You’ve taken the time to customize your pet’s collar, their water bowl, even their haircut—so why not customize their pet insurance coverage?

A basic accident & illness pet health insurance policy with Lemonade Pet will help cover the costs of diagnostics, procedures, and medications to treat your dog or cat’s eligible accidents and illnesses, but Lemonade also offers lots of additional ways to tailor your pet’s coverage to meet their needs —and your budget.

Let’s get into it.

What’s an add-on?

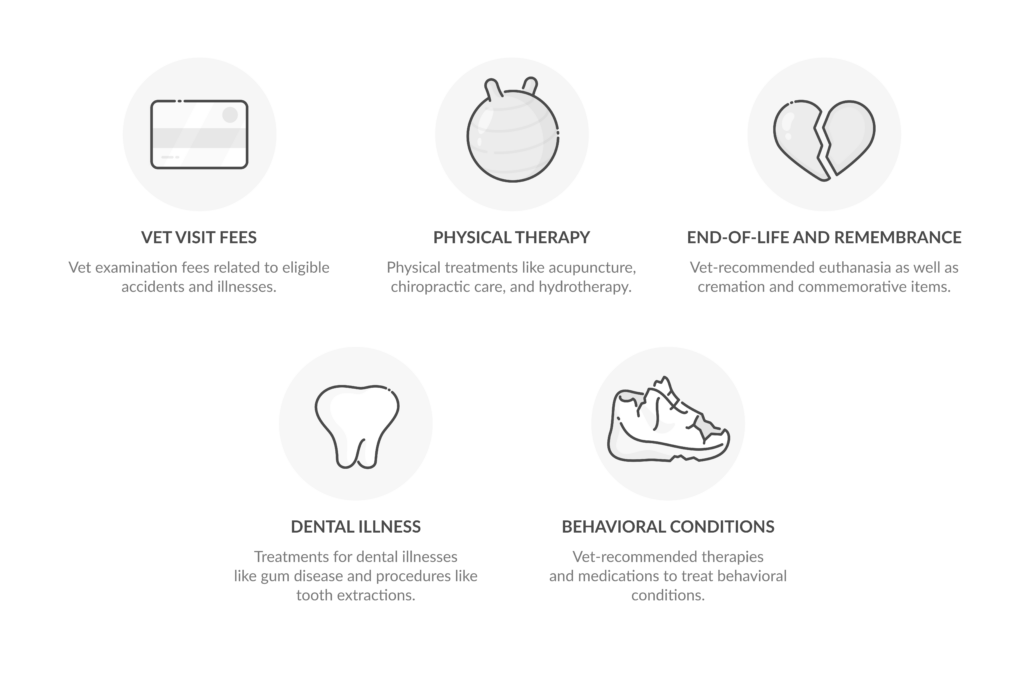

Add-ons are optional coverages that help cover the costs of specific veterinary care and pet-related expenses not otherwise covered by the base accident & illness Lemonade Pet policy.

Currently, Lemonade offers a vet visit fee add-on, a physical therapy add-on, a dental illness add-on, a behavioral conditions add-on, and an end-of-life add-on, each of which provides additional coverage in case of an accident or illness.

We’ll break down what our add-ons cover—and what they don’t.

Vet Visit Fees

What it covers

With the vet visit add-on, we’ll help pay for vet visit fees that are charged for eligible accidents and illnesses. This is the fee some vets charge for their time and labor, in addition to the actual cost of the treatment, which is covered by a base accident & illness policy.

If your Tabby breaks their leg while enthusiastically hunting a fly, he’ll need to be examined by the vet before getting an x-ray, a cast, and pain medicine. Your base policy would cover the treatments your vet recommends except for the vet examination, but with this add-on, you’d be covered for the examination as well.

Lemonade’s vet visit fee add-on is subject to your base policy’s co-insurance and annual deductible.

What it doesn’t

This add-on will not cover your pet’s annual wellness exam or other preventative care (more on that in a minute), or vet visit fees related to pre-existing conditions.

Can I get coverage for my pet’s routine care?

You sure can!

If you’re looking to get coverage for your pet’s routine care, adding the Preventative package, Preventative+ package, or our Preventative package for puppies and kittens to your base policy will help cover things you’re probably already paying for towards your pet’s health, like your pet’s annual wellness exam, vaccinations, a heartworm test, routine dental cleaning, blood and fecal tests, spaying and neutering (if you have a puppy or kitten), and more!

