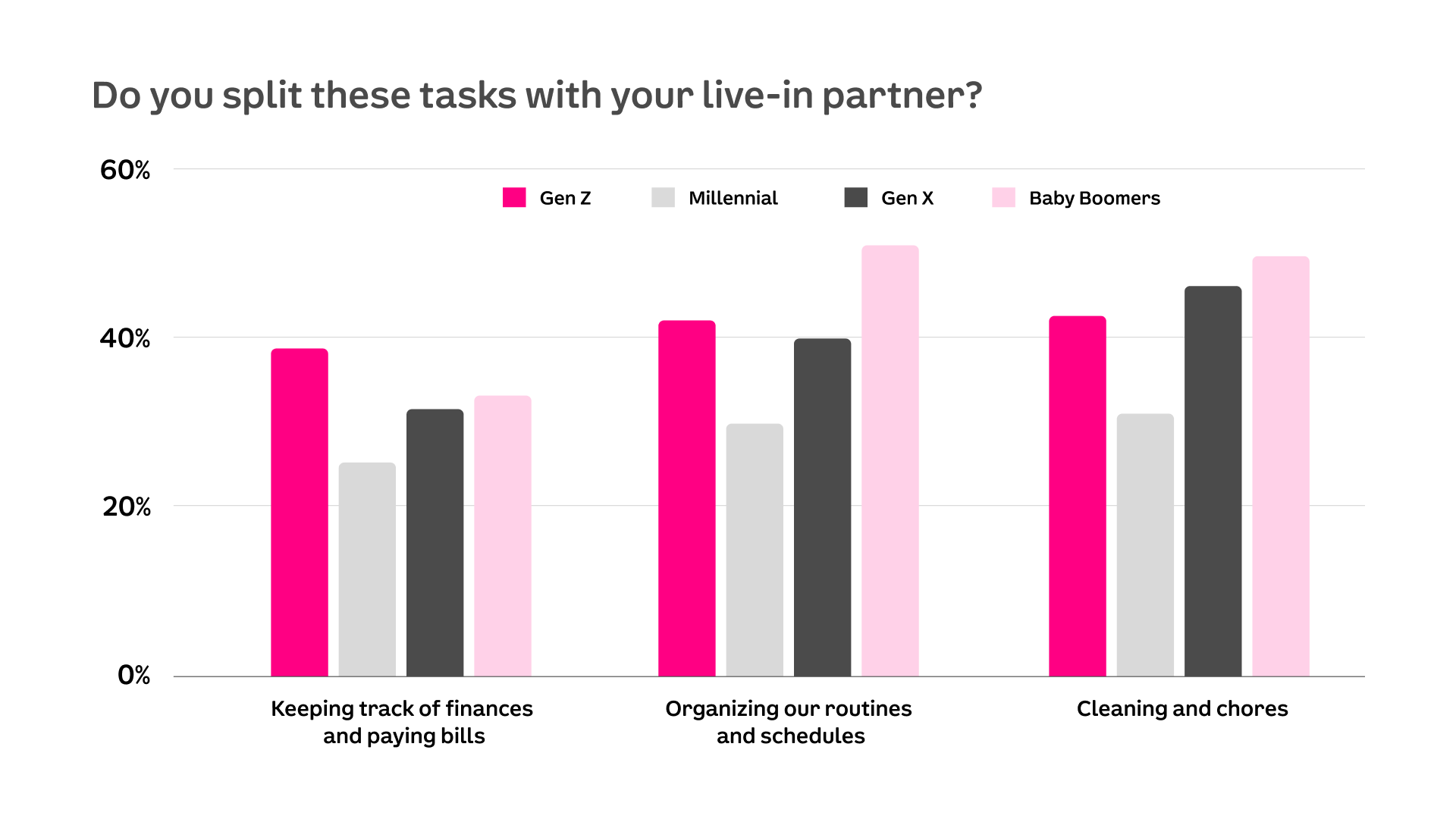

When it comes to ongoing tasks and responsibilities, more than half (51%) of respondents indicated that they are the ones to keep track of finances and paying bills, while 15% say their partner takes care of that. Only 9% said that shopping for everyday needs is done by their partner, and 36% split with their partner.

Half of Gen Zers and 55% of Gen Xers surveyed reported they’re usually the ones shopping for everyday needs, while their partners were the ones keeping track of finances (both generations reported 15%). However, Gen Z couples prefer to care for pets together (48%), while Gen X couples prefer to share responsibility over cleaning and chores (46%).

