Landlord Insurance

Landlord insurance is a policy that covers property owners renting out their homes, condos, or apartments.

Landlord insurance is a policy that covers property owners renting out their homes, condos, or apartments.

For people who own their pads, there’s homeowners or condo insurance to protect themselves and their homes against the unexpected. Renters, for their part, can achieve peace of mind by purchasing renters insurance.

But those policies only apply to people who actually live in the property they’re insuring. What about people who own property but rent it out? Fortunately, there’s yet another type of home insurance: landlord insurance.

Lemonade offers landlord insurance to owners of condos and apartments in NY, IL, TX, PA, NJ, CA, GA and Washington, D.C., and policies start at approximately $25/month.

Landlord insurance is a policy that covers property owners renting out their homes, condos, or apartments.

Sometimes, first-time landlords assume their standard homeowners insurance will still be suitable once they start renting out their home — but this isn’t necessarily the case.

Homeowners insurance is intended to cover owner-occupied homes. That means when you’re renting out your home to someone else this coverage may no longer be suitable. The same goes for if you’re a renter subletting your place — any losses that occur while you’re outside your home won’t necessarily be covered.

Whether you need a landlord policy or homeowners insurance policy typically depends on whether or not you will be living there, and how often you plan on renting out your place.

For instance, if you’re only renting out a room within your home but you’re still living there, or if you’re only renting out your place occasionally — a homeowners policy might be enough.

However, if you intend to rent it out regularly, you’ll likely to need a landlord policy. It’s definitely worth checking with your insurance company if you plan to rent your apartment on a regular basis. It’s also a good idea to familiarize yourself with the basic differences between landlord and homeowners insurance.

Landlord insurance coverage comes with four basic levels of protection:

Btw, your liability protection will also cover you if you’re found responsible for another person’s property damage. For instance, if your leaking pipe causes damage to your neighbor’s property, your landlord insurance may have your back.

If you’re renting out a property you own, you can enhance your landlord insurance coverage with a few different add-ons.

For instance, condo landlords insured with Lemonade can purchase Equipment Breakdown Coverage (EBC) for a small monthly fee. EBC comes with a flat $500 deductible. It covers things like landlord-owned appliances and electronics against occurrences not covered by a standard insurance policy, including electrical failure or mechanical breakdown.

And while most insurance policies won’t cover water backup or earthquakes, Lemonade offers water backup as a landlord endorsement.

While landlord insurance provides important protections for your structure, your furnishings and lost rental income, you’ll find certain things are excluded from your policy, including:

1. Equipment and maintenance breakdowns: If equipment like the AC or dishwasher breaks down, you’ll likely have to pay out-of-pocket for the repairs, and the same goes for any maintenance costs. If you purchase EBC, however, you’ll be able to file a claim for damages that wouldn’t be covered by your base policy.

2. Your tenants’ personal property: Rental house insurance won’t help cover your tenants’ personal possessions, such as clothing or electronics. For that, your tenants will have to purchase their own renters insurance policy. Here’s why you should ask your renters to get their own insurance.

3. Floods, earthquakes and water backup: Similar to most homeowners insurance policies, landlord insurance won’t automatically cover floods, earthquakes or water backups.

