Pet insurance can absolutely be worth it, especially when you consider the high costs of pet ownership—from routine vet visits averaging around $50 to $100 to unexpected emergencies where an x-ray alone can cost anywhere from $75 to $400.

With pet insurance, you can have peace of mind knowing that something like a costly procedure (and so much more) could be reimbursed, allowing you to focus on your pet’s well-being, rather than the financial burden.

Let’s break down the ins and outs of why pet insurance could be the right choice for you and your furry friend.

The cost of going to the vet

If you do end up at the vet, how much is a check-up or serious medical care going to set you back? It’s important to note that the costs for various pet procedures can differ for many reasons—with the main factor being where you live.

For example, blood tests will likely cost more for a domestic short-hair cat in Brooklyn than for a Siamese cat in Ohio. This all has to do with relative local costs of veterinary care.

That being said, these costs can rack up no matter where you live.

Accidents and illnesses

Let’s take a look at some conditions dogs may face during their lifetime, and the average annual cost of treatment.

| Condition | Average annual cost to treat |

|---|---|

| Arthritis | $200 to $2,700 |

| Dental disease | $300 to $2,000 |

| Ear infections | $100 to $300 |

| Allergies | $200 to $1,000 |

| Heart murmur | $500 to $2,000 |

| Addison’s disease | $600 to $2,400 |

| Cancer | $10,000 to $30,000 |

| Cruciate ligament illness | $3,000 to $8,000 |

| IVDD | $3,000 to $8,000 |

| Cherry eye | $500 to $2,500 |

| Diabetes | Up to $2,500 |

| Hypothyroidism | $50 to $100 |

| Lipomas | $200 to $1,000 |

Moving on to our feline friends, here are some common conditions cats may face during their lifetime, and the average annual cost of treatment.

| Condition | Average annual cost to treat |

|---|---|

| Chronic kidney disease | $500 to $2,000 |

| Diabetes | $500 to $3,000 |

| Uveitis | $300 to $1,000 |

| Hyperthyroidism | $200 to $1,000 |

| Asthma | $100 to $800 |

| Cancer | $10,000 to $30,000 |

| Dental disease | $300 to $2,000 |

| Feline immunodeficiency virus | $150 to $2,000 |

| Feline leukemia virus | $150 to $600 |

| Ringworm | $50 to $100 |

Preventative care

If you’re already a pet owner, you probably know that vet costs don’t only come up when your pet is sick. In order to keep your pet happy and healthy, routine vet visits and vaccinations are crucial. The expense of routine care, from rabies vaccines to dental cleanings, can add up.

Here’s the estimated cost of routine vet services for dogs in some of America’s top cities:

Vet Service | San Francisco, California | San Antonio, Texas | Brooklyn, New York | Atlanta, Georgia | Chicago, Illinois |

|---|---|---|---|---|---|

| Office visit | $111 | $74 | $87 | $75 | $79 |

| Office visit (add additional pet) | $87 | $58 | $68 | $59 | $61 |

| Bordetella vaccine | $42 | $34 | $37 | $34 | $35 |

| DAPP vaccine | $49 | $39 | $43 | $40 | $41 |

| Bivalent Influenza vaccine | $66 | $53 | $58 | $54 | $55 |

| Leptospirosis vaccine | $30 | $24 | $26 | $24 | $25 |

| Lyme Disease vaccine | $53 | $43 | $47 | $44 | $45 |

| Rabies vaccine | $35 | $28 | $31 | $28 | $29 |

| Professional dental cleaning | $569 | $417 | $474 | $425 | $441 |

| Neuter package (over 6 months) | $623 | $507 | $552 | $513 | $526 |

| Neuter package (under 6 months) | $535 | $435 | $474 | $440 | $451 |

| Spay package (over 6 months/over 50 pounds) | $753 | $612 | $667 | $619 | $635 |

| Spay package (over 6 months/under 50 pounds) | $658 | $535 | $582 | $541 | $555 |

| Spay package (under 6 months) | $571 | $464 | $505 | $470 | $481 |

Here’s the estimated cost of routine vet services for cats in some of America’s top cities:

Vet Service | San Francisco, California | San Antonio, Texas | Brooklyn, New York | Atlanta, Georgia | Chicago, Illinois |

|---|---|---|---|---|---|

| Office Visit | $111 | $74 | $87 | $75 | $79 |

| Office visit (add additional pet) | $87 | $58 | $68 | $59 | $61 |

| Feline Distemper FVRCP | $41 | $33 | $36 | $34 | $34 |

| Feline Leukemia Virus Vaccine | $44 | $36 | $394 | $36 | $37 |

| Rabies Vaccine | $35 | $28 | $3 | $28 | $29 |

| Professional dental cleaning | $569 | $417 | $474 | $425 | $441 |

| Neuter package (over 6 months) | $344 | $280 | $305 | $283 | $290 |

| Neuter package (under 6 months) | $276 | $225 | $245 | $227 | $233 |

| Spay package (over 6 months/over 50 pounds) | $467 | $380 | $413 | $384 | $394 |

| Spay package (under 6 months) | $397 | $323 | $351 | $327 | $335 |

How much can you save on costs with pet insurance?

