Your home is one of your most valuable assets—so it makes sense that you’d want to keep it well-protected. That’s where the right homeowners insurance policy comes in.

You probably know that in exchange for paying a monthly or yearly premium, homeowners insurance protects your home against covered losses. But you may not be familiar with the intricacies of homeowners insurance because, let’s face it, most of us don’t spend our spare time talking insurance. So let’s take a closer look at how it works.

What is homeowners insurance?

A home insurance policy is an agreement between you and your insurance company. You pay a monthly premium, and in exchange, the insurer offers you financial protection in the event that there’s damage due to a covered “peril.” There are a few different types of homeowners insurance, with Lemonade offering HO3 and HO6 (condo) policies.

A standard HO3 policy can cover the costs of repairing damage from “perils” like fire, lightning, windstorms, hail, smoke, theft, and vandalism.

Homeowners insurance doesn’t just apply to the physical structure of your house. It also covers your belongings—from your bicycle to your laptop—even when you’re not at home. It also has your back in the case of accidents on your property which might lead to legal action.

A general rule: When you read your policy, pay close attention to the exclusions from coverage and to the conditions you must satisfy to get coverage.

We’ll break down all the things homeowners insurance covers in just a sec.

Why should I get homeowners insurance?

The main reason to get Lemonade homeowners insurance is well, because you probably have to.

When you take out a mortgage, a lender or a bank lend you a large amount of money to cover the price of a home, with the expectation that you, the homeowner, pay back this loan with interest. If your home was damaged and you didn’t have insurance (or the funds for the repairs), you might default on your loan, the property would go down in value, and the lender would take a big loss on their investment. Yikes.

But beyond being required, a homeowners insurance policy is just common sense. The right coverage can protect your wallet if you run into a bit of bad luck, like if a tree falls on your roof, or if someone slips on your patio and breaks their ankle and ends up in the ER.

What’s covered by homeowners insurance?

Here’s a closer look at what’s covered by your standard homeowners insurance policy:

It covers your home

Dwelling coverage (Coverage A) is the centerpiece of a homeowners insurance policy. If your physical home is damaged or destroyed, dwelling coverage could help cover the costs to repair or even rebuild it.

Naturally, there will also be some exclusions to what’s covered by your dwelling coverage, which you’ll see listed out in your policy. For example, it’s common for things like damage caused from flooding, mold, and earthquakes to not be covered by your policy. (You’d generally want to secure separate insurance policies to cover floods and earthquakes.)

It covers other structures on your property

Referred to as ‘Other Structures’ coverage, or Coverage B, this part of your policy covers assets on your property that aren’t connected to your home or built into your property’s foundation.

This coverage includes your driveway, fence, toolshed, aboveground or in-ground pool, or detached driveway. Basically, if it’s not attached to your home, didn’t sprout from the ground, and is a part of your property—it’s covered under Coverage B.

It covers the stuff you own

Personal property coverage (Coverage C) protects your belongings from certain named perils. Anything from your Peloton to your laptop or living room couch would fall under Coverage C. Keep in mind, however, that you won’t be able to file a claim if those things just stop working—if your MacBook dies, that’s between you and Apple. But if your MacBook is damaged in a fire, or is stolen, your Lemonade homeowners insurance comes into play.

Coverage C also travels with you when you leave the house. If you lock your bike in front of a local coffee shop and someone blasts through the chain, you’d be able to file a claim for the theft.

It covers situations in which your place becomes uninhabitable

If unexpected damages force you out of your place for a period of time, your Loss of Use coverage (Coverage D) comes into effect to cover the additional costs connected to temporarily living outside of your home.

Coverage D will help foot additional expenses related to hotel lodging, takeout, laundry, and parking—above and beyond what you’d normally pay if you were in your home.

It’s important to note that certain situations won’t make you eligible for Loss of Use on their own. For instance, if you lose power, or your pipes freeze—without any additional damage to your property—this would not be sufficient to activate Loss of Use coverage.

