It’s a Thursday night and your roomie asks to borrow your car to go pick up some essentials—dish soap, oat milk, cat food.

It’s a nice gesture. After all, they’re volunteering to run an errand for the greater good of your apartment! But are they even allowed to get behind the wheel of your car? And, if they get in a crash along the way, would it be covered by your insurance?

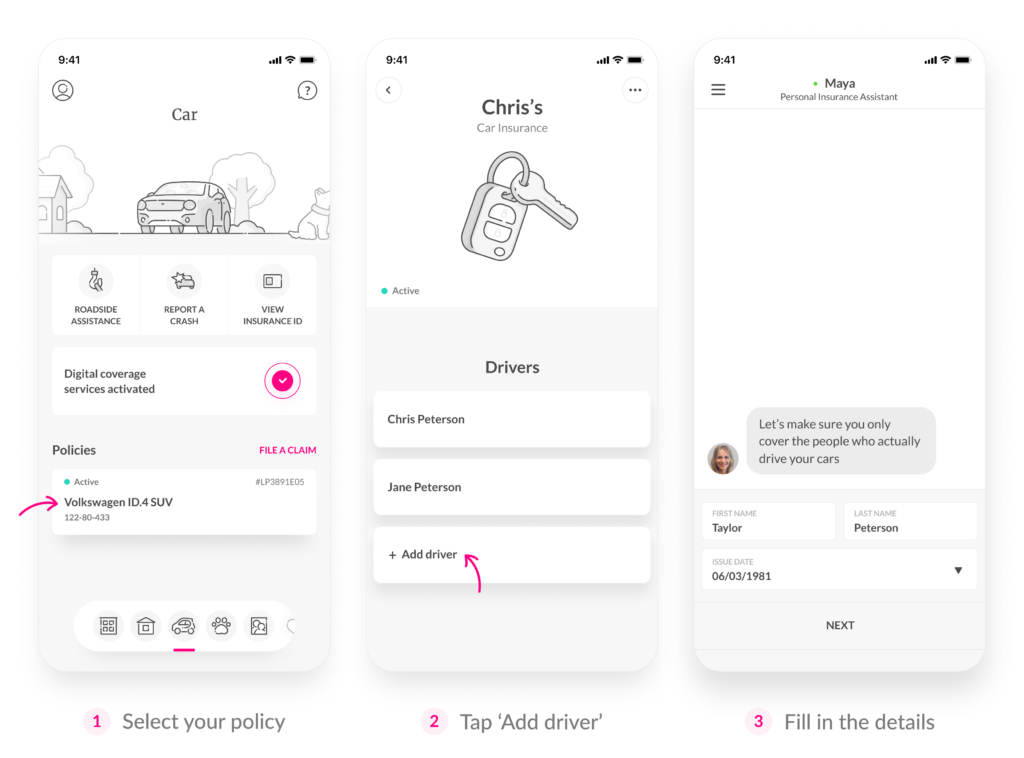

Whether or not you need to cover someone as a driver on your car insurance policy depends on a few factors—like whether or not they live under the same roof as you and how often they’re driving your car. Luckily at Lemonade car insurance it’s easy to include additional drivers when you’re building your policy, or after the fact.

Let’s take a look under the hood at what goes into building your multi-driver policy with Lemonade Car.

- At Lemonade Car, you can cover up to seven drivers on a single policy.

- You can add additional drivers when you sign up, or at any point afterward, all through the Lemonade app.

- You need to add someone to your policy if you share a home; they have a driver’s license; and they have regular access to your car.

- Adding additional drivers to your policy may affect your premium, depending on their driving history and other factors.

- If you allow an uninsured person who isn’t listed on your policy to drive your car, you might not be covered if they get in an accident.

What is multi-driver car insurance?

Multi-driver car insurance is there to protect your car, and your loved ones who regularly take it for a spin.

It’s pretty simple: When you’re building your car insurance policy, you add all the drivers that you want covered to drive your car.

You’re able to cover multiple family members (or your trustworthy roommates) to drive your car under a single policy. Keep in mind that your car insurance company may have a limit on how many drivers you can add to your policy—at Lemonade Car, we limit it to seven drivers per policy.

Don’t forget, though: On a single policy, you can only cover cars that are registered under your or your spouse’s names, and that are registered and garaged in the same state.

How does a multi-driver policy work?

Most coverages that you include on your Lemonade Car policy are geared towards the cars themselves, not each driver that gets behind the wheel. In other words, if your car is involved in an accident, your coverage will depend more on the car involved than on which driver from your policy was in the driver’s seat when it happened.

For example, when you include certain coverages on your car—like comprehensive coverage and collision coverage (which are different, but both really important)—anyone listed on your policy who’s driving that car could be covered for things like a crash with another vehicle, or with a deer.

Just a refresher: All cars on your Lemonade Car policy will have to carry the same liability coverage—the bare minimum car insurance that covers damage you may cause to other drivers and their property. But beyond that, our add-on coverage options are super customizable. Plus, if you drive with the Lemonade app, we’ll include roadside assistance, on us.

Can I include multiple drivers on my Lemonade Car policy?

Yes! Most car insurance providers will let you cover up to four drivers, but at Lemonade Car you can include up to seven drivers on your policy.

You can easily cover multiple drivers when you build your Lemonade Car policy on the Lemonade app (available for iOS and Android) or on our website.

