What You Need to Know About Mortgage Interest Rates

Here's what goes into setting your interest rate—and how you can secure the lowest rate possible.

Here's what goes into setting your interest rate—and how you can secure the lowest rate possible.

Despite an unpredictable pandemic economy and huge spikes in housing prices, millennials have been eager to claim their share of the homeownership dream—so eager that millennial homebuyers already account for a majority of all new home purchases.

But many millennial homebuyers are encountering a circumstance that’s entirely new to them: rising interest rates.

On July 27, 2022, the Federal Reserve—aka the Fed, the nation’s central bank—announced its fourth interest rate hike of the year. The Fed first raised rates in March, from near zero, and after its series of rate increases, the Fed rate now stands at a range of 2.25% to 2.5%.

The Fed’s interest rate decisions influence the rates that lenders charge for both consumer and business loans, including mortgages and car loans. The higher the interest rate on federal funds, the higher the interest rate banks charge one another—and the higher your interest rate will be for one of these loans.

If you’ve been thinking about purchasing a new home—or if you’re already in the process of doing so – this is something to pay attention to.

You’ll also want to get smart on how interest rates work and how you can more effectively manage your personal finances to lower the cost of buying a new home, even if interest rates are rising.

Fortunately, we’ve got you covered.

Don’t be embarrassed to ask the most basic questions!

Taylor Tepper, an investment writer with Forbes, broke it all down for us.

“An interest rate is what a lender, like a bank, charges someone who wants to borrow money,” Tepper explained.

“When people say, ‘the Fed raised interest rates,’ they’re talking about the federal funds rate,” he continued. The federal funds rate is the interest rate banks charge each other to trade federal funds and which helps shape those banks’ decisions about what to charge their clients for their loans.

In other words, the Fed doesn’t directly set the rate that you’ll pay for your home loan. But your mortgage lender pays close attention to the federal funds rate and that rate helps determine what your interest rate will be, along with a few other factors we’ll discuss later.

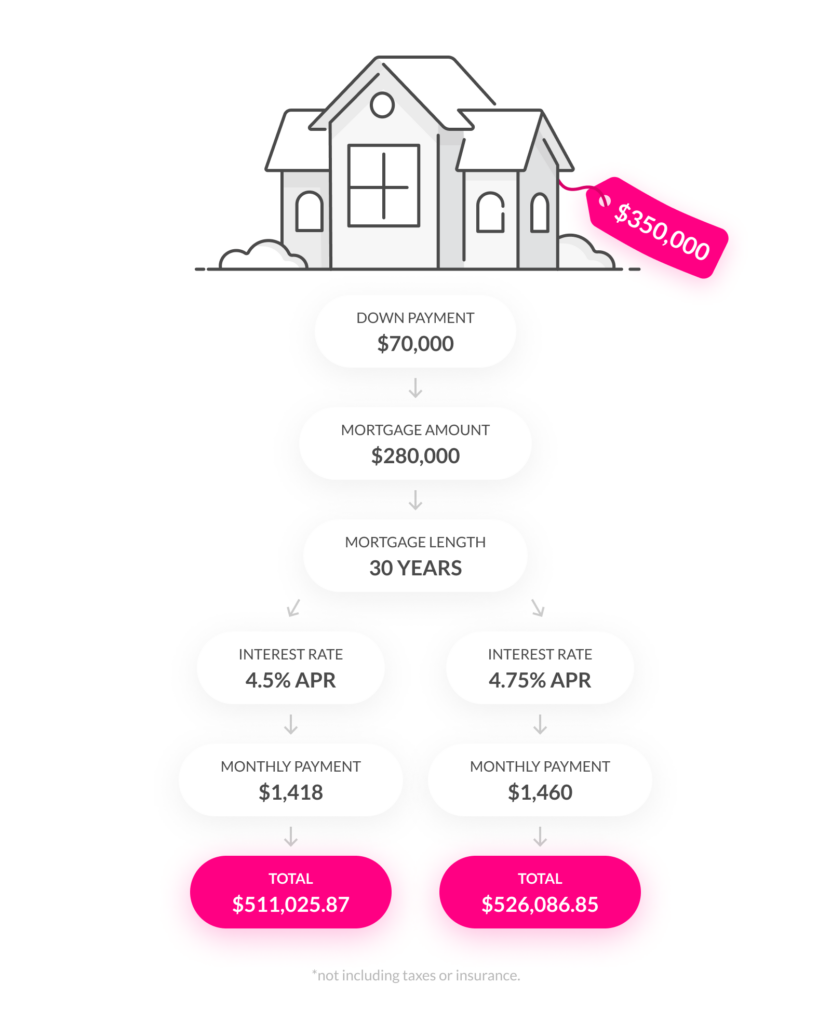

For now, let’s say you plan to put down $70,000—a 20% down payment—to buy a $350,000 house. In this scenario, you’d need to take out a mortgage loan of $280,000 for the remaining cost of your new home.