The cost of caring for your furry friends can vary widely, depending on factors like your location, their age and breed, and your vet’s fees. Want to know how much you might spend on vet bills each year—and how much pet insurance could save you—for your cat or dog? Try out our tool below. Just input your pet’s breed, age, and state to get started.

It’s a simple way to check out potential costs and see how insurance might help, so you can decide if it’s worth it for you and your wallet.

Why pet insurance is worth it for dogs:

Here’s a closer look at how pet insurance can help you save on vet bills for your canine companion.

| Breed | Age | State | Average annual cost of vet bills | How much you could save with Lemonade pet insurance |

|---|---|---|---|---|

| Golden Retriever | 2 months old | CA | $1,340 | $992 |

| Akita | 6 months old | VA | $526 | $341 |

| Chihuahua | 1 years old | GA | $549 | $359 |

| Maltese | 2 years old | IL | $905 | $644 |

| Labrador Retriever | 3 years old | NY | $1,139 | $832 |

| Beagle | 4 years old | PA | $1,687 | $1,270 |

| Australian Shepherd | 5 years old | FL | $1,351 | $1,001 |

| Great Dane | 6 years old | CT | $1,627 | $1,222 |

| Rottweiler | 7 years old | WA | $1,597 | $1,197 |

| Pug | 8 years old | TX | $1,844 | $1,395 |

Why pet insurance is worth it for cats:

Let’s take a look at how much pet insurance can save on our feline friends’ vet bills.

| Breed | Age | State | Average annual cost of vet bills | How much you could save with Lemonade pet insurance |

|---|---|---|---|---|

| Siamese | 2 months old | CA | $948 | $659 |

| Scottish Fold | 6 months old | VA | $1,340 | $992 |

| Sphynx | 1 years old | GA | $610 | $408 |

| Domestic Shorthair | 2 years old | IL | $1,252 | $922 |

| Devon Rex | 3 years old | NY | $1,139 | $832 |

| Himalayan | 4 years old | PA | $991 | $713 |

| Maine Coon | 5 years old | FL | $1,351 | $1,001 |

| Domestic Longhair | 6 years old | CT | $1,627 | $1,222 |

| Munchkin | 7 years old | WA | $844 | $595 |

| Persian | 8 years old | TX | $2,409 | $1,847 |

Here’s how our pet insurance was worth it to our customers

Pros and cons of pet insurance

Deciding whether pet insurance is worth it largely depends on your unique circumstances and your pet’s needs. Let’s take a closer look at some of the key benefits and potential downsides:

Pros

- You can generally use pet insurance at any licensed vet in the US.

- Pet insurance can typically cover 70% to 90% of unexpected vet bills related to new accidents and illnesses, after reaching your deductible, depending on the coverage you select.

- By signing your pet up for pet insurance early, you can have confidence that your furry friend will be eligible for coverage for unforeseen conditions they may develop over the course of their life.

Cons

- Most pet insurance works on a reimbursement basis, meaning that you will pay the vet bill up-front, and then file a claim for reimbursement.

- In general, pre-existing conditions are not covered by pet insurance. This means any conditions your pet has been diagnosed with, or has shown signs or symptoms of, prior to purchasing a policy and before any waiting periods are over, will not be covered.

- Most elective or cosmetic procedures, such as ear-cropping or dew claw removal, will not be covered.

The cost of owning a pet

It’s no secret that providing a safe and healthy life for your pets can be pretty expensive. From pet food, to vet check-ups, to grooming costs, and all those adorable little toys and treats that make them so happy… the numbers start to add up.

And that’s not including all the extra costs that could be factored in if your pet BFF accidentally eats some toxic food or tumbles down the stairs and breaks their leg.

A study conducted by the People’s Dispensary for Sick Animals and reported by CNBC predicts that the lifetime cost of owning a cat comes in at a whopping $21,917 to $30,942, with a dog costing you a staggering $27,074 to $42,545 over their lifetime.

Also keep in mind that some of the biggest costs you might face, like emergency medical procedures, generally arise with no advance warning, giving you little time to save up in advance.

