- What is renters insurance?

- When does renters insurance cover theft?

- When is theft not covered under your renters policy?

- Replacement cost vs. actual cash value

- What if stuff was stolen outside of my home?

- Does renters insurance cover car or bicycle theft?

- Does renters insurance cover stolen cash?

- Does renters insurance cover stolen laundry?

- Does renters insurance cover theft of other people’s belongings?

- Does renters insurance cover theft by my roommate?

- Does renters insurance cover a locksmith if my keys are stolen?

- How can I prevent theft?

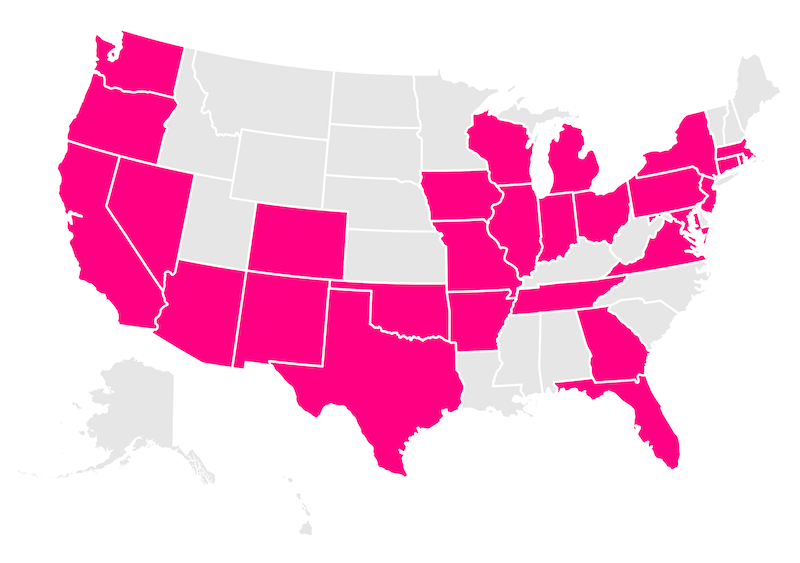

- Which states currently offer renters insurance?

Your renters insurance policy can help alleviate some serious anxiety when it comes to theft. It insures your phone on the subway, your laptop at the coffee shop, and all your other valuables if you’re the unfortunate victim of an apartment burglary.

Hopefully you never need to experience this firsthand, but with 6.42 million property theft cases in the US in 2021, per Statista, renters insurance provides much-needed peace of mind that your stuff is covered if you fall victim to theft.

So other than your own preventive behavior, such as wearing your backpack on your chest, or investing in some super heavy locks and installing an alarm system, getting covered with renters insurance is a smart strategy.

How, exactly, can a renters policy help soften the blow? And what does renters insurance cover you for in the first place?

If you’re in a rush, feel free to check out our brief summary below.

- Your renters insurance will cover most of your stuff for theft both inside and outside your home, including electronic items, furniture, clothing, and jewelry.

- Theft coverage applies, among others, to your bicycle, stolen laundry and cash up to $200.

- If your insurer decides you were responsible for the theft due to negligence, they might decide not to approve your claim.

- There are many ways to reduce the likelihood of a theft, one of which is keeping track of what sort of information you post online to ensure your home address or phone number aren’t publicly available.

What is renters insurance?

If you’re renting your home, renters insurance coverage can help protect you and your stuff. While your landlord is responsible for any damage to your walls or the structure of your home (within reason), they aren’t responsible for you or your personal items.

Renters insurance typically includes three types of coverage: Personal property, personal liability, and additional living expenses (‘loss of use’ in insurance-speak). What do all of these mean?

- Personal property coverage – helps pay to replace your belongings if they’re stolen or damaged by a covered risk, such as theft, fire, windstorm, etc (‘named perils,’ in insurance-speak

- Renters insurance liability coverage – protects you if a guest is injured in your home, or if you accidentally damage someone else’s property

- Loss of use – helps pay for things like your hotel bills or storage costs if your rental becomes unlivable, due to things like fire or windstorm

Note: If your claim is approved, your insurance company will reimburse you, minus your deductible. Let’s say your $750 iPhone was stolen and your deductible was $250. Your insurer would pay you $500.

If you want to know more read our guide on what is renters insurance and how does it work.

When does renters insurance cover theft?

Your renters insurance will cover most of your stuff for theft both inside and outside your home, including electronic items, furniture, clothing, and jewelry – as long as you’ve purchased enough coverage for ‘em!

What does ‘enough coverage’ mean? For each coverage type discussed above (personal property, personal liability, loss of use, etc.), your insurer will indicate your coverage limit– how much they can pay you if something happens.

