Does Homeowners Insurance Cover Ice Dams?

It often will, but there's a lot you can do to avoid trouble in the first place.

It often will, but there's a lot you can do to avoid trouble in the first place.

Ice dams can wreak havoc on your home. Thankfully, your homeowners insurance will cover certain types of property damage related to ice dams.

Let’s get to the bottom of what causes these frozen disasters-in-waiting, and what role your homeowners insurance might play in it all.

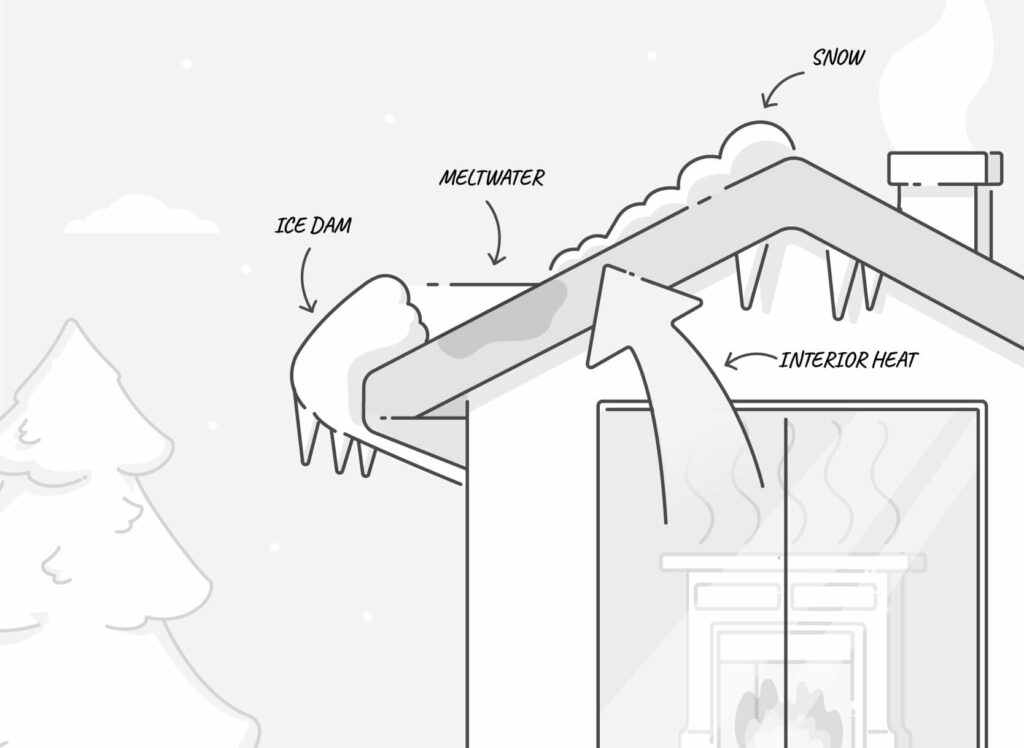

If you have snow packed on your roof, the heat from inside of your house can rise up and melt it. That melted snow can then pool and refreeze into a sheet of ice at the edge of your roof. Voila! An ice dam.

That ice can block your gutters, which means trapped water flowing around up there will have nowhere to go—except, perhaps, down through your roof and into the structure of your home.

While ice dams probably won’t do too much damage to your shingles or roof, they can cause damage to your walls, ceilings, insulation, and your HVAC and plumbing systems.

You can’t see the top of your roof, so how do you know if you have a problem? Well, icicles are gorgeous, but they’re also a warning sign for homeowners.

If you spot icicles forming off the edges of your roof, this might indicate that you have an ice dam on your hands. Sound the alarm!

It depends. Your homeowner’s insurance policy will cover some kinds of damage, but not all.

Your insurance policy should cover:

So, if water from an ice dam seeps through the eaves of your home and damages your walls, your homeowners insurance would likely kick in.

Commonly, covered claims tend to involve damage to ceilings, walls, baseboards, flooring, and paint, as well as the actual water mitigation efforts to deal with the water from the ice dam.

The most important exception to keep in mind is that your Lemonade policy won’t cover ice dam-related damage to your personal property.

So if stuff like your entertainment system or furniture is affected by ice dam leaking, you won’t be covered.

Additionally, there are some structures on your property that homeowners insurance policies will not cover in the case that they are damaged by ice dams. Some of the exclusions are:

So, if an ice dam has formed on a roof overhang and your patio beneath that overhang becomes damaged by melting ice from the dam, your insurance policy will not cover the damage.

Nope. Your insurance policy will not cover the removal of an already existing ice dam.

But if you’re safe and don’t do anything foolish (like running around on the roof right after a snow or ice storm) you can do a lot to solve the problem on your own.

According to the University of Minnesota the best way to deal with an ice dam is to remove the snow that has gathered on the top of your roof.

One easy method for snow removal is to use a roof rake. This is a safe and effective (and oddly satisfying) way to remove snow from your roof without hopping on a ladder (please do not climb onto your roof immediately after a snow storm!)

