Phew! You’re insured, so check that off your massive to-do list.

But you may still have some burning questions – so we whipped up this cheat sheet to make sure you get the most out of your Lemonade insurance policy, and it’s customized to fit your lifestyle.

Skim through it, or hop over to the sections you want to double down on.

But before we dive in, make sure you download the Lemonade app. It’ll take you a minute, and will open up a treasure chest of fun things you can do to further customize your policy. (Yeah, we just said insurance is fun.) Plus, if you ever need to make a Lemonade claim, you’ll need the app handy to file it on the spot.

Once you’ve downloaded the app, read on to make sure your insurance policy reflects your needs.

1. How to add your spouse/family members

So, who does your insurance policy cover? In general, know that all residents of your household who are related to you by blood, marriage, or adoption are automatically covered. 🙂

In insurance-speak, we call them ‘named insureds,’ and there is no extra cost for adding ‘em to your policy. If you’d like to name your spouse to your policy:

1. Open your Lemonade app, and choose ‘My Insurance’ from the Settings menu.

2. Tap ‘Add-ons’ on the next screen and choose ‘add spouse.’

3. Fill in the details, and you’ll get a fresh copy of your policy with the updated names of your spouse straight to your inbox.

Note: your roommates aren’t covered under your insurance policy – tell ’em to get their own!

2. How to add an Interested Party

If you have a renters insurance policy, your landlord/property manager might ask you to add them to your policy so they can receive any relevant updates about your policy. In insurance-speak, we call this an ‘Interested Party.’ (BTW, other insurance-y names for this are: Party of Interest, Insurable Interest, Certificate Holder, etc.)

It takes approximately 28 seconds to add an Interested party:

1. Open your Lemonade app, and tap on your renters policy.

2. Tap ‘Add-Ons’ and toggle ‘Interested Party.’

3. Fill in your landlord’s name, address and email.

You’ll need to provide your landlord’s name, physical address, and email, so make sure to gather this info before heading to the app. Note: there’s no extra cost for adding their details as an Interested Party.

P.S you can also head over to Lemonade.com and sign into your account to do this.

Once done, we’ll automatically email a fresh copy of your policy to you and your landlord.

3. Adding Extra Coverage For Valuables

If you have jewelry, bikes, camera equipment, musical instruments, or fine art worth over $1,000 per item, you’ll want to get Extra Coverage (in insurance speak, we call it scheduled personal property coverage).

Extra Coverage provides a few added benefits, like protection against accidental damage/mysterious disappearance, with no deductible!

Additionally, jewelry items are only covered up to $1,500 total in the event of theft under your base policy, but adding Extra Coverage means you can insure jewelry items for their replacement cost value.

Btw- furniture, clothing, laptops, fashion accessories, and electronics are all covered under your base policy.

If you’d like to add Extra Coverage:

1. Open your Lemonade app, and tap on your renters or homeowners policy.

2. Tap ‘Add-ons’ on the next screen, and choose ‘Extra Coverage.’

3. Once you fill in your items’ details, our team will work with you to get your valuables covered.

Take note that Extra Coverage only kicks in after your items have been approved by our team.

Spoiler alert: To add Extra Coverage for your valuables, you’ll need to provide a short description, photo, and receipts or appraisals (from the last 5 years) for each item.

Btw, take note that renters and homeowners insurance only covers items that are intended for personal use. If you use your items etc. professionally, we recommend taking out a separate insurance policy for your camera, guitar, etc.!

4. How to add your significant other

If you want your policy to cover your significant other who lives with you, that’s easy! Note: it comes at a small additional cost.

To add your significant other:

1. Open your Lemonade app, and tap on your renters or homeowners policy.

2. Tap ‘Add-ons’ on the next screen and choose ‘Significant Other.’

3. Fill in the required details; we’ll send you an updated policy with your SO’s name on it.

Remember, your policy automatically covers those related to you by blood, marriage, or adoption, so if you’re living with your partner, but decided not to take the marriage plunge, you may still want to add them to your policy.

5. How to adjust your policy/coverage

You probably chose your coverage amounts when you got your quote, before you purchased your policy. Or you might have skipped right over it and went straight to the payment step – and that’s okay! If you’d like to adjust your coverage amounts, or if your landlord requires different limits than what you already have- fear not!

Why update your coverage amounts? In case something bad happens (ex. a fire or burst pipe damages all of your stuff), you’ll want to be fully covered. For example, if you chose $10,000 worth of personal property coverage but later realize you in fact have $25,000 worth of stuff, your policy will only be able to reimburse you up to $10,000.

BTW, if you need help determining how much coverage you need, take a look at this quick guide.

One of our favorite parts of the Lemonade app is what we call Live Policy. With your app, you can make changes to your coverage instantly, right from your phone!

You can also update your payment info, cancel a policy, start a new policy, and so much more.

Simply open up the Lemonade app, choose ‘My Insurance’ from the Settings menu. You’ll be able to adjust coverage amounts to reflect your needs, and we’ll email you a fresh copy of your policy with the updated amounts.

BTW, if you want to read why we built Lemonade’s Live Policy, take a read!

6. How to change your deductible

A deductible is a fancy term to describe the amount of money that’ll be subtracted from any future claims payouts. You get to choose your own deductible, and you’ll never need to physically pay this amount to anyone.

Here’s an example: Let’s say your $750 iPhone was stolen, and your deductible was $500. Your insurance company would pay you $250 if your claim was approved.

Generally speaking, the higher your deductible, the lower your monthly insurance premium (and vice versa). So choose a deductible you’d be comfortable paying if, say, your iPhone is stolen.

Btw- the minimum deductible for homeowners insurance is $500.

