How to Split Costs with Roommates

How to make sure splitting the bill doesn't turn into a splitting headache.

How to make sure splitting the bill doesn't turn into a splitting headache.

How you and your roommates manage your shared expenses is important—but what are the right ground rules when it comes to how to split bills and build a solid shared household?

Whether you’re a college student living the roommate experience for the first time or a veteran of living with housemates, here’s a guide to help you effectively manage your financial relationship with your roommates.

There’s no one-size-fits-all approach to dealing with roommates and personal finance. But many people fall into one of two extreme camps. This is why it’s a very good idea to ask potential roommates their thoughts on expense sharing before they move in.

One holds that what’s mine is mine and what’s yours is yours. That Coke Zero in the fridge? You bought it, so your roommates better not even think about touching it.

The other way of thinking about your roommate relationship is that since you live together, it’s only fair to share expenses.

Which one is better?

People often gravitate toward the “I’ll pay for my part” since they think it’s more fair. But while thinking, “I’ll have my own yogurt, and you’ll have your own laundry detergent” may seem reasonable enough, it’s rarely the optimal way to foster a harmonious living arrangement with your roommates.

At any rate, this is why—just like with significant others—it’s smart to talk finances before you commit to becoming roommates. Creating a roommate agreement is an excellent way of ensuring that you’re all on the same page and have a game plan for how you’ll cover rent, utilities, and other household expenses.

And while paying the bills (hopefully) won’t be the most enjoyable part of living together, the good news is that there are plenty of apps and tools to help make it easier.

If you can manage your renters insurance policy through a smartphone app, it stands to reason that you should be able to do the same thing for managing expenses with your roommates.

Venmo is among the most popular apps for requesting and sending money, although you’ll need to find a way of knowing who owes what to whom. That’s where maintaining a spreadsheet of shared expenses comes in handy.

Alternatively, you could turn to apps like Splitwise or Splittr, where you can upload expenses and the apps themselves will enable you to divide costs among your roommates—no spreadsheet necessary. There are even apps like OurGroceries that let you manage specific expenses.

The bottom line: One person doesn’t need to do it all, and you don’t need to open a joint bank account with your roomies. Some basic ground rules and an app or two are all you need.

Perhaps you prefer a more hands-on approach to managing your expenses with your roommates.

In that case, you’ll want to create a split expenses spreadsheet. Log every shared expense, note who paid for what, and divide costs accordingly. Let’s say you’ve just signed a contract on a new place. Here’s how the first few line items on your expense sheet might look:

| Expense | Cost | Who Paid? | Roommate 1 Owes | Roommate 2 Owes |

| Security deposit | $2,500 | Roommate 1 | $0 | $1,250 |

| First month rent | $2,500 | Roommate 2 | $1,250 | $0 |

| Energy bills | $300 | Roommate 2 | $150 | $0 |

| Groceries | $175 | Roommate 1 | $0 | $87.50 |

| Internet | $50 | Roommate 1 | $0 | $25 |

| Total Owed | $1,400 | $1,362.5 |

If you’re Roommate 1, the difference between what your share of the expenses and your roommate’s is $37.50, and since your roomie has footed slightly more of the bills, you’re the one who’s $37.50 in the red.

By carefully tracking your expenses and who’s paid for what, you’ll gain invaluable experience managing your household budget. You’ll also have a window into your overall spending patterns, so if you need to adjust course, you’ll have real numbers to help you decide whether, for example, you should spend less on Seamless this month.

Whatever your financial situation, you’ll want to ensure that the stuff in your home is protected with renters insurance—and Lemonade offers excellent coverage starting as low as $5 per month.

Renters insurance covers only your personal property, not your roommates’, so this isn’t an expense you’ll be able to split. But insuring your stuff at an affordable price provides peace of mind that if your iPhone is swiped at a coffee shop or a burst pipe floods your living room, your insurance company will have your back.

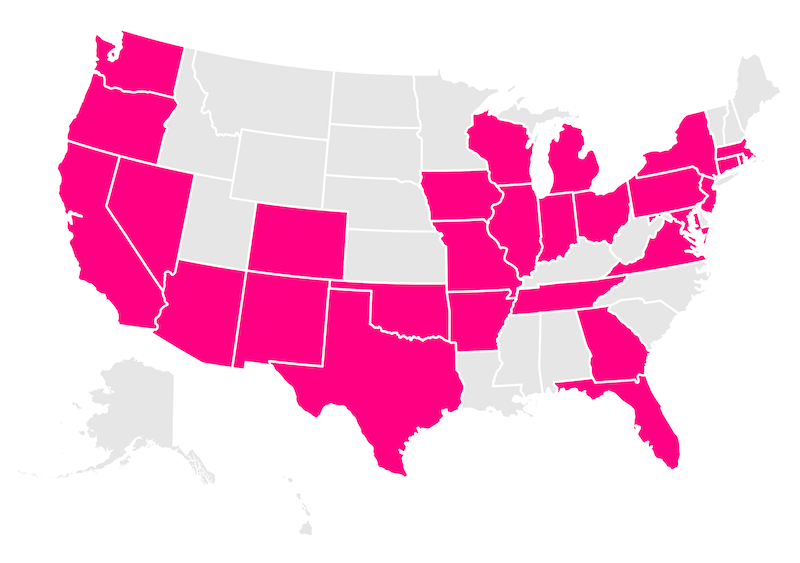

Bill-splitting doesn’t have to be complicated, and neither does insurance—so why not go with America’s top-rated renters insurance?

Arizona, Arkansas, California, Colorado, Connecticut, Florida, Georgia, Illinois, Indiana, Iowa, Maryland, Massachusetts, Michigan, Missouri, Nevada, New Jersey, New Mexico, New York, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, Tennessee, Texas, Utah, Virginia, Washington, Washington, D.C. (not a state… yet), and Wisconsin.

A few quick words, because we <3 our lawyers: This post is general in nature, and any statement in it doesn’t alter the terms, conditions, exclusions, or limitations of policies issued by Lemonade, which differ according to your state of residence. You’re encouraged to discuss your specific circumstances with your own professional advisors. The purpose of this post is merely to provide you with info and insights you can use to make such discussions more productive! Naturally, all comments by, or references to, third parties represent their own views, and Lemonade assumes no responsibility for them. Coverage and discounts may not be available in all states.

Please note: Lemonade articles and other editorial content are meant for educational purposes only, and should not be relied upon instead of professional legal, insurance or financial advice. The content of these educational articles does not alter the terms, conditions, exclusions, or limitations of policies issued by Lemonade, which differ according to your state of residence. While we regularly review previously published content to ensure it is accurate and up-to-date, there may be instances in which legal conditions or policy details have changed since publication. Any hypothetical examples used in Lemonade editorial content are purely expositional. Hypothetical examples do not alter or bind Lemonade to any application of your insurance policy to the particular facts and circumstances of any actual claim.