Baby boomers also said they prefer to handle the shopping (51%) and have their partners handle finances (17%), but prefer to share organization of routines (51%).

Millennials stood out from the rest—they would rather take care of the finances (61%), but would like to have their partner take care of the cleaning and chores (20%). They were also likely to share responsibility for pets (38%). Millennials are also least likely to split tasks with their partner and most likely to take care of tasks on their own.

62% of men who took the poll said they prefer to keep track of the finances, while 57% of women said they prefer taking charge of shopping.

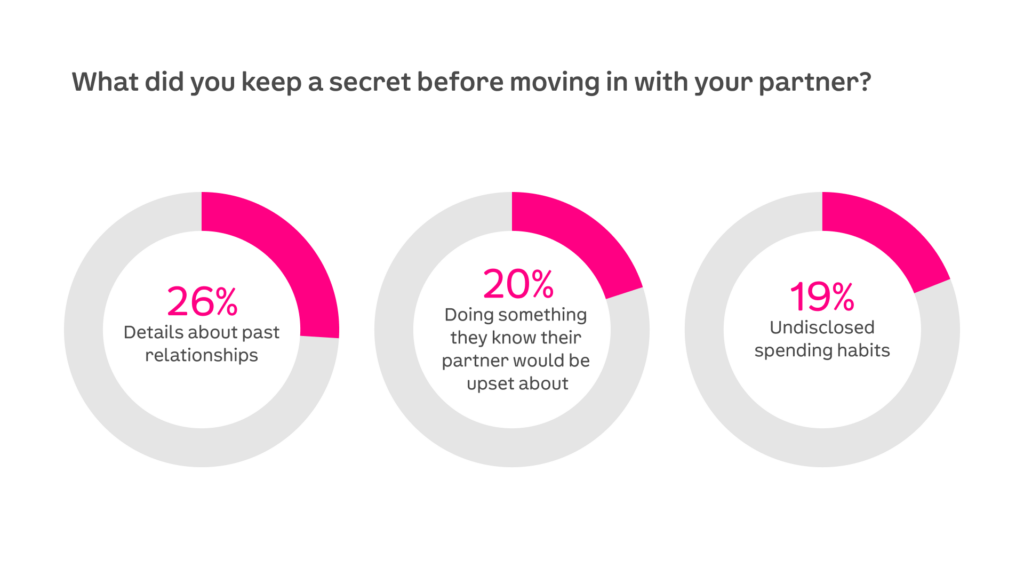

Nearly one in four people surveyed (22%) have kept a secret from their partner when moving in together. One-third of respondents (29%) who kept a secret from their partner hid it for over a year, and nearly half (48%) still have private details they haven’t shared with their honey.

It turns out, millennials are the most likely to keep a few details confidential from their partners when taking the big step (33%), followed closely by Gen Z (27%) with baby boomers being the most forthcoming of all generations (11%).

More than a quarter (26%) of couples surveyed kept details about a past relationship from their current partner when they moved in together.

If you’re thinking—well, I bet they’re just waiting for the right timing—think again. Not even half (43%) of respondents are planning to reveal all of their secrets to their partner, but the majority (68%) do feel guilty about keeping things hidden.

Are couples not showing all their cards because it goes both ways? One in five respondents who hid something from their partner said their partner also hid something from them. In fact, more than half (52%) of respondents believe their partner is still hiding something.

It probably comes as no surprise that pets play a significant role in the decision-making and the adjustment phase of a live-in relationship. Three-fourths of surveyed couples who live together (74%) currently own a pet.

Baby boomer respondents reported the lowest rate of pet ownership (59%) compared to other generations, and millennials with the highest (82%), while Gen X and Gen Z were close behind (78% each).

Forty-eight percent of respondents who own a pet bought or adopted a pet together, while 35% owned a pet by themselves before their significant other entered the scene.

The majority of baby boomers who have a pet with their partner (62%) got the pet together with their current partner after they moved in together, compared to half (50%) of millennials who got a pet by themselves before they started dating their current partner.

