Whether you live a quick drive outside of Hartford, or you have the Bear Mountain Trail right in your backyard, you deserve the best homeowners insurance coverage in Connecticut.

Homeowners insurance covers you financially if something were to happen to you, your property, or your stuff. Let’s say someone breaks into your home while you’re on a weekend hike at Wadsworth Falls, or your friend twists their ankle after getting too excited while watching riveting ESPN athletics event in your living room. The right homeowners insurance policy can offer you financial protection if something terrible (or just plain inconvenient) were to happen.

What does Connecticut home insurance cover?

Connecticut is a natural wonder. Because of the state’s cozy placement in New England, many Connecticut residents enjoy modest rolling green hills, meandering streams and a lovely shoreline.

Along with the state’s natural beauty, there are also some natural risks, like floods, hurricanes, coastal storms, wildfires, and brutal winter storms. It’s worth nothing that while no insurance policy can cover you from every possible thing in the universe, the right homeowners policy can keep you financially afloat through a host of common situations.

You might know that a home insurance policy is a good (and necessary) idea, but you might not have a handle on all the moving parts. We’ve got a very extensive, plain English guide here, so feel free to take a deep dive into the specifics—but for now, we’ll break down the basics for you here, so you can get a grasp on the general things a policy covers.

Dwelling

‘Dwelling coverage’ helps pay for damages to the structure of your home. So, if your pipes burst next winter and damage your walls, or a windstorm blows over a tree and damages your home, you’re covered.

Other Structures

If one of the dangers mentioned above causes damage to your driveway, fence, shed, or other structures on your property, your homeowners insurance has you covered.

Loss of Use

If you can’t live in your home due to covered damages, your ‘loss of use’ home insurance coverage can help pay for a temporary place to stay and basic living expenses above what you’d normally pay such as food, laundry, parking, etc.

Personal Property

Personal property coverage protects your stuff both inside and outside your home. So, if your couch is ruined due to a burst pipe or your laptop is swiped at a coffee shop, homeowners insurance has your back.

Liability coverage

If your neighbor slips and falls on an ice sheet on your driveway, you could be held liable. If someone is injured on your property, or anyone on your policy causes damage to someone else’s property or stuff, your insurance company should have you covered with liability protection.

Medical protection

If your neighbor needs to go to the hospital because of that slip and fall, your coverage will kick in to cover the medical payments. Home insurance covers you if a guest gets injured at your place, or if you accidentally cause injury to someone outside your home.

How much are home insurance rates in Connecticut?

Homeowner’s insurance does not have a standard policy price for residents of Connecticut. A 60-year-old in a Norwalk mansion will pay a different monthly premium than a college student who owns a two-bedroom home in New Haven, of course.

According to Value Penguin, Connecticut residents can get a pretty good deal when it comes to homeowners insurance rates. The average cost of homeowners insurance in Connecticut is around $1,539 per year. The national average for homeowners insurance is $2,151 in comparison. How much you pay on homeowners insurance depends on your coverage limits, your insurer, your property, and your deductible.

What are the different types of homeowners insurance?

Lemonade offers two types of homeowners insurance policies: one for single-family homes, (called HO3 in insurance-speak), and one for condo insurance (HO6). There are minor differences between the two, and you’ll choose the right policy depending on the type of home you’re looking to insure. A key difference is that homeowners own and are responsible for everything on their property—the house itself, the garage, fence, etc.—whereas condo owners with HO6 policies are only responsible for the outermost walls of their unit, inward.

Want to lock in a Lemonade homeowners insurance quote? Our 100% digital application takes just a few minutes (and it’s fun, too!).

Best places to buy a home in Connecticut

Simsbury

Simsbury is a suburb in the Hartford area with a 350-year-old community. Not surprisingly, this suburb in the state capital, is considered one of the best places to live. Famous for its old copper mines, Simsbury is a mix of a city-feel, history and natural beauty with an abundance of outdoor activities. Hiking, fishing, and kayaking are just some of the activities you can enjoy. Significant nature sites include Penwood State Park, the Talcott Mountain State Park, in which the historic Heublein Tower is located, and Farmington River which flows through the town.

Boasting classic New England style homes, the home value is quite hefty compared to other areas. The median income is $153,715, suggesting the average resident can foot the bill. The median price of a home in Simsbury is $482,521 according to Zillow, which is higher than the typical home value in Connecticut.

West Hartford

Another charming and more affordable suburb of the state capital is West Hartford. Diverse, inclusive, and popular with millennials, West Hartford has ranked the best place to live in Connecticut for three years straight, according to Niche.com, which factors in affordability, walkability, public schooling, neighborhood diversity, and more. More affordable is relative of course, with a median home value at $450,041 according to Zillow, it’s more attainable than Simsbury and attracts young professionals and retirees alike.

West Hartford is considered an ideal place to raise a family. The area is safe with plenty to do. Elizabeth Park, the West Hartford Reservoir, and Westmoor Park all offer beautiful green spaces to relax, hike and more. West Hartford’s Center also has a teeming nightlight full of bars and restaurants. Whether you’re into nature, history, or even escape rooms, West Hartford has something for everyone.

Greenwich and Old Greenwich

With its proximity to New York City, mansions, and coastline, the exclusive Greenwich might very well be the crème de la crème of Connecticut suburbs. Since it is the largest town on Connecticut’s Gold Coast and just a 60 minutes train ride to Grand Central Station, many of its residents are city workers, bringing in high-paying city salaries, averaging a yearly income of $357,112. From museums, like the Bruce Museum, to high-end shops and restaurants, as well as excellent public schools and prestigious academic institutions, Greenwich has much to offer and a competitive housing market to go with it. The median price of a Greenwich home is a hefty $2,021,941.

