No matter where you are in the home buying journey, we bet you’re at least a little familiar with home insurance, but you may not know that it will cost you about $2,151 each year on average. Buying a house is no picnic, and getting homeowners insurance is a must for peace of mind as a homebuyer, but also for meeting your mortgage lenders’ requirements.

Homeowners insurance is different from renters insurance. Think of it this way: you now own your own walls, so naturally, a home insurance policy will cost more than a renters.

But don’t get too worked up about the cost of your insurance just yet. The final price of your premium will depend on a whole host of factors.

What is the average cost of homeowners insurance?

Nationwide, the average homeowners insurance premium is $2,151 annually, or approximately $179 a month, according to the most recent report by Value Penguin.

Of course, average premiums can vary widely depending on where you live, ranging from a low of $717 in Delaware to $3,119 in Oklahoma.

Lemonade homeowners insurance policies start at as low as $25/month. However, your personalized price depends on a variety of factors, including:

- Your deductible

- The age of your building

- Your chosen coverage amounts

- Your location

Average homeowners insurance cost by state

Here’s a breakdown of the average annual home insurance cost by state, via Value Penguin:

| Rank | State | Average annual home insurance cost | Average monthly home insurance cost | Percent difference from national average |

|---|---|---|---|---|

| 1 | Oklahoma | $3,119 | $260 | +45% |

| 2 | Nebraska | $2,961 | $247 | +38% |

| 3 | Kansas | $2,505 | $209 | +16% |

| 4 | Colorado | $2,339 | $195 | +9% |

| 5 | Texas | $2,317 | $193 | +8% |

| 6 | Arkansas | $2,197 | $183 | +2% |

| 7 | Florida | $2,185 | $182 | +2% |

| 8 | Missouri | $2,018 | $168 | -6% |

| 9 | Louisiana | $2,014 | $168 | -6% |

| 10 | Tennessee | $1,961 | $163 | -9% |

| 11 | Mississippi | $1,916 | $160 | -11% |

| 12 | Kentucky | $1,855 | $155 | -14% |

| 13 | Alabama | $1,831 | $153 | -15% |

| 14 | Montana | $1,753 | $146 | -18% |

| 15 | South Dakota | $1,710 | $143 | -21% |

| 16 | New Mexico | $1,608 | $134 | -25% |

| 17 | North Dakota | $1,593 | $133 | -26% |

| 18 | Connecticut | $1,539 | $128 | -28% |

| 19 | Illinois | $1,498 | $125 | -30% |

| 20 | North Carolina | $1,497 | $125 | -30% |

| 21 | Georgia | $1,483 | $124 | -31% |

| 22 | Minnesota | $1,483 | $124 | -31% |

| 23 | Indiana | $1,474 | $123 | -31% |

| 24 | South Carolina | $1,466 | $122 | -32% |

| 25 | Iowa | $1,428 | $119 | -34% |

| 26 | Arizona | $1,403 | $117 | -35% |

| 27 | Maryland | $1,383 | $115 | -36% |

| 28 | Massachusetts | $1,366 | $114 | -36% |

| 29 | West Virginia | $1,216 | $101 | -43% |

| 30 | Wyoming | $1,208 | $101 | -44% |

| 31 | Rhode Island | $1,204 | $100 | -44% |

| 32 | California | $1,201 | $100 | -44% |

| 33 | Michigan | $1,153 | $96 | -46% |

| 34 | Washington | $1,102 | $92 | -49% |

| 35 | Washington, DC | $1,089 | $91 | -49% |

| 36 | Virginia | $1,058 | $88 | -51% |

| 37 | New Jersey | $1,043 | $87 | -51% |

| 38 | Ohio | $1,016 | $85 | -53% |

| 39 | Alaska | $1,011 | $84 | -53% |

| 40 | Idaho | $989 | $82 | -54% |

| 41 | New York | $969 | $81 | -55% |

| 42 | Nevada | $965 | $80 | -55% |

| 43 | Oregon | $901 | $75 | -58% |

| 44 | Wisconsin | $895 | $75 | -58% |

| 45 | Pennsylvania | $832 | $69 | -61% |

| 46 | Utah | $803 | $67 | -63% |

| 47 | Delaware | $717 | $60 | -67% |

| 48 | New Hampshire | $717 | $60 | -67% |

| 49 | Maine | $624 | $52 | -71% |

| 50 | Vermont | $618 | $52 | -71% |

| 51 | Hawaii | $370 | $31 | -83% |

What factors impact your homeowners insurance rates?