| Coverage Type | Included with Standard Landlord Insurance Policy? |

|---|---|

| Dwelling | Yes |

| Property damage | Yes |

| Loss of use | Yes |

| Liability protection | Yes |

| Flood Insurance | No |

| Earthquakes | No |

| Water backup | No |

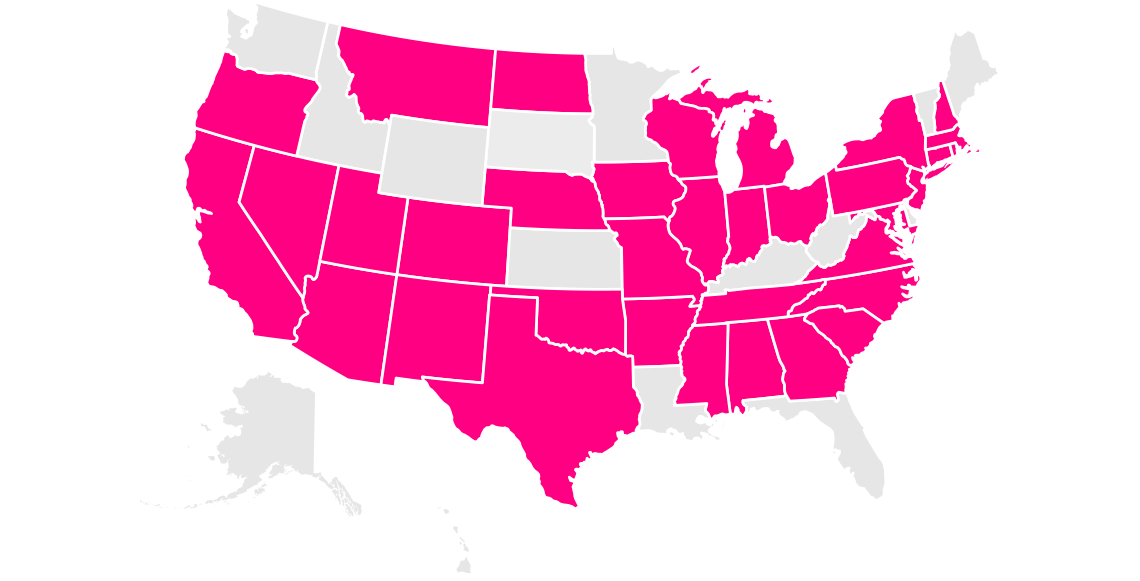

Lemonade’s landlord insurance is available to owners of condos and apartments in NY, IL, TX, PA, NJ, CA, GA, and Washington, D.C., and starts at approximately $25/month.

The price of landlord insurance differs depending on your home size, location, and cost to repair or rebuild. The security measures you have in place, like burglar alarms, or motion sensors, may also influence the cost of your landlord insurance policy.

Generally, rental property insurance is slightly more expensive than a homeowners insurance policy. Think about it this way — if you’re making money on your rental property, that’s your business and you’ll want to take every measure to protect it.

Landlords know their tenants need renters insurance, but exactly how much do they need? Renters insurance will come with its own set of coverage limits, for instance with Lemonade, Personal Property coverage starts at $10,000 and goes up until $100,000. Personal Liability coverage starts at $100,000 and goes up to $500,000.

In the worst case scenario, how much would it cost to replace their personal belongings? If a tenant has some high-ticket personal items, like jewelry, bikes or cameras they may need to purchase some extra coverage. Renters should pick an amount based on their own personal circumstances.

While we’re on the subject, here’s what you and your tenants should know about the differences between renters insurance and landlord insurance.

Arizona, California, Colorado, Connecticut, Georgia, Illinois, Indiana, Iowa, Maryland, Massachusetts, Michigan, Missouri, Nevada, New Jersey, New York, Ohio, Oklahoma, Oregon, Pennsylvania, Tennessee, Texas, Virginia, Washington, D.C. (not a state…yet), and Wisconsin.

A few quick words, because we <3 our lawyers: This post is general in nature, and any statement in it doesn’t alter the terms, conditions, exclusions, or limitations of policies issued by Lemonade, which differ according to your state of residence. You’re encouraged to discuss your specific circumstances with your own professional advisors. The purpose of this post is merely to provide you with info and insights you can use to make such discussions more productive! Naturally, all comments by, or references to, third parties represent their own views, and Lemonade assumes no responsibility for them. Coverage and discounts may not be available in all states.

Please note: Lemonade articles and other editorial content are meant for educational purposes only, and should not be relied upon instead of professional legal, insurance or financial advice. The content of these educational articles does not alter the terms, conditions, exclusions, or limitations of policies issued by Lemonade, which differ according to your state of residence. While we regularly review previously published content to ensure it is accurate and up-to-date, there may be instances in which legal conditions or policy details have changed since publication. Any hypothetical examples used in Lemonade editorial content are purely expositional. Hypothetical examples do not alter or bind Lemonade to any application of your insurance policy to the particular facts and circumstances of any actual claim.