- Indiana home insurance

- What does Indiana homeowners insurance cover?

- How much is home insurance in Indiana?

- Average cost of homeowners insurance in Indiana

- Why get Lemonade homeowners insurance in Indiana?

- How much home insurance do I need?

- Dwelling coverage

- Personal property coverage

- Loss of use coverage

- Personal liability coverage

- Medical payments to others coverage

- Homeowners Insurance FAQ

Indiana home insurance

Whether you’re into hiking at Prophetstown State Park or wait the entire year to attend the Indy500 we can all agree on one thing: When it comes to your homeowners insurance, speed, trust, and empathy matter.

Homeowners insurance financially buffers you, your family, and your property (including your stuff!) against bad things that could do some serious damage to your bank account. If your home is broken into while you’re chilling out at the Bean Blossom Bluegrass Festival, or your neighbor slips and injures themselves on your driveway after a spring BBQ, homeowners insurance has your back.

What does Indiana homeowners insurance cover?

If you live in the Hoosier State, you know that summers are long, warm, humid and wet and the winters are short, very cold, and windy. You’ll want your homeowners insurance coverage to protect you from all sorts of risks that might damage your home, and your wallet.

Your homeowners policy covers six broad categories:

Dwelling

‘Dwelling coverage’ helps pay for damages to the structure of your home. So if your air condenser on the roof leaks and causes your pipes to burst, or a windstorm blows over a tree and damages your home, you’re covered.

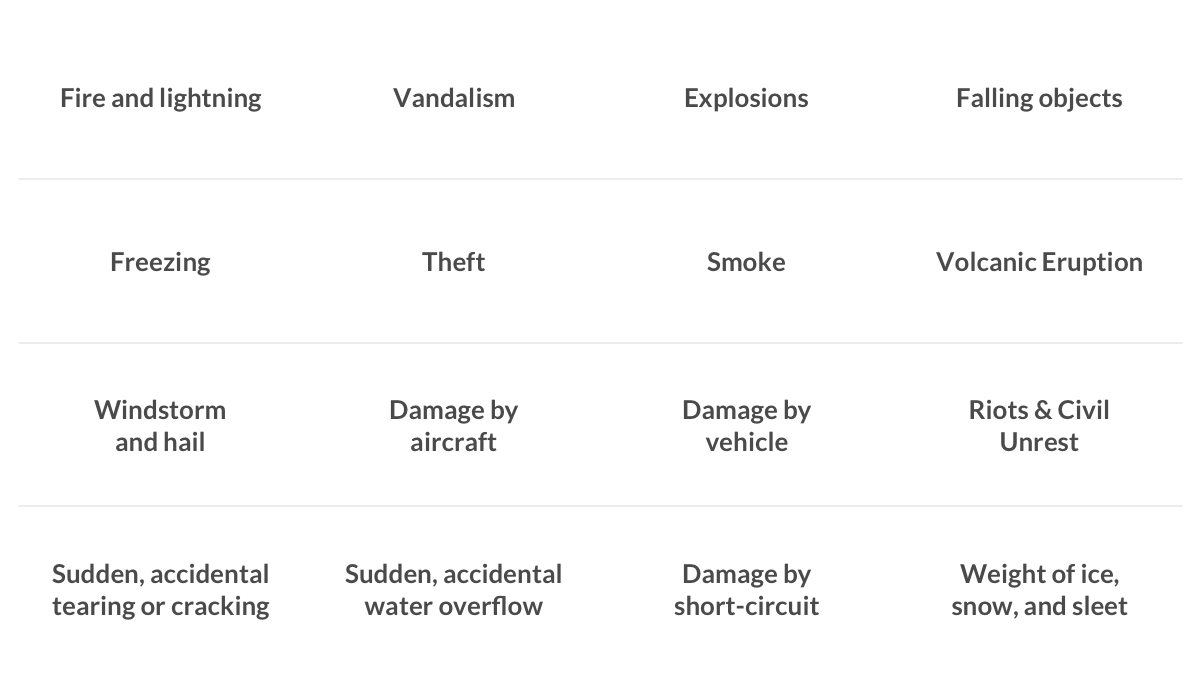

Btw homeowners insurance covers your home for 16 different perils (aka bad things) that could happen.

Keep in mind that if one of these perils happens to your stuff outside of your home, you’ll also be covered.

Other Structures

If one of the dangers mentioned above causes damage to your driveway, fence, shed, or other structures on your property, your home insurance can help you out.

Loss of Use

If your place becomes uninhabitable due to covered damages, your ‘loss of use’ coverage can help pay for a temporary place to stay and additional living expenses such as food, laundry, parking, etc.

Personal Property

‘Personal property’ covers your stuff both inside and outside your home. So if your couch is ruined due to a burst pipe or your laptop is swiped at a coffee shop, homeowners insurance has your back.

Liability protection

If your neighbor slips and falls on your driveway, you could be held liable. If someone is injured on your property, or anyone on your policy causes damage to someone else’s property or stuff, your insurance company should have you covered for legal fees and any other payouts.