The price of your insurance can vary significantly, depending on factors like your home’s condition, location, deductible, and the amount of coverage you need. Building costs, inflation, and local climate trends also play a big role in determining your home insurance costs. Let’s dig a bit deeper into this.

Here are 5 factors that can determine what you’ll pay your insurer for your home insurance policy:

1. Your state

Homeowners insurance differs from state to state. States with a higher chance of natural disasters generally have higher premiums than states that don’t. For example, Louisiana, Texas, Florida, Oklahoma, Kansas, Mississippi, and Rhode Island have the highest premium for homeowners insurance. It’s no coincidence that Florida, Texas, and Louisiana are coastal states and can encounter some pretty crazy storms, and Oklahoma and Kansas are bang in the middle of Tornado Alley.

The states with the cheapest insurance rates are, (with the exception of Wisconsin) in the west, where natural disasters like hurricanes, windstorms, tornadoes, and hail are generally less frequent. Hawaii, Vermont, Utah, New Hampshire, and Nevada have some of the lowest home insurance rates.

2. Condition of your home

The condition of your home will impact your Lemonade homeowners insurance premium. For instance, how old is the house you live in? When was the last time the roof was replaced? What kind of renovations has it been through? Those pre-war hardwood floors may be your favorite thing about your home, but are the pipes as old as the carpentry? The older your house is, the more prone it is to damage. So older homes = higher premiums.

3. Your deductible

An insurance deductible is the amount of money you choose when purchasing a home insurance policy that will be subtracted from any future claims payouts. So if a fire destroyed a part of the structure of your home costing $30,000 and your deductible was $1,000, your insurance company would pay you $29,000. Think of a deductible as your participation in the damage or loss. You’re saying, “I commit X dollars to any claim, and my insurance company will cover the rest.”

With a higher deductible, you’ll pay a lower premium. But keep in mind that in the event of a claim, a higher deductible also means you’ll pay a lot more out of pocket before your insurer chips in. Different people have different preferences – you’ll have to decide what’s right for you at the end of the day.

4. Your zip code

Not only will your state come into play when it comes to your insurance premium, but also your address. For instance, if your home is close to a Class 1 fire department, or you live in a gated community, you’ll pay a lower premium. On the other hand, if your home is in an area that has a higher crime rate, your premium will go up.

5. The amount of coverage you choose

The amount of coverage you choose in each category—like dwelling coverage, personal property, and more—has an impact on the final price of your premium. Here’s a handy guide to finding out how much coverage you need.

How to save on homeowners insurance

If this is your first time buying a home, you might not have factored in the price of homeowners insurance into your monthly payments. In which case, you might be looking for ways to bring your premium down slightly.

- Bundling different Lemonade policies together can unlock savings and discounts—for instance, you could combine homeowners and car insurance, or homeowners and pet health insurance.

- Your home doesn’t need to be ‘smart’ in order to install some devices that will help to lower your insurance premium. Start with a standard fire alarm and burglar alarm, and you’ve already lowered your risks. And lowered risks equals lowered premiums.

- If where you live is closer to potential bad weather, check with your insurance company what sort of reinforcements you can add to make your home more weather-proof. For instance, you may be able to save money on your premiums by adding storm shutters or adding laminated glass windows. You could also replace your heating, plumbing, and electrical systems to cut down the risk of fire and water damage.

- Lemonade has its own ‘Get Discounts Now’ feature where you can help lower your premium price by answering a series of questions about your home’s characteristics and safety measures like home renovations, or whether you live in a gated community.

