When you buy a car insurance policy, there are plenty of ways to find the best coverage and fairest price.

The ability to include multiple cars on a single policy can make your life easier by keeping all of your coverage in one place (and even helping you save on your premium). When you sign up with Lemonade Car and include more than one car on a single policy, you automatically become eligible for a multi-car insurance discount.

Including multiple cars on the same policy is easy and is a simple way to keep you and your loved ones protected without breaking the bank. Let’s take a spin through what it means to be a policyholder with multiple cars to cover.

- The number of cars you can include on a single policy is determined by state rules, and your insurer.

- Lemonade Car allows four cars on a single policy, provided each is registered and kept in the same state and registered under your or your spouse’s name.

- With a Lemonade Car policy, your multi-car discount will be automatically applied to each car.

- A lot of perks come along with a multi-car policy—like having one quote, one policy document, and one renewal date for all the cars covered.

- You can customize the specific coverages for each car on a multi-car policy—you don’t have to choose for the same coverages and limits for all vehicles.

What is a multi-car insurance policy?

Rather than having separate policies for each car you own, a multi-car insurance policy lets you cover more than one car on a single policy. Each car is listed under the same policy and policyholder, but some of the specific coverages for each vehicle are customizable.

How does a multi-car policy work?

Signing up for a multi-car policy is really no different than for a single-car policy (except the fact that it includes more than one car). It’s this simple—when you’re looking for quotes with different car insurance companies, you add all the cars that you want to cover. The number of cars that you can cover on a single policy will depend on the state that you live in and your car insurer.

How can I add multiple cars to my Lemonade Car policy?

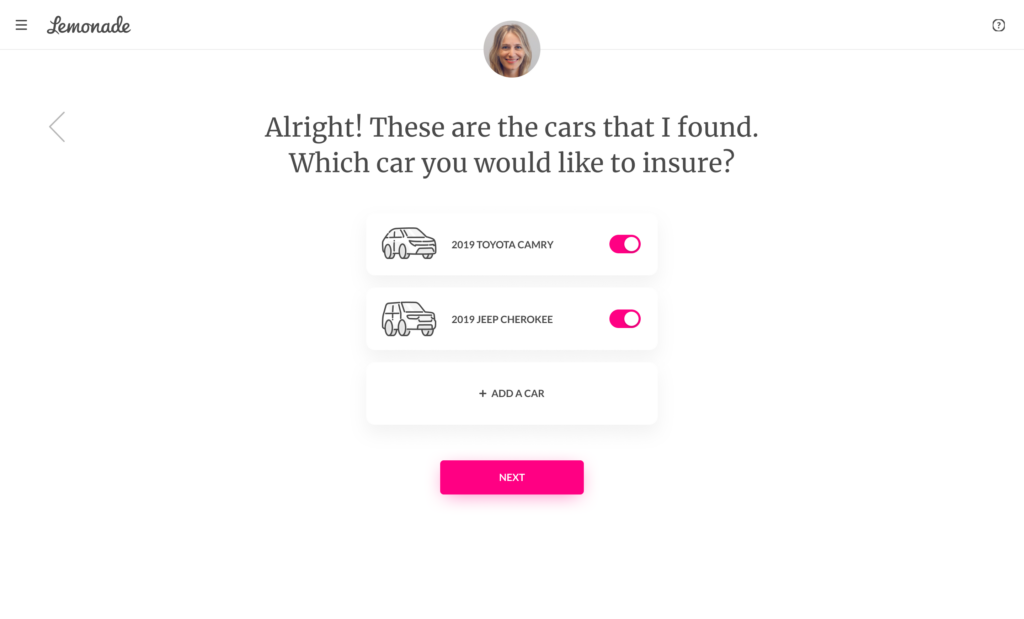

When you buy a Lemonade Car policy, you can easily add each car that you’d like to include on your policy. Our records may automatically identify the cars in your household, but you can also add cars manually that don’t already appear—like a new car that you’ve recently purchased and registered.

It’s important to make sure that all cars that you’d like to include in your policy are toggled so that they’re highlighted in pink.

