- Does renters & homeowners insurance cover cameras?

- Can I insure my camera gear or equipment?

- Can I insure my camera and gear as a professional photographer?

- Is it worth it to get a separate camera insurance policy?

- How much does it cost to insure a camera?

- How do I insure my camera?

- How much is my camera worth?

- Insure your camera in a snap!

- FAQs

Picture this: You trek to Antelope Canyon to capture its curvy red rocks with your DSLR camera. After snapping some shots, you head to a local coffee shop to sift through your photos. But when you reach to grab your camera, you realize it was snatched while you were ordering your latte. Ouch!

If the pain of losing your pictures wasn’t bad enough, you also need to buy yourself a new camera. But here’s the good news: You can get it insured through your renters insurance or homeowners policy, which can make this situation a little less painful.

Why? Turns out, your policy can insure your camera for a wide range of scenarios, from theft to accidental damage. Andrew Y., a Lemonader from Brooklyn, covered his Sony A7II and lenses with his Lemonade policy:

“Photography is my passion and outlet. It gives me a reason to go out and explore wherever I can. My camera helps me capture moments in a single frame, so I can go back and relive those moments in the future. I wanted to insure it so I can focus on getting the perfect shot.”

- Your standard renters or homeowners policy protects your camera against named perils like theft, fire, or vandalism.

- Extra Coverage for your camera can be added to cover scenarios like accidental damage or mysterious loss.

- To insure your camera with Extra Coverage, you will need to provide photos and receipts if available, in order to determine its value for coverage purposes. Coverage costs vary based on the equipment you want to protect and the cost of replacing it.

But does renters or homeowners insurance cover you if you break your lens? Or leave it on the subway? Or damage a camera you use professionally?

The truth is, camera coverage options can be confusing. To answer your most common coverage questions, we’ll take a deep dive into all things camera insurance.

What is camera insurance and what does it cover?

Camera insurance protects your camera plus photography equipment such as your flash or tripod from a variety of perils, including:

- Theft and vandalism

- Power surges caused by lightning

- Accidental damage – if you drop the camera and the lens cracks, or if you spill your coffee on it, this would be covered

But wait, do you really need to get separate coverage for your camera, or is it already covered by your existing policies.

Does renters & homeowners insurance cover cameras?

It sure does! If you want to insure your camera for theft, vandalism, fire, and other ‘named perils,’ it will automatically be covered under your base policy.

But if you also want to insure it against accidental damage (like cracks in your lens) and mysterious disappearance, you’ll need to get Extra Coverage (or ‘scheduled personal property coverage,’ in insurance speak).

What’s Extra Coverage? It’s additional coverage for your valuable items, such as your camera and equipment worth over $350, that offers extra perks, including:

- Coverage against accidental loss (aka, mysterious disappearance)

- Coverage against any accidental physical damage

- Zero deductible

So if your lens cracks or you leave it in a Lyft, your Extra Coverage may cover the cost to get your camera repaired or replaced. Plus, you won’t have to pay a deductible, so your insurance company can pay you the full replacement cost, deductible-free!

When we asked why he insured his camera, Peter G., a Lemonade renter from Brooklyn, NY, told us:

“I have quite valuable gear and love taking pictures of wildlife, so I want peace of mind knowing my gear will be covered in case of accidental damage or theft. That way, I can take pictures of mountain sunsets in the Alps, green turtles swimming at the bottom of the Red Sea, or polar bears in the Arctic, without worrying about my camera.”

Can I insure my camera gear or equipment?

You sure can! Any camera equipment you own—such as a tripod, remote shutter release, lens, or external flash—is automatically covered under your base home insurance policy for theft, fire, vandalism, etc.

But if you want to add Extra Coverage specifically for your camera body or lenses, you’ll need to schedule that separately. Please also note that you must have a camera body scheduled on the policy first, in order to add Extra Coverage for any lenses.

Josh W., a Product Designer at Lyft from San Francisco, got Extra Coverage on a few lenses in addition to his cameras:

“I carry a camera every day so I can document my life, take pictures of the beautiful city I live in, and take photos of my one-year-old son as he grows up. I have a photo blog I like to post to, and upload my photos to Unsplash to let people use them however they want.”

And Kristen L., a long-time Lemonade user, said:

“I dropped my camera while in Yosemite. I was glad I had Extra Coverage, but skeptical about whether Lemonade would actually ‘work.’ Well it did… and very well! It was easy to file my claim, easy to understand the process, and my claim was approved!”

Can I insure my camera and gear as a professional photographer?

If you use your camera professionally, it will be covered to a certain extent under your base homeowners or renters insurance policy. However, cameras that are used professionally, or for business—even once in a blue moon—are not eligible for Extra Coverage.