Now let’s say that after reviewing your personal financial situation, your mortgage lender approves your loan application. Congratulations! Now all you have to do is pay off that $280,000—right?

If only it were that easy. The $280,000 is the principal of the loan, but there’s also your interest rate, a percentage of your principal.

Each month, you’ll pay a portion of both your outstanding principal as well as your interest payment—but don’t worry, it’s all rolled into one simple payment.

Your mortgage will be either a fixed rate mortgage – meaning your interest rate is effectively frozen for the duration of your loan, usually 15 to 30 years – or an adjustable rate mortgage (ARM).

If you’ve got an ARM, that doesn’t mean your lender can decide at a whim to change your interest rate at any point they want from the day you secure your mortgage. When you secure an ARM, your mortgage will be slightly lower than the fixed rate on a 15- or 30-year loan. That lower rate will usually last for a period of sometime between one year to seven years, depending on the conditions of your loan.

The catch? Once an ARM expires, if you want to get another one, you’ll have to pay whatever new rate there is based on market trends.

“Consider how long you want to stay in the home,” Tepper advises those in the process of looking for a mortgage.

If you’re planning to live in your new place for seven years or less, an ARM might be a good option.

Let’s explore how this would work with some hypothetical numbers.

Say you’ve got a 30-year mortgage with a five-year ARM. The initial interest—let’s say it’s 4.2%, a bit below the market rate of 4.8%—is set for a fixed period of time (in this case, five years).

After that, the interest rate on the balance of your mortgage (aka what you still owe your lender after the payments you’ve already made) will reset. If you move homes within five years, you won’t have to worry about this.

But if you’d obtained a 30-year fixed mortgage at the then-current market rate of 4.8%, you’d have had to pay that higher rate—even though you didn’t plan to stay in your home for the long term.

On the flip side, let’s say you bought a new place, thinking you’d only want to stay for a handful of years. You opted for an ARM, which seemed like a good idea until you fell in love with the place, or you took a look at your overall financial situation and life priorities, and decided your starter home was going to be, if not your forever home, then at least your abode-until-your-toddler-graduates-from-high-school home.

In the meantime, interest rates have gone way up since you secured that five-year 4.2% ARM.

You could obtain another ARM a bit below the fixed rate of 5.9%. You’ll still be paying more, of course, than if you’d taken that 30-year mortgage five years ago.

Alternatively, you could go for a 15- or 30-year fixed loan at 5.9%, having learned the hard way that if you think there’s the slightest risk you’ll either want to or need to stay in your home for the long haul, a fixed rate mortgage might be the best option.

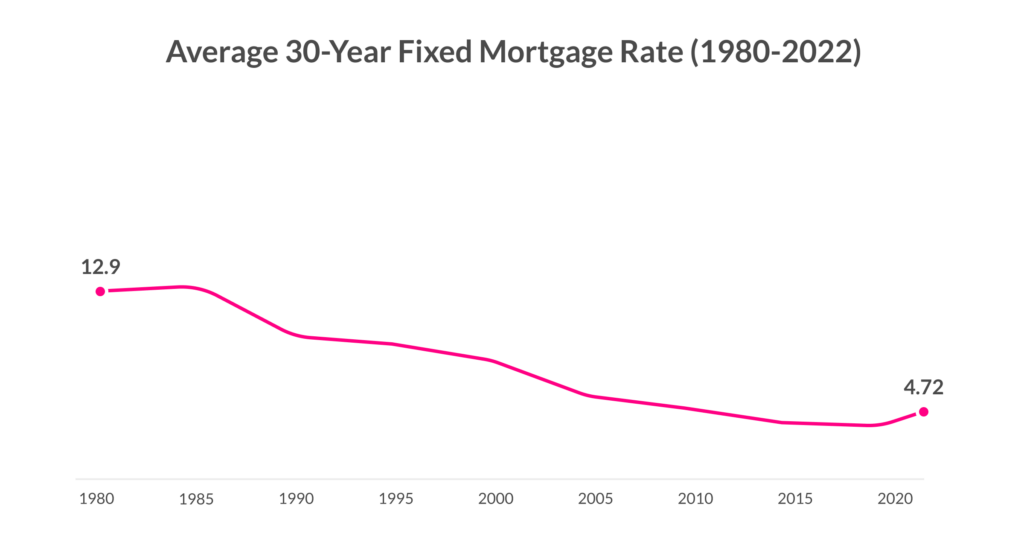

According to data compiled by the St. Louis Federal Reserve Bank, the average rate for a 30-year fixed rate mortgage stood at 5.54% in late July 2022.

