If a tree falls on your fence, would you care? We bet you would.

Below, we’ll take a deep dive into the world of fences as they relate to your homeowners insurance. We’ll clarify which fence-related scenarios are likely covered by your insurance, and when you’ll have to pay for repair costs yourself. And hey, maybe we’ll even have a bit of fun in the process.

When does your homeowners insurance cover damage to a fence?

It’s important to know the cause of your fence’s damage in order to understand if your insurance company would cover you or not.

Before we start: If you own a condo, your fence may not technically be part of your property. In that case, fence repairs won’t be your responsibility—they will likely fall under the authority of your homeowners association.

Now let’s take a look at some common scenarios homeowners might face.

FYI, while we’ll focus on fences in this article, the same details and scenarios would apply equally to many “other structures” on your property, like gazebos or tool sheds.

Your fence gets damaged by fire, windstorms, or vandalism

If your fence catches fire and burns down or is vandalized by an angry stranger, both instances should be covered by your homeowners insurance policy. Ditto if your fence gets knocked over by heavy winds during a storm.

Your house collapses and damages your fence

If your house collapses due to a fire, windstorm, or hail, and buries your precious fence under it, your insurance would likely cover the latter damages as well.

However, this does not apply to cases in which you knew your house was in a very fragile condition to begin with, and you failed to take suitable precautions to prevent its collapse.

Someone steals parts of your fence while it’s being built

Picture this: You’ve just moved into a brand new house and are planning to build a new fence that will ring your property. The workers have piled up the necessary fence-building materials next to your front porch, ready to be used the next day.

But something unexpected happens: A sneaky thief pulls up in a white van and steals those building materials while you sleep. Luckily, this theft would fall under the responsibility of your home insurance, and your insurer would likely reimburse you for the loss.

BTW, the coverage only applies to materials for private use. If you’re in the construction industry and the building materials for one of your clients get stolen, this won’t be covered, since it would fall under the category of business use.

Your neighbor’s tree falls on your fence

The resulting damage to your battered fence will likely be covered, but hopefully you and your neighbor are both taking steps to minimize the risk of tree damage to your property.

Also worth knowing: If the tree did not directly damage one of your structures (e.g. your house or fence), but is blocking your driveway, the cost of tree removal will likely be partially covered by your homeowners insurance.

I’ve driven my car into my own fence

Um, no judgment! If you do have an unfortunate crash, your homeowners insurance will likely cover the fence’s damage. For your vehicle’s sake, though, we hope you have car insurance.

Someone else has driven their car into my fence

Here’s some good news—if a random driver took a wrong turn and drove into your fence by accident, your homeowners insurance will likely come to your rescue and cover the fence repairs.

Some scenarios in which your insurance would not cover fence-related damage

Let’s put all our cards on the table, so you’re prepared when it comes to fence-related scenarios your homeowners insurance likely won’t cover.

Water and ice

The cold weather brings with it a lot that can compromise your fence’s health. If water collects on your fence, freezing and causing it to topple, this won’t be covered by your insurer. If frozen slush melts on your fence and causes damage, this won’t be covered either.

Insects or vermin

So beware of termites that might want to make a meal of your tasty wooden fence…

(A lot) of rain

If your fence happens to collect rain and breaks under its weight, your homeowners insurance won’t cover the damage. However, as we mentioned before, if there’s a heavy storm and wind causes damage to your fence, that would be covered.

Use of defective materials or faulty methods

Contractors have occasionally been known to cut corners. If your fence was built with defective materials and that’s the reason it later falls into disrepair, you’ll have to pay for the damage yourself. Make sure to employ the right people so your well-built fence will withstand the test of time and all its wear and tear.

Some additional, more nuanced scenarios

There are other situations in which coverage depends on the context of what happened—and whether you could have done anything to prevent it.

One of my trees falls on my fence and destroys it.

Whether this is covered or not depends on the reason why your tree toppled in the first place.

- Did you ignore a prior warning from your city to cut down the precarious tree? Not great. Its collapse and the subsequent fence-destruction are probably not covered by your insurance.

- The bad news: Preventive tree removal—even if necessary—is never covered under your insurance policy. Generally, your homeowners insurance covers scenarios that cause unexpected or sudden damage.

If one of your trees is in a questionable state, and you rather want to be safe than sorry, you can get in touch with a contracted/licensed expert in your area.

- Did your healthy tree collapse due to ‘natural’ reasons, such as a heavy windstorm? Your insurance company likely will cover the damage to your fence.

My fence gets swept away by flooding or is damaged by an earthquake or a hurricane.

- Hurricanes: Yep, these kinds of damages should be covered, but make sure to take a look at your policy to double-check that wind and hail coverage is included.

- Flooding: Likely not covered, but feel free to check this helpful blogpost on flood insurance.

- Earthquakes: Likely not covered.

What to do if your fence is damaged

If your fence has fallen over or has a huge hole in it, you obviously want to do something to resolve that situation ASAP. (And if your situation involves a theft of building materials for a fence that you’d be claiming later, definitely file a police report immediately.)

Here’s what to keep in mind in the aftermath of damage to your fence.

Make sure the damage doesn’t get any worse!