Most home and renters insurance policies can cover your professionally used camera and gear up to a set amount (in insurance speak, this is called a ‘sublimit’). If you’re at home, it will be covered up to $2,500, and if you’re outside your home, it will be covered up to $1,500.

Let’s say you have a Lemonade renters insurance policy with a $250 deductible. You’re away from home, taking portraits for an advertising campaign—so the sublimit to keep in mind is $1,500.

Someone sneaks into the photo studio and steals your $10,000 camera body. You file a claim. If it’s approved, you’d receive up to $1,500 for the camera body. However, if someone had only stolen a $1,000 lens from the studio, you’d receive only up to $750 for the lens (your deductible kicks in before the sublimit, in this case).

Take note that the camera you use professionally will only be covered for ‘named perils,’ including theft, windstorm, fire, vandalism, etc. You can’t get Extra Coverage if the camera is used for business purposes.

If you happen to own a photography business and need more robust insurance coverage for your professional camera, you may want to look into a business owners policy. It’s a commercial policy for freelance and small business owners.

In addition to insuring your professional camera and gear, you might consider adding some liability coverage into the mix. Photography liability insurance protects you in case your clients aren’t satisfied with your service, or if you damage others or their property while working.

But back to regular camera insurance.

Is it worth it to get a separate camera insurance policy?

The answer is: If you snap the odd pic just for fun or are a semi-professional photographer who’s already covered by a renters or homeowners policy, it’s probably not worthwhile to get additional coverage for your camera.

The only scenario in which additional protection might make sense is if you own very expensive business equipment which—as we’ve clarified before— doesn’t qualify for Extra Coverage or if you’d like to insure against additional scenarios such as the ones covered by photographer liability insurance.

How much does it cost to insure a camera?

The cost to insure your camera with renters or via different home insurance quotes depends on the type of coverage you get, how many you insure, and their value!

If you don’t get Extra Coverage for your camera, it will be covered under your basic personal property coverage.

Basic policies typically start with $10,000 worth of personal property coverage—meaning, if a fire destroyed your apartment and stuff, your insurance company could pay you a maximum amount of $10,000 to replace all of your stuff, such as your clothes, couch, laptop, phone, camera, etc.

If you think your stuff is worth more than $10,000 (which it probably is), you’ll want to increase your personal property coverage. Here’s a helpful guide to figuring out how much your stuff is worth.

Depending on your insurance company, increasing your personal property coverage will probably tack on a few dollars a month to your premium.

If you want to add Extra Coverage for your camera, it will probably cost a few more $$ per month, since it provides an extra suite of perks.

How much will it cost? It really depends on its value—it can cost anywhere from $2-$10/mo.

For Raghav M., a Lemonader from Newark, getting Extra Coverage didn’t add much:

“When I added my camera and lens to my Lemonade policy, it cost me $2.51 extra per month. Photography is my hobby and passion. Being able to have peace of mind and keep all of my equipment protected lets me shoot without worrying about my gear.”

How do I insure my camera?

Protecting your camera with Lemonade renters or homeowners insurance is easy!

If you aren’t looking to get Extra Coverage for it, all you need to do is get a basic insurance policy, which takes less than 2 minutes: Download the Lemonade app, answer a few questions about your home, and get insured in seconds.

And if you want to get Extra Coverage on your camera items, just follow these additional steps:

1. When getting your Lemonade policy, tap ‘Activate Extra Coverage.’ (If you already have a policy, head to Lemonade app and tap the Extra Coverage button under ‘Add-Ons.’)

2. Open up the email you get from Maya, and click ‘Add Extra Coverage’

3. Answer a few questions, and send over:

- A pic of your camera/gear

- A pic of the receipt

- A pic of your item on top of the receipt

Btw, if you don’t have a receipt, it’s no problem! Rachel E., one of Lemonade’s Customer Experience specialists, let us know that:

“You can send in a picture of the model and serial number on your camera along with a screenshot of a link online showing the current value of that same camera. This way, we can still determine its replacement value.”

4. Our Underwriting team will get back to you, and let you know the status of your request via email! Btw, you can always add more items later.

Take note that if you decide to add Extra Coverage when you get your policy, Lemonade will automatically grant you temporary EC for 14 days. This will give you time to send over the necessary info, and for our team to review it. If you can’t submit your info within 14 days, you can still add on the Extra Coverage yourself after it expires.

How much is my camera worth?

If you’re getting Extra Coverage for your camera, you’ll need to provide its exact worth.

The best way to figure out how much it’s worth is to check your camera’s original receipt. Lemonader Alex V. of Jersey City told us:

“When insuring my camera and lens, I pulled the receipts from my purchases to determine their value. I accessed my receipts via email, since all of my equipment was purchased online.”

Take note that Lemonade accepts receipts that are up to 5 years old. If you can’t find your receipt or bought your camera more than 5 years ago, your next best bet is Googling your camera’s serial and model number, and checking out how much retailers are currently selling it for.

