- Does renters insurance coverjewelry?

- Jewelry sublimits

- Protecting your jewelry with Extra Coverage

- Who needs jewelry insurance?

- Who’s covered by jewelry insurance?

- What types of jewelry are covered?

- How much does jewelry insurance cost?

- Is it worth it to get Extra Coverage for my jewelry?

- How do I add jewelry to my policy?

- How do I get a jewelry appraisal?

- How do I file a claim for my jewelry?

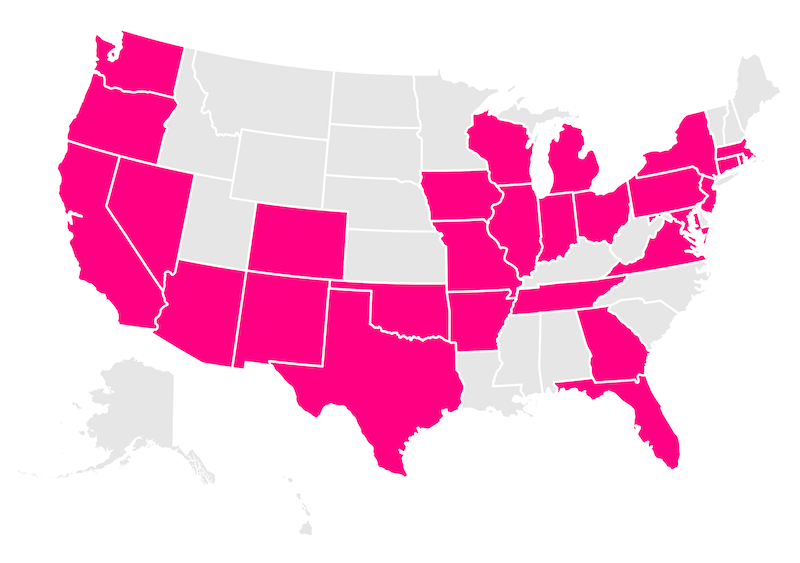

- In which states does Lemonade currently offer renters insurance?

- FAQs

A standard renters insurance policy covers jewelry theft up to $1,500. And your policy could protect your jewelry up to its full replacement value for other unfortunate scenarios, like fire damage and water damage.

However, if you want to ensure that an individual piece of pricey jewelry is fully covered in every situation, you’ll need to schedule it for additional coverage. Purchasing Extra Coverage for your high-value bling means that if it gets lost, stolen, or damaged, you can get it replaced, without paying a deductible.

- A standard Lemonade renters insurance policy covers your jewelry for theft (at home or away from home), up to a $1,500 sublimit. For other unfortunate scenarios, like fire damage or water damage, your jewelry could be protected up to its full replacement value.

- You can purchase Extra Coverage for individual, high-ticket items, like your engagement ring, to cover them for their full replacement value.

- Extra Coverage also protects against additional damages, including accidental damage and mysterious loss.

- Extra Coverage does not cover your jewelry for general wear and tear.

Does renters insurance cover jewelry?

There are a few different ways you can cover your jewelry under your renters insurance policy.

The first way to cover your jewels is through a standard renters insurance policy.

Whether you’re looking to protect your splashy new Rolex, a bracelet you inherited from your grandmother, or any of your other precious gems, your standard renters policy has you covered.

Your policy can help reimburse you if your jewelry (or anything else) is lost or damaged due to theft, vandalism, fire, a windstorm, or 12 other bad events (aka, ‘perils,’ in insurance speak). Plus, your policy covers your jewelry wherever you flaunt it. So if your ring is stolen at the gym, or your earring collection is damaged in an apartment fire, your renters insurance can help ease the financial burden of replacing it.

