- How much is renters insurance in my state?

- What factors impact my renters insurance rates?

- How can I lower my renters insurance cost?

- What does a standard renters insurance policy cover?

- How much renters insurance do I need?

- How does Lemonade keep its rates affordable?

- Which states currently offer Lemonade Renters insurance?

- FAQs

As of 2025, the average cost of renters insurance in the U.S. is around $23/month.*

Meanwhile, the average cost of Lemonade renters insurance across the U.S. is around $16/month with prices starting as low as $5/month, as of January 2025.*

Although the cost of renters insurance is generally quite affordable, prices can vary depending on a number of factors, including your rental’s location, your deductible, and your coverage and limits.

- Across the U.S., the average cost of renters insurance is around $23/month, as of 2025.

- The average cost of Lemonade renters insurance is around $16 a month but can vary significantly, depending on factors such as your apartment’s location, your deductible, and the actual amount of coverage you purchase.

- There are several ways to lower your renters insurance premium, including installing security devices, bundling policies, and more.

How much is renters insurance in my state?

Here are some average renters insurance prices across the U.S., as of 2025. These include rates from various insurers, not Lemonade specifically.

| State | Average renters insurance price per month in 2025 |

|---|---|

| Alabama | $31 |

| Alaska | $22 |

| Arizona | $27 |

| Arkansas | $35 |

| California | $19 |

| Colorado | $24 |

| Connecticut | $18 |

| Delaware | $18 |

| Florida | $27 |

| Georgia | $33 |

| Hawaii | $22 |

| Idaho | $20 |

| Illinois | $23 |

| Indiana | $25 |

| Iowa | $21 |

| Kansas | $24 |

| Kentucky | $24 |

| Lousiana | $36 |

| Maine | $17 |

| Maryland | $23 |

| Massachusetts | $18 |

| Michigan | $30 |

| Minnesota | $20 |

| Mississippi | $32 |

| Missouri | $28 |

| Montana | $16 |

| Nebraska | $21 |

| Nevada | $22 |

| New Hampshire | $17 |

| New Jersey | $18 |

| New Mexico | $22 |

| New York | $19 |

| North Carolina | $17 |

| North Dakota | $16 |

| Ohio | $28 |

| Oklahoma | $31 |

| Oregon | $21 |

| Pennsylvania | $21 |

| Rhode Island | $20 |

| South Carolina | $20 |

| South Dakota | $21 |

| Tennessee | $24 |

| Texas | $25 |

| Utah | $24 |

| Vermont | $17 |

| Virginia | $20 |

| Washington | $17 |

| West Virginia | $19 |

| Wisconsin | $20 |

| Wyoming | $16 |

What factors impact my renters insurance rates?

Here are the factors that can determine how much you pay for renters insurance.

1. The location of the property

The state, city, and even neighborhood you reside in may affect your renters insurance rate. If you live on the coast, you may be more likely to encounter extreme weather and appear riskier to your insurer. The same goes if you live in an area with higher rates of theft, burglary, vandalism, or other covered perils. As an insurance rule-of-thumb, the more likely you are to file a claim, the more your renters insurance will cost.

But your location could also help lower your price! For example, living around the corner from a fire station could help bring costs back down.

