- Homeowners insurance generally covers roof leaks when they’re caused by a named peril, like a windstorm, hail damage, vandalism, or weight of ice, sleet or snow.

- Roof leaks typically aren’t covered when they result from gradual events, like aging, mold, fungus, wait rot, pests, general wear-and-tear, or lack of maintenance.

- To prevent roof leaks, regularly clean your gutters, clear debris from your roof, check your flashing, and replace broken or missing shingles.

Having a roof over your head is one of life’s most basic necessities, and let’s be honest, it’s easy to take those protective shingles for granted. But if you’ve ever experienced a leaky roof, you know that this damage can leave you, your family, and your stuff exposed to the elements—and can even leave your home temporarily unlivable.

According to 2024 data from HomeGuide, replacing an asphalt roof could set you back around $7,500, while you could pay upwards of $40,000 to install a new metal roof. Luckily, there are some cases where your homeowners insurance policy can kick in to repair your damaged roof, saving you and your wallet some major stress.

We’ll take you through the basics of roof leaks in your home insurance policy, so your coverage doesn’t go over your head. We’ll also go through some helpful tips and tricks for keeping your roof in tip-top shape.

When roof leaks are covered by homeowners insurance

Here’s the general rule: Roof leaks are covered when they’re caused by sudden, accidental events. You’re generally covered if your roof leaks after a named peril like:

- A windstorm

- Hail damage

- Vandalism

- Weight of ice, sleet, or snow

Let’s say a windstorm blows through, and lifts your roofing shingles on your house, causing rain to leak into your home. Your homeowners insurance would cover you, since this is a sudden, unexpected occurrence, and is named in your policy’s list of named perils.

Roof leaks are just one example of water damage for which homeowners insurance has you covered.

BTW, by ‘covered,’ we mean your homeowners insurance will help reimburse you for damages to your roof itself, as well as any damages to furniture, appliances, systems, etc. that were caused as a result of the roof leak (minus your deductible, of course).

When roof leaks aren’t covered

Generally, roof leaks aren’t covered when they happen because of gradual events, such as:

- Age

- Mold, fungus, or wet rot

- Wear and tear/deterioration

- Neglect

- Lack of maintenance

- Birds, vermin, rodents, insects

Why aren’t these covered? Well, insurance companies believe people can take steps to prevent roof leaks caused by these events. And like humans, roofs need regular maintenance to stay in healthy shape.

So if you’re trying to figure out if your roof leak is covered by homeowners insurance, ask yourself: “Could I have prevented the roof leak?”

The more you show your insurer you maintained your roof and prevented damage, the greater the chance your policy will cover you.

But luckily, homeowners insurance is not a zero-sum game. For instance, if you have an old roof that ends up leaking into your kitchen, homeowners insurance might still cover the interior damage, even if they won’t cover the roof itself.

Also, take note: Homeowners insurance alone doesn’t cover roof leaks that result from flooding or earthquake damage. To protect your home during these events, you’ll need separate flood insurance and earthquake insurance.

If you live in a high-risk flooding area (i.e. you own a sump pump or use the word ‘levee’ frequently), check out your community’s flood map and seriously consider getting flood insurance.

For more info on flooding, FEMA’s National Flood Insurance Program has a pretty good Q&A section.

How to prevent roof leaks

When it comes to roof damage, the best offense is defense. While there’s little you can do to prepare your roof from sudden, unexpected events, you can take steps to prevent mildew, pests, and general roof wear and tear.

Please note that maintaining your roof yourself can be extremely dangerous, even if you’re not afraid of heights. Proceed with caution and safety, and consider hiring a professional roofing company.

Clean your gutters

Gutters are your roof’s drainage system after rain or snowfall. When there’s a blockage, it could leave standing water on your roof, making it a prime location for water damage and mildew growth. Standing water could freeze over, creating an ice dam. When water has no place to flow off your roof, it can drip into your attic, your insulation, or your living room. Yikes.

Make a point of having your gutters cleaned at least twice a year. If you live in an area with tons of foliage, you might want to clean your gutters every three months. Trimming trees on your property regularly will also help keep your roof and gutters free and clear.

Clear your roof

At the end of the fall season, clear debris from your roof. Berries, nuts, or flowers dropped onto your roof can attract insects, rodents, and other pests. That frisbee you tossed just a little too hard could get knocked around by wind, cracking shingles. Properly maintaining your roof can prevent potentially severe winter roof damage. For example, wet leaves left on your roof through the winter can rot, creating mildew.