So if you choose to get $30,000 worth of personal property coverage (aka, coverage for your stuff), your insurance company can pay you up to $30,000 for your stolen stuff. But if you choose only $10,000 worth of personal property coverage, and more than that is stolen, your renters insurance company can only pay up to $10,000 (minus your deductible, of course). If you’d like some help figuring out how much your stuff is worth, check out this quick guide.

Now let’s dig into a practical example of when theft would and wouldn’t be covered by your renters insurance company:

Burglarized apartment

Let’s say you go out for a movie with a friend, and come home to find that a burglar broke into your place and stole your TV, computer, sound system, a bunch of expensive jewelry, and your friend’s backpack which had a laptop and headphones inside. Ouch.

Would you be covered? Yes, mostly.

First off, your and your friend’s stuff would be covered, provided they don’t have a policy of their own. Just make sure you can provide a full inventory of what was stolen, make and model, receipts, and pictures if possible. The more info you can get, the easier it will be for your claims adjuster and insurance company to process your claim.

The only tricky thing in this scenario is the expensive jewelry.

Most companies provide around $1,500 of insurance coverage for jewelry under your base insurance policy. If your jewelry was worth more than that, you’ll need to have something called an endorsement to add on extra coverage in order for it to be protected in scenarios like this. Otherwise, if your jewelry was worth more than $1,500 and it wasn’t properly insured, you may be in a bit of a pickle.

When is theft not covered under your renters policy?

Take note that there are a couple of instances when theft isn’t covered by renters insurance.

Theft isn’t covered if:

- You’re the one who stole something (never a good look)

- It happened somewhere you rent that’s under construction

Places that are under construction carry a much higher risk of something happening to your stuff, and are therefore excluded from your coverage.

There are a few more exemptions you should note:

If you check your luggage on an airline, and they’re stolen in their possession, your renters insurance policy won’t cover you – because your item was in the possession of a third party.

Plus, if your insurer decides you were responsible for the theft due to negligence, like leaving the keys in your front door or leaving your bicycle unlocked — they might decide not to approve your claim.

Replacement cost vs. actual cash value

Think of replacement cost as the “Amazon price” of how much your item (same make and model) would sell for today, if it were new.

That means, if you originally bought headphones for $300 and the current retail price for the same make and model is $250, that’d be your replacement cost.

Actual cash value, or ACV, is a way in which some insurers price out most personal property claims to renters. Meaning, if your bike is stolen, most insurers will calculate the bike’s actual cash value when determining how much they’ll pay you for it. Think of it as the “eBay” price of your item.

Insurers calculate ACV by:

- Figuring how much it would cost to replace your stolen or damaged property with a similar item today (aka the replacement cost)

- Subtracting the loss in value over time due to age, wear, and tear (depreciation)

What if stuff was stolen outside of my home?

One of the best things about renters insurance is that you’re also covered for theft outside of your home. That means you’re protected if your laptop gets stolen from the local coffee shop, or if someone pickpockets your phone on the subway.

And what’s the radius of that coverage? Your personal belongings are even covered from theft while you’re abroad!

So let’s say you’re on a business trip, and return to your hotel with your iPad nowhere to be found. Or, your phone was swiped while dancing at a music festival — your renters insurance policy could have you covered. In short, there are a lot of common situations renters insurance covers you for.

Does renters insurance cover car or bicycle theft?

Renters insurance does cover bike theft — Hallelujah! Whether your bike was stolen from your apartment or snatched outside the local gym, you’re covered. However, your policy has more nuance when it comes to e-bikes, and coverage depends what type of e-bike you own.

Btw, take note that renters insurance doesn’t cover car theft. Cars are insured separately by your auto insurance. However, renters insurance does cover you if your personal items, like a laptop or were stolen out of your car.

Does renters insurance cover stolen cash?

Yes, renters insurance covers stolen cash, but only up to $200.

Why? If unlimited cash was covered, it would be way too tempting to claim someone stole $10,000 worth of cash, in hopes of getting a quick payday.

On the other hand, if someone stole your backpack with your laptop, phone, and cash, you’d claim the cash along with the other items, and the deductible would be subtracted from the total value of your stolen stuff.

Does renters insurance cover stolen laundry?

It sure does! Renters insurance covers almost all of your belongings against theft, including your favorite pair of jeans and your go-to workout ensemble. So if your laundry was stolen at the laundromat, in your apartment building’s laundry room, or anywhere else, renters insurance would have your back.

