Survey: Settling In Without Settling Down. What It Means to Be a Renter in 2025

Meet the modern renter: They’ve been in the same apartment for four years, spent hundreds on unauthorized wall paint, and accumulated $15K worth of stuff. They browse rental listings like it’s Instagram, dream about upgrades they’ll never make, and when disaster strikes, say a break-in or fire, they’re completely unprotected.

Sound familiar?

Lemonade commissioned a survey in collaboration with market research firm Talker Research of 2,000 American renters revealing a generation stuck in commitment limbo. They’re investing like homeowners in places they could lose tomorrow, breaking lease rules to make rentals feel like home, then rolling the dice when it comes to protecting what matters most.

The result? A third have lost belongings to damage, with some losing everything. Yet only 40% have renters insurance.

This is what it means to be a renter in 2025. Settling in without settling down, building a life in borrowed space, and hoping nothing goes wrong.

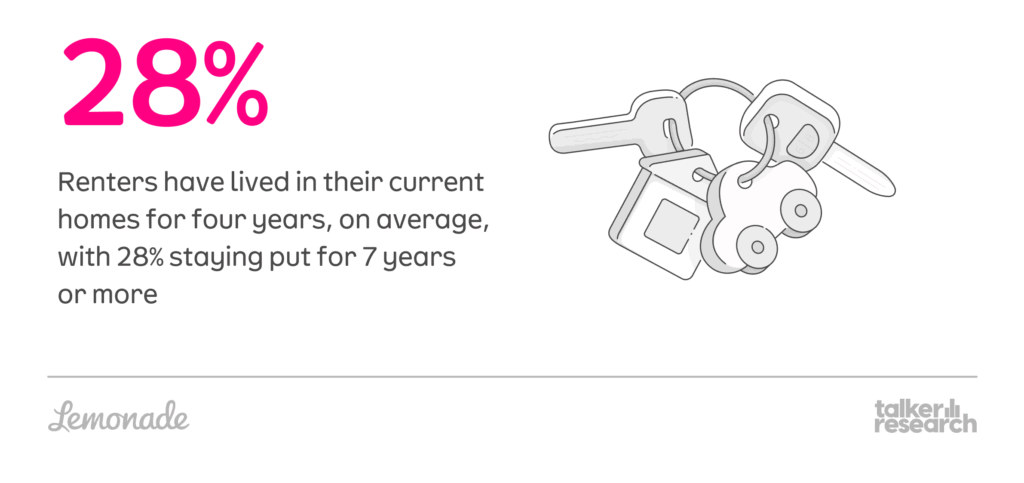

According to new research from Lemonade, renters on average have lived in their current rental for nearly four years (46 months) with 28% of renters staying in their cur rent rental for seven years or more, including 41% of baby boomers, 28% of Gen X, and 17% of millennials.

Rental housing may have once been seen as temporary, but today, it’s increasingly where people are putting down roots.

But just as modern relationships are redefined by dating apps and ghosting, renter relationships are full of commitment issues, too. Nearly a quarter (22%) of renter respondents admit they’re emotionally torn, wanting to upgrade but not quite ready to say goodbye, with over half (62%) reporting that they’re unlikely to move before the year ends. That same emotional limbo has one in four renters thinking they’ll move before the end of the year, with another 14% saying they definitely will in 2025.

As for why renters decide to move, motivations range from emotional to practical.

| Reason for moving | Percentage of renters |

|---|---|

| Wanted a change of scenery | 19% |

| Sought a better neighborhood | 15% |

| Could no longer afford their current place | 14% |

| Needed more space | 13% |

| Wanted to be closer to family | 12% |

| Were looking for an upgrade | 11% |

| Wanted to live alone, rather than with roomates | 10% |

These feelings are especially common among Gen Z, where 27% say they’re definitely moving before year’s end, and 32% are currently having commitment issues with their home. In contrast, only 4% of baby boomers plan to move, and just 16% report feeling unsettled where they live.

Gen Z’s mobility reflects broader economic pressures. Job market volatility, student debt, and delayed homeownership make younger renters more transient despite wanting to settle down. This trend aligns with Pew Research Center data showing that young people (35 years or younger) are more likely to rent than any other age group, with two thirds occupying rentals.