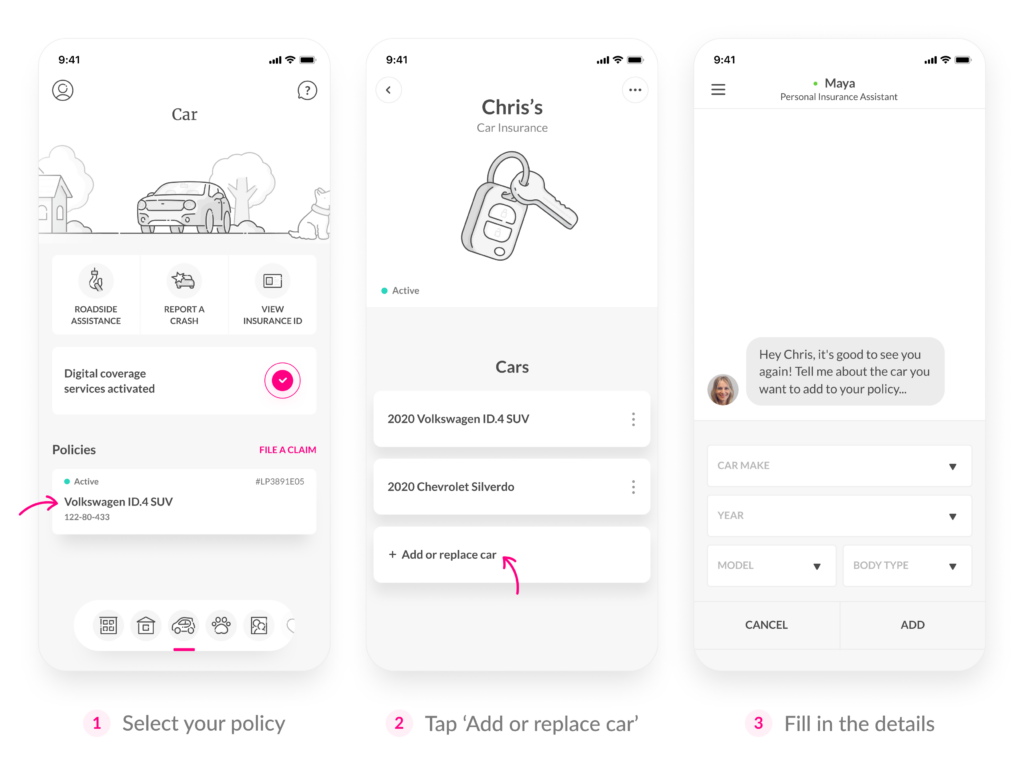

What if I get a new car after buying my policy?

Maybe you just traded in your older car for a newer model, or bought a car for your teenager once they earned their full-fledged driver’s license. As cars come and go from your life, you can easily adjust the details mid-term on the Lemonade app.

Keep in mind: Adding or replacing cars on your policy can impact your policy price.

Can I get a multi-car discount?

For sure. Once you add a second car or more to your policy, you become eligible for a multi-car discount on your premium. With a Lemonade Car policy the discount will be automatically applied to each car, including the first one, once there is more than one car included in the policy.

When you sign up with Lemonade Car for a multi-car policy, you’ll get one quote for the whole policy that will already factor in the multi-car discount (along with any other discounts that you’re eligible for).

Once you buy your Lemonade Car policy, the policy document itself will give you a price breakdown for each car that’s on your policy.

What other perks can a multi-car policy have over multiple single car policies?

Besides the savings you could get from having a multi-car insurance policy, there are additional conveniences to having a single insurance provider and policy to cover your needs.

Here are a few of the many perks:

- You get one quote for your whole policy, so there’s no need to go through the process for each car you want to cover

- You don’t have to file multiple policy documents for each car you cover, because your single policy will outline the coverage—and savings—of each car in one cohesive document

- When it comes time to renew, you don’t have to worry about remembering multiple dates, because each car on the single policy will have the same renewal date

Whose cars can and can’t be included on my multi-car policy?

On a single Lemonade Car policy you can include up to 4 cars. Each car included on your multi-car policy must be registered and kept in the same state and registered under your or your spouse’s name.

Curious if your personal situation makes you eligible for a multi-car policy? Here are a few common scenarios.

Immediate family members

What if you’re a family of 4 that wants to share a car insurance policy—and each of you has your own car and a valid driver’s license or learner’s permit?

It can get a little complicated depending on the specifics. Let’s say your teenager who lives with you just got a new Toyota Corolla registered in their name for their Sweet 16. To include that car on your policy, you’d just have to have the car re-registered in your or your spouse’s name.

Meanwhile, if you decided to buy your out-of-state college student a used Subaru in your name, it wouldn’t be eligible for inclusion on your multi-car policy since it would be stored and driven in a different state.

Friends and trusted acquaintances

If you’re looking to save on your car insurance premium by sharing a multi-car policy with your significant other or college roommates… it’s probably more trouble than it’s worth.

Unless each of the cars that you’re looking to jointly cover are registered under the same name—which would be pretty uncommon—you’ll have to stick to your own individual policies.