When Brannon N. was figuring out how much his is worth, here’s what he did:

“I went on Amazon to see how much my camera and equipment cost. Fortunately, the items were relatively new, so I didn’t worry too much about depreciation.”

If your cameras are a few years old, note that their value might have decreased over time. For example, if you’re looking to insure your $3k camera that you purchased back in 2013, you might find that its current listing price is $2.5k. If this is the case and it gets snatched, Lemonade may only be able to pay out $2.5k since that is the current cost to replacement (aka, the replacement cost).

Insure your camera in a snap!

Cameras can be expensive. After shelling out $$ on your camera plus its equipment, the last thing you’ll want to do is replace it after things go sour. As Lemonader James A., Head of Innovation at Cloudfare, told us:

“The problem with cameras is that they’re expensive. If I was worried about how much they cost all the time, I wouldn’t take them with me—which completely defeats the purpose!”

Luckily, getting your camera and gear insured is easier and faster than you’d think- take Lemonade for a spin—it’ll take you less than 2 minutes.

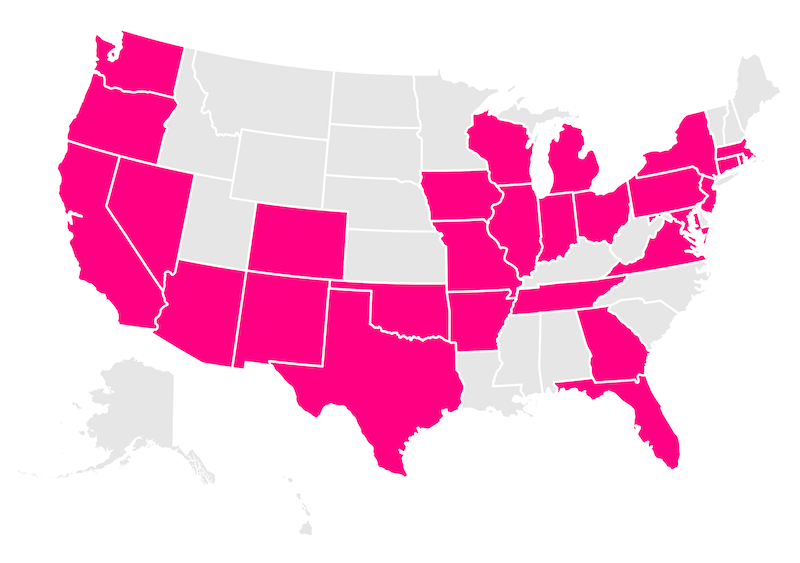

Which states currently offer renters insurance?

Arizona, Arkansas, California, Colorado, Connecticut, Florida, Georgia, Illinois, Indiana, Iowa, Maryland, Massachusetts, Michigan, Missouri, Nevada, New Jersey, New Mexico, New York, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, Tennessee, Texas, Utah, Virginia, Washington, Washington, D.C. (not a state… yet), and Wisconsin.

FAQs

Are memory cards and stored digital images covered under renters insurance?

Memory cards and stored digital images are generally not covered under renters insurance policies. Coverage typically extends to physical camera equipment but not to digital data or memory cards. To protect digital files, consider backing them up and exploring specific data insurance options.

Can I insure a secondhand camera?

Yes, you can insure a second-hand camera with renters insurance. You’ll need to provide proof of the camera’s value, such as a receipt or current market value, to get coverage. If you’re adding Extra Coverage, be sure to follow the specific steps required to include your second-hand camera.

Are vintage or collectible cameras covered differently under renters insurance?

Vintage or collectible cameras are typically covered under renters insurance like any other camera, but their value might be higher than standard equipment. For such valuable items, you may need to add Extra Coverage to ensure full protection and avoid depreciation issues.

How does renters insurance handle coverage for drone cameras?

If you are using your drone camera for personal and recreational use, renters insurance can cover drone cameras under personal property coverage for theft, vandalism, and certain types of accidental damage. However, drones often have specific risks and high values, so it’s a good idea to add Extra Coverage to fully protect against loss or damage.

Does camera insurance cover water damage?

Yes, in general, camera insurance can cover water damage in certain situations. For example, if a pipe bursts causing damage to your camera, your base renters insurance policy will generally cover this. If you have Extra Coverage, it will also generally protect against accidental damage, including water damage from spills or accidents.

A few quick words, because we <3 our lawyers: This post is general in nature, and any statement in it doesn’t alter the terms, conditions, exclusions, or limitations of policies issued by Lemonade, which differ according to your state of residence. You’re encouraged to discuss your specific circumstances with your own professional advisors. The purpose of this post is merely to provide you with info and insights you can use to make such discussions more productive! Naturally, all comments by, or references to, third parties represent their own views, and Lemonade assumes no responsibility for them. Coverage and discounts may not be available in all states.