Check your flashing

Flashing is used to connect, seal, and fortify your roof around things like chimneys, vents and skylights. Flashing is usually made of either metal or plastic.

Gaps can form between flashing and your roof, caused by temperature changes, humidity, or natural wear and tear, leaving your roof vulnerable to serious leaks. Water loves to find a way into your home, and all it needs is a tiny crack.

Roof flashing should be replaced around every 15 years, and will roof flashing replacement will cost you between $400 to $1,000, according to HomeGuide, depending how much flashing you have.

Replace broken or missing shingles

Shingle roofs usually need to be replaced every 20 to 25 years, but instead of paying tens of thousands of dollars all at once for a brand new roof, you can nip roof damage in the bud. Have a professional roofer come in for an inspection, and have damaged or missing shingles patched and replaced for around $600. This is a good idea on an annual basis, or following any major weather events that may have caused damage. Trust us, raising the roof isn’t as fun as it sounds.

If you’re wondering whether replacing your roof can lower insurance premiums, the answer is yes. Replacing your roof with sturdy material like metal can help unlock big savings on your insurance rate. Just be sure to let your insurer know as soon as you make plans to replace your roof, and be sure and tell them what kind of material your new roof will be made of.

Unfortunately, if you’re already experiencing leaks in your home, you’re could be in for thousands of dollars of roof repairs. As of 2025, it costs an average of $400 to $2,500 to repair a roof leak, depending on the extent of the damage and where you live, according to Fixr.

It’s always better to stop problems before you notice that dreaded drip, drip, drip…

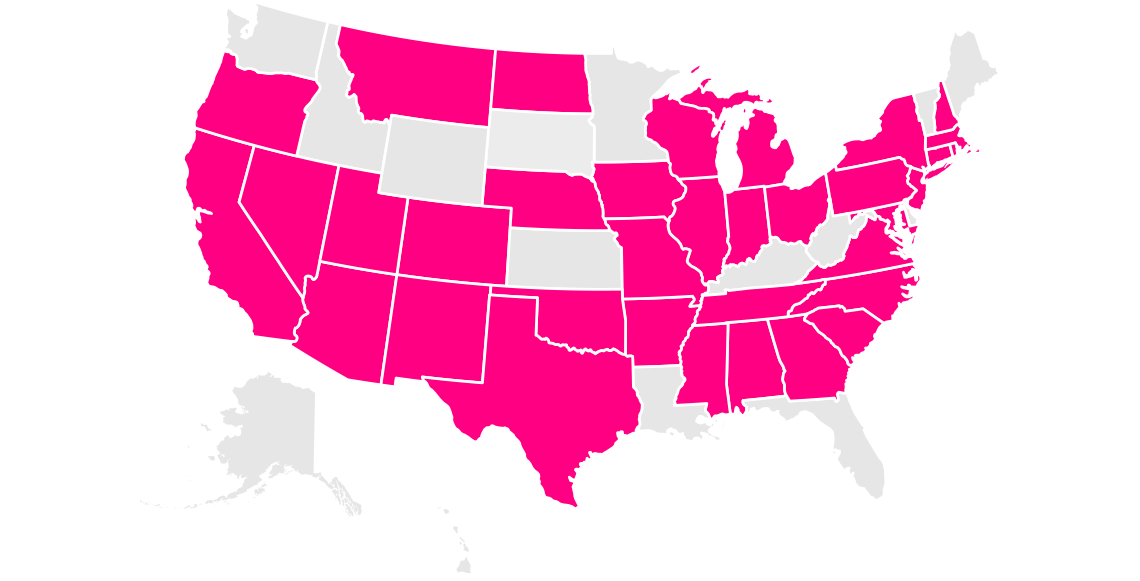

Which states currently offer homeowners insurance?

Arizona, California, Colorado, Connecticut, Georgia, Illinois, Indiana, Iowa, Maryland, Massachusetts, Michigan, Missouri, Nevada, New Jersey, New York, Ohio, Oklahoma, Oregon, Pennsylvania, Tennessee, Texas, Virginia, Washington, D.C. (not a state…yet), and Wisconsin.

A few quick words, because we <3 our lawyers: This post is general in nature, and any statement in it doesn’t alter the terms, conditions, exclusions, or limitations of policies issued by Lemonade, which differ according to your state of residence. You’re encouraged to discuss your specific circumstances with your own professional advisors. The purpose of this post is merely to provide you with info and insights you can use to make such discussions more productive! Naturally, all comments by, or references to, third parties represent their own views, and Lemonade assumes no responsibility for them. Coverage and discounts may not be available in all states.