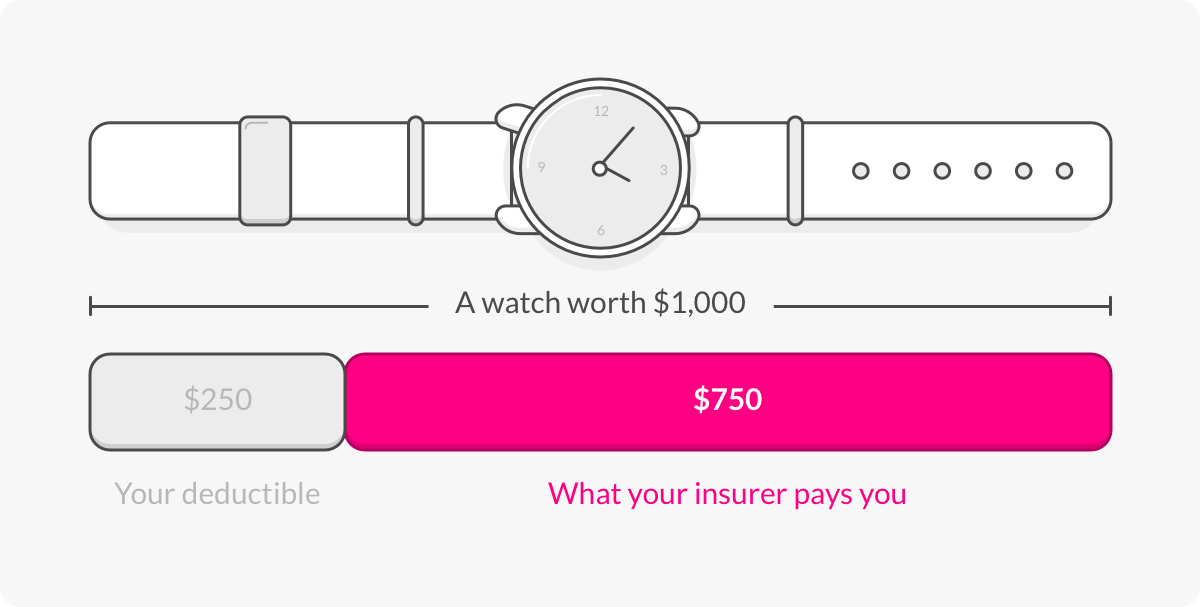

2. Your deductible

An insurance deductible is the part of the claim that the policyholder retains responsibility for that will be subtracted from any future claims payouts. So if your $1,000 watch were stolen, and you had a $250 deductible, your insurance company would pay you $750.

Think of a deductible as your participation in a covered loss. You’re saying, “I commit X dollars to any claim, and my insurance company will pay the rest of the covered amount.”

Generally speaking, the higher your deductible, the lower your premium. But keep in mind that a higher deductible also means you’ll pay a lot more out of pocket in the event of a claim. At the end of the day, it depends on how much you’re comfortable with paying out of pocket in the event of a claim.

3. The number of past claims you’ve filed

If your claims history is pretty extensive, your premium could be higher since people who’ve filed a lot of claims in the past are statistically more likely to file more claims in the future.

4. Your credit history

Lower credit scores are also statistically linked to more claims, so, depending on the laws and regulations where you live, a lower credit score could lead to a higher premium. On the other hand, good credit could help you land a better rate by demonstrating to your insurer that you’re a lower risk.