Medical Protection

If your neighbor needs to go to the hospital because of that slip and fall, your medical payments will kick in. Home insurance covers you if a guest gets injured at your place, or if you accidentally cause injury to someone outside your home.

How much is home insurance in Indiana?

There’s no standard policy price when it comes to homeowners insurance. Your hip college buddy who lives in Broad Ripple will have a totally different price than your cousin who owns a home in Fort Wayne.

On average, Indianian residents pay around $1,474 per year for home insurance, compared to the national average of $2,151 according to Value Penguin. So what variables impact your home insurance rates?

Location of your home

If you live in a high-risk area for theft, fire, or windstorm for example, your policy will be pricier than it would be if you live in a low-risk area.

Age of dwelling

If your home is brand spanking new, you could get a discount on your homeowners insurance policy. However, old buildings are more likely to have structural issues or problems with the electrical or plumbing systems, which may hike up the price of your insurance a bit.

Protective devices

If you have a fire alarm, for example, you could get a discount on your homeowners insurance. That’s because they’ll allow you to prevent a fire before it’s too late.

Coverage amount

The cost to rebuild your home has a big impact on the price of your policy. If your home is on the large side, or made of expensive materials, your home insurance policy might be a bit pricier.

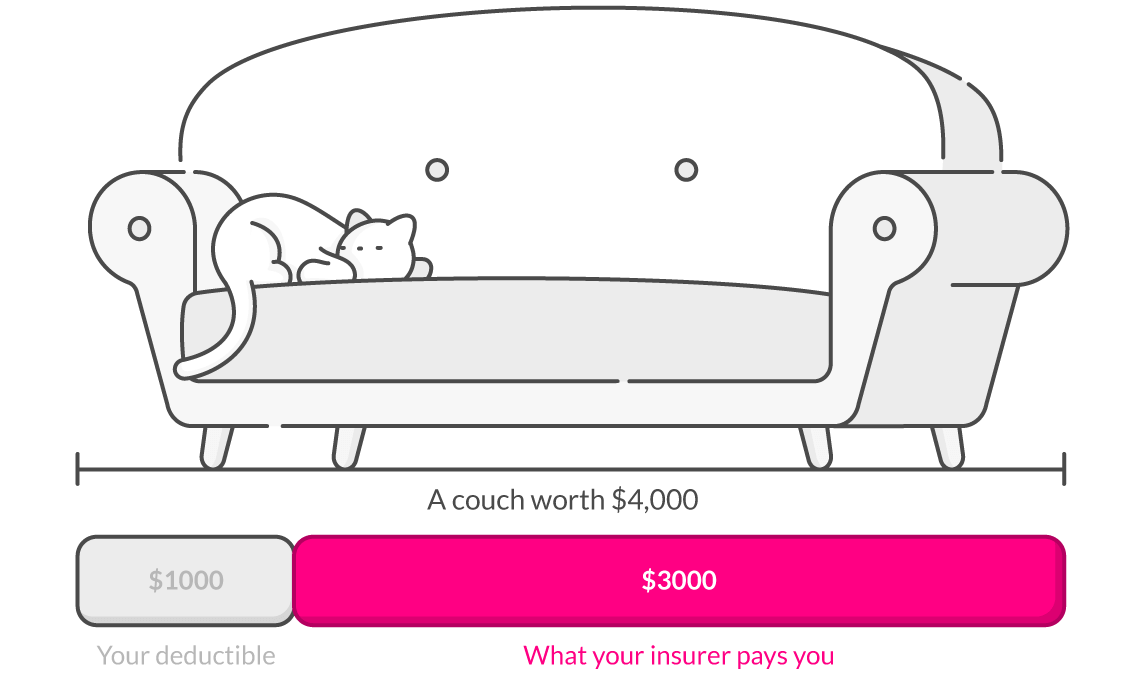

Deductible

The lower your deductible, the higher your homeowners insurance price. So choose a deductible that makes the most sense for your lifestyle.

Add-Ons

If you get Extra Coverage for your expensive jewelry, or tack on water backup coverage to your policy, your price will go up a bit.

Claims history

If you’ve never filed a claim, you’ll probably have a cheaper homeowners insurance policy than someone who has a history of filing claims.

Average cost of homeowners insurance in Indiana

| City | Average cost of homeowners insurance |

|---|---|

| Indianapolis | $2,060 |

| Fort Wayne | $1,725 |

| Bloomington | $1,970 |

| Gary | $2,235 |

Why get Lemonade homeowners insurance in Indiana?