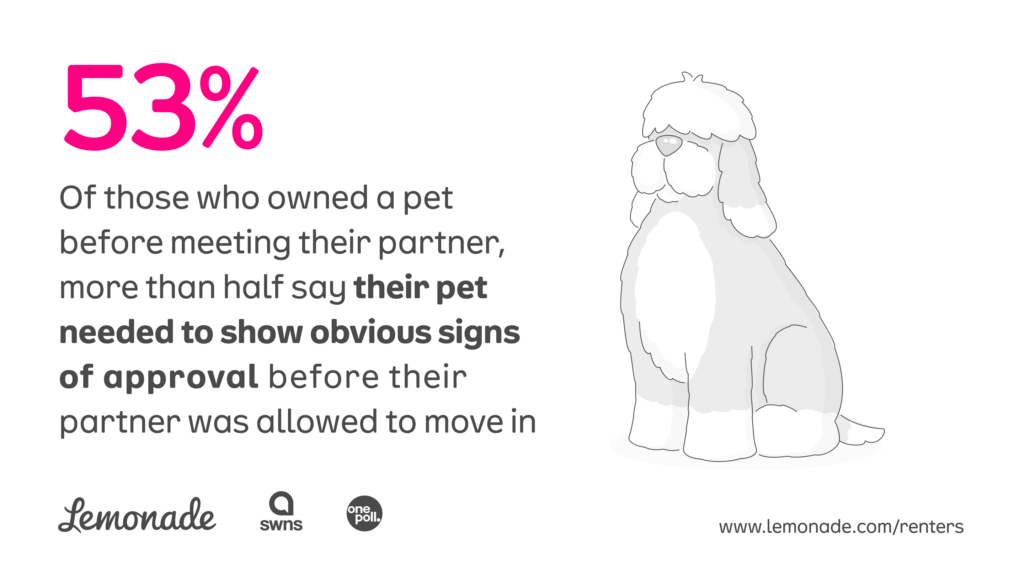

The acceptance of a partner by a pet is crucial, with more than half (53%) of those who owned a pet before meeting their partner saying their pet needed to show obvious signs of approval before their partner was allowed to move in.

Just over one quarter (26%) of baby boomers who had a pet before dating their partner required their pet’s approval before moving in with their current partner, in contrast with 70% of millennials and 59% of Gen Z respondents.

However, most of these pets now curl up in the laps of two loving parents instead of one. Over three quarters (78%) of those who owned a pet by themselves say their partner is now the co-parent of their pet.

Talking about how a pet fits into the picture before moving in together is a big deal. It’s important to plan for who will take care of the pet on a daily basis but also how the pet will be financially taken care of. The last thing any couple wants to deal with is a surprise bill from the vet, so just as they would themselves, making sure the practicalities like pet insurance are part of those conversations are just as important.

Dr. Stephanie Liff, Lemonade’s vet health expert

As couples navigate taking the next step in their relationship, the importance of open dialogue—covering everything from the heart to the wallet—becomes abundantly clear.

And to protect against the unexpected as you take the next step, there’s Lemonade. A renters insurance policy with Lemonade can safeguard your joint stuff against theft and damage, while pet insurance can take a bite out of your fur baby’s vet bills.

Get started now by clicking the button below!

This random double-opt-in survey of U.S. adults who live with their partner split evenly by generation was commissioned by Lemonade between Feb. 6 and Feb. 12, 2024. It was conducted by market research company OnePoll, whose team members are members of the Market Research Society and have corporate membership to the American Association for Public Opinion Research (AAPOR) and the European Society for Opinion and Marketing Research (ESOMAR).

Please note: Lemonade articles and other editorial content are meant for educational purposes only, and should not be relied upon instead of professional legal, insurance or financial advice. The content of these educational articles does not alter the terms, conditions, exclusions, or limitations of policies issued by Lemonade, which differ according to your state of residence. While we regularly review previously published content to ensure it is accurate and up-to-date, there may be instances in which legal conditions or policy details have changed since publication. Any hypothetical examples used in Lemonade editorial content are purely expositional. Hypothetical examples do not alter or bind Lemonade to any application of your insurance policy to the particular facts and circumstances of any actual claim.

Please note: Lemonade articles and other editorial content are meant for educational purposes only, and should not be relied upon instead of professional legal, insurance or financial advice. The content of these educational articles does not alter the terms, conditions, exclusions, or limitations of policies issued by Lemonade, which differ according to your state of residence. While we regularly review previously published content to ensure it is accurate and up-to-date, there may be instances in which legal conditions or policy details have changed since publication. Any hypothetical examples used in Lemonade editorial content are purely expositional. Hypothetical examples do not alter or bind Lemonade to any application of your insurance policy to the particular facts and circumstances of any actual claim.