How a pet health insurance policy can help

When deciding if pet insurance is worth it for your fam financially, it may help to see it as an investment for the future. First, you’ll want to consider the costs you’ll have to pay out-of-pocket without an insurance plan.

Picture this: Kim, a caring pet parent, takes her five-year-old Corgi, Fancy, to the vet after noticing unusual bloating and lethargy. Fancy is diagnosed with GDV, a critical condition requiring emergency surgery costing $5,000. Without insurance, this bill would be overwhelming, and the vet tells her that the only other option beyond surgery is euthanasia. It’s a pet parent’s worst nightmare: Having to chose between their pet’s life, and their own financial stability.

If insured with a $250 deductible and 90% co-insurance, Kim would only be responsible for $725, and her insurer would cover the remaining $4,275. Instead of a $5,000 financial burden, Kim’s allowed to focus on Fancy’s recovery without the stress of unplanned expenses.

What doesn’t pet insurance cover?

There are a number of things a basic pet policy often won’t cover, including:

- Grooming fees

- Dental care

- Elective cosmetic procedures

- Boarding

- Breeding or pregnancy

- Pre-existing conditions

Pro tip: Lemonade lets you sign up when your pet is as young as 8 weeks old! In fact, we offer a Puppy/Kitten Preventative package, which covers things like spaying or neutering and microchipping, so your sweet baby can start off life on the right paw. Plus, our accidents and illness base pet insurance policy covers a whole lot.

Do vets recommend pet insurance?

While we can’t speak for every vet, it’s fair to say that many do recommend pet insurance.

Lemonade’s own Vet Consultant Stephanie Liff puts it this way: “I always tell my clients that I want to remove financial anxiety from their medical decisions.” She says that at the end of the day, “insurance helps [pet owners] know they can afford any medical issues that arise in the future.”

Now we know what you might be thinking: Is it really worth it to pay a premium for years… only to never make a claim?

Depending on which pet plan and add-ons you pick, you’ll find your pet’s insurance actually works a lot like human health insurance, in that you’ll find yourself using it often—not just when there’s a major medical calamity or a huge pet medical bill.