Need to cover an additional driver on your policy once your term has already started? No problem! You can add drivers to your existing policy at any time, all through the Lemonade app. Keep in mind that adding more drivers to your policy may impact your car insurance premium (but we’ll expand on that later).

Who should I cover on my Lemonade Car policy?

Technically, you can cover just about any licensed driver on your policy, but there are certain people that you need to cover before they can get behind the wheel of your car.

If someone meets these 3 criteria, you need to include them on your policy:

- They live in your home (or in the same home as you)

- They have a driver’s license

- They have regular access to your car

There may be a lot of different people in your life who you should cover on your car insurance policy. Let’s take a spin through a few of the most common scenarios.

Your spouse

You and your spouse share a lot of things—vows, plans for the future, a bed, and car insurance. When it comes to car insurance coverage, there’s no need for your spouse to have a separate policy. Just make sure to add them as a driver on yours.

There are so many perks that come along with carrying a single car insurance policy with your spouse—like having one quote, one policy document, and one renewal date for all the cars you need to cover. What’s more romantic than organization and efficiency? That was rhetorical…

You’ll also be eligible for a multi-car discount if you and your better half need to cover more than one car on your policy. Together you can cover up to four cars that are registered under either of your names on a single policy.

Your teen driver who lives at home

As soon as your teenager gets their learner’s permit you can add them to your policy with no additional charge. But let us know when they get their full-fledged driver’s license and officially join the fleet.

It’s true: Having a young, licensed driver on your policy will impact your premium. But with Lemonade Car, they’ll have the chance, every six months, to prove their safe driving habits (and get you better rates when they do).

If your youngster drives their own car, it would have to be registered under your or your spouse’s name—and registered and kept in the same state—to be covered by your policy.

Your significant other or roommate

You trust your long-term partner or roomie to water your plants while you’re on vacation. But you shouldn’t trust them with your car unless they’re covered on your auto insurance policy.

Even if they’re a safe driver and only heading a few blocks away, it’s not worth letting an uninsured driver take your car for a spin, because they might not be covered in the case of a crash.

Let’s say you regularly let your roommate Chad take your Prius for weekend trips. He’s not listed on your Lemonade Car policy. On the way to Bonnaroo he rear-ends a farm truck carrying a ton of heirloom tomatoes. Guess what? The damage to your vehicle (and to the truck, plus any liability for injuries) probably wouldn’t be covered by your policy.

Your nanny or house sitter

If your babysitter is frequently using your car to pick your kids up after school, or someone is borrowing your car while they look after your home (or cats) during your extended vacation—you should include them as a driver on your Lemonade Car policy.

What if this is just a temporary situation? Well, you can contact us at any point to remove them from your policy. Then the driver that you covered temporarily will only impact your premium for the amount of time they were listed on your policy.

What details do I need when I include another driver on my policy?

When you’re adding drivers to your Lemonade Car policy, we’ll ask for things like their:

- Full legal name

- Date of birth

- Relationship to you

- Marital status

- Driver’s license details—like what state their license is from, and how many years they’ve been licensed

- Driver’s license number

- Driving and claims history

At Lemonade Car, we need up-to-date and accurate information on all the drivers you include on your policy to help us determine the fairest car insurance quote. Keep in mind: Some people might not be eligible to be added to your policy depending on their driving record and other factors.

How will having multiple drivers on my policy impact my car insurance rates?

Adding another driver to your Lemonade Car policy could help or hurt your insurance rates depending on a lot of factors—like their driving history and claims history. While covering a spouse or significant other with a spotless driving record might help you score lower rates, having an inexperienced, young driver on your policy may have the opposite effect.

But there are so many ways you can lower your car insurance costs—like driving with the Lemonade app, or bundling your Lemonade car insurance policy with Lemonade renters, homeowners, pet, or term life insurance. When you have more than one car to cover, you’ll also be eligible for a multi-car discount.

At Lemonade Car, the way you actually drive matters. We reward low-mileage drivers and drivers that consistently prove their safe driving habits with serious savings. Everyone that you cover will have the chance, during every six-month term, to show they’re the safest driver on your policy.

Should each driver on my Lemonade Car policy use the Lemonade app?

Yes! Your Lemonade Car policy will be under your name, and each driver you include will be part of that coverage.

When you add another driver to your policy, we’ll ask you for their mobile number so we can send them a link to join the policy. Once they download the Lemonade app on their own phone from the link and make a profile, they’ll be ready to see the policy and take your car for a spin (with your permission of course).

Why are the other drivers on my Lemonade Car policy not listed on my insurance ID card?

No matter how many drivers are listed on your policy, the only name that you’ll usually see on your Lemonade insurance ID is your own (but this varies by state). That’s because the car(s) being covered on the policy are registered under your name.

If you’re covering multiple cars on your policy, and at least one of them is registered under your spouse’s name, the ID will include both of your names.

Your Lemonade insurance ID is still a totally valid document for any other driver that’s covered on your policy to use as proof of insurance, even if their name isn’t on it.

Cover your bases…

So, what’s the best car insurance when you need a multi-driver policy? Glad you asked. We’re a bit biased, but… when you cover your loved ones—or your ex-boyfriend that’s still sleeping on your couch—with Lemonade Car, you can enjoy great coverage, score savings and discounts, and help make the planet a little greener for generations to come.

Ready to take Lemonade Car for a spin? Click the button below to get your quote.