Asking if homeowners insurance is required is sort of like asking whether applying sunscreen is required.

Turns out, homeowners insurance isn’t required by law. But just like buying sunscreen, it may help you avoid a helluva lot of trouble in the long term.

Whether you’re thinking of buying a house, or you’re already in the process, homeowners insurance is definitely a term you’ll come across. That home you’re purchasing will be one of the most valuable assets you’ll ever own (unless you’re Mr. Monopoly). Homeowners insurance will protect that asset, and in the long term, it will protect you too (just like sunscreen!).

Is homeowners insurance required by law?

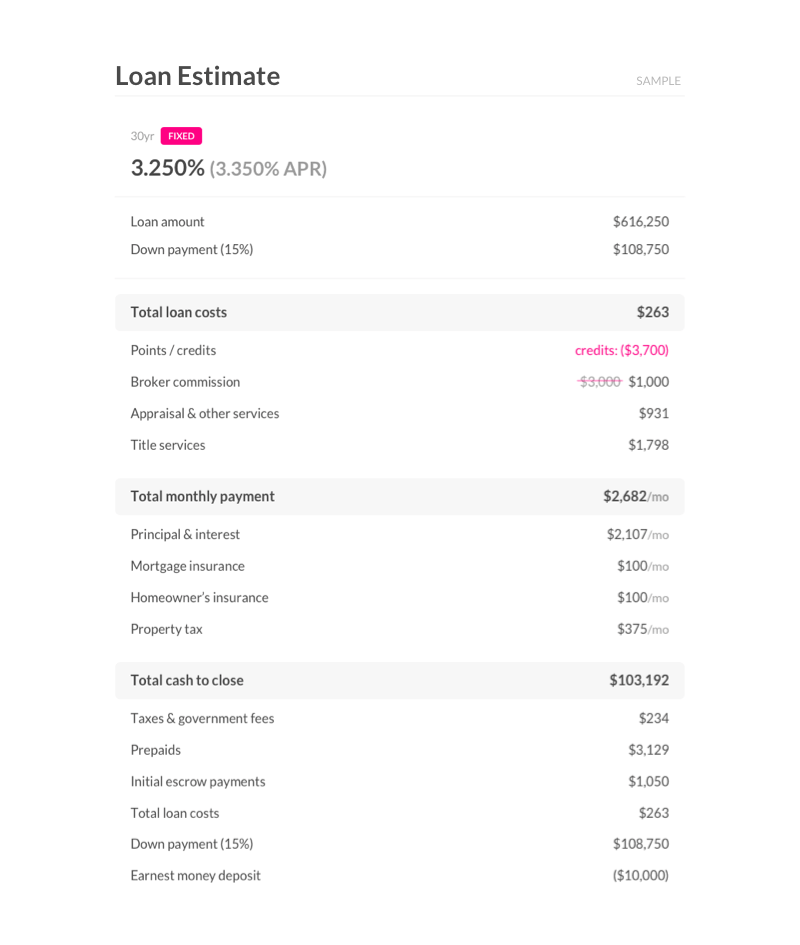

Unlike car insurance, which is required by law, homeowners insurance is not. However (and this is a pretty big however), most mortgage lenders will require some basic form of homeowners insurance.

Think of it this way: your mortgage lender is kind of a joint homeowner with you. It’s in their best interest to keep your home in tip-top shape – kind of like a very responsible business partner!

Your mortgage lender will make sure that if the worst happens to your joint asset, you’ll have the funds to take care of it. Because if you don’t, you’d have little to no mortgage value, and you’d both lose your asset.

Do I need homeowners insurance?

Even if you are Mr. Monopoly and you purchased your home outright (with cash) you’ll still want to invest in some homeowners insurance. Why, you ask?

1. Home insurance protects your house

You’ve gone through the trouble to finance your new home, so you might not have that same chunk of change readily available if the worst happens and you need to repair or rebuild.

So if a huge unexpected disaster takes place, like a fire or windstorm, you’ll save hundreds of thousands (or millions depending on your house size) on out-of-pocket expenses.

2. Home insurance protects your belongings

Homeowners insurance protects more than just your actual house. What about all of that valuable stuff you’ve spent so many years collecting?

Your stuff, aka your personal property, is also covered by homeowners insurance. It protects your precious valuables in case of theft, damage, or loss. It would be a major bummer if something valuable got stolen, but having the money to replace it would definitely soften the blow.