It covers you (and others on your policy) when you’re in a legal bind

Personal Liability coverage (Coverage E) defends you in scenarios where you might be legally vulnerable. For instance:

- You’re sued because someone got injured on your property

- You, or someone else on your policy, is sued for damaging someone else’s property or stuff

- You’re faced with legal fees for accidents for which you (or someone else on your policy) are at fault. This only covers injury to others—not yourself, and not to people listed on your policy.

It can cover you (and others on your policy) when someone else gets hurt on your property

You’re having a party. After one too many pints of Moral Hazard IPA, a guest slips, falls, and breaks their ankle on your patio. Their medical bill comes to $2,000. In this case, your Medical Payments Coverage (Coverage F) will help foot the bill (pun intended).

This part of your policy helps cover medical bills up to $5,000 for guests on your property, whether or not you’re liable for what caused them to be injured.

Medical bills in excess of $5,000 might be covered by your personal liability coverage (Coverage E, discussed above).

What isn’t covered by homeowners insurance?

Earthquakes and flooding won’t be covered in a standard home insurance policy. If you still want coverage for these types of disasters, you can take out additional coverage. Here’s more info on flood insurance and earthquake insurance.

Additionally, chances are your policy won’t cover damages or personal liability related to things like:

- Mold

- Sewer backups

- Infestations (including bed bugs)

- Swimming pool accidents (depending on your state)

- Wind damage in certain hurricane-prone states

- Wear and tear

- Damages related to construction work

- Certain breeds of dangerous or aggressive dogs

- Stolen cash (over $200)

- Nuclear hazards.

Your basic homeowners policy protects your electronics and appliance against certain “perils,” but not against every type of damage.

For instance, if your washing machine has an electrical failure, your base policy wouldn’t help. If you want to add on extra protections, you can purchase Equipment Breakdown Coverage (EBC). Also known as Appliance Coverage, this is an endorsement to complement and enhance your homeowners insurance and provide coverage for many other types of damage.

You might also consider Buried Utility (BU) coverage, an endorsement for your Lemonade homeowners insurance that covers underground utility lines.

Underground utility lines are all the pipes and cables that help keep your home connected and in working order. BU offers coverage up to $10,000 for damage from a leak, tear, break, or collapse caused by mechanical breakdown, artificially generated electric current, wear and tear, and freezing incident, as well as the weight of people, equipment, or animals (this really comes in handy if you often host elephants on your property).

Who is covered by homeowners insurance?

Homeowners insurance is a family affair. If you take out a policy, everyone who lives under your roof who is related to you by blood, marriage, or adoption is covered. Your kids, your spouse, your parents—they’d all be covered by your policy if they share your address.

If you purchase a policy and you and your live-in partner are not officially married or in a state-recognized civil union, they won’t be automatically covered. No stress, though. In this case, you can easily add them as an additional insured for an additional cost.

How much homeowners insurance do I need?

When purchasing a home insurance policy, it can be tempting—especially with homeowners insurance costs on the rise—to choose the lowest coverage options, since that leaves you with a more affordable premium. That might be fine if disaster never strikes, but in the case of covered damages, you might regret your decision to pinch pennies.