If you are facing an emergency where meltwater is actively flowing into your house, you can get up on a ladder and try to create channels in the snow on your roof. This will make it possible for the water to flow off the roof and into the gutters, or on to the ground. This isn’t a permanent solution, though.

In reality though, the best thing you can do to keep yourself and your home safe from ice dam damage is to take long-term action to prevent the formation of ice dams in the first place.

Typically, ice dams form due to poor insulation or not enough ventilation. Warmth from the interior of the home rises, as it tends to do. That warm air heats the attic, which heats the roof sheathing from below—causing the snow to melt and refreeze, and forming the dreaded ice dam.

This means you want your attic to allow some air from the outside to come inside, therefore keeping the attic “cool enough” so that it doesn’t warm up the sheeting and start that whole process.

Some homeowners also rely on heated cables installed on their roof, which can help mitigate ice dam damage—but will also raise your electric bill.

In addition, when it comes to your roof, you should take a proactive role in preventing damage this winter. Maintenance is the best defense.

Maintaining your roof means replacing missing shingles regularly, and having your roof inspected around twice a year to spot wear and tear to your vents, skylights, and chimneys. If you feel confident to safely do this yourself, go ahead and grab a ladder and survey the situation both before and after the winter weather season. If you’re not so fond of heights, hire a professional.

Also, don’t forget to maintain and clear your gutters regularly. Clean gutters can be a first line of defense to make sure snow, ice, and debris don’t get trapped on your roof.

Ice dams aren’t the only cold-weather peril that can damage your home. Here’s a few others to consider.

Unfortunately, many of us are familiar with the risk of burst pipes during cold winter weather.

Luckily, your homeowners insurance policy should cover the water damages to your property, and may help with extra living expenses if you’re temporarily forced to relocate.

However, you have certain responsibilities as a homeowner. If you’re spending the winter elsewhere—say, you’ve headed down to a second home in Florida to avoid a freezing December in Maine—then you’ll want to prepare your property for the cold.

That means either maintaining heat in the house while you’re off at the beach, or shutting off the water to avoid burst pipes. Failing to take those precautions might complicate your claim or cause it to be denied.

Snow is heavy, and when mounds and mounds of it accumulate on your roof it can do some serious damage: roof leaks, roof collapse, and/or water damage. Luckily, your home insurance policy should cover the cost of repairs as well as the damage done to your property.

Melting snow and spring rains can often bring flooding. Snowmelt floods can cause considerable damage to your home. Unfortunately, flooding isn’t covered under your homeowners insurance policy.

If you live in a place where flooding is a concern it may be a good idea to get flood insurance as well as a regular homeowners insurance policy.

Hail is grouped with windstorms on a Lemonade renters or homeowners policy as a named peril: an insurance-covered event that could cause damage to your home or your property.

So, let’s say hail damages your roof, causing a leak. Water soaks through your ceiling, damaging your clothes, furniture, and laptop. Luckily, you’d be covered for the repairs to your roof, and we’d also help repair or replace your ruined stuff.

Whether you live in Rochester, New York and get 100 inches of snow a year, or you enjoy the more mild conditions of Raleigh, North Carolina (which averages around 4 inches of the white stuff annually), it pays to be prepared for winter storms.

As we all observed in Texas, extreme winter weather can wreck the most havoc in places that aren’t used to an annual blizzard or two. As climate change increases, it’ll likely become even harder to predict typical weather patterns—leaving the door open for more so-called “freak” meteorological events.

This winter, prepare yourself, stay calm, and get the scoop on how Lemonade Homeowners insurance coverage can help you weather the storm.

A few quick words, because we <3 our lawyers: This post is general in nature, and any statement in it doesn’t alter the terms, conditions, exclusions, or limitations of the policies issued, which differ according to your state of residence. You’re encouraged to discuss your specific circumstances with your own professional advisors. The purpose of this post is merely to provide you with info and insights you can use to make such discussions more productive! Naturally, all comments by, or references to, third parties represent their own views, and Lemonade assumes no responsibility for them. Coverage may not be available in all states. Please note that statements about coverages, policy management, claims processes, Giveback, and customer support apply to policies underwritten by Lemonade Insurance Company or Metromile Insurance Company, a Lemonade company, sold by Lemonade Insurance Agency, LLC. The statements do not apply to policies underwritten by other carriers.

Please note: Lemonade articles and other editorial content are meant for educational purposes only, and should not be relied upon instead of professional legal, insurance or financial advice. The content of these educational articles does not alter the terms, conditions, exclusions, or limitations of policies issued by Lemonade, which differ according to your state of residence. While we regularly review previously published content to ensure it is accurate and up-to-date, there may be instances in which legal conditions or policy details have changed since publication. Any hypothetical examples used in Lemonade editorial content are purely expositional. Hypothetical examples do not alter or bind Lemonade to any application of your insurance policy to the particular facts and circumstances of any actual claim.