- Does homeowners insurance cover damage from wildfires?

- Does homeowners insurance cover damage from hurricanes?

- Does homeowners insurance cover damage from tornadoes?

- Does homeowners insurance cover damage from winter storms?

- Does homeowners insurance cover flooding?

- Does homeowners insurance cover earthquakes?

- Does homeowners insurance cover damage caused by power outages?

- Does homeowners insurance cover damages to my car?

- Before we go…

In 2024, there were 27 natural disasters that racked up at least $1 billion in damages in the U.S., which left millions of homeowners devastated, emotionally and financially. In the wake of so much destruction, your home insurance policy can help.

Below, we’ll break down how homeowners insurance is applied in the event of some of the most common natural disasters. That way, you can file a claim with confidence.

This article summarizes the basics about various natural disasters and homeowners insurance policies. If you’re looking for more info, click on the more extensive explainers linked in each section.

Does homeowners insurance cover damage from wildfires?

Yes—coverage for smoke damage and fire damage are both included in a basic homeowners insurance policy.

Besides wildfires, you’d also be covered for damages from a fire started in your own home (in your kitchen, for example), or one that spreads to your place from a neighbor’s home.

Keep in mind that you might have the option to increase coverage for fire damage coverage by increasing your policy’s limit or to decrease coverage by accepting a higher deductible (that is, by keeping a greater amount of the loss for yourself). This addendum to your policy is called an “endorsement.”

Does homeowners insurance cover damage from hurricanes?

Yes! Your windstorm coverage in your Lemonade policy should keep you covered from damages caused by the high winds of a hurricane. For example, replacing or repairing your roof if high-speed winds tear through your home may be covered by your Lemonade homeowners insurance policy.

If you live on the coast, Lemonade might prompt you to add an additional hurricane deductible. This is an additional, usually larger, deductible that kicks in if you file a hurricane-related claim.

This deductible makes it possible (and financially feasible) for insurance companies to offer coverage to more people in hurricane-prone areas.

Learn more about hurricanes and homeowners insurance.

Does homeowners insurance cover damage from tornadoes?

Like hurricanes, tornadoes are considered a type of “windstorm” in your homeowners insurance policy, and damage caused by tornadoes would be covered.

Learn more about tornadoes and homeowners insurance.

Does homeowners insurance cover damage from winter storms?

Snow sure looks pretty, but it can wreak serious havoc on your home. Luckily, homeowners insurance can help cover a range of damages and inconveniences caused by severe winter storms and extreme cold.

If your pipes burst and damage your property—whether that’s your laptop or your couch—your homeowners insurance would help cover you for the damages. You might also be eligible to be compensated for any costs related to temporary accommodations and living expenses, if the incident forced you out of your home for a while. And your homeowners policy would also help cover repairs to the burst pipes themselves.

But (and it’s a big “but”) if you weren’t home and/or you didn’t maintain sufficient heat in your home to help prevent your pipes from bursting, you might not be eligible for coverage.

Also, it’s important to note that if you just have frozen pipes that haven’t burst, you won’t be covered for an Airbnb or a motel stay. Before the storm comes, be sure to stock up on drinking water in case you find yourself with frozen pipes.

Here’s when your Lemonade homeowners insurance coverage can kick in the wake of a winter storm:

- The weight of snow causes damage your roof’s shingles or the structure of your roof