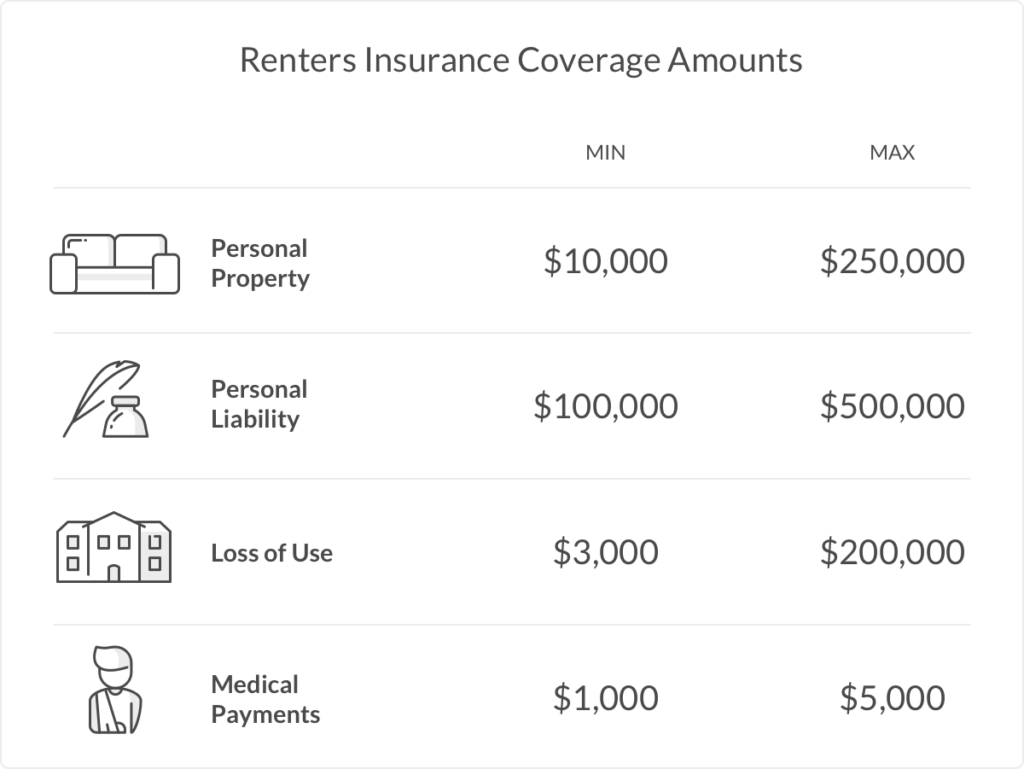

5. The amount of coverage you choose

The amount of coverage you choose in each category—like loss of use, personal property, and liability coverage— impacts the final price of your premium.

At Lemonade, a basic renters insurance policy starts at $5/month and includes $10,000 of personal property coverage. However, the $5 minimum will vary depending on the state and risk characteristics where you live. But if, for instance, you decide that your personal belongings are worth closer to $30,000, then you’ll pay more than if your stuff were worth just $10,000.

6. Your insurance provider

Different providers will offer different coverages, deductibles and rates, so it’s best to shop around and compare quotes before settling on a policy. While it might be tempting to go with the lowest rate, you also want to pick a provider that meets all of your unique coverage needs. Here are some tips for finding the best renters insurance for your circumstances and your budget:

- Check the policy details: When comparing quotes and rates, make sure you’re comparing policy details before making a decision. This includes deductibles, coverage exclusions, add-ons, and policy limits.

- Look into company claims handling: How will your homeowners insurance company handle your claim when the worst actually happens?

- Consider who all needs to be covered by your policy: FYI, with Lemonade, your spouse and children are automatically covered. You also have the option of adding a significant other as an additional insured, for a small fee.

How can I lower my renters insurance cost?

Even though renters insurance premiums are already quite affordable, there are still some ways to make yours even lower. Let’s look at some options.

Security devices

If your apartment has some basic security devices, like a fire alarm and a burglar alarm, be sure to let your insurer know. Since these devices mitigate the possibility of future losses, you could qualify for a discount.

Bundling

Some insurers might offer you a discount if you choose to buy more than one insurance policy with them. Bundling your renters policy with other Lemonade products, such as pet insurance or car insurance, could save you money on your insurance costs.

Adjusting your deductible and coverage limits

As we mentioned above, you have may have the ability to adjust your premium based on the deductible and coverage amounts you opt for. Increasing your deductible and reducing your coverage amount are straightforward ways to lower your premium. However, we recommend that you proceed with caution before making any drastic changes. You don’t want to end up in a situation where you’re denied coverage for something essential, like the costly replacement of your furniture in the event of an apartment fire.

And, if you opt for a higher deductible, just make sure that it’s still an amount you’re comfortable paying out of pocket in the event of a claim. (BTW, here are some handy tips for choosing a deductible.)

Don’t forget: You can make any changes to your policy directly through the Lemonade app without doing any paperwork.

What does a standard renters insurance policy cover?

As we already mentioned, a typical renters insurance policy covers three main areas:

- personal property

- temporary living expenses

- personal liability/medical bills

If you want to take a deeper dive into the topic, here’s more on what renters insurance does and doesn’t cover.

How much renters insurance do I need?

In order to determine how much renters insurance you need, you should weigh how much you think you need in terms of your belongings and lifestyle against how much you think you can pay monthly. Picking a higher coverage amount will push up your monthly premiums slightly, but on the other hand, you don’t want to be left without the right amount of coverage in the worst-case scenario.

If you’re not sure how much your stuff (ie., your personal property) is worth, look around your apartment, and mentally calculate the value of everything. Think about clothing, furniture, and electronics, but don’t forget about the stuff outside of your home, like your bicycle or that old box of stuff you keep forgetting to clear out of your car.

As you tally, think about the value of your stuff in increments of $10,000 since those are the increments of our coverage limits. So, if you have $18,000 worth of items, you should pick around $20,000 of personal property coverage.

Standard policies start with $10,000 of personal property coverage. But you should decide based on the value of your own stuff.

Keep in mind too that if you have any high-ticket items, like a diamond ring or a Sony a7S III camera, you might want to purchase additional coverage for each item. This is known as scheduled personal property coverage, or ‘Extra Coverage,’ as we call it at Lemonade.

