Let’s be honest, you could always use a hand to understand the fine print in your insurance policy. A homeowners insurance declarations page is the summary of your insurance policy—it includes important details like coverage amounts, deductibles, who’s covered, and more.

We’re going to take an up close and personal look at a homeowners insurance declarations page, so you can fully understand your policy, your premium, and your coverage.

Why do you need a declaration page?

If you have a mortgage, your lender will require proof of insurance. The declarations page serves as this proof, confirming that you have adequate coverage to protect the property. Without it, your lender might purchase insurance on your behalf, often at a higher cost.

How do you get a declaration page?

Getting your declarations page from your insurance company should be pretty straightforward, but how to go about it depends on your insurer.

Here are some common ways to get it:

From your insurance provider

When you first purchase homeowners insurance, your insurance company will send you a copy of your declarations page, typically via mail or email. If you’ve misplaced it, don’t worry—you can request a new copy from your provider at any time.

Online access

Many insurance companies offer online portals or mobile apps where you can access your policy documents, including the declarations page. Logging into your account allows you to view, download, and print your dec page whenever you need it. This is often the quickest and most convenient method.

Through your insurance agent

If you work with an insurance agent, they can provide you with a copy of your declarations page. Agents are there to assist you, so don’t hesitate to reach out to them for help with any insurance documents.

What’s included on a homeowners insurance declaration page, and how can I read it?

Your declarations page is the summary of your coverage under your homeowners insurance policy. It’s fairly easy to read and includes important information regarding things like your coverage, coverage limits, deductibles, who’s covered, and more.

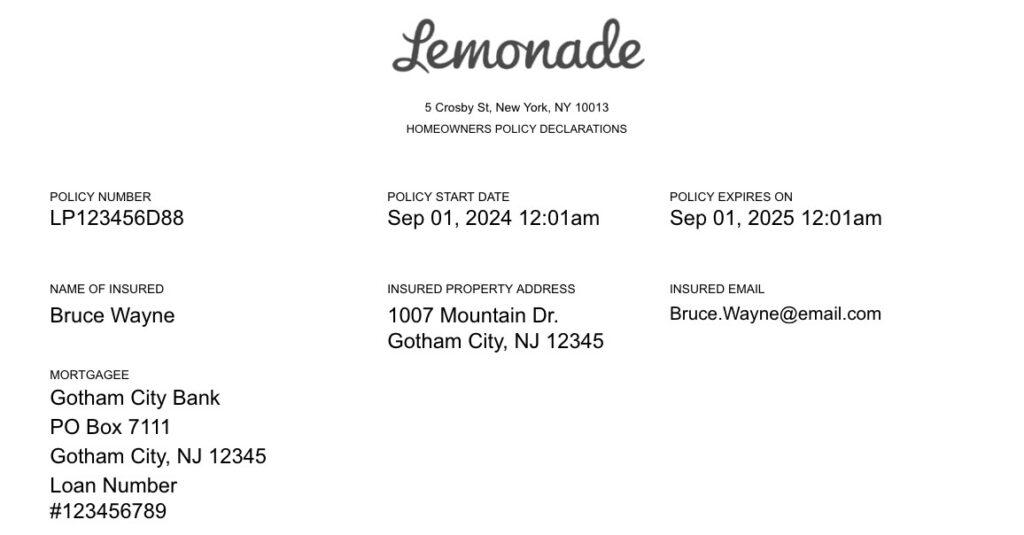

Let’s break it down with an example of a Lemonade homeowners insurance declarations page.

The basics

When reading through your declarations page, this is the section you should start with. The top part of the first page of your homeowners insurance declarations page will have some basic information about you and your policy, including:

- Your name (or the “named insured”),

- Others covered under the policy (referred to as “additional insureds”, often spouses or relatives under 21 years old)

- Your policy number

- Your physical address (the property insured under the policy)

- Your email address

- When the policy starts (the policy’s “effective date”)

- When your policy ends (the policy’s “expiration date”)

- Your mortgagee information

This info might seem like a no-brainer, but be sure to thoroughly check that everything is accurate. If you spot a mistake, or if your contact information changes, be sure to get in touch with your insurance company to nip any potential issues in the bud.

If you’re a Lemonade homeowners insurance policyholder, you can often update your policy information online or via your Lemonade mobile app.