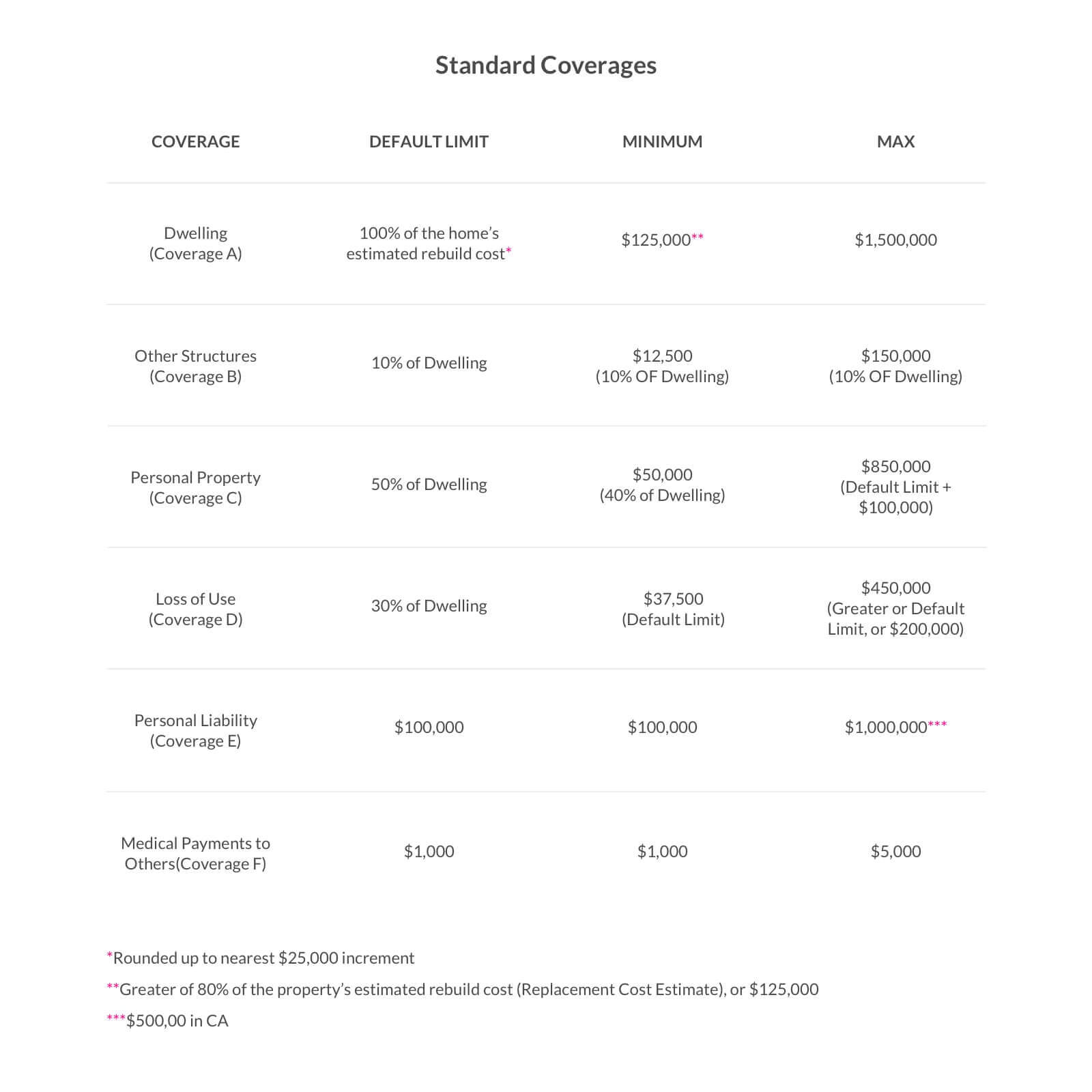

Let’s run through the six components of your homeowners policy and look at how you should customize the coverage limits for each. (If you need a reminder of what each of these coverages entails, click here.)

Dwelling coverage (Cov A)

Your dwelling coverage should cover the property’s Reconstruction Cost (RC), the cost of rebuilding your home from the ground up. If the worst were to happen and your home were completely destroyed, you’d want to have sufficient coverage.

Recently, reconstruction costs have been on the rise—you can read more about the reasons why here. Lemonade recalculates an estimate of your RC each year, so we’ll get in touch and let you know if it has increased, allowing you to adjust your Coverage A accordingly.

Other structures (Cov B)

This coverage—which pertains to things on your property like swimming pools, sheds, and detached garages—is generally set at 10% of the amount you chose for Coverage A.

Even if you don’t think you have valuable ‘other structures’ on your property, you’ll need to have this minimum 10% limit.

In certain states you’re able to increase your Cov B up to 30% of your Cov A.

Personal property coverage (Cov C)

Rule of thumb: Your personal property coverage should be somewhere around 50 to 75 percent of your dwelling coverage amount. If your Coverage A is $300,000, your personal property coverage should be somewhere between $150,000 and $250,000.

If you have certain high-value items, you’ll want to look into scheduling personal property coverage. At Lemonade, we refer to this as adding ‘Extra Coverage.’ Lemonade’s Extra Coverage applies to jewelry as well as valuables like bikes, cameras, fine art, and musical instruments.