Still not sure what coverage amount is right for you? Check out our easy guide to figuring out how much renters insurance you need.

How does Lemonade keep its rates affordable?

While the average price of renters insurance across the U.S. is $23/month, Lemonade renters insurance rates are quite competitive at an average of just $16/month.

But let’s be clear: Affordable doesn’t have to mean cheap or unreliable. We’re able to offer such reasonable rates at Lemonade because we use AI and machine learning. AI Maya handles all of our basic customer inquiries, which means we have lowered overhead. But our use of AI doesn’t mean we’ve lost the human touch or forgotten the value of personalized interactions. With Maya taking the lead on the easy stuff, our (human) support team is free to handle your trickier insurance questions, like how to replace a lost engagement ring.

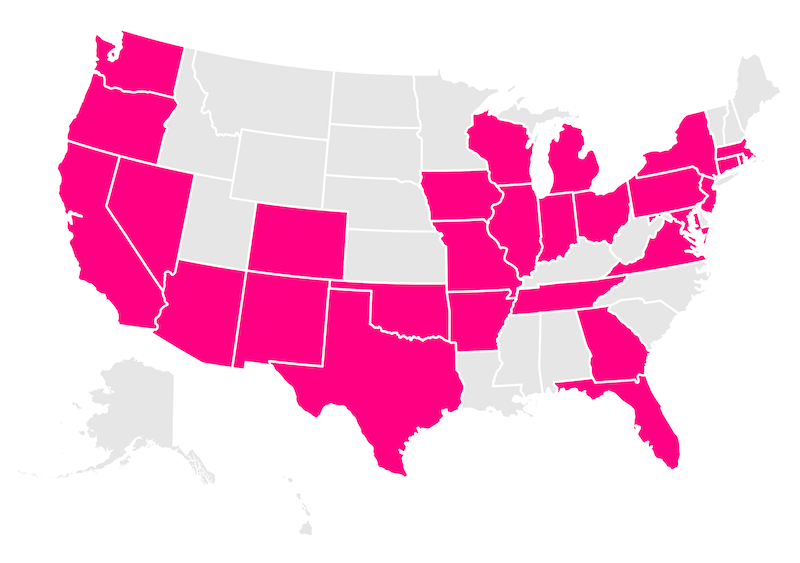

Which states currently offer Lemonade Renters insurance?

Arizona, Arkansas, California, Colorado, Connecticut, Florida, Georgia, Illinois, Indiana, Iowa, Maryland, Massachusetts, Michigan, Missouri, Nevada, New Jersey, New Mexico, New York, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, Tennessee, Texas, Utah, Virginia, Washington, Washington, D.C. (not a state… yet), and Wisconsin.

FAQs

Why does renters insurance cost less than home insurance?

Renters insurance generally costs less than home insurance because it only covers the personal belongings and liability of renters, not the structure itself. Home insurance, on the other hand, includes coverage for the home’s structure in addition to personal property and liability, which makes it more expensive.

Why is the cost of renters insurance different from state to state?

The cost of renters insurance varies by state due to factors such as regional risk levels, local crime rates, weather patterns, and overall cost of living. States with higher risks of natural disasters or higher property values typically have higher insurance costs.

Does the cost of renters insurance increase with high-value items?

Yes, because they require higher coverage limits to fully protect them. Adding Extra Coverage (aka scheduling personal property) for these valuable items will raise your premium to ensure they are adequately covered.

How does my credit score affect my renters insurance premium?

A lower credit score may lead to a higher renters insurance premium because it’s associated with a higher risk of claims. Conversely, a higher credit score can help reduce your premium by demonstrating lower risk.

A few quick words, because we <3 our lawyers: This post is general in nature, and any statement in it doesn’t alter the terms, conditions, exclusions, or limitations of policies issued by Lemonade, which differ according to your state of residence. You’re encouraged to discuss your specific circumstances with your own professional advisors. The purpose of this post is merely to provide you with info and insights you can use to make such discussions more productive! Naturally, all comments by, or references to, third parties represent their own views, and Lemonade assumes no responsibility for them. Coverage and discounts may not be available in all states.

*https://www.valuepenguin.com/average-cost-renters-insurance, Accessed January 2025.