What your standard renters policy covers

Your diamond necklace isn’t likely to be destroyed by an aircraft, but isn’t it nice to know that it could be? Here’s a comprehensive list of covered perils:

| Fire or lightning | Vandalism | Explosions |

| Freezing | Theft | Smoke |

| Windstorm or hail | Damage by aircraft | Damage by vehicle |

| Sudden, accidental tearing or cracking | Sudden, accidental water overflow | Damage by short-circuit |

| Falling objects | Riots and civil unrest | Weight of ice, snow, or sleet |

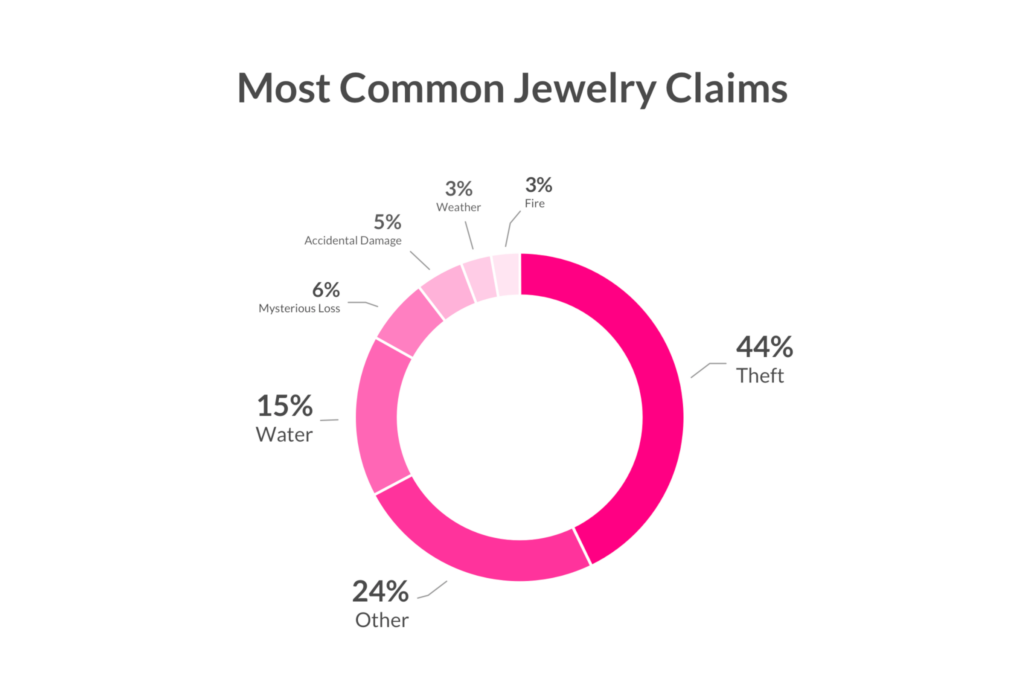

What peril should you be the most concerned about? According to our claims data, theft is by far the most common thing to befall your gems, accounting for 44% of total jewelry claims.

What your standard renters policy does not cover

While your policy has your back for many sudden and accidental events, it still excludes several scenarios, including basic wear and tear. So if your watch face gets scratched up, your policy can’t help you out.

Same goes for redipping your bling: If your favorite bracelet doesn’t sparkle like it used to, or your cufflinks have dulled, your policy doesn’t cover a fresh polish.

Jewelry sublimits

If you file a claim for stolen jewelry, your Lemonade policy can only pay you a maximum of $1,500 under your standard policy (this is called a ‘sublimit’ or ‘coverage limit,’ in insurance speak).

You may not think your jewelry collection is worth much, but it adds up. Imagine you have two gold necklaces, an old charm bracelet, your Grandpa’s class ring, and a set of diamond studs. Individually, these items may cost less than $1,500—but if your entirely jewelry box is stolen, your insurer can only pay you $1,500, and you’ll have to pay out-of-pocket to replace the rest.

Why? Insurance companies don’t assume you own expensive things, because they don’t want to charge you for coverage you don’t need. And when you get your policy, you can usually choose a deductible between $250 to $2,500. If your insurer approves your jewelry claim, they’ll subtract that fixed amount from your payout. But here’s the good news: Your deductible kicks in before the $1,500 sublimit.

Protecting your jewelry with Extra Coverage

What’s Extra Coverage? It’s additional insurance coverage for extra special items—like your jewelry, camera, fine art, musical instruments, or bikes—that you can add on to your homeowners or renters insurance policy. (Other words for this are ‘jewelry floater’ or ‘scheduled personal property coverage.’)