If your whole fence is about to collapse due to some initial damage, take the necessary measures to avoid that worst case scenario. Initiate reasonable and necessary repairs. (Paying to replace a basic chainlink fence with one made out of rare South American wood would not qualify as reasonable and necessary, but… nice try.)

Document everything, and file an insurance claim!

- Keep a receipt of repair costs

- Create a list of all damaged items (your fence and its parts, plus anything else that was affected) and their value. It’s best if you can collect relevant bills and receipts or other documents that provide your insurance with an adequate proof of ownership plus show the price you bought the items at.

- Take pictures and/or videos to document the damage

Pro Tip: You’ll need to tell the story around your fence-damage as accurately as possible. (Who knows, maybe someday a producer will want to buy the film rights to this exciting tale…)

In the end, an insurance adjuster will determine if the particular incident falls under your insurance coverage—so try to make their job as easy as possible (and increase your chances of being reimbursed!).

How much does your insurance pay in case your fence gets damaged?

Before we get into the nitty-gritty details, let’s first find the part in your homeowners policy that mentions damage to fences. It’s called Coverage B – Other Structures.

While Coverage A protects your home itself, and any directly attached structures, Coverage B applies to all detached structures such as your sheds, gazebos, pools, free-standing garages—and fences.

In most cases, your Coverage B is capped at 10% of your Coverage A. What does that mean?

Well, if you’ve chosen Coverage A of $300,000, your Coverage B would be limited to $30,000. That’s the maximum amount your insurer reimburses you for if your fence gets damaged by a covered peril.

However, if your property happens to come with a lot of detached structures—or very expensive ones (hello to you, fancy hot tub, 7 gazebos, and beautiful 70 feet architect-designed pool)— you’re in luck. Lemonade offers the option to upgrade your Coverage B to 30% of your Coverage A. In the previous example, that means you could be reimbursed up to $90,000 for damage to your fence or other detached structure.

In all cases, keep in mind that you’d be responsible for your deductible before receiving any additional claim compensation. That means if your fence damage is minor, and the costs are less than your deductible, you’d be responsible for handling them out-of-pocket.

Before we go…

Now that you’re a pro when it comes to fences and homeowners insurance, why not take a few quick minutes to get a homeowners quote from Lemonade?

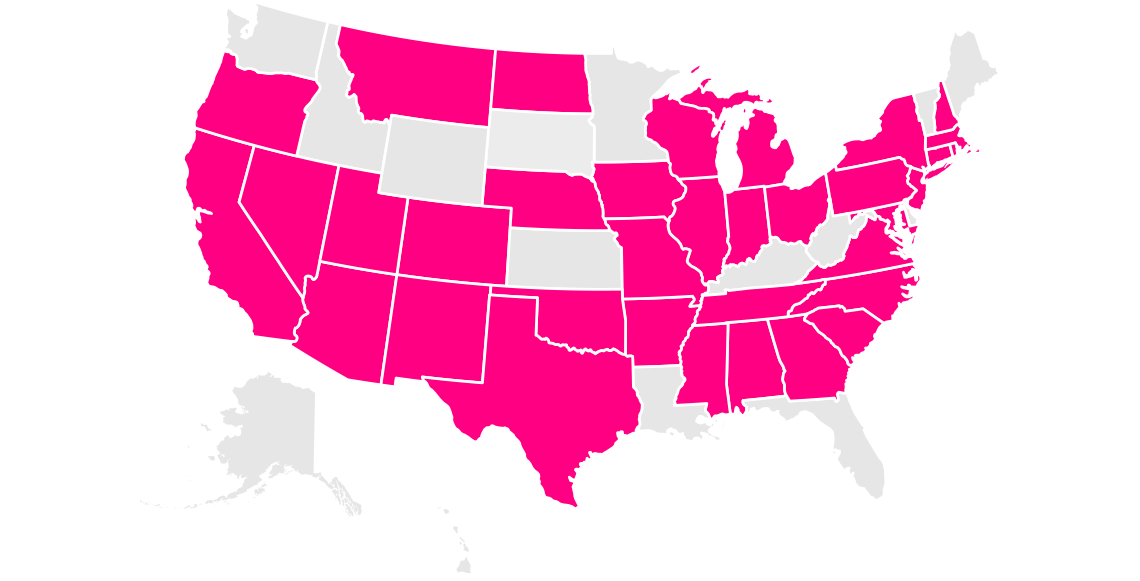

Which states currently offer homeowners insurance?

Arizona, California, Colorado, Connecticut, Georgia, Illinois, Indiana, Iowa, Maryland, Massachusetts, Michigan, Missouri, Nevada, New Jersey, New York, Ohio, Oklahoma, Oregon, Pennsylvania, Tennessee, Texas, Virginia, Washington, D.C. (not a state…yet), and Wisconsin.

A few quick words, because we <3 our lawyers: This post is general in nature, and any statement in it doesn’t alter the terms, conditions, exclusions, or limitations of policies issued by Lemonade, which differ according to your state of residence. You’re encouraged to discuss your specific circumstances with your own professional advisors. The purpose of this post is merely to provide you with info and insights you can use to make such discussions more productive! Naturally, all comments by, or references to, third parties represent their own views, and Lemonade assumes no responsibility for them. Coverage and discounts may not be available in all states.