You can change your deductible at any time:

1. Open your Lemonade app, and tap “Edit Coverage” on the home screen.

2. Scroll down to the deductible section, and change away!

3. You’ll get copy of your updated policy via email right away.

7. How billing works

It’s automatic and monthly, like Netflix! In other words, we’ll automatically charge your card on the same day each month – beginning on the date your policy becomes active. So if your policy activates on November 6th, we’ll charge you automatically on December 6th, January 6th, etc!

Btw, all of our insurance policies last for one year at a time, and we take a look near the end of the year to make sure everything is okay and your price is still right. If anything needs adjusting, we’ll reach out to you well in advance to let you know before we renew your policy for the following year.

8. What Giveback is

Unlike all other insurance companies, we’re a certified B-Corp! That means social good is baked into our business model, and we’re legally committed to the public good.

Introducing: the Lemonade Giveback program!

Our business model is structured so that if there’s money leftover at the end of the year after all claims have been paid out, we donate the excess $$ to charities you – our Lemonaders – choose. 🙂 Dive deeper into the Giveback program here.

To clarify, this doesn’t mean you have to donate any extra money. After choosing a cause you believe in, we take your leftover premium and donate it directly to the charity. If you don’t choose a cause, your unclaimed premium will stay with Lemonade, and we’ll donate it on your behalf… so be impactful and choose a charity you’d like to support!

FYI, as Lemonade grows, so does the potential of our Giveback. Our community of Lemonaders was able to 3x the 2017 Giveback and donate to 14 different organizations for Giveback 2018. In 2019, we donated $631,540 nonprofit organizations chosen by policyholders, which is a 1000% increase from our first Giveback donation in 2017. If you’d like to suggest a charity for Lemonade to partner with, email us here: [email protected]. We’re constantly updating our list of Giveback partners to reflect what our community is passionate about.

9. How to renew my policy

All Lemonade insurance policies last for one year at a time, but we take a look near the end of the year to make sure everything is okay and that the price is still right. Most of the time, we’ll just renew your policy automatically, and if anything needs adjusting, no worries—we’ll reach out to you well in advance.

When your policy renews, you and any listed Interested Parties will automatically be emailed a copy of your upcoming renewed policy. BTW – if you sign a rental contract for 15 months; there’s no need to reach out about renewals.

Looking for more information on renewals? Check this out.

10. How to cancel a Lemonade policy

It’s our goal to make policy cancellation as easy as possible. You can cancel your policy right through the Lemonade app downloaded on your phone. From the home screen, simply select the policy you wish to cancel, and then click the three dots in the top right corner and you’ll be able to cancel that policy from there!

Or you can cancel on the Lemonade website. Head to Lemonade.com and click the ‘My Account’ button in the top right-hand corner of the screen. Once you are in your account you can select the policy you no longer need then click on the pink “cancel” link (towards the bottom of our webpage).

We write the policy for a full year, but there’s no fee or penalty for cancelling early.

What’s next?

You’re done – go party! We hope you loved getting your policy as much as we loved welcoming you to our community.

Here’s hoping it’s smooth sailing from now, but if you ever need to file an insurance claim, just open the Lemonade app, tap ‘Claim’ on the top right corner, and we’ll handle it asap.

Also, be sure to check out Lemonade’s other insurance offerings. In addition to renters insurance, we also have homeowners insurance, pet insurance, and term life insurance. Lemonade has you covered where it matters most.

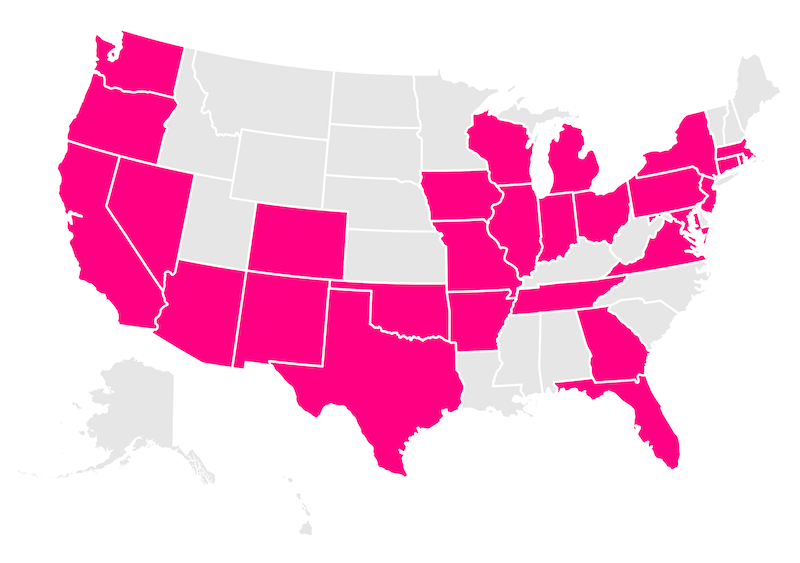

Which states currently offer renters insurance?

Arizona, Arkansas, California, Colorado, Connecticut, Florida, Georgia, Illinois, Indiana, Iowa, Maryland, Massachusetts, Michigan, Missouri, Nevada, New Jersey, New Mexico, New York, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, Tennessee, Texas, Utah, Virginia, Washington, Washington, D.C. (not a state… yet), and Wisconsin.

A few quick words, because we <3 our lawyers: This post is general in nature, and any statement in it doesn’t alter the terms, conditions, exclusions, or limitations of policies issued by Lemonade, which differ according to your state of residence. You’re encouraged to discuss your specific circumstances with your own professional advisors. The purpose of this post is merely to provide you with info and insights you can use to make such discussions more productive! Naturally, all comments by, or references to, third parties represent their own views, and Lemonade assumes no responsibility for them. Coverage and discounts may not be available in all states.