Better than that: Homeowners insurance protects your valuables even if they’re outside your home, like your laptop, bike, or phone.

3. Home insurance protects you from lawsuits

There’s always a chance a visitor could get hurt on your property, and if that injury leads to medical fees (aka bodily injury), you could be sued for damages. This type of coverage is called personal liability, and it’s really important to have.

4. Home insurance helps you sleep at night

Let’s be honest: when thinking about worst-case scenarios, our imagination can run wild, from natural disasters to an Oceans 11-style robbery. Homeowners insurance won’t necessarily stop bad things from happening, but it will put those monsters to bed by giving you the necessary protection and peace of mind that if and when they do, you’ll be able to handle it. You can learn more about the specifics of Lemonade home insurance coverage here.

In the end, homeowners insurance isn’t something you’ll feel forced to have – it will be something you’ll want to have. Homeowners insurance is the best financial defense against bad things that may happen in life, giving you much-needed peace of mind.

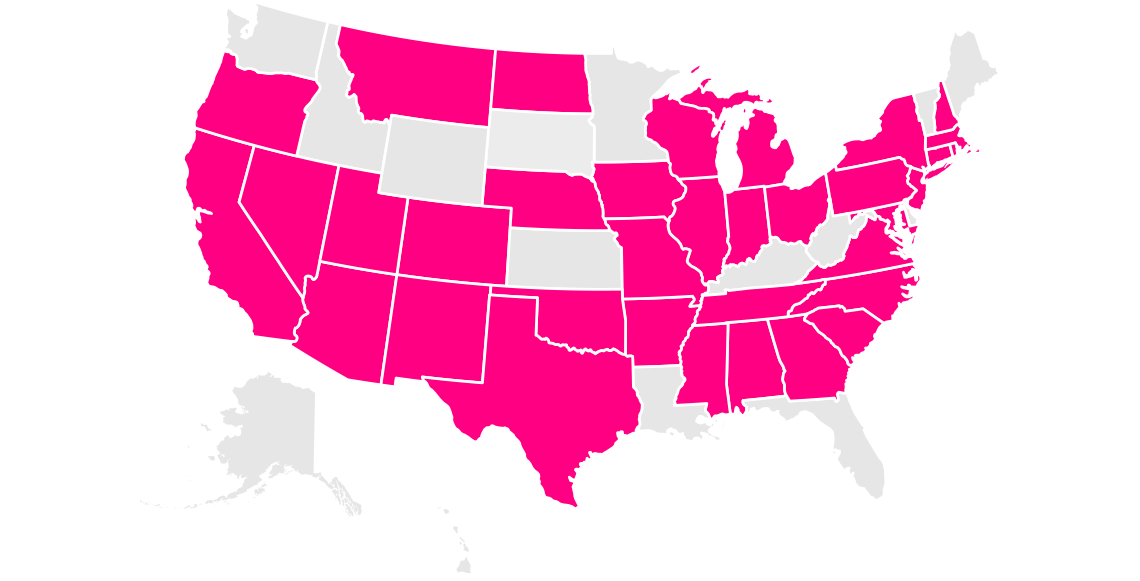

Which states currently offer homeowners insurance?

Arizona, California, Colorado, Connecticut, Georgia, Illinois, Indiana, Iowa, Maryland, Massachusetts, Michigan, Missouri, Nevada, New Jersey, New York, Ohio, Oklahoma, Oregon, Pennsylvania, Tennessee, Texas, Virginia, Washington, D.C. (not a state…yet), and Wisconsin.

A few quick words, because we <3 our lawyers: This post is general in nature, and any statement in it doesn’t alter the terms, conditions, exclusions, or limitations of the policies issued, which differ according to your state of residence. You’re encouraged to discuss your specific circumstances with your own professional advisors. The purpose of this post is merely to provide you with info and insights you can use to make such discussions more productive! Naturally, all comments by, or references to, third parties represent their own views, and Lemonade assumes no responsibility for them. Coverage may not be available in all states. Please note that statements about coverages, policy management, claims processes, Giveback, and customer support apply to policies underwritten by Lemonade Insurance Company or Metromile Insurance Company, a Lemonade company, sold by Lemonade Insurance Agency, LLC. The statements do not apply to policies underwritten by other carriers.