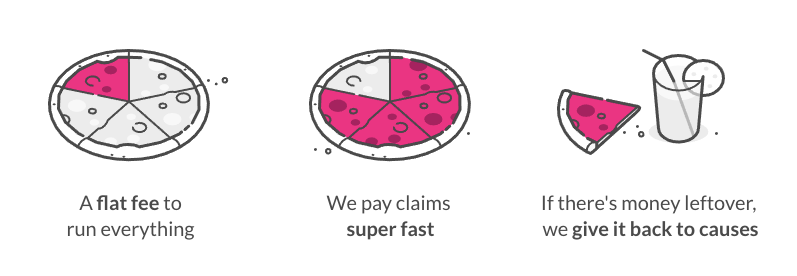

Lemonade is powered by tech, so you can get a home insurance policy on the Lemonade app in less than 5 mins – zero paperwork, zero hassle.

If you ever need to file a claim, Lemonade can process them instantly, handling around 30 percent in 3 seconds. Lemonade also does not use brokers, making each policy cheaper than competitors.

Lemonade was built differently than traditional insurance companies, who profit from the money they don’t pay out in claims. This means whenever they pay your claim, they lose profit. This is why getting your claims paid quickly and in full is sometimes so hard.

Lemonade takes a fixed fee out of your monthly payments, pays reinsurance (and some unavoidable expenses), and uses the rest for paying out claims. We treat premiums as if they were still your money, and return unclaimed remainders in our annual ‘Giveback’.

Giveback is a unique feature of Lemonade, where leftover money is donated to causes our policyholders care about each year.

How much home insurance do I need?

When it comes to home insurance, most people know they need it, but make the mistake of purchasing too little. Your home insurance comes with six broad areas of coverage.

We’ll break down how much coverage you need in each category, so you’re properly protected against every scenario. Get more info on how much homeowners insurance you need here.

Dwelling coverage

When it comes to setting a dwelling coverage amount for your home, you don’t want to choose the purchase price or current market value. Instead, choose the amount it would take to rebuild your home (as it was before the damage), known as ‘reconstruction costs.’ This is what your insurer will be reimbursing you for in the worst-case scenario that you have to rebuild.

Personal property coverage

To determine how much personal property coverage you need, choose a limit between 50 – 75 percent of your dwelling coverage amount. If you don’t think this covers all your stuff (including your priciest purchases), look into getting Extra Coverage . Also known as scheduled personal property, this add-on protects expensive items like jewelry, and bicycles, with no deductible.

Loss of use coverage

How much loss of use coverage you need is also based off of dwelling coverage. You should choose an amount that’s around 20-30 percent of your dwelling coverage. Also, take your lifestyle into consideration, as this covers what you’d usually spend on stuff like food, temporary storage of property, moving costs, etc. So if you eat takeout for every meal, you’ll most likely want to select an amount that’s more than someone who buys groceries and prepares their meals.

Personal liability coverage

When choosing personal liability coverage, take into account the total dollar amount of your financial assets, like your home, retirement accounts, investments, etc. So, let’s say you have a boat, two homes, and four cars between you and your wife, you should have significantly higher liability limits than the total worth of your stuff, since you have more assets that you could potentially lose if there is a major liability claim with minimal liability coverage. People with less assets generally can get by with minimum liability coverage.

Medical payments to others coverage

You should generally choose between $1,000 – $5,000, but it really depends on you. Try looking at how often you host and the safety of your home.

Homeowners Insurance FAQ

Is homeowners insurance required?

While your state may not require homeowners insurance by law, your lender will almost always require coverage if you take out a mortgage to buy a home. If you owe money on your mortgage and your home is destroyed, your homeowners insurance policy can have your back. So if you’ve ever wondered, ‘do I actually need homeowners insurance?’ Yes, you do!

What are the different types of homeowners insurance?

Lemonade offers two types of homeowners insurance policies: one for single-family homes, (called HO3, in insurance-speak), and one for condos and co-ops (aka, HO6). There are minor differences between the two, and the right policy for you depends on the type of home you’re looking to insure. While homeowners are responsible for everything on their property (home, garage, fence, etc.), condo owners are only responsible for the outermost walls of their unit, inward.

How can I save on homeowners insurance

Homeowners insurance can get expensive, so you might be looking for ways to bring your premium down slightly. First off, your home doesn’t need to be ‘smart’ in order to install devices that will help lower your insurance premium. Start with a standard fire alarm and burglar alarm, and you’ve already lowered your risks. And lowered risks equals lowered premiums. Also, if you experience routine bad weather, ask your insurance company what kind of reinforcements you can add to make your home more weather-proof. For instance, you may be able to save money on your premiums by adding storm shutters or laminated glass windows. You could also replace your heating, plumbing, and electrical systems to cut down the risk of fire and water damage.

A few quick words, because we <3 our lawyers: This post is general in nature, and any statement in it doesn’t alter the terms, conditions, exclusions, or limitations of policies issued by Lemonade, which differ according to your state of residence. You’re encouraged to discuss your specific circumstances with your own professional advisors. The purpose of this post is merely to provide you with info and insights you can use to make such discussions more productive! Naturally, all comments by, or references to, third parties represent their own views, and Lemonade assumes no responsibility for them. Coverage and discounts may not be available in all states.