Did you know that the majority of American renters don’t have insurance? It might be because they think applying for a renters insurance policy is a pain. Or they might have trouble estimating the value of all the stuff that their policy will protect.

The average person can be a little clueless when it comes to the benefits of insurance or how much insurance coverage they really need. Often, they’ll overestimate when guesstimating the actual cost of a policy.

In this article, we’ll clear up another issue that tends to confuse anyone shopping for renters insurance: Calculating how much your belongings and valuables are actually worth, so that you can buy the right amount of coverage.

Why is estimating the value of your stuff so important?

Even if you don’t consider yourself to be someone with a ton of fancy stuff, take a quick look around your place.

It’s pretty clear that you have tons of personal property you care about, from your iPhone X to your Bianchi bike to that watch you got for college graduation and only wear when you go to visit your uncle.

That stuff all has value, and it adds up pretty quickly. And when applying for a renters insurance policy, it’s vital not to undervalue your personal property.

How to estimate the value of your stuff

Stick to a plan! Here are some easy steps to follow:

- Take a few minutes to walk around your apartment, recording video (or taking pictures) of everything you care about that has value

- Write out a list of the stuff of everything you just filmed / photographed and estimate how much each item costs

- For electronics and more expensive items, it’s important to know the make and model as well as when and where you bought them, so be sure to note that down

- If you have receipts for certain stuff, take pictures of those receipts—it’ll come in handy if you ever have to make a claim

- Arrive at a rough total, and you’ve got the estimated value of your stuff—in other words, the amount of personal property coverage you’d want to select for your renters insurance policy

While basic policies start with $10,000 of personal property coverage (aka contents insurance), you can set this number based on your own needs and lifestyle.

How much renters insurance do you need?

There are a few helpful tricks to follow here. We recommend taking the number you arrived at above—the value of all your stuff—and then adding $10,000 for each person living with you who’s on your policy. (At Lemonade, only people related to you by blood or marriage can share your policy.) If you’ve got very fancy tastes, you might want to add $15,000 instead of $10k.

Figuring out how much renters insurance you need can get a little confusing, so it might help to walk through some hypothetical examples.

A young married couple in Chicago

You live in a highrise building in the Windy City. You own a $1,500 sound system, a $5,000 engagement ring, and a $1,500 bike. Your partner also owns a $2,000 bike and you both tend to love brand name stuff. The amount you’d want in personal property coverage would look something like this:

$1,500 + $1,500 + $5,000 + $2,000 + ($15,000 x 2) = $40,000

The undergrad in Philadelphia

Let’s say you’re a college student majoring in English, and you probably think you don’t have so much stuff. But there’s your laptop ($1,250), smartphone ($850), bicycle ($1,500), and clothing (you don’t even want to start figuring out how much you spent for those jeans back in 2019). Your personal property coverage amount would look something like this:

$1,250 + $850 + $1,500 + ($10,000) = $13,500

You’d probably want to choose a personal property coverage limit that’s more than $13,500, rather than sticking with the $10,000 default.

Keep in mind that the more personal property coverage you choose, the higher your premium may be. But having adequate coverage in place will mean you’re not stuck paying a ton out-of-pocket in the event of a claim.

A note on high-value items

Sub-limits are one of the biggest (unknown) things people miss when signing up for a renters insurance policy.

What’s a sub-limit? Well, basic insurance policies will only cover around $1,500 or $2,000 worth of valuable items such as fine art, some jewelry, bikes, cameras, and musical instruments for certain types of claims, like theft.

