Homeowners insurance is a major part of buying a new home. After all, your home will be one of the most valuable assets you’ll ever own, and your homeowner insurance policy will protect that investment. It’s as simple as that.

But trying to understand home insurance quotes can sometimes feel like you’re drowning in a pool of documents, policies, and small print. Buying a new house is stressful enough—the last thing you need to deal with is the confusion of comparing homeowners insurance companies and rates.

People often make the mistake of shopping around for the cheapest homeowners insurance quotes, without comparing coverage options, limits, and deductibles.

When comparing homeowners insurance quotes, you may find ones that are cheaper than others, but don’t offer sufficient coverage to insure that precious heirloom you’ve just inherited. A shocking 3 out of 5 Americans are underinsured, but worst of all — they have no idea how much coverage they need, and are rudely awakened when things go pear-shaped.

Comparing quotes doesn’t need to be complicated. Ultimately, the right policy should be tailored to fit your needs as a homeowner.

It’s possible to wade through the insurance lingo and become a homeowners insurance aficionado.

What’s included in your homeowners insurance policy

Before diving into insurance quotes, you should first get acquainted with a typical homeowners policy so you can understand how much coverage you’ll get and how much coverage you’ll need. The average home insurance policy is split up into a bunch of different coverages areas.

1. Your house (dwelling)

Referred to as “dwelling coverage,” this protects you from damages to your place (your home and everything attached to it, such as a garage, chimney, in-ground pool, etc.).

2. Other structures on your property

Things like your driveway, fences, sheds, and so-called ‘other structures‘ that are located your property are also covered by homeowners insurance.

3. Your stuff (aka personal property)

Personal property refers to coverage for your personal belongings, whether that’s a computer or a bicycle.

Your household insurance has your back whether your stuff is at home or anywhere else. So you’re covered if your shed burns down with a bunch of power tools inside of it—but also if your laptop gets stolen while you’re traveling.

Take note: there may be limits on certain valuable things like jewelry and artwork: make sure to add Extra Coverage (aka “schedule your personal property,” as we say in the biz) when buying your policy.

4. Additional living expenses

Say your place becomes uninhabitable because of a kitchen fire or mandatory evacuation. What then? Well, this situation is covered under something called “loss of use,” and your insurer may need to pay for a temporary place for you to stay and some basic living expenses such as food, laundry, parking, etc.

5. Personal liability

Personal liability refers to damages to others that you’re responsible for. If someone gets injured on your property and it’s your fault, or you cause property damage to someone else’s stuff, your insurance company should have you covered. Just to be 100% clear: we’re only talking about unintentional damage here.

Btw, homeowners insurance only covers personal injury to others, not to yourself or others covered under your policy.

6. Medical fees to others

While personal liability or liability insurance kicks in if you get sued, medical payments kick in even if you’re not sued —they’re a quick way to settle in the case of small injuries.

Home insurance doesn’t cover your own medical bills (that’s what health insurance is for!). But it does help cover injuries sustained by guests who may have gotten injured at your summer BBQ, or people you may have accidentally injured outside of your home as well

Decide how much coverage you need

Set your ‘dwelling coverage’ to the amount you estimate it would cost to rebuild your home (as it is now, and without including the land value). So if you expect your home would cost $200,000 to rebuild, make sure not to choose coverage any lower than that, so you won’t need to pay out-of-pocket if the worst happens.

And when it comes time to choosing your personal property coverage, take an inventory of what you own to figure out how much your stuff is worth.

If you’re not sure how much homeowners insurance coverage you really need, check out this guide.

Extra Coverage

You’ll want to get Extra Coverage to properly insure expensive items like camera, jewelry, bikes, musical instruments, or fine art. FYI, Extra Coverage is also referred to as ‘scheduling personal property’ or ‘scheduling personal property coverage’.

Add-ons

When comparing home insurance quotes, look at the additional types of insurance coverage that aren’t offered as part of your basic insurance policy. For example, a basic policy will not cover you for earthquakes, so if you live in an earthquake-prone zone, you’re going to want to purchase an earthquake insurance add-on. Same goes for flood insurance. When comparing insurance providers, keep your add-ons top of mind. Consider add ons like Equipment Breakdown Coverage and Buried Utilities which for a small amount will really enhance your policy.

How to lower the cost of my homeowners insurance?

There are a few things that can lower the cost of your homeowners insurance premium. For example, if you have a burglar alarm system, smoke detectors, fire extinguishers, sprinklers, deadbolts, wind protection, water or temperature alerts, or a central station reporting alarm, these can all help lower the price of your policy.

Another method to lower your cost is to increase your deductible, or decrease your coverages. But it’s important to have an adequate amount of coverage, so you won’t ever have to pay out-of-pocket if the absolute worst happens to your home or stuff.

An insurance deductible is an amount you choose that will be subtracted from any future claims payouts. If you select a low deductible your premium might go up, and vice versa.

How do claims work?