That’s up pretty sharply from the 2.67% average at the end of 2020, but in historical perspective, rates are still quite low, noted Barbara Harzog, a personal finance expert at U.S. News & World Report.

“We’ve seen much much higher rates than this. Everybody got used to 3% rates and we got really comfortable with that, especially with home prices so high,” Harzog said.

Rates have historically been much higher than the 3–5% fixed rate average we’ve seen since the economy started recovering from the Great Recession of the late 2000s.

In 1981, for example, the average rate for a 30-year fixed rate mortgage at one point reached an astounding 18.53%. That’s a pretty big anomaly historically, but nevertheless, rates rarely dipped below 10% over the course of the entire 1980s, and rates never got as low as 5% until 2009.

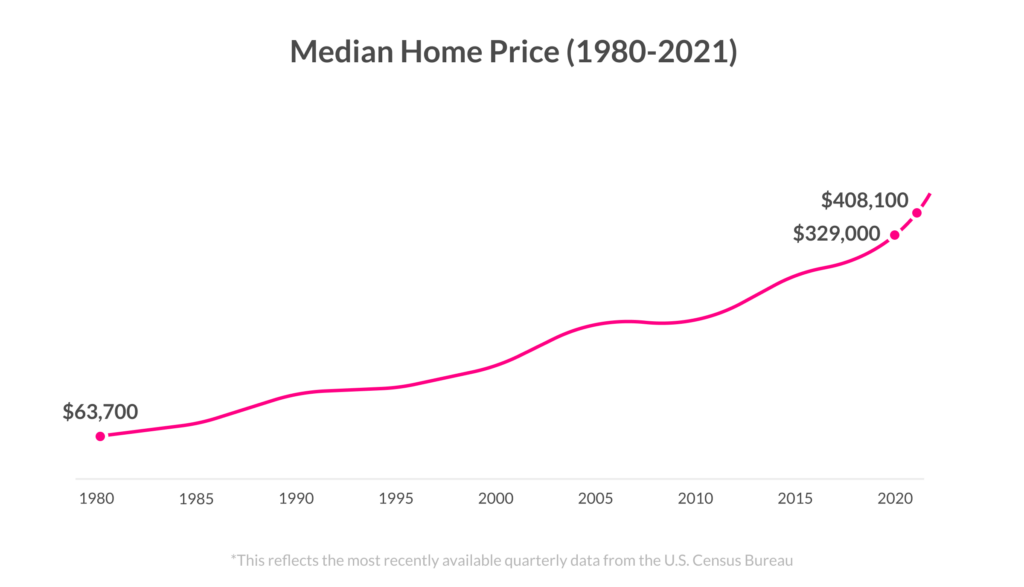

This might seem confusing. If we’re just comparing interest rates, it can seem like it was hell to buy a house in the 1980s, and is comparatively simple now. But even a cursory look at the real estate section these days shows that you need a lot of cash—and luck—to land a home.

Interest rate figures alone can paint a pretty deceptive picture of the real estate climate millennials are currently confronting.

True, our parents and grandparents might have had to pay higher interest rates—but housing was much more affordable back then, with the median home sale price starting at $63,700 at the beginning of 1980, climbing to $123,900 as the 1990s dawned, inching up to $165,300 as we rang in Y2K, and hitting $222,900 at the start of 2010… before skyrocketing to $408,100 at the end of 2021.

We’ve established that you’ll probably have to pay way more for your first or second home than your Boomer predecessors ever had to—though you’ll generally pay a lower interest rate than they did.

But you’re probably wondering what factors go into setting the interest rate you’d personally be offered if you tried to go out and purchase a home in 2022.

Harzog said that your lender will look closely at your employment and income information on your loan application.

The greater your ability to demonstrate you’ve been earning a steady livelihood, the lower your rate will be.

It also helps to have paid off as much of your debt as possible and to have a good credit score, she added.

“You don’t need a perfect credit score but if you get up to 760 that’s great,” she advised.

If you’re curious what mortgage rate you’d likely pay based on your specific financial circumstances, this handy mortgage rate comparison tool from Forbes Advisor gives you a pretty good idea of what to expect.