Loss of Use (Cov D)

Loss of Use coverage is generally set at around 30 percent of your Coverage A. So, if your dwelling coverage is $300,000, your loss of use coverage should be somewhere between $90,000 to $120,000.

Personal Liability (Cov E)

Your Personal Liability coverage kicks in if you cause bodily injury or property damage to someone else or their property. The incident could take place in your home or anywhere else.

The amount of personal liability protection should also take into account the value of your financial assets, which includes your home (and other properties you own), retirement accounts, and investments.

Besides legal fees, your insurer is covering your assets as a whole. The maximum amount of personal liability coverage offered by Lemonade is $500,000—if this isn’t sufficient for you, consider adding an umbrella policy to bring you to $1M in coverage (except in California, where you’re maxxed out at $500k).

Medical payments to others coverage

Medical expense coverage covers costs related to injuries that take place on your property. In other words, this coverage helps pay for things like an ER visit to set a broken leg after an accident.

You can set this coverage between $1,000 and $5,000. If you’re often hosting parties and social events, it might make sense to opt for the higher end of the range.

Can I update my coverage after I purchase a policy?

Lemonade’s Live Policy allows customers to update their own coverage, whenever and wherever, all on the Lemonade app. You can update your policy to reflect your needs instantly, with no brokers or paperwork involved.

In general, if you want an easy way to eyeball what your current coverages are, you can also take a look at your declarations page, which summarizes the main details.

How to shop for homeowners insurance

By all means, when shopping for homeowners insurance, get a number of quotes, compare your options, and make a measured decision.

It’d be kind of weird, though, if we didn’t stand behind Lemonade Homeowners as a terrific option for those interested in 21st-century insurance. The entire experience—from signing up to filing a claim—is all done through our seamless, intuitive app.

Another unique perk that sets us apart? Lemonade takes a flat fee from your premium, uses the rest to pay claims, and then gives back what’s left to causes you care about. In 2021, for instance, our policyholders helped us donate over $2 million to amazing nonprofits. What’s more, our founders care about important issues, and have taken bold stances on things like guns, coal, and public health.

Which factors impact the price of homeowners insurance?

Here are five key factors that can determine how much your Lemonade homeowners insurance premiums will cost:

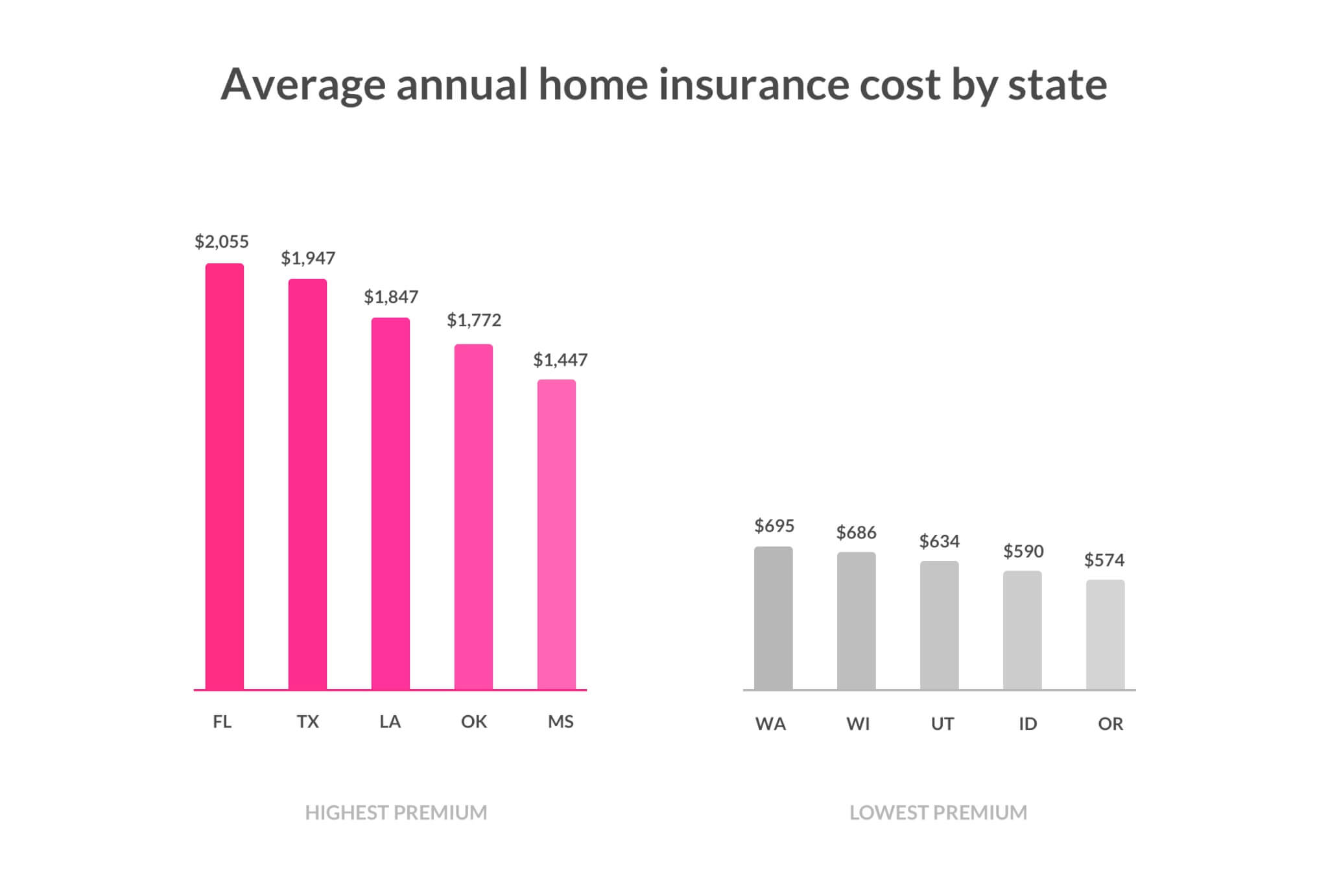

Your state

Where you live will affect your premium. Coastal states like Florida, Texas, and Louisiana have some of the highest premiums in the country, because of the high frequency of natural disasters and extreme weather. States that sit on the path of Tornado Alley, like Oklahoma and Kansas, also tend to have pricier premiums.

The states with the cheapest insurance rates are mostly in the western United States, where natural disasters like hurricanes, tornadoes, and hail are generally less frequent.

Your zip code

Pricing gets pretty granular. Not only will your state impact your insurance premium, but your exact address will, too.

For instance, if your home is close to a Class 1 fire department, your premiums might be lower than if you live half an hour from the nearest fire station. Similarly, if you live in a place with a lower crime rate, premiums are likely to be lower than in an area with more crime (this makes sense, considering that theft and vandalism are covered perils).

The condition of your home

The state of your home itself will impact your home insurance premium.

Ask yourself these questions:

- How old is your property?

- Have you replaced the roof recently?

- What kind of renovations has your home been through?

That pre-war crown molding may be your favorite thing about your home, but are the pipes as old as the ceiling? That could be bad news come winter. Basically, the older your house is, the more prone it is to damage—which is why the older the home, the higher the premium.

Your deductible

An insurance deductible is the amount you choose to be liable for in any future claims payouts. For example, if a tree fell on your roof and caused $20,000 in damage, and your policy has a $1,200 deductible, you’d pay $1,200, and the insurance company would pay the remaining $18,800 (provided your claim was accepted).

The higher your deductible is, the lower your premium could be.

Keep in mind, however, that a high deductible also means you’ll pay a lot more out-of-pocket in the event of a claim. Different people have different preferences. Would you rather pay more up front, and potentially less down the line in the event of a catastrophe? Or pay less month-to-month, and hope that you don’t have to file any big claims?

If you choose a high deductible and lower premium, and that tree doesn’t fall on your house—well, you’ve come out ahead. But predicting the future is pretty tough.

There’s no right or wrong answer. At the end of the day, choose what makes sense for you.