If disaster strikes, how will your insurance company handle your claim? When comparing quotes, make sure you dig into each company’s claims process.

This is where it gets interesting. Traditionally, if you had home insurance coverage and you needed to make an insurance claim, you’d have to get in contact with your insurance company, listen to hold music for about 20 minutes, and answer a whole host of questions. Then your insurance company might try hard to find reasons to deny your claim. After all, that money could have gone straight into their pockets.

That’s where Lemonade is different. We take a flat fee from your insurance premium, use the rest to pay claims, and give back what’s left to causes you care about. We gain nothing by delaying or denying claims.

This also impacts loss cost. While AI Maya is the helpful bot who gets your policy off the ground, AI Jim is the one who handles, investigates, and settles claims. He saves our Claims Experience Team 58,246 hours per year by using anti-fraud algorithms, claim data aggregation, and instant claims.

Customer satisfaction

With traditional insurance carriers, you might get some one-on-one attention either in-person from an insurance agent or over the phone, but it’s unlikely they’ll give you a quote on the spot. You’ll also have stacks of paperwork to sign.

Lemonade relies on tech and AI to change the field, but that doesn’t mean we’ve forgotten how important a human touch is. While AI Maya expertly handles more than a quarter of all basic customer inquiries, we know the value of personalized interactions. Because Maya takes care of the small tasks, it frees up our (human) support team to help with particularly complicated insurance questions, like how to replace a lost engagement ring.

Get the details and then decide

When comparing homeowners insurance rates, compare each and every policy detail before making a decision, including deductibles, add-ons, and coverage limits. Sure, price is important, but there’s no point in purchasing a cheap policy that doesn’t offer you peace of mind.

In our extremely unbiased opinion, we think that Lemonade would be a great fit—but don’t just take our word for it. Play the field, get quotes from a few different companies, and then you’ll be ready to make a confident choice.

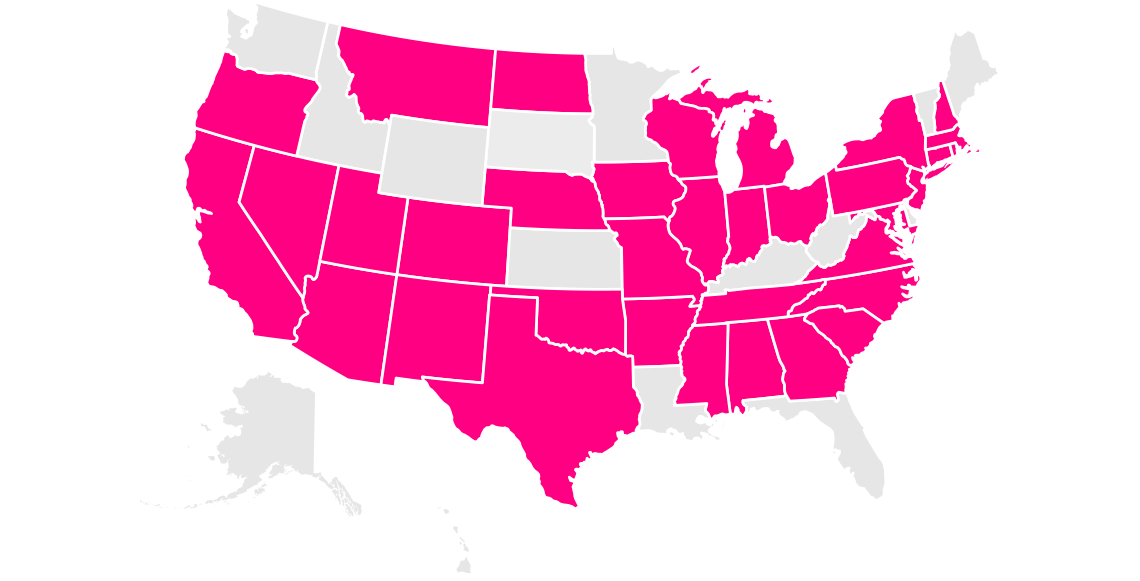

Which states currently offer homeowners insurance?

Arizona, California, Colorado, Connecticut, Georgia, Illinois, Indiana, Iowa, Maryland, Massachusetts, Michigan, Missouri, Nevada, New Jersey, New York, Ohio, Oklahoma, Oregon, Pennsylvania, Tennessee, Texas, Virginia, Washington, D.C. (not a state…yet), and Wisconsin.

Click below if you’re ready to get your free quote from Lemonade.

A few quick words, because we <3 our lawyers: This post is general in nature, and any statement in it doesn’t alter the terms, conditions, exclusions, or limitations of policies issued by Lemonade, which differ according to your state of residence. You’re encouraged to discuss your specific circumstances with your own professional advisors. The purpose of this post is merely to provide you with info and insights you can use to make such discussions more productive! Naturally, all comments by, or references to, third parties represent their own views, and Lemonade assumes no responsibility for them. Coverage and discounts may not be available in all states.