- Lastly, if you want your premium to go down, you can increase your deductible. The higher you’ll pay on your deductible the lower you’ll pay on your premium and vice versa.

Find peace of mind

Poring over a homeowners policy can be a headache, but working with a tech-savvy insurance company like Lemonade can make things simple and straightforward. Using AI and chatbots, Lemonade has made buying policies and paying insurance claims a walk in the park. The seamless experience also includes sending your home insurance quote to your lender, so you don’t have to worry yourself with the never-ending back and forth.

The @Lemonade_Inc product team should win every award out there. Just got my homeowners insurance in < 5min. Easiest part of buying a new home by far.

— Michael Wieder (@mwieder) January 14, 2020

Purchasing a new home will be one of the most expensive and important decisions of your life, and making sure you have the right amount of coverage will give you the peace of mind you need to get on with your life—worry-free.

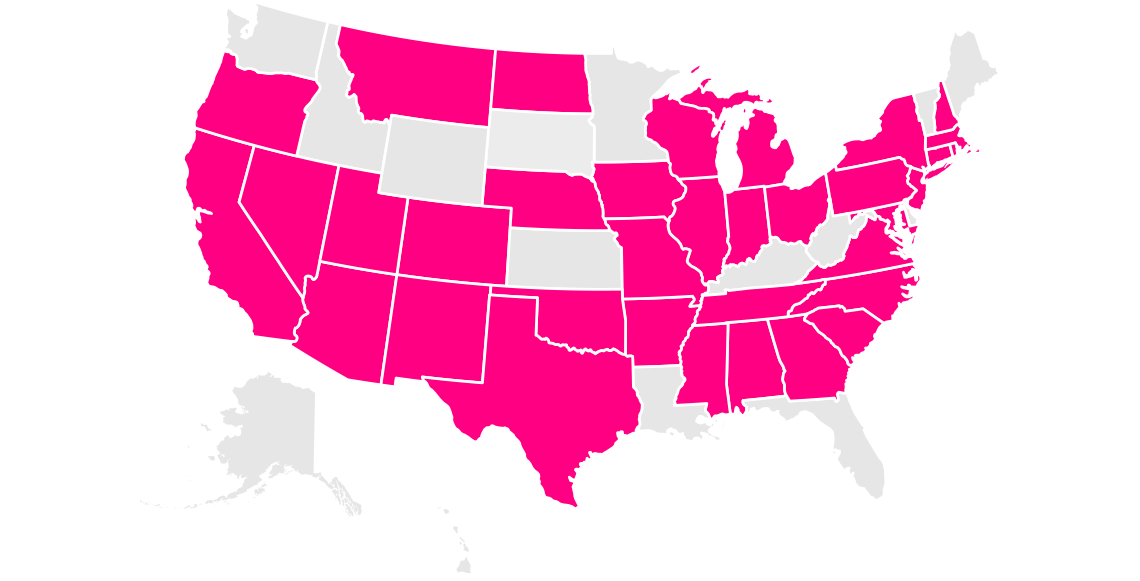

Which states currently offer Lemonade homeowners insurance?

Arizona, California, Colorado, Connecticut, Georgia, Illinois, Indiana, Iowa, Maryland, Massachusetts, Michigan, Missouri, Nevada, New Jersey, New York, Ohio, Oklahoma, Oregon, Pennsylvania, Tennessee, Texas, Virginia, Washington, D.C. (not a state…yet), and Wisconsin.

A few quick words, because we <3 our lawyers: This post is general in nature, and any statement in it doesn’t alter the terms, conditions, exclusions, or limitations of policies issued by Lemonade, which differ according to your state of residence. You’re encouraged to discuss your specific circumstances with your own professional advisors. The purpose of this post is merely to provide you with info and insights you can use to make such discussions more productive! Naturally, all comments by, or references to, third parties represent their own views, and Lemonade assumes no responsibility for them. Coverage and discounts may not be available in all states.