What puts the ‘Extra’ in Extra Coverage? First off, it covers the full worth of your jewelry, deductible-free! So if your $10k engagement ring were swiped, your insurer would reimburse you for its full replacement cost if you had protected it with Extra Coverage.

An Extra Coverage endorsement also covers two additional perils: Accidental damage and mysterious disappearance. So if your favorite necklace mysteriously disappears from your vanity, you’re not covered by renters or home insurance unless you have purchased Extra Coverage.

To get Extra Coverage, you need to add (aka, ‘schedule’) each individual piece of jewelry you’d like to insure—it just has to be more than $350 to qualify.

Here’s a handy chart that compares jewelry coverage between a standard Lemonade Renters policy and our Extra Coverage endorsement.

| Lemonade Standard Policy | Lemonade Extra Coverage | |

|---|---|---|

| Accidental damage | No | Yes |

| Mysterious loss | No | Yes |

| Theft from your home | Yes | Yes |

| Theft outside of your home | Yes | Yes |

| Basic wear & tear | No | No |

| Deductible? | Yes | No |

Who needs jewelry insurance?

As we mentioned above, you’ll want to consider Extra Coverage if you own any high-ticket pieces that exceed $1,000. If you have an engagement ring, you should probably schedule it. Or, if you have, say, a $2,000 Art Deco cocktail ring plus a $3,000 strand of Tahitian pearls, you’d want to schedule each item individually.

But if you’re more of the costume jewelry type or still rocking some nostalgic faves from Claire’s, you’re probably okay with the jewelry coverage that’s already included in your standard policy.

Who’s covered by jewelry insurance?

Your standard renters policy covers you and your spouse.

So if an apartment fire destroyed all of your combined jewelry, your insurer could reimburse you for the full value of both of your collections, up to your personal property coverage limit. If you both have some expensive bling, though, Extra Coverage is the best way to make sure you’re getting enough coverage for everybody’s stuff.

But what about your roommate? While some of your shared items are covered, your roomie’s personal things aren’t, including her jewelry. We recommend that you each get your own policy, so you both have enough insurance coverage for your jewelry, and the rest of your stuff.

Or, what if you’ve just moved in with your significant other and want to protect all of your jewelry under one roof? Your policy doesn’t automatically cover them unless you’re officially married, or in a legally-recognized civil union. But no worries—you can add them as an ‘additional insured’ for an extra cost. If you go down this route, just keep in mind that it may be cheaper (and easier) for each of you to get your own policy.

What types of jewelry are covered?

With a standard renters policy or Extra Coverage, you’re covered for pretty much any type of jewelry. Here are some common examples of jewelry you could be covered for:

- Rings, including wedding and engagement rings

- Earrings

- Necklaces

- Watches

- Heirloom jewelry

How much does jewelry insurance cost?

Renters insurance prices are generally pretty affordable, and a standard Lemonade policy starts at just $5/month. However, your price will vary depending on several factors, including:

- Your state and zip code

- Your building’s age

- Your deductible

- How much coverage you have

- Whether you add on Extra Coverage

For example, if you live in a neighborhood with a low crime rate, your policy will be cheaper than if you live in a risk-prone area. That’s because you have a lower chance of your jewelry (or other stuff) being stolen.

And if you choose a low deductible or high coverage amount, or add Extra Coverage, your policy will be a bit pricier, because you’re taking on a higher risk.

Is it worth it to get Extra Coverage for my jewelry?