TLDR: There’s no uniform interest rate that everyone buying a home at a given time will pay. Rates overall will move higher or lower based on the Fed’s benchmark rate—for more on that, just read on below—but your individual rate will be determined by your personal financial situation.

Spoiler alert: The goal isn’t solely to generate alarmist news headlines and endless online explainers.

The federal funds rate is a reflection of the overall economic climate in which banks have to make decisions.

The Fed‘s dual mandate, set by Congress, is to both keep in check the rate of inflation—the cost of goods and services—as well as achieve lower unemployment. The interest rates the Fed sets in its capacity as the nation’s central bank aim to achieve both of these goals.

Finding that Goldilocks balance can be tricky.

That’s because low interest rates tend to stimulate economic activity – encouraging more people to take out loans to buy homes and start businesses, which then create more jobs.

But more money floating around means higher prices, which means the Fed sometimes feels compelled to “cool down” the economy by raising interest rates as signs of inflation emerge.

With the rate of inflation at 40-year highs in 2022, the Fed is increasing rates in order to prevent the economy from “overheating” prices from reaching unsustainably high levels. Raising rates does come at a price—including higher borrowing costs, and potentially higher unemployment.

But supporters of rate increases argue that keeping rates low even in the face of soaring inflation simply isn’t sustainable.

That’s because, they argue, the economy would eventually reach such a breaking point—with everyday goods like groceries and gas getting ever more expensive—that the long-term cost would be even higher than the pain that comes from increasing interest rates at an earlier stage.

Is the flip side of higher interest rates that we might see lower home prices – much like earlier generations saw?

Don’t bet on it, Tepper cautions.

“Rising rates typically happen when the economy is growing” and incomes are rising, he noted. “So it’s not as if buyers will dry up. And since there are so few homes for sale, prices are still expected to be expensive, depending on where you live.”

In other words, while it’s possible in theory that over time, higher interest rates will discourage more people from buying and thereby hold housing prices in check, there’s still not enough housing supply to match all the demand that’s out there.

And as interest rates have ticked up since 2020, housing prices have continued to climb, as well.

Even with prices high and interest rates likely to be higher for the foreseeable future, there are still steps you can take to hold down the costs of buying a new home.

Ideally, you should aim to make a 20% down payment on your home. The more you pay up front, the lower your loan principal will be. You’ll also have a lower interest rate, because a higher down payment signals to lenders that you’re probably a pretty good risk.

But if you put less than 20% down, you’ll have to purchase private mortgage insurance, which gets expensive (especially if you’re putting down a very small down payment, or have a poor credit score).

“Be realistic about the type of home you can afford,” Harzog said. “Don’t set yourself up for a major financial commitment you’re going to regret.”

If you think it might be another couple of years before you can afford your ideal home—but you’re worried about what the interest rate climate will look like by then—it’s a good idea to speak to a financial advisor about your different options and how they align with your long-term goals.

And as we discussed earlier, it’s important to think about how long you’d like to live in your new home. Even if you’re offered a lower rate on a shorter-term ARM, if you plan to stay in your home long-term, you may well be better off financially paying a slightly higher rate on a 15- or 30-year fixed rate mortgage.

Wherever you are in the homebuying process—whether you’re still aspirationally scrolling Zillow with the vague hope of owning your own place someday, or getting ready to make an offer on that Craftsman bungalow you always admired—you know it’s a high-stakes moment in your financial life.

That’s why protecting your long-term financial security should be top of mind both during the process and after you’ve settled into your new digs. To that end, you’ll want to make sure your most valuable asset is protected by a quality homeowners insurance policy.

Homeowners insurance covers your home against common hazards—from weather-related damage to your home to vandalism and theft of your property.

You’ll want to select a homeowners insurer that understands the importance of your financial wellbeing—and the security of your home. Lemonade offers affordable homeowners insurance policies starting as low as $25 per month, and we make it easy to add additional coverage for valuable items, equipment breakdown, and more.

Getting a quote takes as little as 90 seconds—why not give Lemonade a spin?

Please note: Lemonade articles and other editorial content are meant for educational purposes only, and should not be relied upon instead of professional legal, insurance or financial advice. The content of these educational articles does not alter the terms, conditions, exclusions, or limitations of policies issued by Lemonade, which differ according to your state of residence. While we regularly review previously published content to ensure it is accurate and up-to-date, there may be instances in which legal conditions or policy details have changed since publication. Any hypothetical examples used in Lemonade editorial content are purely expositional. Hypothetical examples do not alter or bind Lemonade to any application of your insurance policy to the particular facts and circumstances of any actual claim.