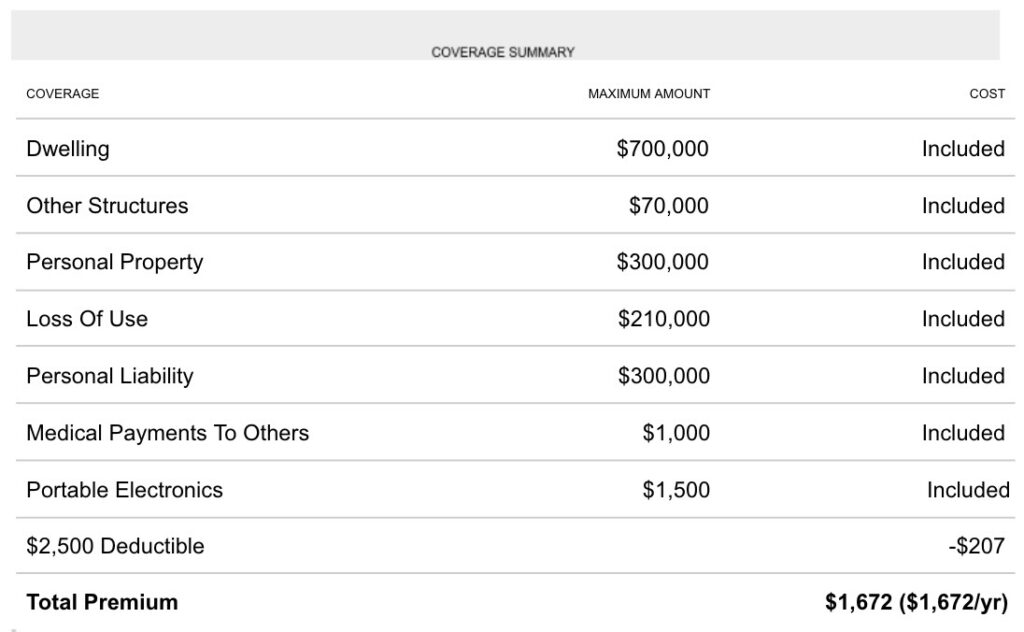

Coverage summary

Now for the real meat of your policy.

On your homeowners declarations page’s coverage summary section, you’ll see several different amounts connected to your coverage broken down for you. It’s important to note, that the coverage summary section of your declarations page may vary slightly depending on your insurer.

(For an even deeper dive into the basics of homeowners insurance, check out this guide!)

First let’s clear up some declarations page terminology:

- Maximum amount: The numbers listed in this column represent the limit to your coverage. Let’s say you have a $70,000 limit for Other Structures, but damage to your “Other Structures” will cost you $100,000 to repair. If your insurance company approves your claim, you’ll only get the $70,000

- Included: When a cost is “included” in a policy it means that this coverage comes standard with the typical underwriting of a policy.

Here’s what you’ll see listed on your coverage summary, so you know what to expect when you decide on your coverage or file a claim:

Dwelling coverage: This covers the costs of repair if your home is damaged or destroyed due to a covered loss under your policy. The amount you choose for dwelling coverage should reflect how much it would cost to rebuild your house from the ground up, not the market value of your home. Our hypothetical policyholder Bruce Wayne has a dwelling coverage limit of $700,000.

Other structures: This covers damage, occurring from a covered loss under your policy, to things like your driveway, fence, or shed. The maximum amount that Bruce’s insurance policy will cover for other structures (aka the coverage limit) is $70,000.

Personal property: If you’ve ever had a renters insurance policy, you’re probably familiar with personal property coverage. This covers your stuff. If your bike gets stolen when it’s chained in front of a coffee shop, it’s covered with homeowners insurance. If your house is broken into and your brand new 65-inch flat-screen TV is stolen, that’s covered too. However, your insurance company will only provide coverage up to your personal property coverage limit, and the loss or damage to your personal property is due to a covered loss. Here, the coverage limit for personal property is $300,000.

Loss of use: If your home is damaged and becomes unlivable due to a covered loss under your policy, loss of use coverage will pay for things like hotel stays, takeout, and laundry while you wait for the damage to your home to be fixed. In this example, Bruce has a loss of use coverage limit of $210,000, which is the maximum amount the insurance company will pay for this coverage.

Personal liability: This coverage comes in handy if you’re in a legal bind. If someone is injured on your property and it’s your fault, or if you or anyone else on your policy damages someone else’s property, this coverage can help cover the costs. Personal liability coverage can also come in handy to cover your legal fees if you’re responsible for an accident. Above, you can see that Bruce’s coverage limit for personal liability in this example is $300,000.

Medical payments to others: If someone who does not reside in your home is injured on your property, this will cover the medical expenses up to $1,000, in the example above, regardless of fault.

Portable electronics: This coverage provides protection against loss or damage to items such as laptops and smartphones. The coverage limit in the example above is $1,500 for portable electronics. It’s important to note that this limit is not a separate coverage limit on the policy, but a special limit under your personal property coverage.

Deductible: Every time you file a claim, the deductible determines how much you pay out of pocket before your insurance coverage kicks in. The higher your deductible, the more you save on your monthly premium. This is why you’ll see a “-X” in the cost column of policies with higher deductibles–that’s how much you save by choosing a higher deductible. The deductible in the above example is $2,500.

Total Premium: This is the amount you pay for homeowners insurance coverage. Bruce Wayne’s total premium is $1,672 per year.