It’s no wonder then that 41% of renters now liken scrolling through rental listings to modern-day doomscrolling. Nearly a third (32%) of renters say they browse listings online at least once a week, even when they’re not planning to move.

On a typical day, respondents said they spend a little more than 30 minutes, on average, looking at homes online. The most popular time to peek? Right after lunch, at 2:06 p.m., as a kind of midday escapism.

“Today’s renters are navigating a tricky mix of uncertainty and aspiration,” said Sean Burgess, Chief Claims Officer at Lemonade. “It’s no wonder so many feel caught between wanting something new and not being ready to let go. Behind every listing is a hope for something better, but the process can be overwhelming.”

According to the study, the ideal time to look for a new rental home is five months in advance of moving.

What makes a place appealing in the first place? The top features that sealed the deal for renters to move into their current rentals included:

More than half of renters (58%) said the moving process to their current rental took longer than they thought it would. On average? Renters clocked in 20 moving boxes, a few moments of ‘why did I start this,’ and at least two mild meltdowns.

Once the 20-odd boxes are unpacked, the real work begins: Trying to make a rental feel like home, especially for those staying long-term.

And with renters staying in one place longer than ever before, the motivation to personalize, upgrade, and protect their space only grows. These homes may be leased, but to the people living in them, they can be deeply personal.

Renters reported it takes about three months to feel fully settled, and it’s not uncommon to wait six months before deciding whether to renew a lease.

Lease or no lease, renters are getting creative. Nearly 40% admit to DIY-ing their way toward ‘home,’ whether the rules allow it or not.

| Common DIY changes | Percentage of renters |

|---|---|

| Hanging curtains | 41% |

| Changing the showerhead | 24% |

| Planting in the yard | 24% |

| Putting nails in the wall for decor | 21% |

| Painting the walls | 18% |

| Installing shelving in the closet(s) | 10% |

Meanwhile, social media plays a huge role in personalizing rentals. Gen Z prefers TikTok (51%) for décor hacks, while older generations gravitate toward YouTube (millennials 38%, Gen X 35%, baby boomers 22%).

On average, renters reported spending 35 minutes a week hunting for rental-friendly decor hacks and tricks, often from favorites like:

“Home isn’t just a place, it’s a feeling,” said Burgess. “There’s something deeply human about wanting your space to feel like yours, even if it’s a rental.”

Once it feels like home, it’s only natural to want to protect it. And when disaster strikes, like a burst pipe, a break-in, or just plain bad luck, what’s inside matters more than ever. Surprisingly, the survey found that only 40% of renters have renters insurance, despite the fact that 33% have experienced damage to their belongings while renting.

The average value of damage reported? $590, but 16% said losses exceeded $1,500.

Renters reported their most valuable items at home as:

And while many renters treasure items like jewelry and electronics, the financial impact of damage or loss often extends far beyond these everyday essentials. When disaster strikes, the losses can be both emotionally and financially devastating, as the following stories from respondents show all too clearly:

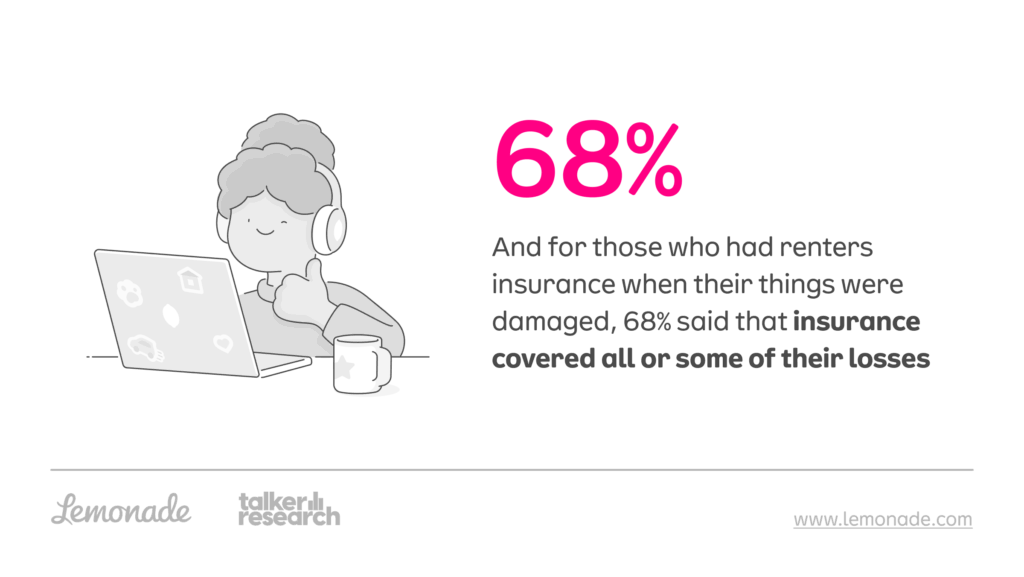

The upside? Of those who reported having renters insurance coverage, 68% were able to recover at least some of what they lost, and nearly half of those with coverage (46%) had all of their loss covered by renters insurance.

“Moving out, moving on, and making a place your own is a big part of growing up,” said Burgess. “But it comes with curveballs, from leaks to break-ins, things happen when you least expect them. Having a safety net in place can make all the difference.”

Renters may not technically own the homes they live in, but many are treating them as their own, emotionally, financially, and practically. And that means they deserve the kind of protection once reserved for homeowners.

You’ve made your place yours. We’re just here to help protect what makes it feel that way. Get covered in seconds with Lemonade.

Yes, and with 16% of renters losing $1,500+ in a single incident, you definitely want to make sure your valuables are protected.

Lemonade’s Extra Coverage provides enhanced protection (and zero-deductible claims!) for high-value items, like jewelry, cameras, bicycles, or art worth $350 or more. You’ll also be covered for accidental damage or mysterious loss, which a standard renters policy won’t cover.

Nope, renters insurance covers your stuff, not damage you cause to the apartment. If your DIY project damages walls, floors, or fixtures, that’s your responsibility (and your security deposit’s worst nightmare).

Since 40% of renters DIY anyway, maybe start with renter-friendly upgrades like adding a stylish rug to your living room.

Yes! If you’re a part of the 14% of renters looking to move before the end of 2025, it’s easy to update your renters insurance for a new address. Simply update your address in the Lemonade app and we’ll adjust your coverage for the new place. Your rate might change based on your new zip code, but we’ll let you know before anything updates.

Not by law, but lots of landlords require it before you can move in. Even if yours doesn’t, it’s still worth it. 68% of insured renters recovered at least some of their losses when disaster struck, and nearly half got everything back. $5/month to protect thousands of dollars of stuff? That’s a no-brainer.

Talker Research surveyed 2,000 American renters; the survey was commissioned by Lemonade and administered and conducted online by Talker Research between May 22 and May 28, 2025.

We are sourcing from a non-probability frame and the two main sources we use are:

Those who did not fit the specified sample were terminated from the survey. As the survey is fielded, dynamic online sampling is used, adjusting targeting to achieve the quotas specified as part of the sampling plan.

Regardless of which sources a respondent came from, they were directed to an Online Survey, where the survey was conducted in English; a link to the questionnaire can be shared upon request. Respondents were awarded points for completing the survey. These points have a small cash-equivalent monetary value.

Cells are only reported on for analysis if they have a minimum of 80 respondents, and statistical significance is calculated at the 95% level. Data is not weighted, but quotas and other parameters are put in place to reach the desired sample.

Interviews are excluded from the final analysis if they failed quality-checking measures. This includes:

It is worth noting that this survey was only available to individuals with internet access, and the results may not be generalizable to those without internet access.

Please note: Lemonade articles and other editorial content are meant for educational purposes only, and should not be relied upon instead of professional legal, insurance or financial advice. The content of these educational articles does not alter the terms, conditions, exclusions, or limitations of policies issued by Lemonade, which differ according to your state of residence. While we regularly review previously published content to ensure it is accurate and up-to-date, there may be instances in which legal conditions or policy details have changed since publication. Any hypothetical examples used in Lemonade editorial content are purely expositional. Hypothetical examples do not alter or bind Lemonade to any application of your insurance policy to the particular facts and circumstances of any actual claim.