Old Greenwich, the southernmost coastal neighborhood of Greenwich, is a quaint, historical, affluent area. True to its name, it is Greenwich’s oldest neighborhood. Peaceful and close to the beach, it has small-town vibes evidenced by the downtown area being called The Village. It also makes the top ten list of America’s richest places. While you don’t need to go for one of the old colonial waterfront estates, still be prepared to pay a pretty penny. At least they have the lowest property rate in the New York metro area.

Westport

Westport, in Fairfield County is another one of the best places to live in Connecticut, and also a suburb of New York City. This wealthy coastal town is both traditional and cosmopolitan, affluent suburb and old New English town. Westport is a cultural hub where you can experience art and history at the Westport Country Playhouse and The Westport Museum for History and Culture. You can also enjoy its natural beauty at Sherwood Island State Park or Compo Beach, take a stroll along the Saugatuck River, or pop by the Westport Farmers Market. There’s no shortage of parks, restaurants and cafes.

The liberal area with a median household income of $250,001, is also top-rated in education, scoring high for the lowest student-teacher ratio. Even the weather and air quality is some of the best you’ll find in Connecticut. The typical value for a home in Westport is around $1,714,819.

Connecticut real estate agents to follow on Instagram

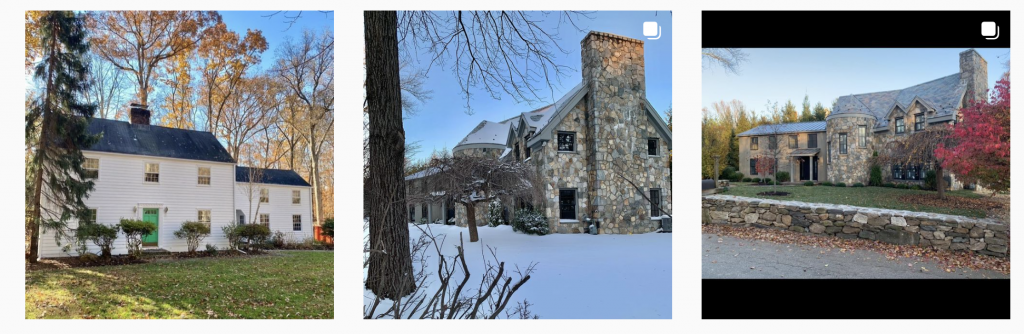

Jason Godoy specializes in luxury homes in Fairfield County. His listings include beautiful Westport homes from the 1880s, such as a restored quintessential Connecticut stone farmhouse.

If you’re looking for a stunning beach home in Stamford CT, check out Pina Basone, who guarantees the best service!

Also check out: The Penrose Team, a husband and wife real estate team who can help you find a home with your own private pond; and Lauren Haberman, is a Connecticut realtor dedicated to helping people find a home that they love to live in.

Things that make Connecticut great

Home to one of America’s most prolific authors

Although he wasn’t a native, Mark Twain (Samuel L. Clemens), an icon of American literature, made his home Connecticut. Two of his most famous works, The Adventures of Tom Sawyer and The Adventures of Huckleberry Fin, were both penned in Hartford, Connecticut, where he lived for seventeen years to be closer to his publisher.. You can even visit the Mark Twain House and Museum there. He also patented three inventions there, including the scrapbook.

A bookworm haven

In the United States, the first free public library, Scoville Memorial Library, was established in Salisbury, Connecticut. It started when Richard Smith brought 200 books back from London in 1771 to Salisbury, originally under the name the Smith Library. In 1805 the library was expanded with gifts from Caleb Bingham and Harriet Church, called the Bingham Library for Youth and the Church library, respectively. Finally, funds for the permanent library building were left in the will of Jonathan Scoville, a Salisbury native. Today, the library has expanded to include over 30,000 items, as well as house impressive works of art.

A taste of history

Did you know that the first hamburger in the world was invented right in New Haven? The official birthplace of the hamburgers is Louis’ Lunch. As legend has it, Louis Lassen invented it by grilling a patty made of ground steak trimmings between two pieces of toast for a customer in a hurry in 1900. You can still taste the original version and learn a little “Louis’ Lingo” on the way.

What’s the word?

Of course these days, you can Google everything. But you must pay homage to the birth of the first American dictionary. In 1806, Noah Webster, who was from West Hartford, published A Compendious Dictionary of the English Language, precursor to the Merriam-Webster dictionary, in Hartford and New Haven, Connecticut. Webster is the reason we get to write “color” instead of “colour” and added Amercan words that British dictionaries didn’t have like “squash” or “skunk.” If you are grateful for words that are easier to spell, visit Noah Webster House & West Hartford Historical Society, a National Historic Landmark in West Hartford, Connecticut.

A few quick words, because we <3 our lawyers: This post is general in nature, and any statement in it doesn’t alter the terms, conditions, exclusions, or limitations of policies issued by Lemonade, which differ according to your state of residence. You’re encouraged to discuss your specific circumstances with your own professional advisors. The purpose of this post is merely to provide you with info and insights you can use to make such discussions more productive! Naturally, all comments by, or references to, third parties represent their own views, and Lemonade assumes no responsibility for them. Coverage and discounts may not be available in all states.