Physical Therapy

What it covers

If you add our physical therapy add-on to your base policy we’ll be able to reimburse you for treatments related to functionality issues as a result of an unexpected illness or an accident.

What does that mean? Let’s say your energetic Pomeranian sprains her knee while running to greet you at the door. Your base policy covers necessary X-rays and surgery. With the physical therapy add-on, she’ll be able to recover in style—including perks like acupuncture and hydrotherapy.

Lemonade’s vet physical therapy add-on is subject to your base policy’s co-insurance and annual deductible.

What it doesn’t

“Alternative medicines”, like CBD or aromatherapy treatments, as well as treatments related to pre-existing conditions.

Dental Illness

What it covers

The dental illness add-on can help cover the cost of treatments, procedures, diagnostics, and medications related to dental illness. This includes: crowns, extractions, root canals, dental surgeries, and treatments for gum disease like gingivitis and periodontal disease.

Lemonade’s dental illness add-on is subject to your base policy’s co-insurance and annual deductible, and has a $1,000 annual limit.

We recommend this coverage for dogs under five and cats under three.

What it doesn’t

Dental illness related to a pre-existing condition, orthodontics, preventative items (like your dog’s toothbrush and toothpaste), and routine dental cleaning—but routine cleaning could be covered by Lemonade’s Preventative+ package.

Behavioral Conditions

What it covers

Lemonade’s behavioral conditions add-on can help cover the costs of diagnostics and vet-recommended treatments and therapies related to eligible behavioral conditions. This could include therapy sessions, prescription medications, and specialized training to address conditions like: phobias and separation anxiety, excessive barking, as well as aggressive or destructive behaviors.

In order to be eligible for coverage, therapies must be administered by either a vet or licensed behaviorist.

Lemonade’s behavioral conditions add-on is subject to your base policy’s co-insurance and annual deductible, and has a separate $1,000 annual limit.

Please note: For those who purchase the behavioral add-on, visit fees and medications prescribed for eligible behavioral conditions would be covered by the base accident & illness policy (and annual limit), while diagnostics and therapies would be subject to the separate annual limit. More coverage and more value—now that’s something to wag your tail about.

What it doesn’t

General or obedience training, pre-existing behavioral conditions, alternative medicines like CBD, prescription food, therapy not performed by a vet or licensed behaviorist, non-vet recommended treatments, or property damage caused as the result of your pet’s behavioral conditions.

End-of-life and Remembrance

What it covers

If you opt for Lemonade Pet’s end-of-life and remembrance add-on, you can get coverage for costs related to vet-recommended euthanasia, cremation, or to help pay for commemorative items like an urn, framed pictures of paw prints, digital photo storage, or even a tattoo to help you memorialize and remember your pet.

Notably, Lemonade’s end-of-life and remembrance add-on still offers coverage if your vet recommends euthanasia as the result of a pre-existing condition.

Lemonade’s end-of-life and remembrance add-on is not subject to your base policy’s co-insurance and annual deductible, and has an up to $500 limit.

What it doesn’t

Funeral or burial costs like coffins, headstones, cemetery fees, or burial permits. This coverage also doesn’t cover preservation services like taxidermy, mausoleums, cloning, mummification, or cryonics. The end-of-life and remembrance add-on is also subject to Lemonade Pet’s waiting period, which varies by state.

How do I “add” an add-on to my policy?

We thought you’d never ask.

If you currently have a Lemonade Pet policy, we’ll be able to review your options with you the next time you renew your policy (don’t worry, you’ll get a reminder email from us). If you happen to be new to Lemonade Pet Insurance, you can update your policy within the first 14 days after purchase. Keep in mind that all changes to your policy are subject to Underwriting approval.

If you don’t have a Lemonade Pet insurance policy (yet), you can include add-ons as you finalize and customize your policy after receiving your quote.

A few quick words, because we <3 our lawyers: This post is general in nature, and any statement in it doesn’t alter the terms, conditions, exclusions, or limitations of policies issued by Lemonade, which differ according to your state of residence. You’re encouraged to discuss your specific circumstances with your own professional advisors. The purpose of this post is merely to provide you with info and insights you can use to make such discussions more productive! Naturally, all comments by, or references to, third parties represent their own views, and Lemonade assumes no responsibility for them. Coverage and discounts may not be available in all states.