The amount of coverage you choose

We’ve already discussed how much coverage you likely need for each of the main six coverage categories, but it bears repeating: The amount of coverage you choose has a direct impact on how much you’ll pay on your monthly premiums. For example, if your dwelling coverage is $300,000, your monthly premiums will probably be lower than if your dwelling coverage is $500,000.

Am I legally required to have homeowners insurance?

Unlike car insurance, which is required by law if you drive, homeowners insurance is not required simply by virtue of the fact that you’re a homeowner. However most mortgage lenders will require at least some basic form of homeowners insurance. And unless you bought your house with cash, you probably have a mortgage.

Think of it this way: your mortgage lender is essentially a joint homeowner, until you’ve paid off your loan. It’s in their best interest to keep your home in tip-top shape.

Your mortgage lender wants to make sure that if the worst happens to your home, you’ll have the coverage and funds to take care of it. If you don’t, you’d both lose your valuable asset.

Anything else I should know?

Well, you can always go ahead and get your free, fast quote for Lemonade Homeowners by clicking the button below.

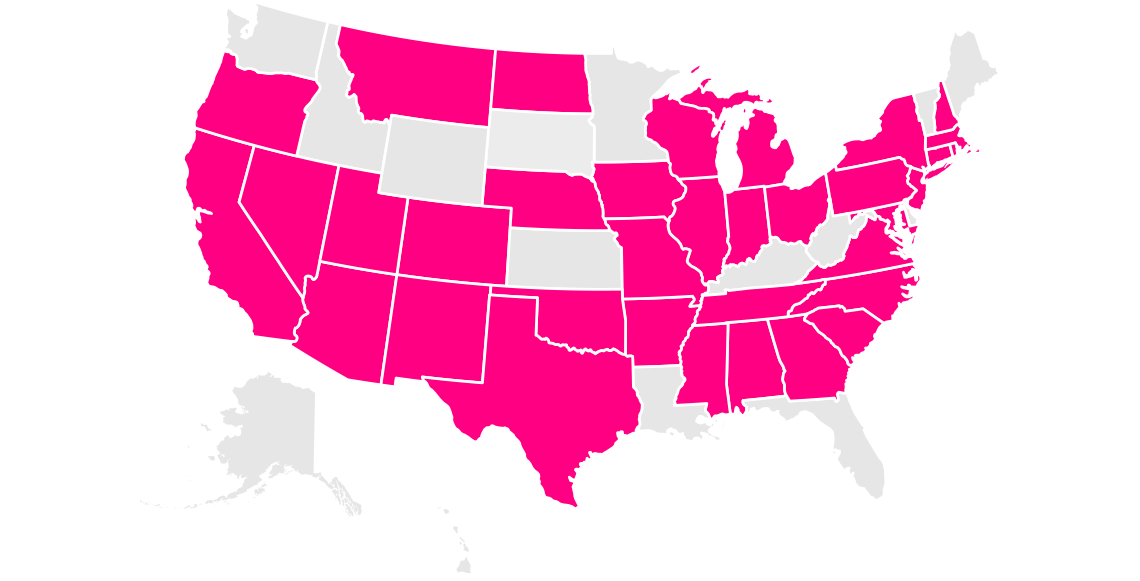

Which states currently offer homeowners insurance?

Arizona, California, Colorado, Connecticut, Georgia, Illinois, Indiana, Iowa, Maryland, Massachusetts, Michigan, Missouri, Nevada, New Jersey, New York, Ohio, Oklahoma, Oregon, Pennsylvania, Tennessee, Texas, Virginia, Washington, D.C. (not a state…yet), and Wisconsin.

A few quick words, because we <3 our lawyers: This post is general in nature, and any statement in it doesn’t alter the terms, conditions, exclusions, or limitations of policies issued by Lemonade, which differ according to your state of residence. You’re encouraged to discuss your specific circumstances with your own professional advisors. The purpose of this post is merely to provide you with info and insights you can use to make such discussions more productive! Naturally, all comments by, or references to, third parties represent their own views, and Lemonade assumes no responsibility for them. Coverage and discounts may not be available in all states.