Take note that if you’re paying someone to do your laundry (through a drop-off service, for example) and it’s stolen in their possession, your renters insurance can’t cover you. Only items stolen in your possession can be covered.

Does renters insurance cover theft of other people’s belongings?

It depends. Under your renters policy, anyone related to you by blood, marriage, or adoption is automatically covered. So if your husband’s noise-canceling headphones were stolen, he’d be able to file a claim under your policy. Take note that all of your family members share personal property coverage limits, so make sure to set those limits to amounts you both feel comfortable with.

For example, if your stuff is worth $20,000 and your husband’s stuff is worth another $20,000, you’re going to want to get $40,000 in personal property coverage.

If you’re currently living with your significant other but haven’t made it down the aisle, you’ll need to add bae as an ‘additional insured’ on your policy, which costs just a few extra bucks a month. And the same goes for your S/O: Make sure you have enough personal property coverage to cover both of your stuff.

What about your roommate? Or a friend popping in to visit? Unfortunately, they’re not covered under your policy. Tell ‘em to get their own! 🙂

Does renters insurance cover theft by my roommate?

It’s a tricky situation if your roommate steals your stuff. If they’re also covered by your policy (i.e. as a significant other or related to you), then you’re not covered if they snatch your things.

Otherwise, your renters insurance can cover you, but there are a few things you’ll need to do. Firstly, your roommate would need to be a named suspect on a police report, and you’d have to elect to press charges against them.

Why? In order to cover this incident, your insurer will need to make sure it’s a criminal matter, rather than a civil dispute.

Does renters insurance cover a locksmith if my keys are stolen?

Yes, your policy might cover the locksmith fees if your keys are stolen and you need to get back into your apartment. However, most other damages to your lock or front door that would require a locksmith would be the responsibility of your landlord, not your own renters insurance policy.

How can I prevent theft?

It’s great to have insurance when something is stolen, but let’s be honest—we’d really rather it not happen at all. Here are some ways to reduce the likelihood of theft:

1. Lock it up

When you move into your new rental, invest in some new locks! Your landlord might even agree to buy these for you. That way, you won’t have any creepy unplanned visits from old tenants or be vulnerable to burglary. Also, make sure to never write any part of your address on your keys (or anywhere else).

2. Keep your eyes open

If anyone asks to enter your home, always double and triple check. A ‘maintenance worker’ might want to enter under the guise of fixing something in the property — or they might claim your landlord sent them.

We’re more likely to be lax about security when it’s someone else’s property, but it’s good sense to never let anyone into your home unless you’ve been told first by your landlord, or if they have an official badge that checks out.

Also, get to know your neighbors, and who comes in and out of the building regularly. If there are any unfamiliar faces lurking around, you might want to inform the authorities.

3. Get digitally secure

It may feel like it’s just you and your friends Instagramming, but be aware, cyberspace can be a dark place. Keep track of what sort of information you post online, and ensure your home address or phone number aren’t publicly available. Criminals can use clues like phone numbers or home addresses to fraud authorities and potentially break into homes.

4. Stay safe!

Let’s be honest, life ain’t a piece of cake. We encounter all sorts of obstacles along the way—and theft is, unfortunately, one of ‘em.

Getting renters insurance is just good sense and covers you for more incidences than just theft. No matter how much your belongings are worth, when s**t hits the fan, you’ll be glad you had renters insurance.

BTW, in case you were wondering about states with the highest theft rates, according to Statista Texas is leading the list with 946,717 property crime rates in 2021, followed by Washington, North Carolina, and Colorado. Property crimes include cases of burglary and theft, but also incidents involving vandalism and arson. For additional information on theft and how you can keep your home safe, check out our guide to some of the most eye-opening burglary statistics.

Which states currently offer renters insurance?

Arizona, Arkansas, California, Colorado, Connecticut, Florida, Georgia, Illinois, Indiana, Iowa, Maryland, Massachusetts, Michigan, Missouri, Nevada, New Jersey, New Mexico, New York, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, Tennessee, Texas, Virginia, Washington, Washington, D.C. (not a state… yet), and Wisconsin.

Have more questions about renters insurance? Check out our guide to renters insurance coverage.

A few quick words, because we <3 our lawyers: This post is general in nature, and any statement in it doesn’t alter the terms, conditions, exclusions, or limitations of policies issued by Lemonade, which differ according to your state of residence. You’re encouraged to discuss your specific circumstances with your own professional advisors. The purpose of this post is merely to provide you with info and insights you can use to make such discussions more productive! Naturally, all comments by, or references to, third parties represent their own views, and Lemonade assumes no responsibility for them. Coverage and discounts may not be available in all states.