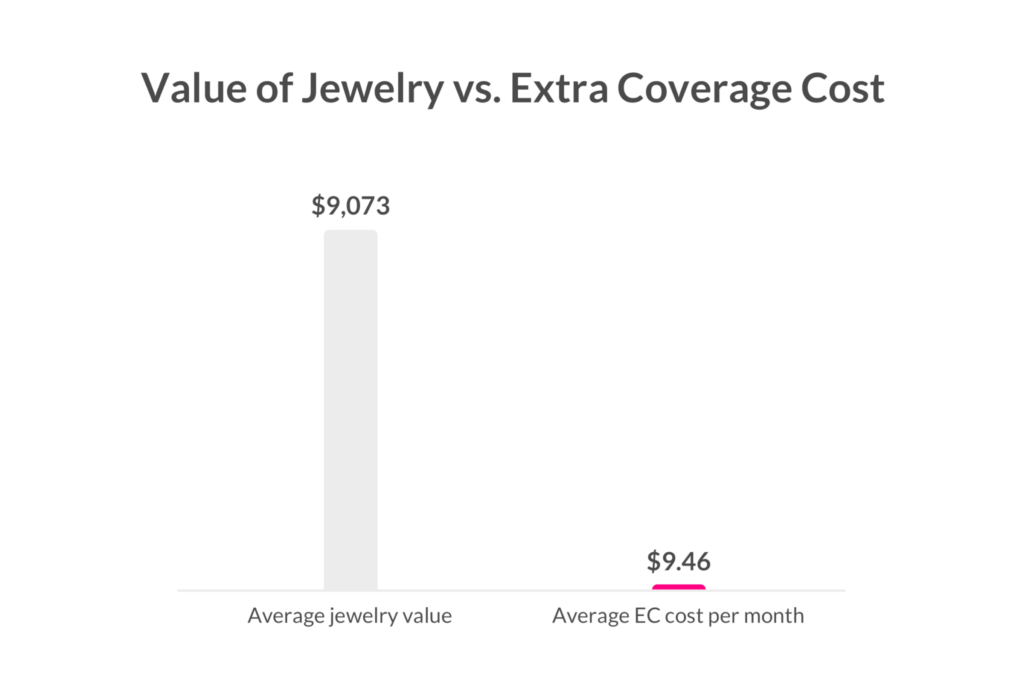

It really depends on how much you’re willing to pay out-of-pocket if you lose your high-ticket jewelry. The average cost to schedule jewelry at Lemonade is $9.46 per month, and the average value of scheduled jewelry is $9,037.

In other words, if you own a watch worth $5k, you’d likely pay around $5/month to avoid a $5,000 expense down the line. It’s up to you to decide whether that’s worth it!

How do I add jewelry to my policy?

If you don’t need Extra Coverage

With Lemonade, it takes less than 2 minutes!

Simply download the Lemonade app, answer a few questions about your home, and get insured in seconds.

If you need Extra Coverage

First things first: Figure out which pieces of jewelry you need Extra Coverage for.

Next, determine how much each piece of jewelry is worth. If you don’t want to know the value of your jewelry (because, say, your fiancé bought it for you), you can hand this process over to them, and provide your insurance company with their contact info. They’ll take it from here.

If you’ve owned your piece of jewelry for less than five years, you can simply provide a receipt. But if you’ve owned it for more than five years or don’t have the receipt, you’ll need to get a jewelry appraisal, which is a document that states how much your jewelry is worth.

This is an important step, since Extra Coverage pays you the full value of your item, and the value of jewelry tends to change over time. We lay out how to get an appraisal in the next section.

Once you have your receipts or appraisals ready, it’s go time. Just follow these steps to schedule your jewelry:

1. If you already have a Lemonade policy, skip to the next step. If you don’t have a policy, download the Lemonade app, tap ‘check prices,’ and answer AI Maya’s Q’s. Answer ‘yes’ when she asks if you own any valuable jewelry, cameras, bikes, or fine art worth more than $1,000 each.

2. In your quote or policy view on the Lemonade app, tap the Extra Coverage button under ‘Add-Ons,’ and indicate how much your jewelry is worth.

3. Open up the email you get from Maya, and click ‘Add Extra Coverage.’

4. Answer a few questions, and send over:

- A pic of your jewelry

- A pic of the appraisal/receipt

- A pic of your jewelry on top of the appraisal/receipt

5. Our Underwriting team will get back to you, and they’ll let you know the status of your request via email! You can always add more items later.

Btw, if you tell AI Maya you need Extra Coverage while getting a quote (see step #1 above), Lemonade will automatically grant you temporary Extra Coverage for 14 days, after your policy’s start date (aka, effective date).

This protects your items while you send over the necessary info, and our team reviews it.

If you can’t submit your info within 14 days, your temporary coverage will expire- but you can still add on the Extra Coverage afterwards. Take note that if you add Extra Coverage after you get a policy (aka, you answer ‘no’ when AI Maya asks if you have expensive items), this temporary coverage isn’t available.