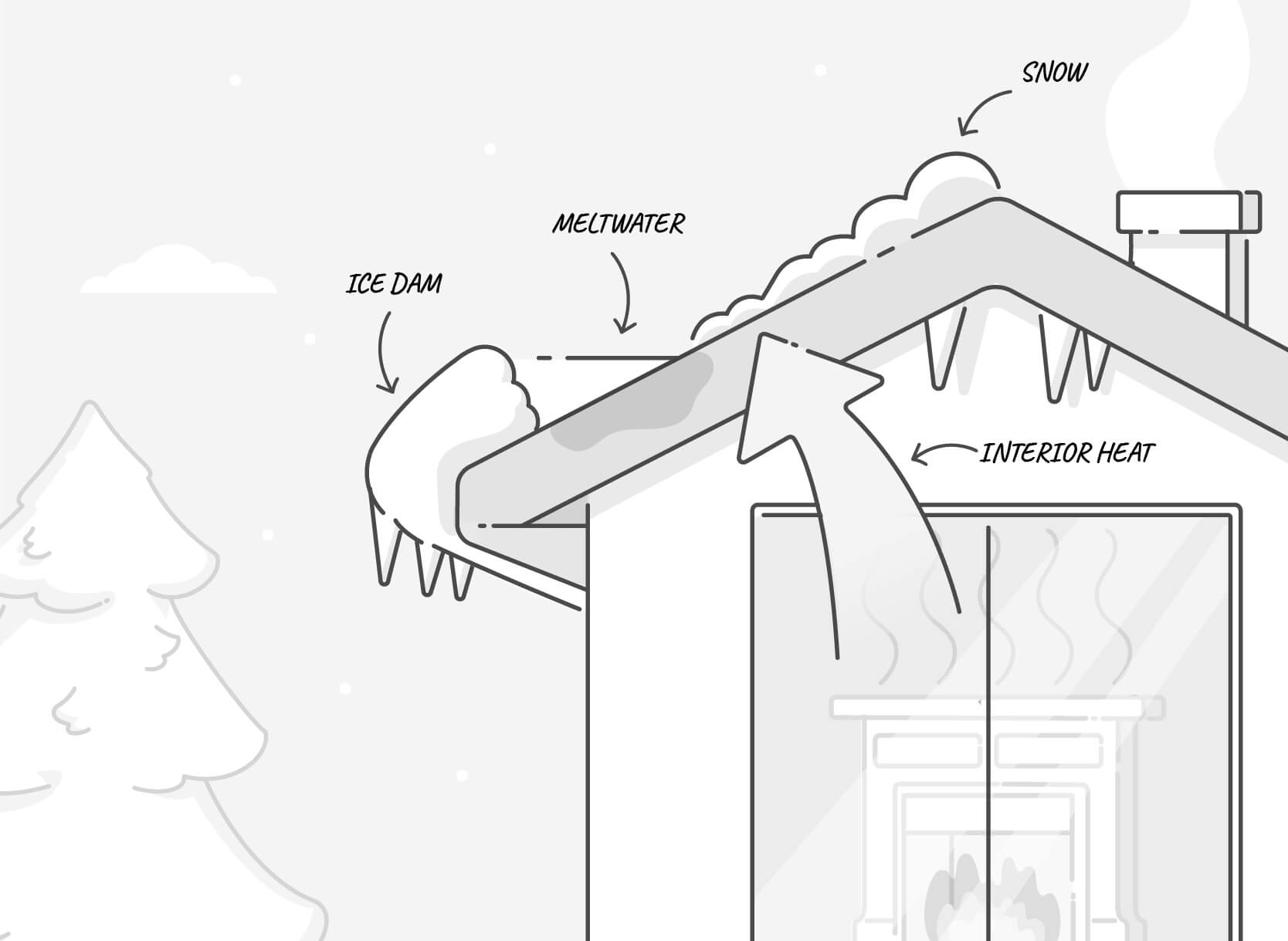

- Damage to your walls, ceilings, insulation, and HVAC and plumbing systems caused by water leaks as the result of ice dams (see below)

Learn more about severe winter storms and homeowners insurance.

Does homeowners insurance cover flooding?

A homeowners insurance policy does not cover flood damage (the same goes for renters insurance, by the way). You can purchase a separate, government-sponsored policy for floods— aptly called flood insurance—through the national flood insurance program.

Your homeowners policy might provide coverage for other types of water damage though, involving things like broken pipes, roof leaks, and overflow from appliances (e.g., your washing machine decides to explode mid-cycle).

It’s worth repeating: Even if the flooding occurs as the result of a tornado, hurricane, snowstorm, or other covered circumstance (aka named peril), you would likely not be covered for any of the specific, flood-related damages.

Learn more about flooding and homeowners insurance.

Does homeowners insurance cover earthquakes?

No. Homeowners and renters insurance policies do not cover damage caused by earthquakes, so if you live in a high-risk area, you’ll likely need to buy a separate policy, along with your base homeowners or renters insurance policy. In certain states, Lemonade offers earthquake coverage as an add-on—also known as an “endorsement.”

Lemonade might cover damages caused by a fire following an earthquake, which is a common consequence of an earthquake.

In certain states, Lemonade offers earthquake coverage as an add-on—also known as an “endorsement.”

Learn more about earthquakes and homeowners insurance policy.

Does homeowners insurance cover damage caused by power outages?

Power outages, without other physical damage to the structure of your home, aren’t covered as part of standard homeowners insurance policies.

Such outages are common in the U.S. due to all sorts of bad or inclement weather, and renters and home policies won’t kick in unless there is actual damage to your home.

So, if you lose power in a bad thunderstorm, for example, you won’t be able to claim a hotel stay as part of your loss of use coverage, or get reimbursed for food that spoils in your fridge as a part of your personal property coverage.

Learn more about power outages and homeowners insurance.

Does homeowners insurance cover damages to my car?

Homeowners insurance does not cover damage to your car caused by natural disasters. While your car is indeed a piece of personal property, it’s treated differently. So if a tornado knocked over a tree and it collapsed on your Prius, the damages wouldn’t fall under your homeowners insurance policy.

Instead, such damages would be handled by your car insurance policy, as long as you have comprehensive coverage.

Before we go…

Natural disasters can leave a path of destruction in their wake.

When extreme weather passes through your community, safety for yourself, your loved ones, and your neighbors should be your #1 priority. Start putting together an emergency kit, so you have important equipment and critical supplies on hand, no matter the weather.

Also, be sure to take a look at your homeowners insurance policy every once in a while, so you can reevaluate your coverage, and make adjustments if needed.

A few quick words, because we <3 our lawyers: This post is general in nature, and any statement in it doesn’t alter the terms, conditions, exclusions, or limitations of policies issued by Lemonade, which differ according to your state of residence. You’re encouraged to discuss your specific circumstances with your own professional advisors. The purpose of this post is merely to provide you with info and insights you can use to make such discussions more productive! Naturally, all comments by, or references to, third parties represent their own views, and Lemonade assumes no responsibility for them. Coverage and discounts may not be available in all states.