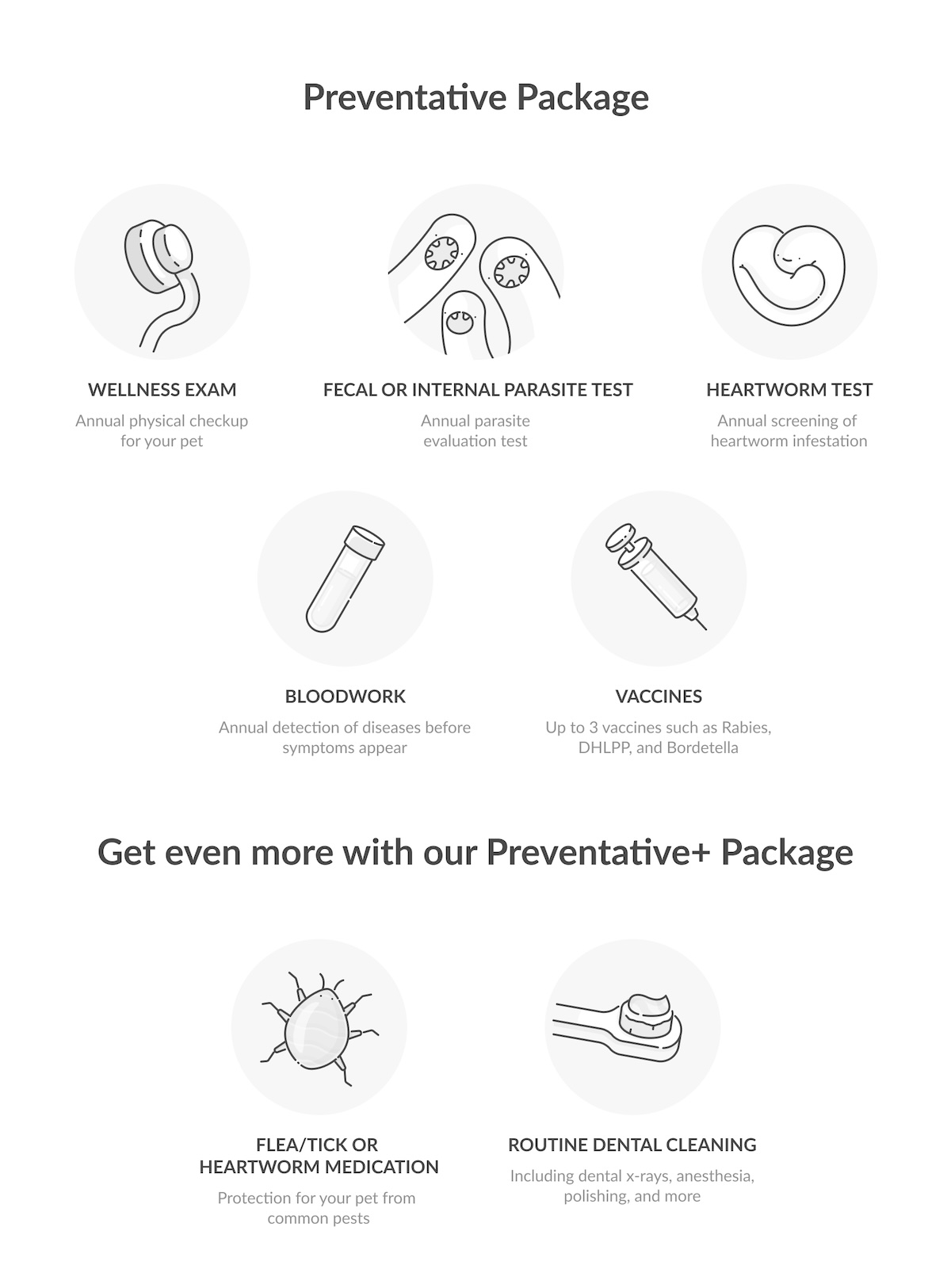

Along with covering emergencies such as an ear infection, broken bones, or hip dysplasia, Lemonade’s pet insurance also offers Preventative and Preventative+ packages, which actually cover routine visits and medical tasks, just like your human health insurance does. Lemonade pet insurance also offers a visit fee, physical therapy, dental illness, behavioral conditions, and end-of-life and remembrance add-on. Customize your coverage, and you’ll find your pet insurance provider reimbursing you frequently for things such as wellness exams, bloodwork, and standard vaccines to help keep your pet healthy.

But along with providing worth by financially covering your furry friends for the basic pet care they need and all the disasters in between, there’s one greater reason vets recommend pet insurance policies to their patients: simple peace of mind.

Before we go…

You’re an excellent pet parent, and you deserve to know that your pet has a safety net if anything happens to them. You’ll find yourself grateful for having signed your cat or dog up for health insurance well in advance… rather than full of regrets if misfortune strikes.

Why wait? Get your quote today.

FAQs

Is getting pet insurance worth it for vaccinations?

Pet insurance is designed to cover the unexpected accidents and illnesses your dog or cat may face, not routine care. Since vaccines fall under routine care, it might not be worth it to purchase pet insurance for that alone.

However, some insurers—including Lemonade Pet—offer wellness plans can help offset these costs. Lemonade offers three robust preventative care packages to help with the costs of vaccines, wellness exams, and more.

Is pet insurance worth it for older pets?

It can be, but it depends on your pet’s health and the costs you’re facing. Older pets are more prone to illnesses and might need expensive ongoing treatments. Some insurers don’t offer new policies for older pets. But if your pet is healthy and still qualifies for a new policy, getting pet insurance can be a great way to manage any unexpected costs down the road.

Keep in mind that pet insurance usually won’t cover pre-existing conditions. For example, if your 7-year-old Beagle was recently diagnosed with diabetes, pet insurance wouldn’t help with the costs of treating the condition. However, if the same pet accidentally broke their leg while running in the yard, pet insurance could cover the costs to treat the new injury.

Should I get pet insurance, or just put money aside?

Saving money is great, but you’re limited to whatever you’ve managed to set aside. With pet insurance, you’re covered up to your policy’s limit, which can make a big difference during expensive emergencies.

At Lemonade, for example, pet parents can select an annual limit anywhere between $5,000 and $100,000, giving you more flexibility and peace of mind.

Is pet insurance worth it for accidents?

Yes, insurance is often worth it for accidents since injuries can lead to expensive emergency treatments. A single incident, like a broken bone, could cost thousands, and insurance can ease that financial burden.

Is pet insurance worth it for life-long illnesses?

Absolutely. Chronic conditions like diabetes or arthritis can rack up significant costs over time. Insurance can help cover ongoing treatments and medications, making care more manageable in the long run.

A few quick words, because we <3 our lawyers: This post is general in nature, and any statement in it doesn’t alter the terms, conditions, exclusions, or limitations of policies issued by Lemonade, which differ according to your state of residence. You’re encouraged to discuss your specific circumstances with your own professional advisors. The purpose of this post is merely to provide you with info and insights you can use to make such discussions more productive! Naturally, all comments by, or references to, third parties represent their own views, and Lemonade assumes no responsibility for them. Coverage and discounts may not be available in all states.