How do I get a jewelry appraisal?

Like we said before, if you bought the piece of jewelry you want insured less than five years ago, a receipt is sufficient to get coverage. If you bought the piece more than five years ago, you’ll need to have it appraised by a professional.

Simply head to your local jeweler, and ask them for an appraisal on your jewelry that includes the:

- Name of insured (aka your name, or the name of the person on your policy who owns that piece of jewelry)

- Insured’s address

- Date of appraisal

- Value of the item

- Detailed description of the item

- Name and signature of the appraiser

- Appraiser’s info (address, phone number, and/or email address)

Btw, make sure your appraisal:

- Was created within the last 5 years (if not, you’ll need to get a new one)

- Is written in English

- Was completed in person (not online!)

How do I file a claim for my jewelry?

If something happens to your jewelry, filing a claim with Lemonade takes just a few minutes. Just follow these steps:

1. Open the Lemonade app on your phone. If you don’t have it, download it and sign in with the email you used when getting your Lemonade policy.

2. Hit the pink ‘claim’ button in the top right-hand corner.

3. Meet our claims expert, AI Jim. He’ll verify your contact info, and ask for more details about what happened.

4. Digitally sign a Pledge of Honor to verify everything you tell us about your claim is truthful and honest.

5. Explain exactly what happened in a short video recording. Pretend you’re talking to a friend, and let us know the details, such as when and where the incident happened.

6. Provide any relevant documents, such as a receipt (if you don’t have Extra Coverage), photos or records (if your jewelry was damaged), or a police report (if your jewelry was stolen).

7. Check to make sure all of the information is accurate in the full summary of the information you provided.

8. Enter your bank account information, so we know where to send the money if your claim is approved.

In which states does Lemonade currently offer renters insurance?

Arizona, Arkansas, California, Colorado, Connecticut, Florida, Georgia, Illinois, Indiana, Iowa, Maryland, Massachusetts, Michigan, Missouri, Nevada, New Jersey, New Mexico, New York, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, Tennessee, Texas, Utah, Virginia, Washington, Washington, D.C. (not a state… yet), and Wisconsin.

Keep on shining

Your gems are precious, and they deserve protection. With a standard Lemonade renters policy, you can protect your jewelry for a number of covered perils.

Getting a quote from Lemonade is quick, easy, and—dare we say it—even kind of fun. Or, if you already have a policy with us but want to add Extra Coverage, just head to the Lemonade app and select the Extra Coverage option under the ‘Add-ons’ header.

FAQs

Do I still need jewelry insurance if I have a safe home?

Yes–jewelry insurance protects you whether your valuables are stolen from home or while you’re out. And, in addition to protecting you from theft, jewelry insurance will cover you in other scenarios not covered by your regular renters policy, like mysterious loss and accidental damage.

Can I purchase jewelry insurance for something I give as a gift?

It depends on whom the recipient is–technically, the owner of the jewelry should be the same person on the policy. If you’re purchasing the item for your legal partner, then they would already be included on your policy as a named insured. However, if you give a piece of jewelry to someone other than your legal partner, you lose all insurable interest in that item as soon as you hand it over. In that case, the recipient would have to purchase their own policy for the item or be added to it as an additional insured if they live with the policyholder.

Is it better to insure my jewelry through my renters policy or through a stand-alone jewelry insurer?

It depends on the value of your jewelry and how much you want to protect it. Insuring your jewelry through an add-on to your renters policy is generally more cost-efficient; however, it offers you less protection than stand-alone jewelry providers, which often cover maintenance costs and general wear and tear in addition to loss and accidental damage. Specialty jewelry insurance providers also allow you to insure your jewelry at higher dollar amounts.

A few quick words, because we <3 our lawyers: This post is general in nature, and any statement in it doesn’t alter the terms, conditions, exclusions, or limitations of policies issued by Lemonade, which differ according to your state of residence. You’re encouraged to discuss your specific circumstances with your own professional advisors. The purpose of this post is merely to provide you with info and insights you can use to make such discussions more productive! Naturally, all comments by, or references to, third parties represent their own views, and Lemonade assumes no responsibility for them. Coverage and discounts may not be available in all states.