Page #2 – Extra Coverages

Your personal property coverage is usually around 50-75% of your total dwelling coverage amount. If that’s not enough to cover all of your valuable personal belongings—things like jewelry, artwork, musical instruments, and cameras, which are typically subject to their own special limits under your personal property coverage— that’s where Lemonade’s Extra Coverage comes in. By adding Extra Coverage, you can increase the limits for your valuables for an additional premium.

Here, on September 1, 2024, the hypothetical customer Bruce Wayne added a Schwinn BatCruiser bike to the policy at a value of $2,000, a Jack Napier painting at a value of $5,000, and at a value of $6,000 all for an additional premium of $83 per year (or $6.93 per month).

You can add certain big-ticket items to your Extra Coverage; pay a little extra on your monthly premium, and if an item listed under your Extra Coverage is lost, stolen, or damaged, you can file a claim and get money back without paying a deductible.

Interested? Learn a whole lot more about Extra Coverage here.

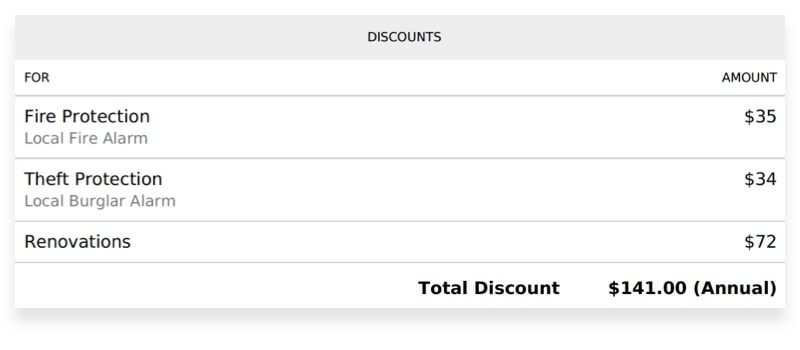

Discounts

Who doesn’t love a discount? If you have certain safety measures in your home, you can save money on your policy. Having features like a smoke detector, fire alarm, or burglar alarm could help you reduce your monthly premium.

In addition, certain renovations like repairing or replacing your roof could also help you save.

In the example above, the user has discounts for fire protection by having a fire alarm, a discount for theft protection by having a burglar alarm, and a discount for renovations. These discounts save this hypothetical customer $141 annually on their homeowners insurance.

Keep in mind that the discounts will vary by policy.

What’s not included in a homeowners insurance declaration?

Your declarations page is useful in giving you an overview of what your policy covers, but it doesn’t contain everything you may want to know. Here are some things that you won’t be able to find on your declarations page.

Exclusions

Your homeowners insurance declarations page will not list specific exclusions. These are the events or types of damage that your policy does not cover, such as certain natural disasters like earthquakes, or normal wear and tear.

There are two sets of exclusions in a homeowners policy. The first set of exclusions is for your property coverage, which includes:

- Coverage A – Dwelling

- Coverage B – Other Structures

- Coverage C – Personal Property

- Coverage D – Loss of Use

- Additional Coverages (aka Extra Coverage)

You will find these coverages in Section I of your policy, where there will be a dedicated exclusions section.

The other set of exclusions will be found in Section II of your policy, which is for your liability coverages including:

- Coverage E – Personal Liability

- Coverage F – Medical Payments to Others

Detailed coverages

While the dec page provides an overview of the types of coverage you have on your policy, and how much you’re covered for, it doesn’t delve into the specifics of each coverage type, such as what events will be covered.

In order to find detailed information on all of your coverages, you’ll need to refer to Section I of your policy, for property coverages, and Section II of your policy, for liability coverages.

The claims process

The declaration page won’t outline the claims process or provide guidance on filing an insurance claim. In both Sections I and II, you’ll find a subsection called Duties after Loss, for property coverage, and Duties after “Occurrence”, for liability coverage.

Both sections contain important information on the steps you need to take when filing a homeowners insurance claim, including how long you have to report the loss or occurrence to your insurer.

Wondering how to navigate all of this information? Just check the Table of Contents after your declarations page. It’s your quick guide to all the info you need about your policy.

Before we go…

When your insurer sends over your insurance policy, you might be overwhelmed by the pages of complicated text outlining the legal and technical elements of your policy. Of course, here at Lemonade, we try to keep things as straightforward as possible.

Think of your homeowners insurance declarations page as a TL;DR of your policy: an outline of the practical, digestible details of your coverage. Once you get a handle on all the information on your declarations page, you can be confident that you fully understand your coverage.

And we’d be pretty remiss if we didn’t say that Lemonade offers home insurance, and we think it’s a pretty great deal. Click below to get started on your quote!

A few quick words, because we <3 our lawyers: This post is general in nature, and any statement in it doesn’t alter the terms, conditions, exclusions, or limitations of policies issued by Lemonade, which differ according to your state of residence. You’re encouraged to discuss your specific circumstances with your own professional advisors. The purpose of this post is merely to provide you with info and insights you can use to make such discussions more productive! Naturally, all comments by, or references to, third parties represent their own views, and Lemonade assumes no responsibility for them. Coverage and discounts may not be available in all states.