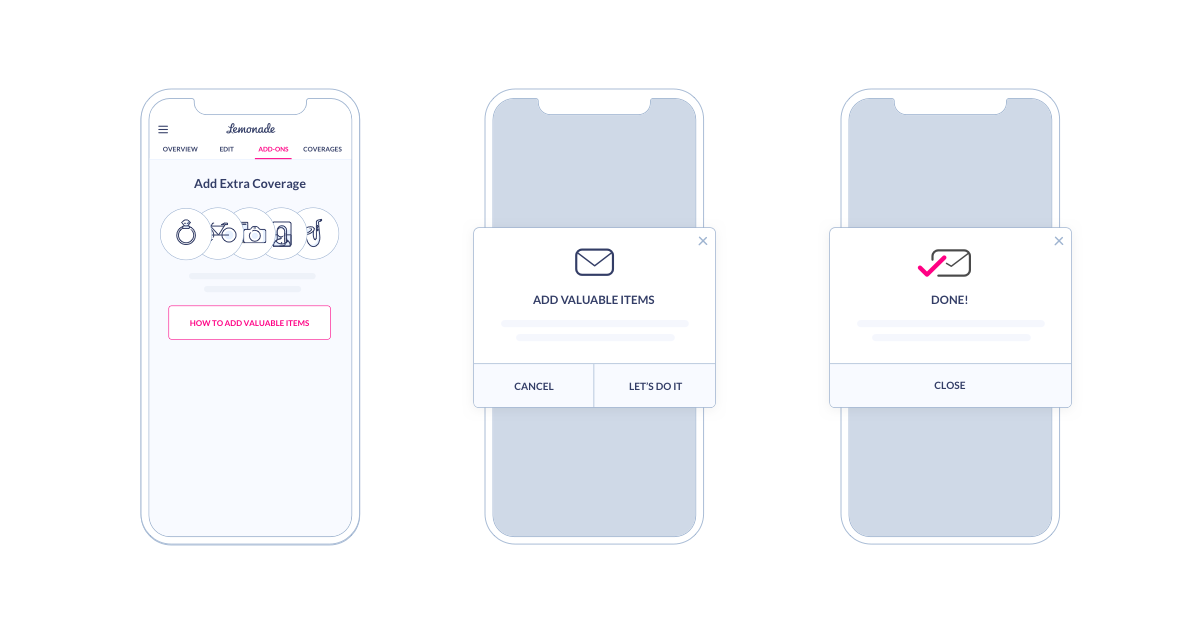

You might want to schedule those really valuable items (aka add on some Extra Coverage) to give yourself the best protection. This will also give you additional benefits on those belongings, like coverage for mysterious loss, as well as zero-deductible claims.

What should you do after determining how much your stuff is worth?

The cost of renters insurance each month can be less than what you might spend on coffee every few days. There’s a good chance it’s less than your Netflix subscription!

Be proactive and don’t wait for a bad reason to start thinking about something that could save you thousands of dollars and a whole lot of headaches.

Click below to get started with Lemonade today—getting a quote only takes a few minutes.

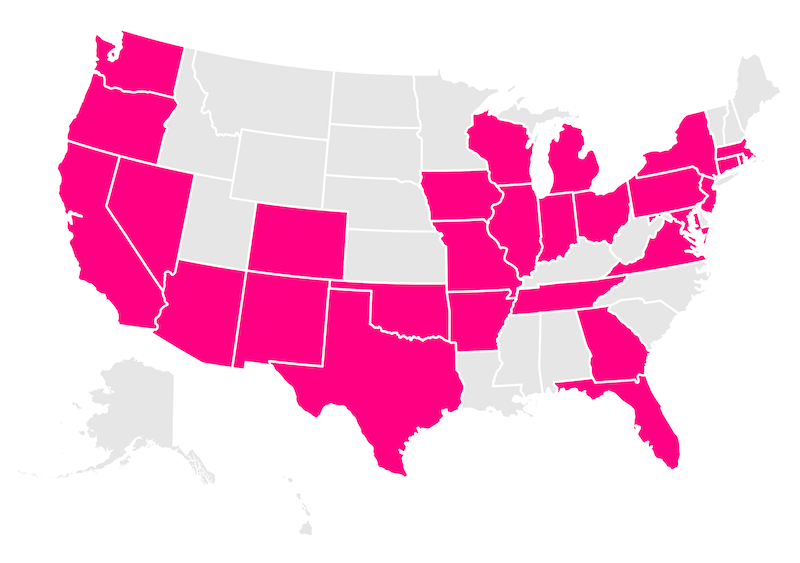

Which states currently offer renters insurance?

Arizona, Arkansas, California, Colorado, Connecticut, Florida, Georgia, Illinois, Indiana, Iowa, Maryland, Massachusetts, Michigan, Missouri, Nevada, New Jersey, New Mexico, New York, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, Tennessee, Texas, Utah, Virginia, Washington, Washington, D.C. (not a state… yet), and Wisconsin.