It is possible, though, to include additional drivers on your policy for a single vehicle. At Lemonade Car you can cover up to 7 drivers on your policy. So if your buddies regularly borrow your Tesla for errands or weekend trips, consider adding them.

Company car

If you drive a company car, it’s registered under the company’s name and not yours. So, that car wouldn’t be eligible for coverage under your multi-car insurance policy.

Leased car

Although a leased car is not technically “yours,” if it’s registered under your name you could include it on your multi-car insurance policy.

How can I customize the coverages for each car on a multi-car policy?

Even though a multi-car insurance policy includes each car under the same policy, at Lemonade Car it’s easy to tailor each car’s individual insurance coverages.

All cars on your multi-car policy will have to carry the same liability insurance—the bare minimum car insurance that covers damage you may cause to other drivers and their property. But beyond that, you can add extra coverages to specific vehicles, according to your tastes and needs.

So, how does this work in practice?

Let’s say you have a multi-car Lemonade Car policy that covers three vehicles: A 2008 Honda Civic, a 2015 Prius, and a 2020 Toyota Corolla.

Maybe you’re less concerned about the Civic, which you don’t drive that often, and so you only add standard liability insurance for that vehicle. No problem. You’re still able to customize coverages for your other cars as you see fit.

That means you could hook the Prius and the Toyota Corolla up with all the bells and whistles to give them “full coverage.” Just don’t let the name fool you—full coverage doesn’t mean you’re covered for everything, nor does it guarantee your claim will be approved.

If you add on coverages like comprehensive and collision insurance (which are separate, but equally important additions) with Lemonade Car, you have the option to go the extra mile to protect your cars with temporary transportation coverage and glass and windshield coverage. You can even customize the deductible you want for each type of coverage on each car. Plus, if you drive with the Lemonade app we’ll include roadside assistance, on us!

One important caveat here: There are certain add-on coverages that must be applied to all vehicles on a multi-car policy, if you choose to add them at all. These include things like coverages for bodily injury, medical payments, property damage, and uninsured drivers.

So, what’s the best auto insurance for a multi-car policyholder?

Glad you asked. We’re a bit biased, but… When you buy a multi-car insurance policy with Lemonade Car, you can enjoy the conveniences of having up to 4 cars covered in one place, with all the savings that entails.

But there are a lot of other ways you can lower your car insurance costs even more with a Lemonade Car policy.

In addition to the multi-car discount, you can save as much as 10% on each of your premiums when you bundle with other Lemonade policies like renters, homeowners, pet, or life insurance.

If one or more of the cars on your multi-car policy is a hybrid or electric car, you’ll get a discount on your Lemonade Car policy. These types of vehicles reduce your CO2 emissions, which helps fight climate change. Not to mention the money you save on gas.

Also, at Lemonade Car the way you drive matters, so we calculate a lot of factors—like your mileage, driving habits, and driving record—to fairly price your car insurance premium.

FAQs

Is it cheaper to get multi-car insurance, rather than separate policies for each car?

Yes, multi-car insurance is usually less expensive. Combining all your cars into one policy often gives you a multi-car discount, which can save you money compared to having separate policies for each car. So, it’s a cost-effective way to cover multiple vehicles.

How many cars can be under an insurance policy?

The number of cars you can include in a single insurance policy varies by insurer and state regulations. With Lemonade Car, you can include up to 4 cars in one multi-car policy.

Can different drivers be listed for each car on a multi-car policy?

Yes, different drivers can be associated with each car on a multi-car policy. However, all cars on the policy must be solely registered to the primary policyholder or the spouse of the primary policyholder.

How does adding extra drivers affect the cost of my multi-car policy?

Adding extra drivers can be done easily on Lemonade Car policies. You can add up to 7 drivers to your policy in most states, which is useful if friends or family frequently borrow your car. This may affect your premium, depending on the added driver’s record.

Does a multi-car policy cover non-traditional vehicles like motorcycles or RVs?

No, a multi-car policy through Lemonade Car does not cover non-traditional vehicles like motorcycles or RVs. These vehicles often require specialized insurance policies tailored to their specific risks.

A few quick words, because we <3 our lawyers: This post is general in nature, and any statement in it doesn’t alter the terms, conditions, exclusions, or limitations of policies issued by Lemonade, which differ according to your state of residence. You’re encouraged to discuss your specific circumstances with your own professional advisors. The purpose of this post is merely to provide you with info and insights you can use to make such discussions more productive! Naturally, all comments by, or references to, third parties represent their own views, and Lemonade assumes no responsibility for them. Coverage and discounts may not be available in all states.